Capital Group Future Generations Global Corporate Bond Fund (LUX)

Conjuguer durabilité et opportunité

Derniers avis aux actionnaires

Your selection has changed, please hit "GO" to refresh.

Please wait. Page is being reloaded...

Résultats

The information in relation to the index is provided for context and illustration only. The fund is an actively managed UCITS. It is not managed in reference to a benchmark.

Past results are not a guarantee of future results.

Cours et dividendes

Portefeuille

Risques

Avant d'investir, il convient de tenir compte des facteurs de risque suivants :

- Le présent document n’a pas vocation à fournir un conseil d’investissement, ni à être considéré comme une recommandation personnalisée.

- La valeur des investissements et les revenus peuvent varier à la hausse comme à la baisse, et vous n’êtes pas assuré de récupérer l’intégralité de votre placement initial.

- Les performances passées ne préjugent pas des résultats futurs.

- Si la devise dans laquelle vous investissez s’apprécie face à celle dans laquelle les investissements sous-jacents du fonds sont réalisés, alors la valeur de votre placement baissera. La couverture du risque de change vise à limiter ce phénomène, mais il n’y a aucune garantie que cette couverture sera totalement efficace.

- Le Prospectus, ensemble avec toute documentation requise par la règlementation locale, énumère les risques, tels que ceux associés aux marchés obligataires, aux instruments dérivés, aux marchés émergents et/ou aux titres à haut rendement (high yield). Les marchés émergents sont volatils et peuvent pâtir de problèmes de liquidité.

- Certains fonds peuvent investir dans des instruments financiers dérivés à des fins d'investissement, de couverture et/ou de gestion efficace de portefeuille.

Documentation

Informations en matière de durabilité

Synthèse

Sans objectif d’investissement durable

Ce Fonds promeut des caractéristiques environnementales ou sociales, mais n’a pas pour objectif l’investissement durable. Toutefois, CRMC (le « Conseiller en investissement ») s’engage à conserver au moins 40 % des investissements du Fonds dans des sociétés qui, selon lui, relèvent des défis sociaux et/ou environnementaux par le biais de ses produits et/ou services actuels ou futurs.

Caractéristiques environnementales ou sociales des produits financiers

Le Fonds promeut des caractéristiques environnementales et sociales par le biais du processus d’investissement du Conseiller en investissement, qui applique une évaluation d’éligibilité et une Politique de filtrage négatif.

Stratégie d’investissement

Le Fonds investit dans des sociétés dont les produits sont majoritairement alignés, ou en cours de transition vers un alignement plus important, sur une ou plusieurs thématiques d’investissement durable axées sur les défis sociaux et environnementaux mondiaux identifiés par le Conseiller en investissement. Ces thématiques correspondent aux Objectifs de développement durable (ODD) des Nations unies. Afin d’identifier les sociétés éligibles, le Conseiller en investissement effectue une évaluation basée sur des recherches ascendantes exclusives réalisées par ses équipes d’investissement et ses équipes ESG. Cette évaluation d’éligibilité repose sur les « Caractéristiques » (qui déterminent si les produits et services contribuent aux ODD) et les « Normes » (qui examinent la gestion des risques ESG importants et de la bonne gouvernance) sectorielles du Conseiller en investissement. Le Fonds investit dans des sociétés « Alignées », dont la moitié au moins des activités sont actuellement alignées, ainsi que dans des sociétés « en Transition », dont le Conseiller en investissement estime qu’elles sont en train de rediriger activement leur activité vers un alignement positif plus important sur les thématiques d’investissement durable identifiées par le Conseiller en investissement et sur les ODD, avec la prévision d’une évolution significative à court ou moyen terme.

Le Conseiller en investissement applique en outre des exclusions ESG et normatives afin d’assurer l’application d’une Politique de filtrage négatif aux investissements du Fonds au moment de l’achat.

Capital Group a mis au point une série de critères permettant afin d’évaluer si une entreprise cause un préjudice important dans le but de déterminer si l’investissement constitue un investissement durable. Le Fonds prend en considération les PIN obligatoires visées au Tableau 1 de l’Annexe I du Règlement délégué (UE) 2022/1288 de la Commission pour les investissements en titres d’entreprises, ainsi que d’autres risques et controverses ESG que le Conseiller en investissement estime potentiellement importants conformément aux Normes sectorielles susmentionnées, comme les questions de confidentialité des données ou de censure.

Dans le cadre de l’évaluation des pratiques de bonne gouvernance, le Conseiller en investissement tient compte au minimum des éléments qu’il estime pertinents pour les quatre piliers prescrits de la bonne gouvernance (à savoir les structures de gestion, les relations avec les employés, la rémunération du personnel et la conformité fiscale).

Proportion d’investissements

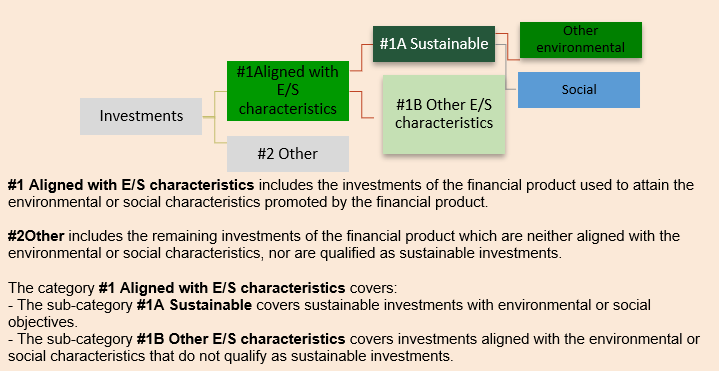

Au moins 90 % des investissements du Fonds sont utilisés pour atteindre les caractéristiques environnementales ou sociales qu’il promeut (catégorie #1 « Alignés sur les caractéristiques E/S »). Le Fonds comptera au minimum 60 % dans la sous-catégorie « #1A Durables » et au maximum 40 % dans la catégorie « #1B Autres caractéristiques E/S ». Au maximum 10 % des investissements du Fonds, qui incluent les investissements non alignés sur les caractéristiques E/S et/ou les produits dérivés, se trouvent dans la catégorie « #2 Autres ». Les espèces et quasi-espèces ne sont pas reprises dans les pourcentages d’actifs indiqués ci-dessus. Elles peuvent être détenues à des fins de liquidité.

Contrôle des caractéristiques environnementales ou sociales

Les indicateurs de durabilité utilisés par ce Fonds pour mesurer la réalisation de chacune des caractéristiques environnementales ou sociales sont les suivants :

- Si les émetteurs privés respectent les critères stipulés dans la Politique de filtrage négatif ; Le pourcentage d’investissements dont au moins 50 % des revenus sont conformes aux ODD ; et

- Le pourcentage d’investissements dans des entreprises considérées comme « en Transition ».

Méthodes

Le Fonds met en œuvre deux critères ESG contraignants : des filtres sectoriels et normatifs qui se traduisent par des exclusions et l’engagement à réaliser des investissements durables.

Sources et traitement des données

Le Fonds utilise plusieurs sources de données y compris, mais sans s’y limiter, les recherches de filtrage de l’implication ESG des entreprises de MSCI (« ESG de MSCI ») et la liste MSCI des émetteurs en violation du Pacte mondial des Nations unies. Il est toutefois possible que ces données ne saisissent pas l’univers complet des activités d’un émetteur, qu’elles changent soudainement, qu’elles soient imparfaites, inexactes, incomplètes ou dépassées, avec pour résultat un investissement par un Fonds dans un émetteur dont les investisseurs pourraient supposer l’exclusion. Capital Group prend en permanence des mesures de diligence raisonnable à l’égard des sources de données tierces et s’efforce de s’assurer de la fiabilité des données de tiers. Si le Conseiller en investissement est convaincu que des données et/ou des évaluations sont incomplètes ou inexactes, il se réserve le droit d’identifier les activités d’implication des entreprises concernées par le biais de sa propre évaluation.

Limites aux méthodes et aux données

La méthodologie et les sources relatives aux exclusions et à l’approche de l’intégration ESG dans leur ensemble présentent certaines limites. Afin d’identifier toutes les sociétés cotées en bourse dans le monde qui exercent des activités telles que la production de produits controversés et dont les revenus proviennent d’activités incompatibles avec les filtres ESG et normatifs, le Fonds utilise des critères ESG et des exclusions qui sont principalement définis par des fournisseurs tiers.

Diligence raisonnable

Les membres des services de conformité réglementaire, de gestion du risque et d’audit interne de Capital Group réalisent des évaluations périodiques de la conception et de l’efficacité opérationnelle des activités et des principaux contrôles de l’entreprise. Cela suppose de se conformer aux processus et procédures internes ainsi qu’au cadre réglementaire des juridictions dans lesquelles la société opère.

Politiques d’engagement

La mise en place d’un dialogue avec les sociétés fait partie intégrante du service de gestion des investissements que le Conseiller en investissement assure pour ses clients. Lorsque l’équipe d’investissement de Capital Group identifie une problématique importante pour la valeur à long terme d’une entreprise en portefeuille ou qu’elle est préoccupée par la performance ESG relative, les professionnels de l’investissement et les équipes de gouvernance de Capital Group entament un dialogue collaboratif avec la direction.

Indice de référence désigné

Le Fonds n’a désigné aucun indice de référence en vue d’atteindre les caractéristiques environnementales et/ou sociales qu’il promeut.

The sustainability-related disclosures are meant to be revised as necessary from time to time to capture any changes or reviews. The capitalized terms are used in accordance with the definitions and references outlined in Capital International Fund Prospectus.

Capital International Fund - Capital Group Future Generations Global Corporate Bond Fund (LUX) (the “Fund”)

LEI: 5493008PZIMIIT0L0K15

The below section “Summary” was prepared in English and is being translated to other official languages of the European Economic Area. In case of any inconsistency(ies) or conflict(s) between the different versions of this section “Summary”, the English language version shall prevail.

Summary

No sustainable investment objective

This Fund promotes environmental or social characteristics, but does not have as its objective sustainable investment. However, CRMC (the “Investment Adviser”) commits to maintain at least 40% of the Fund’s investments in companies that, in the Investment Adviser’s opinion, are addressing social and/or environmental challenges through their current or future products and/or services.

Environmental or social characteristics of the financial products

The Fund promotes environmental and social characteristics through the Investment Adviser’s investment process, which applies an eligibility assessment and a Negative Screening Policy.

Investment strategy

The Fund invests in companies whose products and services are majority-aligned, or transitioning towards higher positive alignment, with any single or combination of sustainable investment themes focused on global social and environmental challenges as identified by the Investment Adviser. These themes map to the United Nations Sustainable Development Goals (“SDGs”). To identify eligible companies, the Investment Adviser performs an assessment that relies on bottom-up proprietary research conducted by the Investment Adviser’s investment and ESG teams. This eligibility assessment is underpinned by the Investment Adviser’s sector-level “Characteristics” (which assess whether products and services contribute to the SDGs) and “Standards” (which examine management of material ESG risks and good governance). The Fund invests in ‘Aligned’ companies that currently have at least half of their business aligned, as well as ‘Transitioning’ companies that the Investment Adviser believes are actively transitioning their business to higher positive alignment with sustainable investment themes as identified by the Investment Adviser and with the SDGs, with material near-to-medium term change expected.

In addition, the Investment Adviser applies ESG and norms-based exclusions to implement a Negative Screening Policy to the Fund’s investments at the time of purchase.

Capital Group has developed a set of criteria to assess whether a company does significant harm to determine whether the investment constitutes a sustainable investment. The Fund considers the mandatory PAIs as set out in Table 1 of Annex I of Commission Delegated Regulation (EU) 2022/1288 for corporate investments, as well as other ESG risks and controversies that the Investment Adviser considers potentially material as outlined in the sector-level Standards described above, such as data privacy or censorship issues.

When assessing good governance practices, the Investment Adviser will, as a minimum, have regard to matters it sees relevant to the four prescribed pillars of good governance (i.e., sound management structures, employee relations, remuneration of staff and tax compliance).

Proportion of investments

At least 90% of the Fund's investments are used to attain the environmental or social characteristics promoted by the Fund (#1 Aligned with E/S characteristics). The Fund will have a minimum proportion of 60% in the sub-category “#1A Sustainable”, and a maximum of 40% will be in category “#1B Other E/S characteristics”. A maximum of 10% of the Fund’s investments, including investments non-aligned with the E/S characteristics promoted and/or derivatives are in category “#2 Other”. Cash and cash-equivalents are not included in the % of assets set out above. They may be held for liquidity purposes.

Monitoring of environmental or social characteristics

The sustainability indicators used by this Fund to measure the attainment of each of the environmental or social characteristics it promotes are the following:

- Adherence of corporate issuers to the criteria set forth in the Negative Screening Policy Percentage of investments having at least 50% of their revenue aligned with the SDGs, and

- Percentage of investments in companies considered as “Transitioning”.

Methodologies

The Fund implements two binding ESG-related criteria: sector- and norms-based screens in the form of exclusions and a commitment to make sustainable investments.

Data sources and processing

The Fund uses several data sources including, but not limited to, MSCI ESG Business Involvement Screening Research (“MSCI ESG”) and MSCI United Nations Global Compact violators. However, such data might not capture the full universe of activities of an issuer, change suddenly, be flawed, inaccurate, incomplete or outdated, resulting in a Fund’s investment in an issuer which an investor may expect to be excluded. Capital Group performs ongoing due diligence on third-party data sources and endeavours to ensure that third-party data is reliable. In the event that the Investment Adviser believes that data and/or assessment is incomplete or inaccurate, the Investment Adviser reserves the right to identify relevant business involvement activities through its own assessment.

Limitations to methodologies and data

The methodology and sources relating to the exclusions and the ESG integration approach as a whole have certain limitations. In order to identify all publicly traded companies globally which are involved in activities such as the production of controversial products and revenue derived from activities that are inconsistent with the ESG and norms-based screens, the Fund uses ESG criteria and exclusions that are primarily identified through third-party providers.

Due diligence

Members of Capital Group's compliance, risk management and internal audit staff conduct periodic assessments on the design and operating effectiveness of the firm’s activities and key controls. This includes compliance with internal processes and procedures as well as with the regulatory landscape in the jurisdictions in which the company operates.

Engagement policies

Establishing dialogue with companies is an integral part of the Investment Adviser’s investment management service to clients. Where Capital Group's investment teams identify an issue material to the long-term value of an investee company or they are concerned about relative ESG performance, Capital Group's investment professionals and governance teams will engage with management.

Designated reference benchmark

The Fund has not designated a reference benchmark to meet the environmental and/or social characteristics it promotes.

No sustainable investment objective

This Fund promotes environmental or social characteristics but does not have as its objective sustainable investment. The Investment Adviser commits to maintain at least 60% of the Fund’s investments in companies that, in the Investment Adviser’s opinion, are addressing social and/or environmental challenges through their current or future products and/or services. This 60% minimum qualifies as “sustainable investments” under Regulation (EU) 2019/2088 on sustainability-related disclosures in the financial services sector.

How have the indicators for adverse impacts on sustainability factors been taken into account?

As mentioned above, the Investment Adviser considers all mandatory PAIs.

The Investment Adviser considers several PAIs within its Negative Screening Policy. In particular, the Negative Screening Policy addresses PAI 4 on exposure to companies active in the fossil fuel sector, PAI 10 on United Nations Global Compact violators and PAI 14 on controversial weapons.

Beyond the negative screening process, with respect to the remaining mandatory PAIs:

where the Investment Adviser considers sufficient and reliable quantitative data is available across the investment universe (for PAIs 1, 2, 3, 6, and 13), the Investment Adviser uses third-party data and prescribed thresholds to determine whether the adverse impact associated with the company’s activities is potentially significant based on the company’s relative ranking (on the specific adverse impact) to the overall investment universe and/or peer group; or

where data availability or quality is not sufficient across the investment universe to enable a quantitative analysis (for PAIs 5, 7, 8, 9, 10, 11, and 12), the Investment Adviser assesses significant harm on a qualitative basis, for example using proxies.

The Investment Adviser’s assessment will also include an overall qualitative assessment of how ESG risks are being managed.

Where third party data or the Investment Adviser’s qualitative assessment indicates that a company is potentially doing significant harm based on a PAI threshold, the Investment Adviser will do additional due diligence to better understand and assess negative impacts indicated by third party or proprietary data. If the Investment Adviser concludes that the company is not causing significant harm based on its analysis, it may proceed with the investment and the rationale for that decision will then be documented. For example, the Investment Adviser may conclude a company is not causing significant harm if (i) the Investment Adviser has reason to believe that third-party data is inaccurate and the Investment Adviser’s own research demonstrates that the company is not causing significant harm; or (ii) the company is taking steps to mitigate or remediate that harm through the adoption of timebound targets and there are meaningful signs of improvement and positive change.

How are the sustainable investments aligned with the OECD Guidelines for Multinational Enterprises and the UN Guiding Principles on Business and Human Rights? Details:

The sustainable investments are aligned with the OECD Guidelines for Multinational Enterprises and the UN Guiding Principles on Business and Human Rights as follows: the Investment Adviser reviews companies involved in significant ESG controversies, with a focus on those that may conflict with existing global standards, including guidelines from the United Nations Global Compact. In accordance with the Negative Screening Policy applied to the Fund, the Investment Adviser will exclude companies violating the UN Global Compact principles. Although other incidents will not automatically result in exclusion from the Fund, the Investment Adviser ensures that appropriate action to remediate the concerns are taken.

Environmental or social characteristics of the financial product

The Fund promotes environmental and/or social characteristics through the Investment Adviser’s investment process, which applies an eligibility assessment and a Negative Screening Policy.

The Fund invests in companies whose products and services are majority-aligned, or transitioning towards higher positive alignment, with any single or combination of sustainable investment themes focused on global social and environmental challenges as identified by the Investment Adviser. These themes map to the United Nations Sustainable Development Goals (“SDGs”).

To identify eligible companies, the Investment Adviser performs an assessment that relies on bottom-up proprietary research conducted by the Investment Adviser’s investment and ESG teams. This eligibility assessment is underpinned by the Investment Adviser’s sector-level “Characteristics” (which assess whether products and services contribute to the SDGs) and “Standards” (which examine management of ESG risks and good governance). The Fund invests in ‘Aligned’ companies that currently have at least half of their business aligned, as well as ‘Transitioning’ companies that the Investment Adviser believes are actively transitioning their business to higher positive alignment, with material near-to-medium term change expected.

In addition, the Investment Adviser applies ESG and norms-based exclusions to implement a Negative Screening Policy to the Fund’s investments at the time of purchase.

There is no reference benchmark designated for the purpose of attaining the environmental or social characteristics promoted by the Fund.

Investment strategy

The Investment Adviser applies the following investment strategy to attain the environmental and/or social characteristics promoted and the sustainable investment objective as follows:

The Fund invests in companies whose products and services are majority-aligned, or transitioning towards higher positive alignment, with any single or combination of sustainable investment themes focused on global social and environmental challenges as identified by the Investment Adviser. These themes map to the United Nations Sustainable Development Goals (“SDGs”). The themes map to the following key United Nations Sustainable Development Goals (“SDGs”):

Where third party data or the Investment Adviser’s qualitative assessment indicates that a company is potentially doing significant harm based on a PAI threshold, the Investment Adviser will do additional due diligence to better understand and assess negative impacts indicated by third party or proprietary data. If the Investment Adviser concludes that the company is not causing significant harm based on its analysis, it may proceed with the investment and the rationale for that decision will then be documented. For example, the Investment Adviser may conclude a company is not causing significant harm if (i) the Investment Adviser has reason to believe that third-party data is inaccurate and the Investment Adviser’s own research demonstrates that the company is not causing significant harm; or (ii) the company is taking steps to mitigate or remediate that harm through the adoption of timebound targets and there are meaningful signs of improvement and positive change.

How are the sustainable investments aligned with the OECD Guidelines for Multinational Enterprises and the UN Guiding Principles on Business and Human Rights? Details:

The sustainable investments are aligned with the OECD Guidelines for Multinational Enterprises and the UN Guiding Principles on Business and Human Rights as follows: the Investment Adviser reviews companies involved in significant ESG controversies, with a focus on those that may conflict with existing global standards, including guidelines from the United Nations Global Compact and the OECD. In accordance with the Negative Screening Policy applied to the Fund, the Investment Adviser will exclude companies violating the UN Global Compact principles. Although other incidents will not automatically result in exclusion from the Fund, the Investment Adviser ensures that appropriate action to remediate the concerns are taken.

Environmental or social characteristics of the financial product

The Fund promotes environmental and/or social characteristics through the Investment Adviser’s investment process, which applies an eligibility assessment and a Negative Screening Policy.

The Fund invests in companies whose products and services are majority-aligned, or transitioning towards higher positive alignment, with any single or combination of sustainable investment themes focused on global social and environmental challenges as identified by the Investment Adviser. These themes map to the United Nations Sustainable Development Goals (“SDGs”).

To identify eligible companies, the Investment Adviser performs an assessment that relies on bottom-up proprietary research conducted by the Investment Adviser’s investment and ESG teams. This eligibility assessment is underpinned by the Investment Adviser’s sector-level “Characteristics” (which assess whether products and services contribute to the SDGs) and “Standards” (which examine management of ESG risks and good governance). The Fund invests in ‘Aligned’ companies that currently have at least half of their business aligned, as well as ‘Transitioning’ companies that the Investment Adviser believes are actively transitioning their business to higher positive alignment, with material near-to-medium term change expected.

In addition, the Investment Adviser applies ESG and norms-based exclusions to implement a Negative Screening Policy to the Fund’s investments at the time of purchase.

There is no reference benchmark designated for the purpose of attaining the environmental or social characteristics promoted by the Fund.

Investment strategy

The Investment Adviser applies the following investment strategy to attain the environmental and/or social characteristics promoted and the sustainable investment objective as follows:

The Fund invests in companies whose products and services are majority-aligned, or transitioning towards higher positive alignment, with any single or combination of sustainable investment themes focused on global social and environmental challenges as identified by the Investment Adviser. These themes map to the United Nations Sustainable Development Goals (“SDGs”).

The themes map to the following key United Nations Sustainable Development Goals (“SDGs”):

| Themes | Key Associated UN SDGs |

|---|---|

| Health & Well-Being |

|

| Energy Transition |

|

| Sustainable Cities & Communities |

|

| Responsible Consumption |

|

| Education & Information Access |

|

| Financial Inclusion |

|

| Clean Water & Sanitation |

|

To identify such companies, the Investment Adviser performs an eligibility assessment that relies on bottom-up proprietary research conducted by the Investment Adviser’s investment and ESG teams. This eligibility assessment is underpinned by the Investment Adviser’s sector-level “Characteristics” and “Standards”:

- Characteristics: focus on whether products and services contribute to the SDGs; and

- Standards: focus on management of material ESG risks and good governance.

The Fund invests in ‘Aligned’ companies that currently have at least half of their business aligned, as well as ‘Transitioning’ companies that the Investment Adviser believes are actively transitioning their business to higher positive alignment with material near-to-medium term change expected. If a company is determined to be aligned or transitioning and purchased in the Fund, but fails to meet the aligned or transitioning requirements thereafter, such company would no longer be considered a sustainable investment anymore and would generally be sold within six months from the date of such determination, subject to the best interests of investors in the Fund.

In addition, the Investment Adviser applies ESG and norms-based exclusions to implement a Negative Screening Policy to the Fund’s investments at the time of purchase.

This is supported by ongoing monitoring of the portfolio, performed by the Investment Adviser, against criteria set out in the Negative Screening Policy to identify any holdings that would be precluded. Any such company would no longer be considered a sustainable investment anymore and would generally be sold within six months from the date of such determination, subject to the best interests of investors in the Fund.

The activities and thresholds, from the Negative Screening Policy, applied to determine the list of companies to be excluded from the Funds’ investment universe consist of the following:

| Activities | Threshold |

|---|---|

| United Nations Global Compact (UNGC) | Companies that, in the Investment Adviser’s opinion, are violating the UNGC should be excluded. |

| Tobacco | Companies generating >5% of their revenue from the manufacture of tobacco products should be excluded. |

| Controversial Weapons | Companies with any ties to controversial weapons (cluster munitions, landmines, biological/chemical weapons, depleted uranium weapons, blinding laser weapons, incendiary weapons, and/or non-detectable fragments) should be excluded. |

| Nuclear Weapons | Companies generating any revenue from the production of nuclear weapons should be excluded. |

| Weapons | Companies generating >10% of their revenue from weapon systems, components and support systems and services should be excluded. |

| Oil & Gas Upstream Producers | Companies engaging in, or generating any revenue from, the exploration & production of oil and gas should be excluded. |

| Thermal Coal | Companies generating >10% of their revenue from the production and/or distribution of thermal coal should be excluded. |

When assessing potential investee companies, the Investment Adviser relies on third-party providers who identify a company’s participation in or the revenue which they derive from activities that are inconsistent with these screens. In the event that exclusions cannot be verified through third-party providers or if the Investment Adviser believes that data and/or assessment is incomplete or inaccurate, the Investment Adviser reserves the right to identify business involvement activities through its own assessment (including by using other third-party data sources).

Companies that fail both the eligibility process and the Negative Screening Policy are considered not to contribute to the Fund’s environmental and/or social characteristics.

What is the policy to assess good governance practices of the investee companies?

When assessing good governance practices, the Investment Adviser will, as a minimum, have regard to matters it sees relevant to the four prescribed pillars of good governance (i.e., sound management structures, employee relations, remuneration of staff and tax compliance).

The Investment Adviser assesses the quality of corporate governance practices of companies as part of its eligibility assessment when examining ESG risks, and as part of its ESG integration process more broadly. The Investment Adviser’s fundamental analysis covers a range of governance metrics including among others, audit practices, board composition, tax paid, controversies and executive compensation. The Investment Adviser engages in regular dialogue with companies on corporate governance issues and exercises its proxy voting rights for the entities in which the Fund invests.

As described above, the Investment Adviser applies a Negative Screening Policy to the Fund. As part of this, the Investment Adviser excludes companies violating the United Nations Global Compact (UNGC) principles as well as those violating principle 10 on anti-corruption and principle 3 on employee relations.

Capital Group's ESG Policy Statement provides additional detail on the Investment Adviser's ESG integration approach and processes, including proxy voting procedures and principles, as well as views on specific ESG issues, including ethical conduct, disclosures and corporate governance. Information on the Investment Adviser’s corporate governance principles can be found in its Proxy Voting Procedures and Principles.

Further details can be found in the ESG Policy Statement on:

https://www.capitalgroup.com/content/dam/cgc/tenants/eacg/esg/files/esg-policy-statement(en).pdf

Proportion of investments

At least 90% of the Fund's investments are used to attain the environmental or social characteristics promoted by the Fund (#1 Aligned with E/S characteristics). The Fund will have a minimum proportion of 60% in the sub-category “#1A Sustainable”, and a maximum of 40% will be in category “#1B Other E/S characteristics”.

A maximum of 10% of the Fund’s investments, including investments non-aligned with the E/S characteristics promoted and/or derivatives are in category “#2 Other”.

Cash and cash-equivalents are not included in the % of assets set out above. They may be held for liquidity purposes.

Monitoring of environmental or social characteristics

The sustainability indicators used by this Fund to measure the attainment of each of the environmental or social characteristics it promotes are the following:

- Percentage of issuers falling under the sectors defined as part of the Negative Screening Policy

- Percentage of investments having at least 50% of their revenue aligned with the SDGs, and

- Percentage of investments in companies considered as “Transitioning”.

Methodologies

The methodologies used to measure how the environmental and/or social characteristics are met are as follows:

- Eligibility process: the Investment Adviser seeks to invest in companies whose products and services are majority-aligned, or transitioning towards higher positive alignment, with any single or combination of sustainable investment themes focused on global social and environmental challenges as identified by the Investment Adviser. These themes map to the United Nations Sustainable Development Goals (“SDGs”). ‘Aligned’ companies currently have at least half of their business aligned and ‘Transitioning’ are companies that the Investment Adviser believes are actively transitioning their business to higher positive alignment with sustainable investment themes as identified by the Investment Adviser and with the SDGs, with material near-to-medium term change expected. The Investment Advisor typically uses revenue to assess business alignment, however in some instances other metrics may be more relevant, for example, energy production mix for utilities. The business alignment is accompanied by a qualitative assessment of the company’s product and service contribution to the SDGs, as well as risk of misalignment. It will also consider how material ESG risks and opportunities are being addressed and managed by the company, such as the quality of corporate governance practices and any adverse environmental or social impacts. For Transitioning companies in particular, company development pathway and timeline to reach intended impact is also considered.

- Relevant KPIs and targets, as well as topics for engagement, are also identified at the time of eligibility and tracked over time. For Transitioning companies in particular, KPIs may include aligned revenue, as well as other transition metrics. Progress against these KPIs and targets is assessed periodically.

- Research is conducted by the Investment Advisor’s ESG analysts and investment analysts. Eligibility decisions are voted on by the strategy’s Principal Investment Officers, Portfolio Managers, and ESG leadership.

- Negative Screening Policy: the Investment Adviser applies ESG and norms-based exclusions to implement a Negative Screening Policy to the Fund’s investments at the time of purchase. The Investment Adviser relies on third-party providers who identify a company’s participation in or the revenue which they derive from activities that are inconsistent with these screens. In the event that exclusions cannot be verified through third-party providers or if the Investment Adviser believes that data and/or assessment is incomplete or inaccurate, the Investment Adviser reserves the right to identify business involvement activities through its own assessment (including by using other third-party data sources).

- Engagement: Engagements are conducted by the ESG team in collaboration with our investment professionals. We engage management teams on topics that are informed by our research, ESG investment frameworks, voting and monitoring process.

- Proxy Voting: We have investment professional-led proxy voting, with our in-house Global Stewardship & Engagement (GSE)/Proxy team conducting analysis. Final proxy outcomes are decided by members of our investment units.

Data sources and processing

Data sources

The Fund uses several data sources as part of the investment process.

In relation to the SDGs alignment, the Investment Adviser typically uses revenue to assess business alignment, but will leverage other metrics if there are more sector-relevant financial metrics for a company and its industry.

The data sources used as part of the Negative Screening Policy are as follows:

| Activities | Datasource |

|---|---|

| United Nations Global Compact (UNGC) | Companies are identified through MSCI’s UNGC violators. |

| Tobacco | Companies are identified through MSCI’s Tobacco Producer – Maximum Percentage of Revenue factor name. |

| Controversial Weapons | Companies are identified through MSCI’s Controversial Weapons – Any Tie factor name. |

| Nuclear Weapons | Companies are identified through MSCI’s Weapons – Nuclear Maximum Percentage of Revenue factor name. |

| Weapons | Companies are identified through MSCI’s Weapons – Maximum Percentage of Revenue factor name. |

| Oil & Gas Upstream Producers | Equity: Companies are identified through Global Industry Classification Standard (GICS) “Integrated Oil & Gas” and “Oil & Gas Exploration & Production” sub-sector classifications. Fixed Income: Companies are identified through Barclays Global Sector Classification (BCLASS) “Independent” and “Integrated” sectors. |

| Thermal Coal | Companies are identified through MSCI’s Thermal Coal – Maximum Percentage of Revenue factor name. |

In the event that exclusions cannot be verified through third-party data or if the Investment Adviser believes that third-party data and/or assessment is incomplete or inaccurate, the Investment Adviser reserves the right to identify business involvement activities through its own assessment (including by using other third-party data sources).

Data quality and processing

Capital Group periodically reviews the performance quality of provider organizations and conducts ongoing monitoring and due diligence activities commensurate with the significance of the services provided.

Data are regularly updated in Capital Group’s internal platforms and made available to relevant teams. When issues are identified in third-party data, they are reported back to the provider(s). The Investment Adviser also applies systematic data quality checks to catch discrepancies and validate with the provider when issues arise.

Proportion of data that is estimated

Third-party providers may estimate data. While reported data are prioritized, Capital Group uses estimated data when reported data are unavailable. The proportion of estimated data varies depending on the data point due to inconsistencies in reporting by investee companies.

Limitations to methodologies and data

The Investment Adviser may be reliant on third-party data or a combination of third-party data and Capital Group’s proprietary research and analysis. However, such data might not capture the full universe of activities of an issuer, change suddenly, be flawed, inaccurate, incomplete or outdated, resulting in a Fund’s investment in an issuer which an investor may expect to be excluded from the portfolio. Capital Group performs ongoing due diligence on third-party data sources and endeavours to ensure that third-party data is reliable.

In addition, in the event that data cannot be obtained through third-party providers or if the Investment Adviser believes that third-party data and/or assessment is incomplete or inaccurate, the Investment Adviser reserves the right to identify business involvement activities through its own assessment (including by using other third-party data sources).

Due diligence

Members of Capital Group's compliance, risk management and internal audit staff conduct periodic assessments on the design and operating effectiveness of the firm’s activities and key controls. This includes compliance with internal processes and procedures as well as with the regulatory landscape in the jurisdictions in which the company operates. Capital Group meets regularly with the third-party data providers to review the quality of the services provided.

Pre-trade and post-trade checks are also in place as further explained in section “Monitoring of environmental or social characteristics” above.

Engagement policies

Establishing dialogue with companies is an integral part of the Investment Adviser’s investment management service to clients. Capital Group’s investment teams meet on a regular basis with company management, including executive and non-executive directors, chairs and finance directors. This enables the company to engage and generate dialogue on any issues that could affect the company’s long-term prospects, including exposures to sustainability issues.

Where Capital Group's investment teams identify an issue material to the long-term value of a company or they are concerned about relative ESG performance, Capital Group's investment professionals and governance teams will engage with management. Management’s response and the steps they take to minimise any associated risks, forms an important part of Capital Group's assessment of management quality, which itself is a key factor in the stock selection decisions.

Designated reference benchmark

The Fund has not designated a reference benchmark to meet the environmental and/or social characteristics it promotes.

Where can more product-specific information be found?

https://docs.publifund.com/1_PROSP/LU1577354035/en_LU

More product-specific information can be found in the periodic reports: