THE CAPITAL SYSTEMSM

Our system prioritises consistent and repeatable fund results.

Jonathan Bell Lovelace 1968

Early in Capital Group history, our leaders realised that their funds would outlast the professionals who managed them.

They believed they had a responsibility to provide stability and management continuity to their investors, so they asked themselves a key question: If a portfolio manager left the firm, how could they keep funds going strong?

They pioneered a plan. By dividing portfolios into sections and giving each of the existing managers a portion to administer, no portfolio would be too dependent on a single person.

This distinctive way of managing money became The Capital SystemSM. By incorporating the highest conviction investment ideas of each manager in a portfolio, we aim to both increase the diversity of those ideas and reduce the volatility of a fund, which can give investors a smoother ride in bumpy markets.

Find out how the development of our investment philosophy helped to create the MSCI indices

Learn how the Capital SystemSM sets us apart from other global asset managers

The best of both worlds.

CRMC Meeting 1961. Jonathan Bell Lovelace,

Chuck Schimpff, Coleman Morton, Jim Fullerton,

Mary Bauer

The Capital System can give advisers and investors the best of both worlds: the upside of high-conviction ideas and the power of collaboration.

At Capital Group, we assemble teams of managers who have different investing styles and complementary strengths to help foster a diversified investing approach.

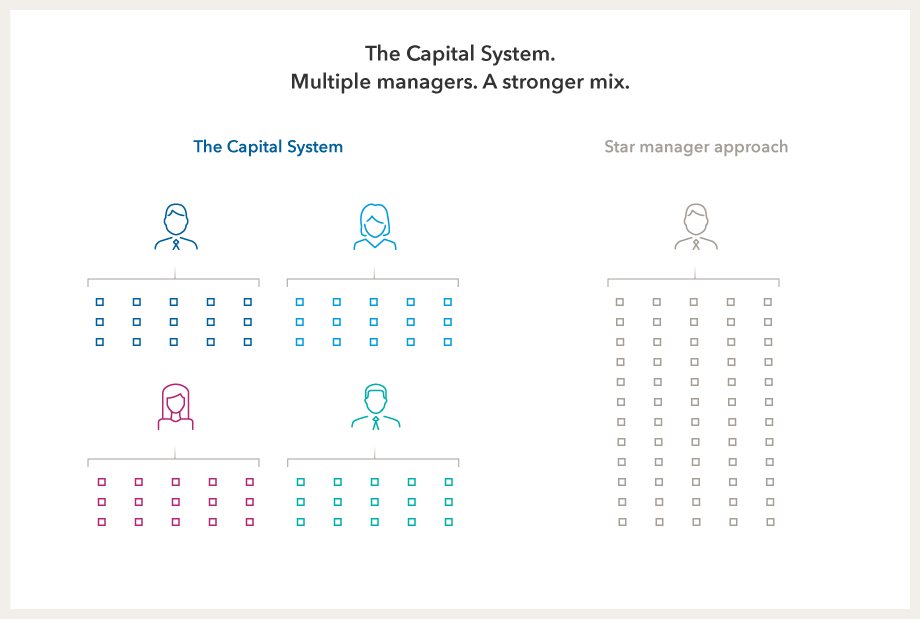

The benefits of our multiple portfolio manager approach can be boiled down to simple maths: If, for example, a fund has a star manager with 120 investment ideas, that’s a lot of ideas for one person to keep track of. But imagine if the fund were divided among four managers, including each of their 30 highest conviction ideas — ideas they've explored inside out — that’s the strength of The Capital System.

For illustrative purposes only.

Aim for a smoother ride.

A group of managers with complementary investing styles on a single fund can deliver long-term results that help clients pursue their goals.

Losing less when the market dips means investors stand to gain more when it climbs. And a steadier journey helps investors stay the course for the long term.

Built to last.

The Capital System has stood the test of time.

An innovative idea then and now, our unique multiple portfolio manager system has become a defining feature of our success. Distinct in the market and diverse in its strategy, The Capital System has helped many of our investment vehicles generate attractive long-term outcomes.

Our beliefs

Your goals power ours.

We have four core beliefs central to helping you succeed.

RESEARCH

We believe in deep, fundamental research.

LONG-TERM APPROACH

We believe in taking a long-term view.

PARTNERSHIP AND SUPPORT

We believe in the power of partnerships.

Find your investment solution

We understand that all your clients are unique, and offer an array of investment solutions designed to meet their needs.

Investment thinking from Capital Group

For industry-leading insights and timely articles delivered to your inbox, subscribe to our Capital Ideas newsletter.