Capital Group Emerging Markets Local Currency Debt Fund (LUX)

Une stratégie tirant profit du dynamisme de la dette émergente en devise locale

Depuis décembre 2023, le fonds [Capital Group Emerging Markets Local Currency Debt Fund (LUX) [Capital Group Euro Bond Fund (LUX)] [Capital Group Global Corporate Bond Fund (LUX)] est classé en tant que fonds dit « article 8 » en vertu du règlement européen « Sustainable Finance Disclosure » (SFDR).

Derniers avis aux actionnaires

Results

Les informations liées à l’indice sont fournies à des fins d’information et d’illustration uniquement. Ce fonds applique une gestion active. Il n’est pas géré par rapport à un indice de référence.

Les résultats passés ne préjugent pas des résultats futurs.

Cours et dividendes

Portfolio

Risques

Avant d’investir, il convient de tenir compte des facteurs de risque suivants :

- Le présent document n’a pas vocation à fournir un conseil d’investissement, ni à être considéré comme une recommandation personnalisée.

- La valeur des investissements et le revenu qu’ils génèrent ne sont pas constants dans le temps, et les investisseurs ne sont pas assurés de récupérer l’intégralité de leur mise initiale.

- Si la devise dans laquelle vous investissez s’apprécie face à celle dans laquelle les investissements sous-jacents du fonds sont réalisés, alors la valeur de votre placement baissera. La couverture du risque de change vise à limiter ce phénomène, rien ne permet de garantir qu’elle sera totalement efficace.

- Certains portefeuilles peuvent investir dans des instruments dérivés à des fins de placement, de couverture et/ou de gestion efficace du portefeuille.

- Des risques supplémentaires (Bond Connect, obligations, CIBM, contrepartie, produits dérivés, marchés émergents, liquidité, opérationnel et durabilité) sont associés à ce fond.

Risques liés aux fonds

Risque lié à Bond Connect : les investissements réalisés dans des obligations onshore chinoises négociées sur le marché interbancaire direct (China Interbank Bond Market – CIBM) via Bond Connect sont assortis de divers risques (compensation et règlement, liquidité, réglementaire, contrepartie).

Risque obligataire : la valeur des obligations peut évoluer en fonction du niveau des taux d’intérêt (en général, quand les taux d’intérêt montent, le cours des obligations baisse). Les fonds investis en obligations sont exposés au risque de crédit. La valeur d’une obligation peut reculer, voire devenir nulle en cas de dégradation de la situation financière de son émetteur.

Risque CIBM : le fonds peut investir sur le marché interbancaire direct chinois (China Interbank Bond Market – CIBM), qui peut être volatil et soumis à des contraintes de liquidité en raison de volumes de transaction limités, ce qui peut se traduire par de fortes fluctuations du cours des instruments de dette négociés sur ce marché, des spreads importants et des coûts de transaction élevés.

Risque de contrepartie : d’autres établissements financiers fournissent des services au fonds, tels que la conservation des actifs, ou peuvent servir de contrepartie à des contrats financiers tels que des produits dérivés. Il existe un risque que la contrepartie n’honore pas ses obligations.

Risque lié aux produits dérivés : un produit dérivé est un instrument financier dont la valeur découle d’un actif sous-jacent, et qui peut être utilisé pour couvrir des expositions existantes ou pour acquérir une exposition. Un produit dérivé peut ne pas produire les résultats attendus, subir des pertes supérieures à son coût et ainsi engendrer des pertes pour le fonds.

Risque lié aux marchés émergents : les investissements sur les marchés émergents sont généralement plus sensibles à des événements comme l’évolution du contexte économique, politique, budgétaire et juridique des marchés concernés.

Risque de liquidité : dans un environnement de marché tendu, certains titres détenus au sein du fonds peuvent être revendus à une valeur inférieure à leur valeur réelle, voire ne pas trouver de repreneur. L’équipe de gestion peut en conséquence décider de reporter ou de suspendre les rachats de parts du fonds, privant ainsi les investisseurs d’un accès immédiat à leur capital.

Risque opérationnel : risque de perte découlant de défaillances internes (processus, personnel, systèmes) ou d’événements externes.

Risque de durabilité : événement ou contexte environnemental, social et de gouvernance pouvant avoir un impact négatif significatif sur la valeur d’un investissement dans le fonds.

Resources

Informations en matière de durabilité

Synthèse

Sans objectif d’investissement durable

Ce Fonds promeut des caractéristiques environnementales ou sociales, mais n’a pas pour objectif l’investissement durable.

Caractéristiques environnementales ou sociales des produits financiers

Le Fonds promeut les caractéristiques environnementales ou sociales en excluant de ses investissements des émetteurs sur la base de critères ESG et normatifs.

Stratégie d’investissement

CRMC (le « Conseiller en investissement ») identifie certains émetteurs ou groupes d’émetteurs qu’il exclut du portefeuille afin de promouvoir les caractéristiques environnementales ou sociales soutenues par le Fonds. Le Conseiller en investissement évalue et applique des filtres ESG et normatifs pour mettre en œuvre des exclusions sur les émetteurs privés et souverains à l’égard de certains secteurs tels que les combustibles fossiles, les armes, ainsi que les entreprises qui enfreignent les principes du Pacte mondial des Nations unies (la « Politique de filtrage négatif »).

Le Fonds promeut, entre autres caractéristiques, des caractéristiques environnementales et sociales, à condition que les entreprises dans lesquelles les investissements sont réalisés suivent de bonnes pratiques de gouvernance. Les pratiques de bonne gouvernance sont évaluées dans le cadre du processus d’intégration ESG du Conseiller en investissement. Dans le cadre de l’évaluation des pratiques de bonne gouvernance, le Conseiller en investissement tient compte au minimum des éléments qu’il estime pertinents pour les quatre piliers prescrits de la bonne gouvernance (à savoir les structures de gestion, les relations avec les employés, la rémunération du personnel et la conformité fiscale). Ces pratiques sont évaluées dans le cadre d’un processus de suivi. Le cas échéant, une analyse fondamentale d’une série d’indicateurs de gouvernance qui abordent des domaines tels que les pratiques d’audit, la composition du conseil d’administration et la rémunération des dirigeants, entre autres, est également réalisée.

La Politique de filtrage négatif de Capital Group s’appliquera à l’ensemble du portefeuille, à l’exception des liquidités, des équivalents de liquidités et des fonds du marché monétaire. Les dérivés sur indices utilisés à des fins de couverture et/ou d’investissement ne seront pas évalués en toute transparence. Par conséquent, dans certaines circonstances, le Fonds peut obtenir une exposition indirecte à un émetteur appartenant aux catégories exclues (par le biais, notamment, de produits dérivés et d’instruments qui permettent une exposition à un indice). Les produits dérivés à dénomination unique devront être conformes à la Politique de filtrage négatif. Le Conseiller en investissement s’assurera que les garanties obtenues sont conformes à la politique.

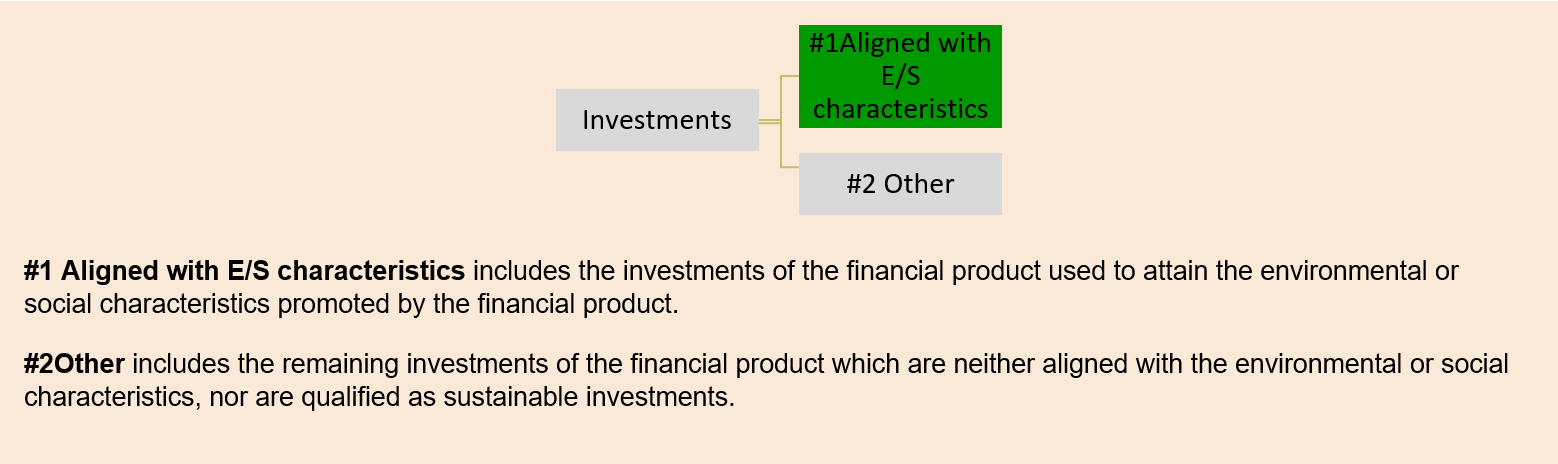

Proportion d’investissements

L’allocation d’actifs prévue fait l’objet d’un suivi continu et d’une évaluation annuelle. Au moins 90 % des investissements du Fonds sont alignés sur les caractéristiques E/S. Au maximum 10 % des investissements du Fonds, qui incluent les investissements non alignés sur les caractéristiques E/S et/ou les produits dérivés, se trouvent dans la catégorie « #2 Autres ». Le Fonds ne s’engage pas à réaliser des investissements durables.

Contrôle des caractéristiques environnementales ou sociales

Les indicateurs de durabilité utilisés par ce Fonds pour mesurer la réalisation de chacune des caractéristiques environnementales ou sociales qu’il promeut sont les suivants.

Le Conseiller en investissement applique des exclusions ESG et normatives afin d’assurer la mise en œuvre d’une Politique de filtrage négatif aux investissements du Fonds. Le Fonds contrôlera :

- le pourcentage d’émetteurs souverains ne relevant pas du processus d’évaluation des souverains du Conseiller en investissement ; et

- si les émetteurs privés respectent les critères stipulés dans la Politique de filtrage négatif.

Méthodes

Le Fonds met en œuvre un critère ESG contraignant : des filtres sectoriels et normatifs qui se traduisent par des exclusions.

Sources et traitement des données

Les exclusions sont principalement définies suite aux recherches de filtrage de l’implication ESG des entreprises de MSCI (« ESG de MSCI ») d’un fournisseur tiers. D’autres données intègrent le Pacte mondial des Nations unies (MSCI) et les indicateurs MSCI de l’empreinte carbone.

Limites aux méthodes et aux données

La méthodologie et les sources relatives aux exclusions et à l’approche de l’intégration ESG dans leur ensemble présentent certaines limites.

Diligence raisonnable

Les membres des services de conformité réglementaire, de gestion du risque et d’audit interne de Capital Group réalisent des évaluations périodiques de la conception et de l’efficacité opérationnelle des activités ESG et des principaux contrôles de l’entreprise.

Politiques d’engagement

La mise en place d’un dialogue avec les sociétés fait partie intégrante du service de gestion des investissements que le Conseiller en investissement assure pour ses clients. Cela permet à Capital Group de mener un dialogue collaboratif sur toute question susceptible d’affecter les perspectives à long terme de l’entreprise en portefeuille, y compris ses expositions aux thématiques de durabilité.

Indice de référence désigné

Le Fonds n’a désigné aucun indice de référence en vue d’atteindre les caractéristiques environnementales et/ou sociales qu’il promeut.

The sustainability-related disclosures are meant to be revised as necessary from time to time to capture any changes or reviews. The capitalized terms are used in accordance with the definitions and references outlined in Capital International Fund Prospectus.

Capital International Fund – Capital Group Emerging Markets Local Currency Debt Fund (LUX) (the “Fund”)

LEI: 5493009VJSAE25SFXL78

The below section “Summary” was prepared in English and is being translated to other official languages of the European Economic Area. In case of any inconsistency(ies) or conflict(s) between the different versions of this section “Summary”, the English language version shall prevail.

Summary

No sustainable investment objective

This Fund promotes environmental or social characteristics, but does not have as its objective sustainable investment.

Environmental or social characteristics of the financial products

The Fund promotes the environmental or social characteristics of excluding investments in issuers based on ESG and norms-based criteria.

Investment strategy

CRMC (the “Investment Adviser”) identifies certain issuers or groups of issuers that it excludes from the portfolio to promote the environmental or social characteristics supported by the Fund. The Investment Adviser evaluates and applies ESG and norms-based screening to implement exclusions on corporate and sovereign issuers with respect to certain sectors such as fossil fuel and weapons, as well as companies violating the United Nations Global Compact principles (the “Negative Screening Policy”).

The Fund promotes, among other characteristics, environmental and social characteristics, provided that the companies in which investments are made follow good governance practices. Good governance practices are evaluated as part of the Investment Adviser’s ESG integration process. When assessing good governance practices, the Investment Adviser will, as a minimum, have regard to matters it sees relevant to the four prescribed pillars of good governance (i.e., sound management structures, employee relations, remuneration of staff and tax compliance). Such practices are assessed through a monitoring process. Where relevant, fundamental analysis of a range of governance metrics that cover areas such as auditing practices, board composition and executive compensation, among others, is also conducted.

The Capital Group’s Negative Screening Policy will apply to the entire portfolio, with the exception of cash, cash equivalents and money market funds. Index derivatives that are used for hedging and/or investment purposes will not be assessed on a look–through basis. Therefore, there may be circumstances where the Fund may gain indirect exposure to an issuer involved in the excluded categories (through, including but not limited to, derivatives and instrument that gives exposure to an index). Single-name derivatives will need to be compliant with the Negative Screening Policy. The Investment Adviser will ensure that collateral received is aligned with the policy.

Proportion of investments

The planned asset allocation is monitored continuously and evaluated on a yearly basis. At least 90% of the Fund's investments are aligned with E/S characteristics. A maximum of 10% of the Fund’s investments including investments non-aligned with the E/S characteristics promoted and/or derivatives are in category “#2 Other”. The Fund does not commit to make any sustainable investments.

Monitoring of environmental or social characteristics

The sustainability indicators used by this Fund to measure the attainment of each of the environmental or social characteristics it promotes are as follows.

The Investment Adviser applies ESG and norms-based exclusions to implement a Negative Screening Policy to the Fund’s investments. The Fund will monitor:

percentage of sovereign issuers failing the Investment Adviser’s process for assessing sovereigns; and

adherence of corporate issuers to the criteria set forth in the Negative Screening Policy.

Methodologies

The Fund implements one binding ESG-related criteria: sector- and norms-based screens in the form of exclusions.

Data sources and processing

Exclusions are primarily identified through a third-party provider, MSCI ESG Business Involvement Screening Research (“MSCI ESG”). Other data points include the MSCI United Nations Global Compact and MSCI Carbon Footprint Metrics.

Limitations to methodologies and data

The methodology and sources relating to the exclusions and the ESG integration approach as a whole have certain limitations.

Due diligence

Members of Capital Group's compliance, risk management and internal audit staff conduct periodic assessments on the design and operating effectiveness of the firm’s ESG activities and key controls.

Engagement policies

Establishing dialogue with companies is an integral part of the Investment Adviser’s investment management service to clients. This enables Capital Group to engage and generate dialogue on any issues that could affect the investee company’s long-term prospects, including exposures to sustainability issues.

Designated reference benchmark

The Fund has not designated a reference benchmark to meet the environmental and/or social characteristics it promotes.

No sustainable investment objective

This Fund promotes environmental or social characteristics but does not have as its objective sustainable investment. The Fund does not make any sustainable investments.

Environmental or social characteristics of the financial product

The Fund promotes environmental and social characteristics, provided that the companies in which investments are made follow good governance practices.

The Investment Adviser evaluates and applies ESG and norms-based exclusions to implement a Negative Screening Policy to the Fund’s investments at the time of purchase.

For sovereign issuers, the Investment Adviser conducts an eligibility assessment leveraging its proprietary sovereign ESG framework, which covers a range of ESG indicators to evaluate how well a country manages its ESG risk. The Investment Adviser uses its proprietary sovereign ESG framework to assess the ESG and Governance score of a sovereign issuer against predetermined thresholds.

For corporate issuers, the Investment Adviser relies on third-party providers who identify an issuer’s participation in or the revenue which they derive from activities that are inconsistent with these screens.

The Investment Adviser selects investments to the extent they are in line with the negative screening policy.

Investment strategy

The Investment Adviser applies the following investment strategy to attain the environmental and/or social characteristics promoted.

Negative Screening Policy: The Investment Adviser evaluates and applies ESG and norms-based exclusions to implement a Negative Screening Policy to the Fund’s investments at the time of purchase.

To support this screening on sovereign issuers, the Investment Adviser conducts an eligibility assessment leveraging its proprietary sovereign ESG framework, which covers a range of ESG indicators to evaluate how well a country manages its ESG risk. To be eligible for investment, sovereigns must score above pre-determined thresholds for their proprietary ESG score on both an absolute and GNI-adjusted basis. The Investment Adviser leverages data from third-party institutions such as the United Nations and the World Bank to calculate ESG scores across the sovereign universe. Sovereign issuers are evaluated on: (1) a gross national income-adjusted basis to better understand how well a country manages ESG risk relative to its wealth and available resources, as well as (2) on an absolute basis. Sovereign issuers that score below pre-defined thresholds in either category are generally not eligible for purchase by the Funds. If the Investment Adviser believes that the third-party data and/or assessment is incomplete or inaccurate, the Investment Adviser reserves the right to identify exclusions for sovereign issuers through its own assessment. The Investment Adviser also periodically reviews sovereign issuers and if a previously eligible sovereign issuer held in the Fund becomes ineligible, the sovereign issuer will not contribute towards the environmental and/or social characteristics of the Fund and the sovereign issuer will generally be sold within six months from the date of such determination, subject to the best interests of investors in the Fund (save that if the Investment Adviser believes that a score is below a pre-defined threshold for a temporary or a transitory reason, the Investment Adviser may, from time to time, exercise its discretion to keep holding or purchase securities issued by the sovereign issuer).

For corporate issuers, the Investment Adviser relies on third party provider(s) who identify an issuer’s participation in or the revenue which they derive from activities that are inconsistent with the ESG and norms-based screens. In this way, third party provider data is used to support the application of ESG and norms-based screening by the Investment Adviser. In the event that exclusions cannot be verified through third-party providers or if the Investment Adviser believes that data and/or assessment is incomplete or inaccurate, the Investment Adviser reserves the right to identify business involvement activities through its own assessment (including by using other third-party data sources). If an eligible corporate issuer held in a Fund subsequently fails a screen, the issuer will not contribute towards the environmental and/or social characteristics of the Fund and will generally be sold within six months from the date of such determination, subject to the best interests of investors in the Fund.

What is the policy to assess good governance practices of the investee companies?

The Investment Adviser ensures that the companies in which investments are made follow good governance practices.

When assessing good governance practices, the Investment Adviser will, as a minimum, have regard to matters it sees relevant to the four prescribed pillars of good governance (i.e., sound management structures, employee relations, remuneration of staff and tax compliance).

As described above, the Investment Adviser applies a Negative Screening Policy to the Fund. As part of this, the Investment Adviser excludes companies that, based on available third-party data, are viewed to be in violation of the principles of the UNGC, which include Principle 10 (anti-corruption) and Principle 3 (employee relations).

In addition, good governance practices are evaluated as part of the Investment Adviser’s ESG integration process. Such practices are assessed through a monitoring process based on available third-party indicators relating to corporate governance and corporate behavior. Third-party data may be inaccurate, incomplete or outdated. Where the corporate governance and corporate behavior indicators cannot be verified through the third-party provider, the Investment Adviser will aim to make such determination through its own assessment based on information that is reasonably available. Where relevant, fundamental analysis of a range of metrics that cover auditing practices, board composition, and executive compensation, among others, is also conducted. The Investment Adviser also engages in regular dialogue with companies on corporate governance issues and exercises its proxy voting rights for the entities in which the Fund invests.

If a previously eligible company held in a Fund subsequently fails the Investment Adviser’s assessment of good governance practices, the company will generally be sold within six months from the date of such determination, subject to the best interests of investors in the Fund.

Capital Group’s ESG Policy Statement provides additional detail on Capital Group’s ESG philosophy, integration, governance, support and processes, including proxy voting procedures and principles, as well as views on specific ESG issues, including ethical conduct, disclosures and corporate governance. Information on Capital Group’s corporate governance principles can be found in its Proxy Voting Procedures and Principles as well as in the ESG Policy Statement.

Information on Capital Group’s corporate governance principles can be also found in its Proxy Voting Procedures and Principles, available on:

https://www.capitalgroup.com/content/dam/cgc/tenants/europe/documents/responsible-investing/global_proxy_voting_guidelines(en).pdf.

The ESG Policy Statement provides additional detail on Capital Group’s views on specific ESG issues, including ethical conduct, disclosures and corporate governance, available on:

http://www.capitalgroup.com/content/dam/cgc/tenants/eacg/esg/files/esg-policy-statement(en).pdf

Proportion of investments

At least 90% of the Fund's investments are in category “#1 Aligned with E/S characteristics” and so are used to attain the environmental or social characteristics promoted by the Fund (being subject to the Investment Adviser’s binding Negative Screening Policy). A maximum of 10% of the Fund’s investments including investments non-aligned with the E/S characteristics promoted and/or derivatives are in category “#2 Other”.

The Fund does not commit to make any sustainable investments.

Cash and/or cash equivalents are excluded from the asset allocation. Cash and cash-equivalents may be held for liquidity purposes to support the Fund’s overall investment objective.

Monitoring of environmental or social characteristics

The sustainability indicators used by this Fund to measure the attainment of each of the environmental or social characteristics it promotes are as follows.

The Investment Adviser applies ESG and norms-based exclusions to implement a Negative Screening Policy to the Fund’s investments. The Fund will monitor:

percentage of sovereign issuers failing the Investment Adviser’s process for assessing sovereigns; and

percentage of corporate issuers failing a screen under the Negative Screening Policy.

The Fund applies investment restrictions rules at the time of purchase on a pre-trade basis in portfolio management systems to restrain investment in companies or issuers based on the exclusion criteria. The portfolio also undergoes regular/systematic post-trade compliance checks. The methodology applied to sovereign and corporate issuers respectively in support of this screening is described in detail under the section “Investment Strategy” of this document.

In the event that exclusions cannot be verified through the third-party provider(s) or if the Investment Adviser believes that third party data and/or assessment is incomplete or inaccurate, the Investment Adviser will aim to identify business involvement activities through its own assessment (including third-party data sources). Please refer to Fund’s Negative Screening Policy for further details.

Methodologies

The Fund implements one binding ESG-related criteria: sector- and norms-based screens in the form of exclusions, with the methodology applied to this commitment having already been presented in detail in the previous sections.

The SFDR classification is related to the European Union’s regulation and is not equivalent to approval or recognition as an ESG Fund by regulators in Asia Pacific.

Data sources and processing

Data sources

The Investment Adviser uses a combination of internal research and third-party data providers to gather ESG-related data.

Third-party providers are used to calculate the carbon footprint of the Fund and for identifying corporate issuers' involvement in activities inconsistent with ESG and norms-based screens. In the event that exclusions cannot be verified through third-party data or if the Investment Adviser believes that third-party data and/or assessment is incomplete or inaccurate, the Investment Adviser reserves the right to identify business involvement activities through its own assessment (including by using other third-party data sources).

Exclusions for sovereign issuers are identified through the Investment Adviser’s proprietary research. The Investment Adviser leverages data from third-party institutions such as the United Nations and the World Bank to calculate ESG scores across the sovereign universe. Sovereign issuers are evaluated on: (1) a gross national income-adjusted basis to better understand how well a country manages ESG risk relative to its wealth and available resources, as well as (2) on an absolute basis. If the Investment Advisor believes that the third-party data and/or assessment is incomplete or inaccurate, the Investment Adviser reserves the right to identify exclusions for sovereign issuers through its own assessment.

Data quality and processing

Capital Group periodically reviews the performance quality of provider organizations and conducts ongoing monitoring and due diligence activities commensurate with the significance of the services provided.

Data are regularly updated in Capital Group’s internal platforms and made available to relevant teams. When issues are identified in third-party data, they are reported back to the provider(s). The Investment Adviser also applies systematic data quality checks to catch discrepancies and validate with the provider when issues arise.

Proportion of data that is estimated

Third-party providers may estimate data. While reported data are prioritized, Capital Group uses estimated data when reported data are unavailable. The proportion of estimated data varies depending on the data point due to inconsistencies in reporting by investee companies.

Limitations to methodologies and data

The methodology and sources relating to the exclusions and the ESG integration approach as a whole have certain limitations. In order to identify all publicly traded companies globally which are involved in activities such as the production of controversial products and revenue derived from activities that are inconsistent with the ESG and norms-based screens, the Fund uses data from third-party provider(s). In the event that data cannot be obtained through third-party providers or if the Investment Adviser believes that third-party data and/or assessment is incomplete or inaccurate, the Investment Adviser will aim to identify business involvement activities through its own assessment (including by using other third-party data sources).

Due diligence

Members of Capital Group's compliance, risk management and internal audit staff conduct periodic assessments on the design and operating effectiveness of the firm’s ESG activities and key controls. This includes compliance with internal processes and procedures as well as with the regulatory landscape in the jurisdictions in which the company operates. Capital Group meets regularly with the third-party data providers to review the quality of the services provided.

Pre-trade and post-trade checks are also in place as further explained in section “Monitoring of environmental or social characteristics” above.

Engagement policies

Establishing dialogue with companies is an integral part of the Investment Adviser’s investment management service to clients. Capital Group’s investment teams meet on a regular basis with company management, including executive and non-executive directors, chairs and finance directors. This enables the company to engage and generate dialogue on any issues that could affect the company’s long-term prospects, including exposures to sustainability issues.

Where Capital Group's investment teams identify an issue material to the long-term value of a company or they are concerned about relative ESG performance, Capital Group's investment professionals and governance teams will engage with management. Management’s response and the steps they take to minimise any associated risks, forms an important part of Capital Group's assessment of management quality, which itself is a key factor in the stock selection decisions.

Designated reference benchmark

The Fund has not designated a reference benchmark to meet the environmental and/or social characteristics it promotes.

Where can more product-specific information be found?

More product-specific information can be found in the pre-contractual template:

https://docs.publifund.com/1_PROSP/LU1577354035/en_LU

More product-specific information can be found in the periodic reports:

https://docs.publifund.com/4_AR/LU1577354035/en_LU