OPPORTUNITIES

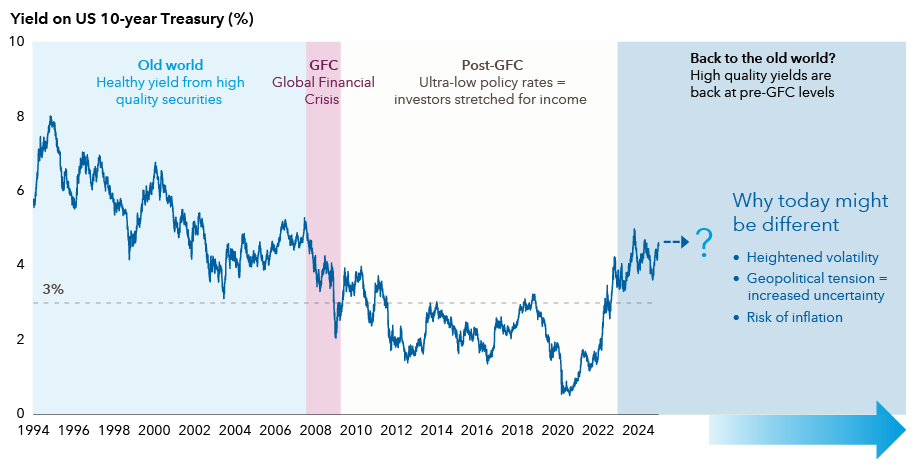

Income in the new investment regime

With the end of the ultra-low policy rate era and bond yields for income generating sectors at attractive levels, investors could once again derive meaningful income from a globally diversified portfolio of bonds.

-

-

Bond yields: Could history be repeating itself?

Past results are not a guarantee of future results.

-

Income generation strategies

-

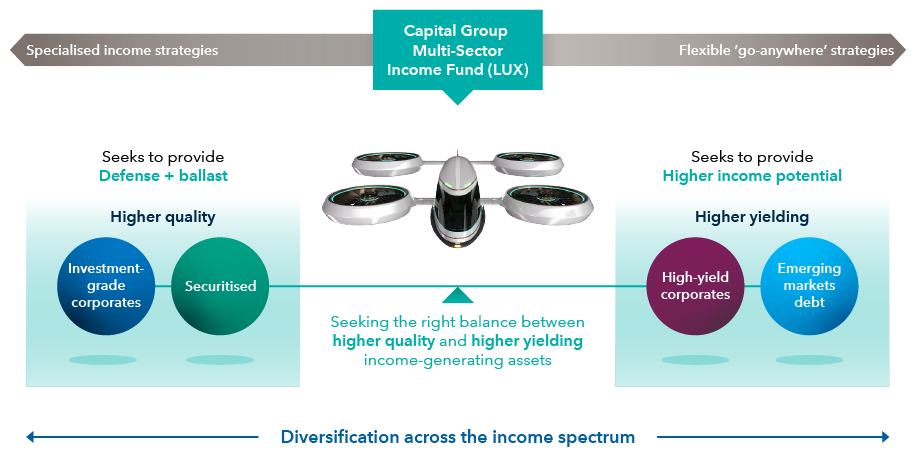

THE POWER OF 4

Capital Group Multi-Sector Income Fund (LUX)

The Multi-Sector Income Fund combines the power of four key fixed income credit sectors, each of which has distinctive income characteristics. We believe that diversifying across multiple income-generating sectors and dynamically adjusting allocations to maintain a balanced risk profile could deliver a reliable income stream.

Hear from Damien McCann, Principal Investment Officer of the Multi-Sector Income Fund, on how the fund’s key characteristics of diversification, balanced, and flexibility can help deliver reliable and attractive income to investors.

ESG FOCUS

ESG integration and beyond

ESG is woven into our investment process through three tightly integrated components: investment frameworks, monitoring and engagement. The fund also applies ESG and norms-based screens and has an explicit carbon target.3

For more information on our approach, to ESG please see ESG at Capital Group.

Screens

The fund excludes issuers within certain sectors, those that violate UN Global Compact principles and sovereigns that score below the Capital Group proprietary framework’s ESG threshold.

Carbon target

The fund’s carbon footprint is also monitored and managed to be lower than its reference index (for all eligible corporate bonds in the portfolio).2,3

The fund has adopted Sustainable Finance Disclosure Regulation (SFDR) article 8 requirements. The SFDR classification is related to the EU’s regulation and is not equivalent to approval or recognition as an ESG fund by regulators in Asia Pacific.

EXPERIENCE COUNTS

Managed by an experienced and specialist team

The portfolio is managed by a Principal Investment Officer and a team of seasoned sector specialist portfolio managers. They are supported by large, dedicated investment analyst teams that help create a portfolio built on deep insights into each of the securities the fund invests in.

Damien J. McCann

Principal Investment Officer

25 years with Capital

25 years of industry experience

Shannon Ward

US high yield

8 years with Capital

32 years of industry experience

Sandro Lazzarini

US high yield

9 years with Capital

17 years of industry experience

Scott Sykes

US investment-grade corporates

19 years with Capital

24 years of industry experience

Robert Burgess

Emerging markets debt

9 years with Capital

33 years of industry experience

Xavier Goss

Securitised credit

4 years with Capital

21 years of industry experience

Years of experience as at 31st December 2024.

WHY CAPITAL GROUP

A leader in global investing

For more than 90 years, we’ve been searching the world for long-term opportunities, making Capital one of the oldest global investors. We have also grown to become one of the world’s largest active fixed income fund managers.

Global investing credentials

US$2.8T

in total assets managed

25 years

average investment experience of our fixed income portfolio managers

US$550.3B

Fixed income assets managed*

*Assets under management by Capital Fixed Income Investors.

Data as at 31 December 2024

Capital Group Multi-Sector Income Fund (LUX)

We're here with the support and solutions you need.

Don't hesitate to reach out if you have questions or need assistance.

Bérenger de la Blache, CFA

Managing Director,

Financial Intermediaries & Institutional

Luxembourg, Belgium & France

+352 27 17 6245

Berenger.delaBlache@capitalgroup.com

Kim Pex

Managing Director,

Financial Intermediaries & Institutional

Luxembourg, Belgium & France

+352 27 17 6223

Kim.Pex@capitalgroup.com

Zoé Lavaud

Business Development Associate

Financial Intermediaries & Institutional

Luxembourg, Belgium & France

+352 27 17 6287

Zoe.lavaud@capitalgroup.com

Fatiha Benmaamar

Client Relations Manager

Luxembourg, Belgium & France

+352 27 17 6237

Fatiha.Benmaamar@capgroup.com

Grégoire Seron

Marketing Director

Luxembourg, Belgium & France

+352 27 17 6224

Gregoire.Seron@capitalgroup.com

Marie Henquet

Client Group Assistant

Luxembourg, Belgium & France

+352 27 17 6289

Marie.Henquet@capitalgroup.com

All data as at 31 December 2024 and attributed to Capital Group, unless otherwise specified.

- Reference index: US Government 10-year index. As at 31 December 2023. Source: Bloomberg

- Reference index: 45% Bloomberg US High Yield Index 2% Issuer Cap; 30% Bloomberg US Corporate Index; 15% JPMorgan EMBI Global Diversified Index; 8% Bloomberg Non-Agency CMBS Ex AAA Index; 2% Bloomberg ABS Ex AAA Index

- Carbon footprint data is based on weighted average carbon intensity

The information in relation to the index is provided for context and illustration only. The fund is an actively managed UCITS. It is not managed in reference to a benchmark.

Past results are not a guarantee of future results.

Fund risks

ABS/MBS risk: The fund may invest in mortgage- or asset-backed securities. The underlying borrowers of these securities may not be able to pay back the full amount that they owe, which may result in losses to the fund.

Bonds risk: The value of bonds can change as a result of interest rate changes – typically when interest rates rise, bond values fall. Funds investing in bonds are exposed to credit risk. A decline in the financial health of an issuer could cause the value of its bonds to fall or become worthless.

Counterparty risk: Other financial institutions provide services to the fund such as safekeeping of assets, or may serve as a counterparty to financial contracts such as derivatives. There is a risk the counterparty will not meet their obligations.

Derivative instruments risk: Derivatives are financial instruments deriving their value from an underlying asset and may be used to hedge existing exposures or to gain economic exposure. A derivative instrument may not perform as expected, may create losses greater than the cost of the derivative and may result in losses to the fund.

Emerging markets risk: Investments in emerging markets are generally more sensitive to risk events such as changes in the economic, political, fiscal and legal environment.

High yield bonds risk: Lower rated or unrated debt securities, including high yield bonds, may, as a result, be subject to liquidity, volatility, default and counterparty risk.

Liquidity risk: In stressed market conditions, certain securities held by the fund may not be able to be sold at full value, or at all. This could cause the fund to defer or suspend redemptions of its shares, meaning investors may not have immediate access to their investment.

Operational risk: The risk of potential loss resulting from inadequate or failed internal processes, people and systems or from external events.

Sustainability risk: Environmental, social or governance event or condition that, if it occurs, could cause an actual or potential material negative impact on the value of an investment of the fund.

Risk factors you should consider before investing:

- This material is not intended to provide investment advice or be considered a personal recommendation.

- The value of investments and income from them can go down as well as up and you may lose some or all of your initial investment.

- Past results are not a guarantee of future results.

- If the currency in which you invest strengthens against the currency in which the underlying investments of the fund are made, the value of your investment will decrease. Currency hedging seeks to limit this, but there is no guarantee that hedging will be totally successful.

- Some portfolios may invest in financial derivative instruments for investment purposes, hedging and/or efficient portfolio management.

- There are additional ABS/MBS, Bonds, Counterparty, Derivative instruments, Emerging markets, High yield bonds, Liquidity, Operational and Sustainability risks associated with this fund.

This communication is intended for the internal and confidential use of the recipient and not for onward transmission to any other third party.

This communication is issued by Capital International Management Company Sàrl (CIMC), unless otherwise stated, which is regulated by the Luxembourg CSSF - Commission de Surveillance du Secteur Financier. CIMC manages the Luxembourg-based UCITS fund(s), organised as a SICAV, which is a (are) sub-fund(s) of Capital International Fund (CIF).

In Singapore, this communication has been prepared by Capital Group Investment Management Pte. Ltd. (CGIMPL), a member of Capital Group, a company incorporated in Singapore.

This advertisement or publication has not been reviewed by the Monetary Authority of Singapore, or any other regulator.

This communication is of a general nature, and not intended to provide investment, tax or other advice, or to be a solicitation to buy or sell any securities. All information is as at the date indicated and attributed to Capital Group unless otherwise stated. While Capital Group uses reasonable efforts to obtain information from third-party sources that it believes to be accurate, this cannot be guaranteed.

The fund(s) is (are) offered only by Prospectus, together with any locally required offering documentation. In Europe, this is the PRIIPs Key Information Document (KID), in the UK the UCITS Key Investor Information Document (KIID), and in Singapore the Product Highlights Sheet (PHS). These documents are available free of charge and in English at capitalgroup.com, and should be read carefully before investing.

Investors acquire shares of the fund, not the underlying assets.

The material is not intended to be distributed or used by persons in jurisdictions that prohibit its distribution. If you act as representative of a client it is your responsibility to ensure that the offering or sale of fund shares complies with relevant local laws and regulations.

The information in relation to the index is provided for context and illustration only. The fund is actively managed. It is not managed in reference to a benchmark.

For Italy: A full list of Paying Agents and Distributors is located on the website stated.

For Singapore: CGIMPL is the appointed Singapore Representative of the Fund.

For Spain: A list of distributors is located at CNMV.es. CIF is registered with the Comisión Nacional del Mercado de Valores (‘CNMV’) under the number 983.

For Switzerland: The Representative in Switzerland: Capital International Sàrl, 3 place des Bergues, 1201 Genève. Paying agent in Switzerland for CIF: JPMorgan (Suisse) SA, 8 rue de la Confédération, 1204 Genève.

For UK: Compensation will not be available under the UK Financial Services Compensation Scheme.

The list of countries where the Fund is registered for distribution can be obtained at all times from CIMC or online at http://www.capitalgroup.com

In Europe, facilities to investors (tasks according to Article 92 of the Directive 2019/1160, points b) to f)), are available at www.capitalgroup.com/individual-investors/lu/en/contact-us.html

For European investors, a summary of Fund Shareholder Rights is available at www.capitalgroup.com/eacg/entry-page/shared/summary-of-investor-rights.html

CIMC may decide to terminate its arrangements for marketing any or all of the sub-funds of Capital International Fund in any EEA country or in any other jurisdictions where such sub-fund(s) is/are registered for sale at any time, in which case it will do so in accordance with the relevant UCITS rules.

All Capital Group trademarks are owned by The Capital Group Companies, Inc. or an affiliated company. All other company names mentioned are the property of their respective companies.

© 2024 Capital Group. All rights reserved.