Capital IdeasTM

Investment insights from Capital Group

Equity

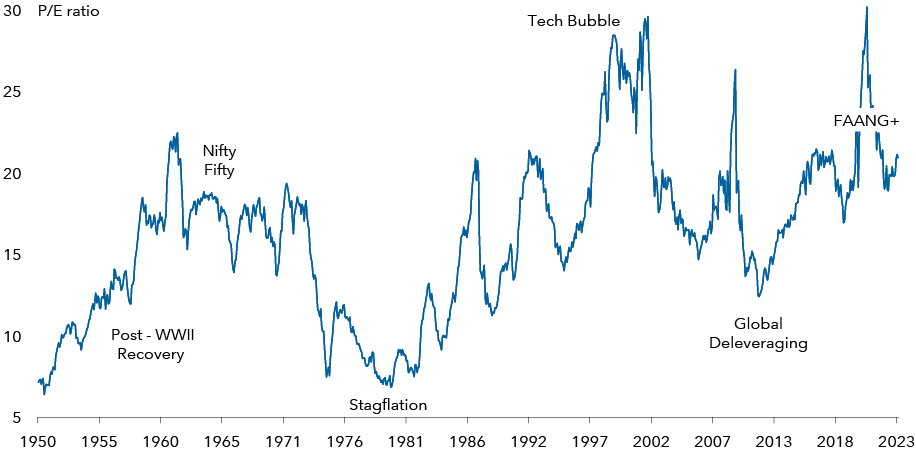

Distinct valuation ‘eras’ can be seen in stock markets across the decades, typically driven by broader macro trends. These can have a significant influence on individual company valuations, even when bottom-up analysis points to different conclusions.

Valuation eras in the US over time

S&P 500 Price/Earnings Ratio (Using trailing four-quarter operating earnings per share)

Past results are not a guarantee of future results. Investors cannot invest directly in an index.

Data to 31 August 2023. Source: Macrobond, Capital Group

How valuations evolve over the coming years will ultimately depend on where growth and interest rates settle. To explore this, we have looked at four potential scenarios based on two questions currently dominating markets: how disruptive Artificial Intelligence might prove to be and whether inflation returns to central banks’ 2% target on a sustained basis.

With AI, we have considered whether the disruption it brings could be benign or destructive. Benign implies that new technologies are easily absorbed into existing structures of capital and labour, creating new job opportunities and boosting output. Destructive suggests tech replaces labour and capital faster than they can be redeployed elsewhere, generating unemployment.

This is scenario planning, not prediction. Still, given the scale and pace of innovation in the AI space, and enormous range of its potential impact, work of this kind will be critical as we look to shape our portfolios for the future.

Our latest insights

RELATED INSIGHTS

Hear from our investment team.

Sign up now to get industry-leading insights and timely articles delivered to your inbox.

Past results are not predictive of results in future periods. It is not possible to invest directly in an index, which is unmanaged. The value of investments and income from them can go down as well as up and you may lose some or all of your initial investment. This information is not intended to provide investment, tax or other advice, or to be a solicitation to buy or sell any securities.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. All information is as at the date indicated unless otherwise stated. Some information may have been obtained from third parties, and as such the reliability of that information is not guaranteed.

Capital Group manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organisation; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

Beth Beckett

Beth Beckett