Capital Group Global Allocation Fund (LUX)

A simpler approach to multi-asset investing

From 21 March 2025, Capital Group Global Allocation Fund (LUX) is classified as an Article 8 fund under the EU’s Sustainable Finance Disclosure Regulation (SFDR).

Latest shareholder notices

Results

The information in relation to the index is provided for context and illustration only. The fund is actively managed. It is not managed in reference to a benchmark.

Past results are not a guarantee of future results.

Price & Distributions

Portfolio

Risk Considerations

Risk factors you should consider before investing:

- This material is not intended to provide investment advice or be considered a personal recommendation.

- The value of investments and income from them can go down as well as up and you may lose some or all of your initial investment.

- If the currency in which you invest strengthens against the currency in which the underlying investments of the fund are made, the value of your investment will decrease. Currency hedging seeks to limit this, but there is no guarantee that hedging will be totally successful.

- Some portfolios may invest in financial derivative instruments for investment purposes, hedging and/or efficient portfolio management.

- There are additional Bonds, Counterparty, Derivative instruments, Emerging markets, Equities, Liquidity and Operational risks associated with this fund.

Fund risks

Bonds risk: The value of bonds can change as a result of interest rate changes – typically when interest rates rise, bond values fall. Funds investing in bonds are exposed to credit risk. A decline in the financial health of an issuer could cause the value of its bonds to fall or become worthless.

Counterparty risk: Other financial institutions provide services to the fund such as safekeeping of assets, or may serve as a counterparty to financial contracts such as derivatives. There is a risk the counterparty will not meet their obligations.

Derivative instruments risk: Derivatives are financial instruments deriving their value from an underlying asset and may be used to hedge existing exposures or to gain economic exposure. A derivative instrument may not perform as expected, may create losses greater than the cost of the derivative and may result in losses to the fund.

Emerging markets risk: Investments in emerging markets are generally more sensitive to risk events such as changes in the economic, political, fiscal and legal environment.

Equities risk: The prices of equity securities may decline in response to certain events, including those directly involving the companies whose securities are owned by the fund, overall market changes, local, regional or global political, social or economic instability and currency fluctuations.

Liquidity risk: In stressed market conditions, certain securities held by the fund may not be able to be sold at full value, or at all. This could cause the fund to defer or suspend redemptions of its shares, meaning investors may not have immediate access to their investment.

Operational risk: The risk of potential loss resulting from inadequate or failed internal processes, people and systems or from external events.

Resources

Sustainability-related disclosures

The sustainability-related disclosures are meant to be revised as necessary from time to time to capture any changes or reviews. The capitalized terms are used in accordance with the definitions and references outlined in Capital International Fund Prospectus.

Capital International Fund – Capital Group Global Allocation Fund (LUX) (the “Fund”)

LEI: 549300SLOS5KBC6BAF90

The below section “Summary” was prepared in English and is being translated to other official languages of the European Economic Area. In case of any inconsistency(ies) or conflict(s) between the different versions of this section “Summary”, the English language version shall prevail.

Summary

No sustainable investment objective

This Fund promotes environmental or social characteristics, but does not have as its objective sustainable investment. However, CRMC (the “Investment Adviser”) commits to maintain at least 10% of the Fund’s investments in companies that, in the Investment Adviser’s opinion, are addressing social and/or environmental challenges through their current or future products and/or services.

Environmental or social characteristics of the financial products

The Fund promotes the environmental and social characteristics by excluding investments in issuers based on ESG and norms-based criteria. For its equity portion, the Fund promotes the environmental and social characteristics of investing in companies with a Weighted Average Carbon Intensity (“WACI”) that is lower than the MSCI AC World index.

Investment strategy

For its equity portion, the Fund aims to maintain a carbon footprint (WACI) for its investments in corporate issuers that is lower than MSCI ACWI index. While this Fund is actively managed and without any reference or constraints to a reference index concerning the composition of the portfolio of the Fund (within the limits of the relevant specific investment objective and policy), the Fund is using this index to monitor the investment’s carbon emissions. The Investment Adviser relies on third party data to carry out ongoing monitoring of the WACI at the Fund level, and may reduce or eliminate exposures to certain companies as necessary.

To promote environmental and social characteristics the Investment Advisor applies ESG and norms-based screening with respect to certain sectors such as weapons (the “Negative Screening Policy”).

The Fund promotes, among other characteristics, environmental and social characteristics, provided that the companies in which investments are made follow good governance practices. Good governance practices are evaluated as part of the Investment Adviser’s ESG integration process. When assessing good governance practices, the Investment Adviser will, as a minimum, have regard to matters it sees relevant to the four prescribed pillars of good governance (i.e., sound management structures, employee relations, remuneration of staff and tax compliance). Such practices are assessed through a monitoring process. Where relevant, fundamental analysis of a range of governance metrics that cover areas such as auditing practices, board composition and executive compensation, among others, is also conducted.

The Fund’s carbon constraint does not apply to the entire portfolio, and will apply only to corporate issuers that have carbon emissions data available (reported or estimated). The Capital Group’s Negative Screening Policy will apply to the entire portfolio, with the exception of cash, cash equivalents and money market funds. Index derivatives that are used for hedging and/or investment purposes will not be assessed on a look–through basis. Therefore, there may be circumstances where the Fund may gain indirect exposure to an issuer involved in the excluded categories (through, including but not limited to, derivatives and instrument that gives exposure to an index). Single-name derivatives will need to be compliant with the Negative Screening Policy. The Investment Adviser will ensure that collateral received is aligned with the policy.

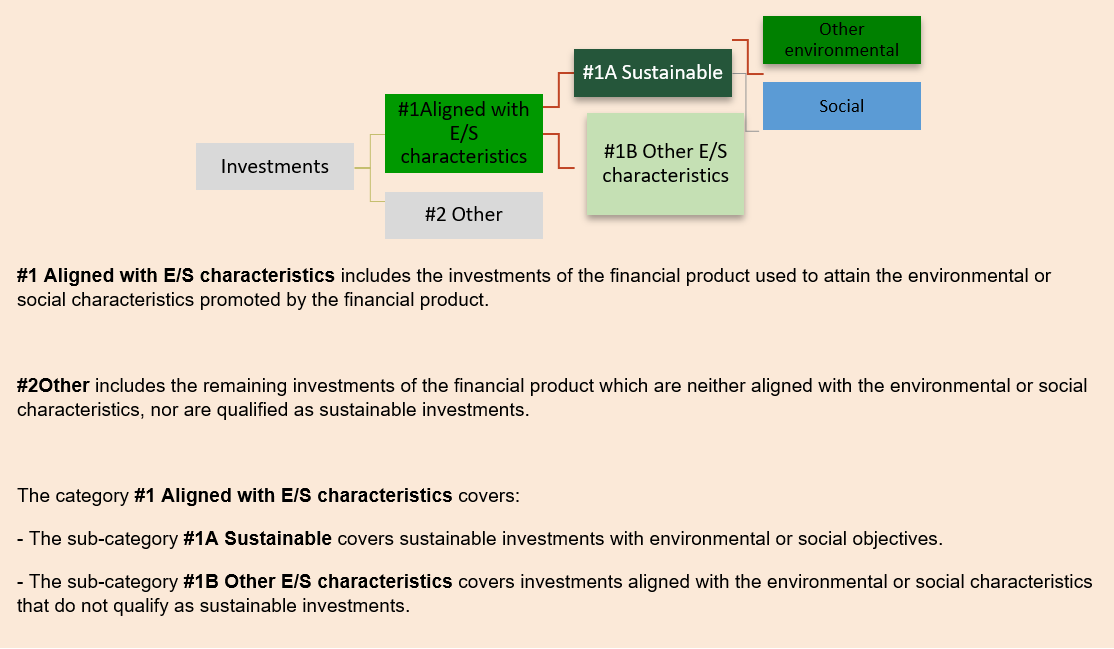

Proportion of investments

The planned asset allocation is monitored continuously and evaluated on a yearly basis. At least 55% of the Fund's investments are aligned with E/S characteristics. A maximum of 45% of the Fund’s investments including investments non-aligned with the E/S characteristics promoted and/or derivatives are in category “#2 Other”. Within the 55%, the Fund will have a minimum proportion of 10% of the portfolio in sustainable investments with an environmental or social objective in economic activities that do not qualify as environmentally sustainable under the EU Taxonomy.

Monitoring of environmental or social characteristics

The sustainability indicators used by this Fund to measure the attainment of each of the environmental or social characteristics it promotes are the following:

The WACI is the metric used to report the Fund’s carbon emissions. It helps show the carbon footprint of the portfolio compared to the index, and is based on Scope 1 and 2 emissions:

- Scope 1: direct emissions from the investee company’s facilities;

- Scope 2: indirect emissions linked to the investee company’s energy consumption.

The Investment Adviser applies ESG and norms-based exclusions to implement a Negative Screening Policy to the Fund’s investments. The Fund will monitor:

- percentage of corporate issuers failing a screen under the Negative Screening Policy; and

- percentage of sovereign issuers failing the Investment Adviser’s process for assessing sovereigns.

Methodologies

The Fund implements two binding ESG-related criteria: sector- and norms-based screens in the form of exclusions and a carbon footprint target.

Data sources and processing

Exclusions are primarily identified through a third-party provider, MSCI ESG Business Involvement Screening Research (“MSCI ESG”). Other data points include the MSCI United Nations Global Compact violators and MSCI Carbon Footprint Metrics.

Limitations to methodologies and data

The methodology and sources relating to the exclusions and the ESG integration approach as a whole have certain limitations. The carbon footprint is measured by the WACI relative to the relevant index. In the event that reported carbon emissions data is not available for a particular issuer, the third-party provider may provide estimates using their own methodologies. Issuers that do not have any carbon emissions data available (reported or estimated) are excluded from the WACI calculation.

Due diligence

Members of Capital Group's compliance, risk management and internal audit staff conduct periodic assessments on the design and operating effectiveness of the firm’s ESG activities and key controls.

Engagement policies

Establishing dialogue with companies is an integral part of the Investment Adviser’s investment management service to clients. This enables Capital Group to engage and generate dialogue on any issues that could affect the investee company’s long-term prospects, including exposures to sustainability issues.

Designated reference benchmark

The Fund has not designated a reference benchmark to meet the environmental and/or social characteristics it promotes.

No sustainable investment objective

This Fund promotes environmental or social characteristics but does not have as its objective sustainable investment. However, the Investment Adviser commits to maintain at least 10% of the Fund’s investments in companies that, in the Investment Adviser’s opinion, are addressing social and/or environmental challenges through their current or future products and/or services. This 10% minimum qualifies as “sustainable investments” under Regulation (EU) 2019/2088 on sustainability-related disclosures in the financial services sector.

Such companies have products and services that are majority-aligned, or transitioning towards higher positive alignment, with any single or combination of sustainable investment themes focused on global social and environmental challenges as identified by the Investment Adviser. These themes map to the United Nations Sustainable Development Goals (“SDGs”). The Investment Adviser also takes into consideration topics, communities, and groups not specifically referenced in the SDG framework. Therefore, investments could be made in companies addressing needs such as but not limited to: (i) energy transition, (ii) health & well-being, (iii) sustainable cities & communities, (iv) responsible consumption, (v) clean water & sanitation, (vi) education & information access, and (vii) financial inclusion.

The sustainable investments that the Fund intends to make are subject to the Investment Adviser’s eligibility process for sustainable investments. Sustainable investments are those whose business activities are majority-aligned or transitioning towards higher positive alignment with any one or a combination of these sustainable investment themes, and that (i) do not significant harm any environmental or social objective (ii) follow good governance practices and (iii) satisfy the Negative Screening Policy.

The sustainable investments that the Fund partially intends to make shall not cause any significant harm to any environmental or social sustainable investment objectives. As such the Investment Adviser considers the mandatory Principle Adverse Impacts (PAIs) as set out in Table 1 of Annex I of Commission Delegated Regulation (EU) 2022/1288 for corporate investments, as well as other ESG risks and controversies that the Investment Adviser considers potentially material, such as data privacy or censorship issues. Companies deemed by the Investment Adviser to be causing significant harm, based on the PAIs, are not considered sustainable investments.

How have the indicators for adverse impacts on sustainability factors been taken into account?

As mentioned above, the Investment Adviser considers all mandatory PAIs.

The Investment Adviser considers several PAIs within its Negative Screening Policy. In particular, the Negative Screening Policy addresses the Principal Adverse Impact 4 on exposure to companies active in the fossil fuel sector, Principal Adverse Impact 10 on United Nations Global Compact violators and Principal Adverse Impact 14 on controversial weapons.

Beyond the screening process, with respect to the remaining mandatory PAIs:

- where the Investment Adviser considers sufficient and reliable quantitative data is available across the investment universe, the Investment Adviser uses third-party data and prescribed thresholds to determine whether the adverse impact associated with the company’s activities is potentially significant based on the company’s relative ranking (on the specific adverse impact) to the overall investment universe and/or peer group; or

- where data availability or quality is not sufficient across the investment universe to enable a quantitative analysis, the Investment Adviser assess significant harm on a qualitative basis, for example using proxies.

The Investment Adviser’s assessment will also include an overall qualitative assessment of how ESG risks are being managed.

Where third party data or the Investment Adviser’s assessment indicates that a company is potentially doing significant harm based on a PAI threshold, the Investment Adviser will do additional due diligence to better understand and assess negative impacts indicated by third party or proprietary data. If the Investment Adviser concludes that the company is not causing significant harm based on its analysis, it may proceed with the investment and the rationale for that decision will then be documented. For example, the Investment Adviser may conclude a company is not causing significant harm if (i) the Investment Adviser has reason to believe that third-party data is inaccurate and the Investment Adviser’s own research demonstrates that the company is not causing significant harm; or (ii) the company is taking steps to mitigate or remediate that harm through the adoption of timebound targets and there are meaningful signs of improvement and positive change.

How are the sustainable investments aligned with the OECD Guidelines for Multinational Enterprises and the UN Guiding Principles on Business and Human Rights? Details:

The sustainable investments are aligned with the OECD Guidelines for Multinational Enterprises and the UN Guiding Principles on Business and Human Rights as follows: the Investment Adviser reviews issuers involved in significant ESG controversies, with a focus on those that may conflict with existing global standards, including guidelines from the United Nations Global Compact. In accordance with the Negative Screening Policy applied to the Fund, the Investment Adviser will exclude companies violating the UN Global Compact principles. Although other incidents will not automatically result in exclusion from the Fund, the Investment Adviser ensures that appropriate action to remediate the concerns are taken.

Environmental or social characteristics of the financial product

The Fund promotes environmental and social characteristics, provided that the companies in which investments are made follow good governance practices.

The binding environmental and/or social characteristics promoted by the Fund are the following:

Carbon constraint: For its equity portion, the Fund aims to maintain a Weighted Average Carbon Intensity (WACI) for its investments in corporate issuers that is lower than MSCI AC World index. The WACI is based on GHG emissions (Scope 1 and 2) divided by the revenue of the investee companies. Should the WACI of the Fund not be lower than the level of the aforementioned index, the Investment Adviser will consider what action is in the best interest of the Fund, its Shareholders and in line with the relevant Fund investment objective to bring the Fund back above the threshold in a reasonable period of time.

Negative Screening Policy: Through its Negative Screening Policy, the Investment Adviser evaluates and applies ESG and norms-based screening to implement exclusions on corporate and sovereign issuers at the time of purchase, with respect to certain sectors such as tobacco, fossil fuel and weapons, as well as companies violating the principles of the United Nations Global Compact (UNGC).

Investment strategy

The Investment Adviser applies the following investment strategy to attain the environmental and/or social characteristics promoted:

Carbon constraint. For the Fund’s Equity portion, the Investment Adviser aims to manage a carbon footprint lower than MSCI AC World index. Should the WACI of the Fund not be lower than the aforementioned index, the Investment Adviser will consider what action is in the best interest of the Fund, its Shareholders and in line with the relevant Fund investment objective to bring the Fund back above the threshold in a reasonable period of time. The Investment Adviser carries out ongoing monitoring of WACI at the Fund level, and may reduce or eliminate exposures to certain companies as necessary.

The selected index is representative of the equity portion of the Fund. The Investment Adviser assesses the portfolio WACI data on an ongoing basis to help the Fund remain within the target level. This allows the Investment Adviser to measure the carbon footprint and carbon intensity of the portfolio compared to the selected index, and to understand the attribution of the emission results. From an investment perspective, carbon footprint analysis can serve as a tool to engage with the investee company and better understand the investee company’s business. In the event that reported carbon emissions data is not available for a particular issuer, the third-party provider may provide estimates using their own methodologies Issuers that do not have any carbon emissions data available (reported or estimated) are excluded from the WACI calculation. It is not the intention of the Investment Adviser to automatically exclude higher carbon emitters on an individual basis as the carbon intensity is monitored at the total portfolio level rather than at the individual holding level.

Negative Screening Policy. The Investment Adviser also evaluates and applies ESG and norms-based screening to implement a Negative Screening Policy relating to the Fund’s investments in corporate issuers, with respect to certain sectors such as tobacco, fossil fuel and weapons, as well as companies violating the principles of the UNGC.

To support this screening on corporate issuers, the Investment Adviser relies on third party provider(s) who identify an issuer’s participation in or the revenue which they derive from activities that are inconsistent with the ESG and norms-based screens. In this way, third party provider data is used to support the application of ESG and norms-based screening by the Investment Adviser. In the event that exclusions cannot be verified through third-party providers or if the Investment Adviser believes that data and/or assessment is incomplete or inaccurate, the Investment Adviser reserves the right to identify business involvement activities through its own assessment (including by using other third-party data sources).

If an eligible corporate issuer held in a Fund subsequently fails a screen, the issuer will not contribute towards the environmental and/or social characteristics of the Fund and will generally be sold within six months from the date of such determination, subject to the best interests of investors in the Fund.

For sovereign issuers, the Investment Adviser conducts an eligibility assessment leveraging its proprietary sovereign ESG framework, which covers a range of ESG indicators to evaluate how well a country manages its ESG risk. To be eligible for investment, sovereigns must score above pre-determined thresholds for their proprietary ESG score on both an absolute and GNI-adjusted basis. If the Investment Adviser believes that the third-party data and/or assessment is incomplete or inaccurate, the Investment Adviser reserves the right to identify exclusions for sovereign issuers through its own assessment. The Investment Adviser also periodically reviews sovereign issuers and if a previously eligible sovereign issuer held in the Fund becomes ineligible, the sovereign issuer will not contribute towards the environmental and/or social characteristics of the Fund and the sovereign issuer will generally be sold within six months from the date of such determination, subject to the best interests of investors in the Fund (save that if the Investment Adviser believes that a score is below a pre-defined threshold for a temporary or a transitory reason, the Investment Adviser may, from time to time, exercise its discretion to keep holding or purchase securities issued by the sovereign issuer).

What is the policy to assess good governance practices of the investee companies?

The Investment Adviser ensures that the companies in which investments are made follow good governance practices. When assessing good governance practices, the Investment Adviser will, as a minimum, have regard to matters it sees relevant to the four prescribed pillars of good governance (i.e., sound management structures, employee relations, remuneration of staff and tax compliance).

As described above, the Investment Adviser applies a Negative Screening Policy to the Fund. As part of this, the Investment Adviser excludes companies that, based on available third-party data, are viewed to be in violation of the principles of the UNGC, which include Principle 10 (anti-corruption) and Principle 3 (employee relations).

In addition, good governance practices are evaluated as part of the Investment Adviser’s ESG integration process. Such practices are assessed through a monitoring process based on available third-party indicators relating to corporate governance and corporate behavior. Third-party data may be inaccurate, incomplete or outdated. Where the corporate governance and corporate behavior indicators cannot be verified through the third-party provider, the Investment Adviser will aim to make such determination through its own assessment based on information that is reasonably available Where relevant, fundamental analysis of a range of governance metrics that cover areas such as auditing practices, board composition and executive compensation, among others, is also conducted. The Investment Adviser also engages in regular dialogue with companies on corporate governance issues and exercises its proxy voting rights for the entities in which the Fund invests.

If a previously eligible company held in a Fund subsequently fails the Investment Adviser’s assessment of good governance practices, the company will generally be sold within six months from the date of such determination, subject to the best interests of investors in the Fund.

Capital Group's ESG Policy Statement provides additional detail on Capital Group’s ESG philosophy, integration, governance, support and processes, including proxy voting procedures and principles, as well as views on specific ESG issues, including ethical conduct, disclosures and corporate governance, available on:

http://www.capitalgroup.com/content/dam/cgc/tenants/eacg/esg/files/esg-policy-statement(en).pdf

Information on Capital Group’s corporate governance principles can also be found in its Proxy Voting Procedures and Principles, available on:

Proportion of investments

At least 55% of the Fund's investments are in category “#1 Aligned with E/S characteristics” and so are used to attain the environmental or social characteristics promoted by the Fund (being subject to the Investment Adviser’s binding Negative Screening Policy and carbon constraint). A maximum of 45% of the Fund’s investments including investments non-aligned with the E/S characteristics promoted, securitised debt, derivatives and/or cash and cash equivalents are in category “#2 Other”.

Within the 55%, the Fund will have a minimum proportion of 10% of the portfolio in sub-category “#1A Sustainable”, being sustainable investments with an environmental or social objective in economic activities that do not qualify as environmentally sustainable under the EU Taxonomy. These are investments that have passed through the Investment Adviser’s sustainable investment assessment.

Monitoring of environmental or social characteristics

The sustainability indicators used by this Fund to measure the attainment of each of the environmental or social characteristics it promotes are the following:

The WACI is the metric used to report the Fund’s carbon emissions. It helps show the carbon footprint of the portfolio compared to the index, and is based on Scope 1 and 2 emissions:

- Scope 1: direct emissions from the investee company’s facilities;

- Scope 2: indirect emissions linked to the investee company’s energy consumption.

The Investment Adviser applies ESG and norms-based exclusions to implement a Negative Screening Policy to the Fund’s investments. The Fund will monitor:

- percentage of corporate issuers failing a screen under the Negative Screening Policy; and

- percentage of sovereign issuers failing the Investment Adviser’s process for assessing sovereigns.

The Fund applies investment restrictions rules on a pre-trade basis in portfolio management systems to prohibit investment in companies or issuers based on the exclusion criteria. The portfolio also undergoes regular/systematic post-trade compliance checks. The methodology applied in support of this screening is described in detail under the section “Investment Strategy” of this document.

In the event that exclusions cannot be verified through the third-party provider(s), the Investment Adviser will aim to identify business involvement activities through its own assessment. Please refer to Fund’s Negative Screening Policy for further details.

For its equity portion, the Fund aims to manage a carbon footprint (weighted average intensity) for its investment in corporate issuers that is lower than the Fund’s selected index (MSCI ACWI). The selected index is representative of the investment universe of the Fund. The Investment Adviser uses the WACI as a metric to measure the Fund’s carbon footprint. In calculating the Fund’s WACI, the Investment Adviser relies on third party data provider(s). In the event that reported carbon emissions data is not available for a particular issuer, the third-party provider may provide estimates using their own methodologies Issuers that do not have any carbon emissions data available (reported or estimated) are excluded from the WACI calculation.

If the portfolio was in danger of breaching the target, holdings would be adjusted to increase the margin between the portfolio carbon footprint and target level; exposure to selected higher emitters would be reduced with increased exposure to lower emitters, while ensuring the Fund’s investment objective is maintained. Compliance checks are in place to facilitate this and mitigate the risk of any breach, for example as the result of market movement. Carbon footprint reports use MSCI Carbon Footprint Metrics data.

Methodologies

In addition to the sustainable investment commitments described above, the Fund implements two binding ESG-related criteria: sector- and norms-based screens in the form of exclusions and a carbon footprint target, with the methodology applied to these commitments having already been presented in detail in the previous sections.

The SFDR classification is related to the European Union’s regulation and is not equivalent to approval or recognition as an ESG Fund by regulators in Asia Pacific.

The exclusionary screens are implemented pre-trade and the carbon target is managed and monitored at the aggregate portfolio level.

Data sources and processing

Data sources

The Investment Adviser uses a combination of internal research and third-party data providers to gather ESG-related data.

Third-party providers are used to calculate the carbon footprint of the Fund and for identifying corporate issuers' involvement in activities inconsistent with ESG and norms-based screens. In the event that exclusions cannot be verified through third-party data or if the Investment Adviser believes that third-party data and/or assessment is incomplete or inaccurate, the Investment Adviser reserves the right to identify business involvement activities through its own assessment (including by using other third-party data sources).

Data quality and processing

Capital Group periodically reviews the performance quality of provider organizations and conducts ongoing monitoring and due diligence activities commensurate with the significance of the services provided.

Data are regularly updated in Capital Group’s internal platforms and made available to relevant teams. When issues are identified in third-party data, they are reported back to the provider(s). The Investment Adviser also applies systematic data quality checks to catch discrepancies and validate with the provider when issues arise.

Proportion of data that is estimated

Third-party providers may estimate data. While reported data are prioritized, Capital Group uses estimated data when reported data are unavailable. The proportion of estimated data varies depending on the data point due to inconsistencies in reporting by investee companies.

Limitations to methodologies and data

The methodology and sources relating to the exclusions and the ESG integration approach as a whole have certain limitations. In order to identify all publicly traded companies globally which are involved in activities such as the production of controversial products and revenue derived from activities that are inconsistent with the ESG and norms-based screens, the Fund uses data from third-party provider(s). In the event that data cannot be obtained through third-party providers or if the Investment Adviser believes that third-party data and/or assessment is incomplete or inaccurate, the Investment Adviser will aim to identify business involvement activities through its own assessment (including by using other third-party data sources).

When assessing the ESG characteristics of securities and the selection of such securities, subjective judgement within the investment process might be involved.

The carbon footprint is measured by the WACI score relative to the relevant index. The WACI is calculated based on securities for which data is reported or estimated. Excluded from the WACI determination are cash holdings, derivatives, sovereigns and securitised products.

Due diligence

Members of Capital Group's compliance, risk management and internal audit staff conduct periodic assessments on the design and operating effectiveness of the firm’s ESG activities and key controls. This includes compliance with internal processes and procedures as well as with the regulatory landscape in the jurisdictions in which the company operates. Capital Group meets regularly with the third-party data providers to review the quality of the services provided.

Pre-trade and post-trade checks are also in place as further explained in section “Monitoring of environmental or social characteristics” above.

Engagement policies

Establishing dialogue with companies is an integral part of the Investment Adviser’s investment management service to clients. Capital Group’s investment teams meet on a regular basis with company management, including executive and non-executive directors, chairs and finance directors. This enables the company to engage and generate dialogue on any issues that could affect the company’s long-term prospects, including exposures to sustainability issues.

Where Capital Group's investment teams identify an issue material to the long-term value of a company or they are concerned about relative ESG performance, Capital Group's investment professionals and governance teams will engage with management. Management’s response and the steps they take to minimise any associated risks, forms an important part of Capital Group's assessment of management quality, which itself is a key factor in the stock selection decisions.

Designated reference benchmark

The Fund has not designated a reference benchmark to meet the environmental and/or social characteristics it promotes.

Where can more product-specific information be found?

More product-specific information can be found in the pre-contractual template:

https://docs.publifund.com/1_PROSP/LU1577354035/en_LU

More product-specific information can be found in the periodic reports: