Long-Term Investing

Capital IdeasTM

Investment insights from Capital Group

Equity

The post COVID-19 era has seen a reset in financial markets on many levels – interest rates, geopolitics and growth paradigms. It's also led to a redrawing of the landscape for emerging markets (EM).

We believe the next phase of growth for EM will be different than the past 20 years. China's economy has matured and is going through a difficult patch of reforms. Geopolitical tensions and the world's energy transition are driving foreign investment into a broader mix of developing countries for manufacturing and natural resource needs. And government-led reforms are changing the trajectory of some developing countries, such as India and Indonesia.

Many asset managers, including us, have increased their capital market assumptions for both EM equities and debt. We believe the outlook for EM is constructive over the medium-term and will expand to markets that have not been front-and-centre for investors.

Here we discuss the macro variables as well as some of the trends and opportunities we are seeing across markets and industries.

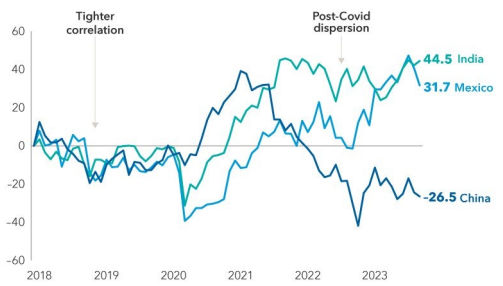

Returns among large EMs have diverged post-COVID

Data as at 30 September 2023. Returns reflect MSCI India Index, MSCI Mexico Index, and MSCI China Index. Five-year time period shown to reflect returns pre and post-COVID. Sources: MSCI, RIMES

Our latest insights

-

-

-

-

European Equity

-

Economic Indicators

RELATED INSIGHTS

Hear from our investment team.

Sign up now to get industry-leading insights and timely articles delivered to your inbox.

Past results are not predictive of results in future periods. It is not possible to invest directly in an index, which is unmanaged. The value of investments and income from them can go down as well as up and you may lose some or all of your initial investment. This information is not intended to provide investment, tax or other advice, or to be a solicitation to buy or sell any securities.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. All information is as at the date indicated unless otherwise stated. Some information may have been obtained from third parties, and as such the reliability of that information is not guaranteed.

Capital Group manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organisation; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

F. Chapman Taylor

F. Chapman Taylor

Lisa Thompson

Lisa Thompson

Brad Freer

Brad Freer

Kent Chan

Kent Chan