Multi-objective approach to portfolio construction

Considers investor needs beyond return and volatility, anchoring quantitative success metrics to investor objectives

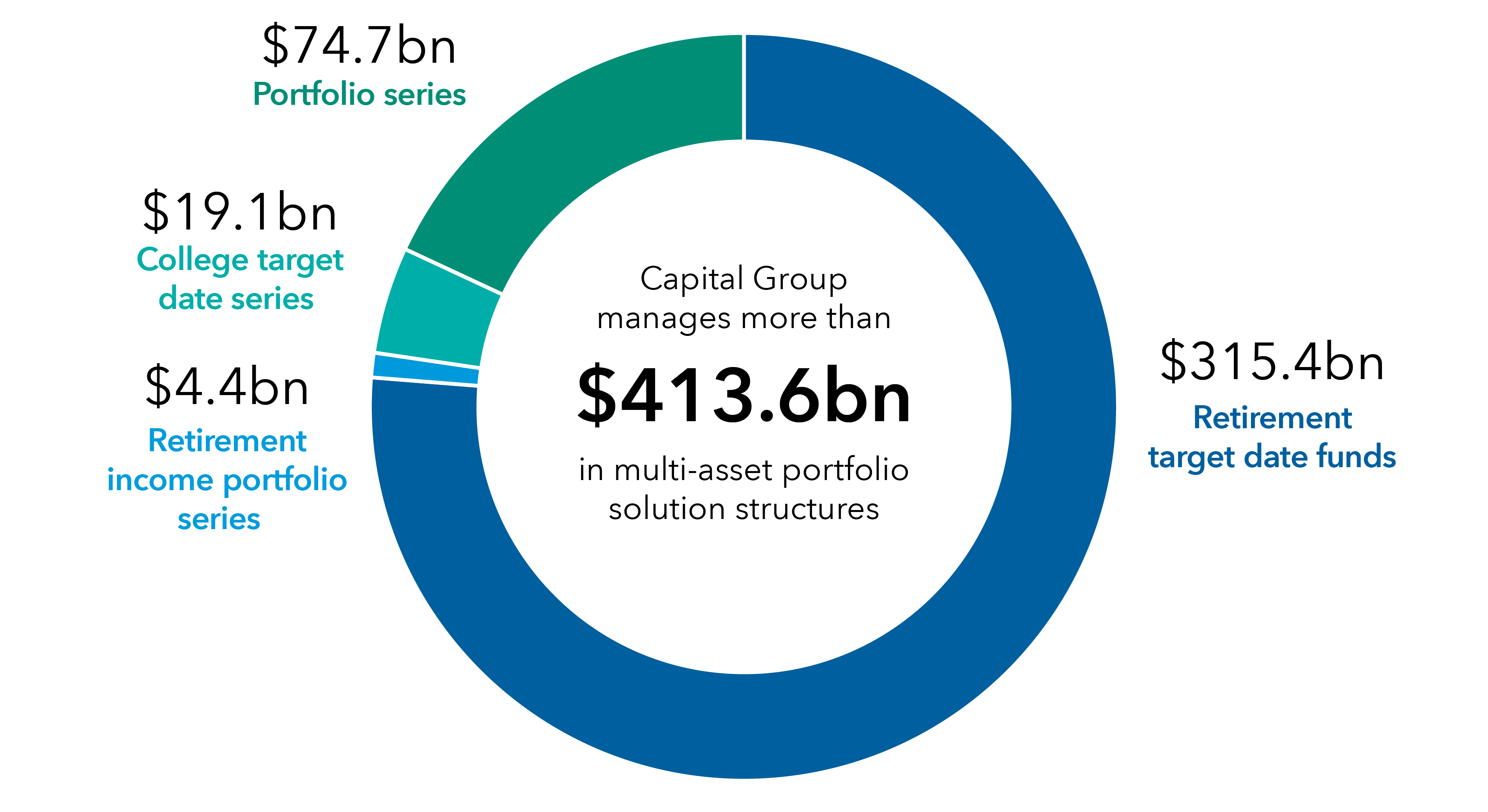

A proven leader in multi-asset portfolio solutions globally.

Segment sizes shown for illustrative purposes only.

Assets under management in US dollar terms for American Funds Retirement Target Date Series, Retirement Income Portfolio Series, College Target Date Series and Portfolio Series. American Funds are not registered for sale outside of the United States. Totals may not reconcile due to rounding.

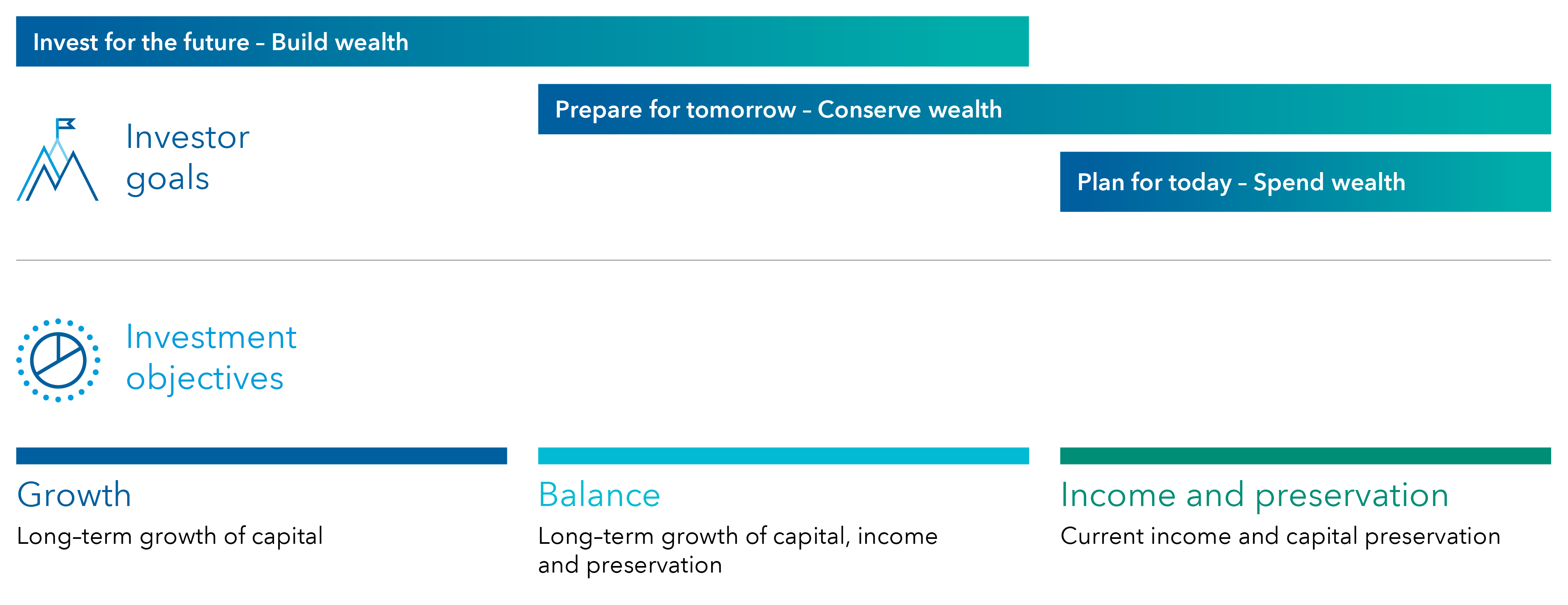

Investor goals and diversification are at the heart of portfolio construction at Capital Group

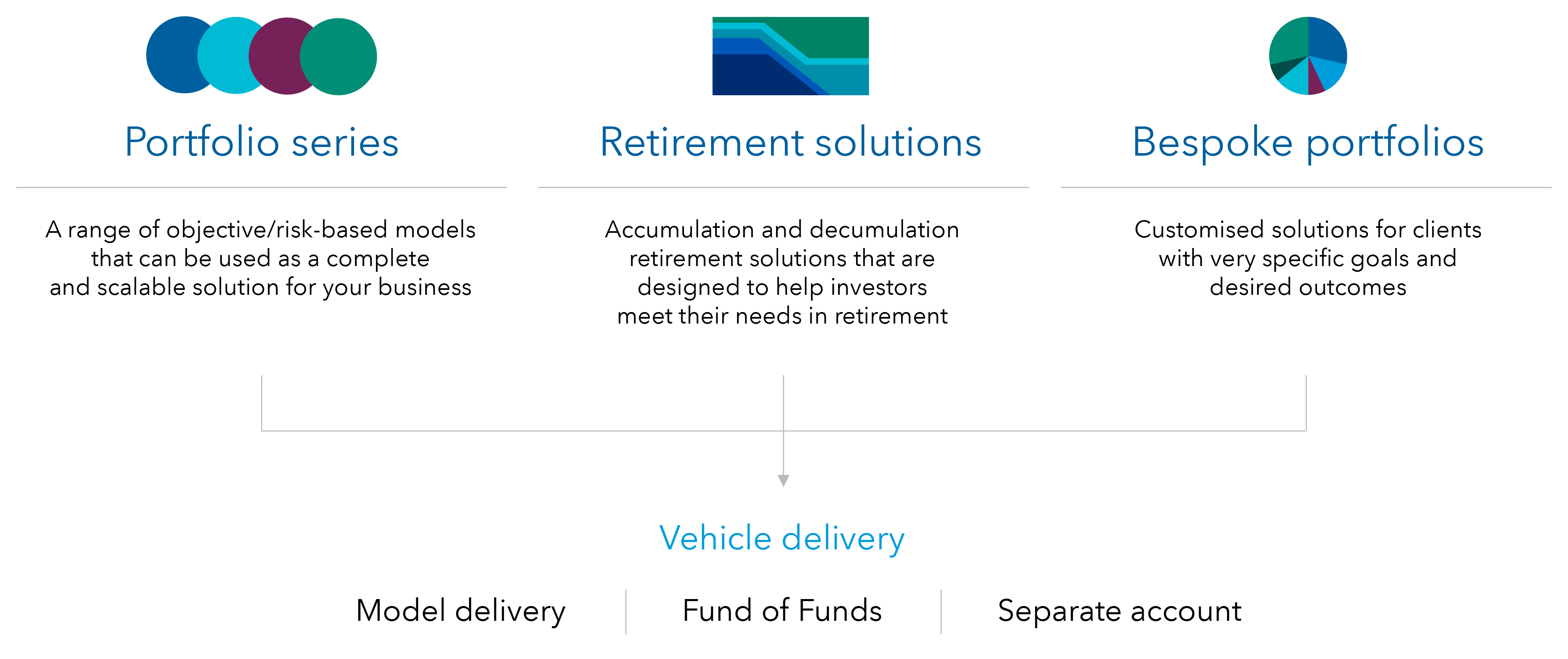

Capital Group’s range of multi-asset solutions

We can deliver a range of diversified solutions catered to a variety of investor goals

Considers investor needs beyond return and volatility, anchoring quantitative success metrics to investor objectives

Equity and fixed income exposures in our portfolios are chosen to address investor objectives

Our portfolios take advantage of decisions by portfolio managers on underlying strategies to dynamically pivot based on market conditions

*Assets under management by Capital Fixed Income Investors.

Data as at 31 December 2024

All data as at 31 December 2024 in USD and attributed to Capital Group, unless otherwise specified.

1. Based on total net assets of US open-end funds in target date global category. Source: Morningstar

Capital Group manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently.

Fixed income investment professionals provide fixed income research and investment management across the Capital organisation; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

Risk factors you should consider before investing: