WHY CONSIDER

Sustainable sources of income

We value fixed income sectors that offer consistent yields and avoid riskier illiquid sectors.

OUR APPROACH

Building income bond by bond

Deep fundamental research provides an in-depth understanding of every income opportunity.

OUR SOLUTION

High-income exposure that is suited to a long-term allocation

Yields are not everything. The key is to seek the sweet spot

between income and risk.

Robert Neithart, fixed income portfolio manager, explains why we take a flexible approach to EM debt and high yield.

Sustainable sources of income

Emerging market (EM) debt and high yield bonds offer attractive and sustainable yield opportunities, despite interest rates remaining lower for longer. A consistent level of income for investors could be achieved in multiple market environments without the need to chase income into lower quality and less liquid sectors.

A proven approach that has provided high, consistent income in multiple market environments

Example: Capital Group Global High Income Opportunities (LUX) (GHIO) vs. selected government bonds

The portfolio invests primarily in EM debt and high yield sectors.

.png)

Past results are not a guarantee of future results. For illustrative purposes only.

Data as at 31 December 2021.

1. Income yield is total income earned by the fund, net of withholding taxes and before management fees and expenses, divided by average net assets over the past 12 months. Source: Capital Group

2. 2-year US Treasury generic spot yield. Source: Bloomberg

3. 2-year German government bond generic spot yield. Source: Bloomberg

4. 2-year Japan government bond generic spot yield. Source: Bloomberg

Building income bond by bond

Headline yield figures are a moot point when the risk is greater than the reward. Our distinctive bottom-up investment process, benefiting from integration between equity and fixed income research, means that every bond is assessed on its own merit. Maximising yields without considering the fundamentals or making top-down macro decisions is not how our portfolios are managed.

Shannon Ward

Portfolio manager

"Our emerging market debt and high yield teams are structured to take advantage of Capital Group’s global reach. We have a team of analysts and portfolio managers who specialise in their respective asset class, and we are also well connected to our equity and investment grade bond colleagues. We frequently work across asset classes as we make investment decisions.”

Integrated research across multiple teams for unique insights and outcomes

As an example, Thomas consulted with his colleagues in the credit and equity teams, and obtained the perspective of the emerging markets trader, before investing in Mexican local currency bonds for the Research Portfolio.

.png)

For illustrative purposes only. The information provided is not intended to be comprehensive or to provide advice. This information has been provided solely for informational purposes and is not an offer, or solicitation of an offer, or a recommendation to buy or sell any security or instrument listed herein.

Dedicated sovereign analyst

|

Thomas Kontchou |

Undertakes fundamental research including in-person meetings with policy makers and CEOs of major companies.

Leverages equity analysts for a 360° view

|

Andrei Margarit |

Covers Mexican industrials, telcos and utilities

Collaborates with credit peers

|

Andrea Montero |

Dedicated trading

|

Javier Martinez Mariscal |

High-income exposure that is suited to a long-term allocation

Just as important as generating excess returns is ensuring that we keep risk at a reasonable level for our investors. A multi-layer approach considers investment, operations and strategy-level risks, and a dedicated Risk and Quantitative Solutions Group (RQS) works together with the respective investment teams to understand and manage sources of high risk in individual portfolios.

Robert Neithart

Portfolio manager

“We incorporate guidance from our Portfolio Strategy Group on the economic environment and fixed income markets, and also draw on the views of the RQS team on asset class risk and portfolio construction. This collaborative process creates a rich body of information that we can draw upon and determine how to position the portfolio.”

We build our portfolios with high convictions from bottom-up fundamental research

.png)

Rethink higher income with Capital Group’s range of funds

-

-

With high yield exposure

Capital Group Global High Income Opportunities (LUX)

Provides exposure to higher yielding fixed income sectors, namely emerging market debt and high yield corporate bonds. It is not managed to any index.

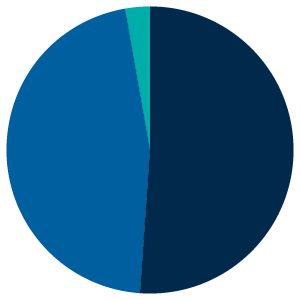

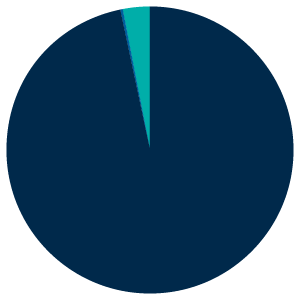

Portfolio allocation

Emerging markets debt 50.6%High yield 45.4%

Emerging markets debt 50.6%High yield 45.4%

Cash and others 2.5%Average credit rating BB Income yield 5.4% Effective duration (years) 5.2 Provides exposure to higher yielding corporate bonds that are primarily USD-denominated. Indexed to Bloomberg U.S. Corporate High Yield 2% Issuer Cap.

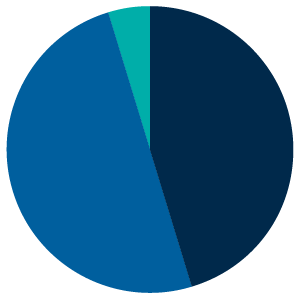

Portfolio allocation

Coporate 97.1%Sovereign 0.2%

Coporate 97.1%Sovereign 0.2%

Cash and others 2.9%Average credit rating BB Income yield 5.5% Effective duration (years) 4.1 -

Emerging markets focused

Provides exposure to the full range of emerging market debt opportunities across countries, currencies and corporates. Indexed to 50% JPM EMBI Global Diversified & 50% GBI EM Global Diversified Total Return.

Portfolio allocation

Hard currency 45.3%Local currency 50.0%

Hard currency 45.3%Local currency 50.0%

Cash and others 4.7%Average credit rating BBB Income yield 6.0% Effective duration (years) 5.8 Provides exposure to local currency fixed income opportunities within emerging markets. Indexed to JPM GBI-EM Global Diversified.

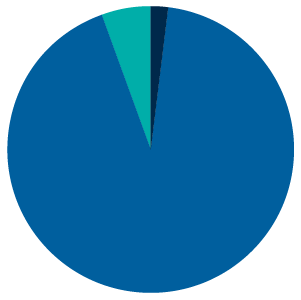

Portfolio allocation

Hard currency 2.1%Local currency 92.4%

Hard currency 2.1%Local currency 92.4%

Cash and others 5.5%Average credit rating BBB Income yield 6.2% Effective duration (years) 4.8

-

Risk factors you should consider before investing:

- This material is not intended to provide investment advice or be considered a personal recommendation.

- The value of investments and income from them can go down as well as up and you may lose some or all of your initial investment.

- Past results are not a guarantee of future results.

- If the currency in which you invest strengthens against the currency in which the underlying investments of the fund are made, the value of your investment will decrease. Currency hedging seeks to limit this, but there is no guarantee that hedging will be totally successful.

- The Prospectus – together with any locally-required offering documentation – set out risks, which, depending on the fund, may include risks associated with investing in fixed income, derivatives, emerging markets and/or high-yield securities; emerging markets are volatile and may suffer from liquidity problems.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates.

Capital Group manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organisation; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.