Fixed Income

Technology & Innovation

How persistent will the shortage in semiconductors be, and what does it bode for the future of the industry? In our view, the shortage is more cyclical in nature and more acute in a couple of industries like autos and PCs. If anything, we see semiconductors powering the next decade of global growth in an increasingly data-hungry world, much like oil fueled the rise of industrial economies in the last century.

Importantly, the semiconductor industry has evolved from boom-and-bust cycles marked by excessive capital expenditures, poor inventory management and lack of pricing discipline. It is more disciplined and better positioned today, following years of consolidation that has resulted in a few dominant players along each specialized area of the global supply chain.

On the demand side, as corporations, governments and industries transition to 5G technologies, artificial intelligence (AI) and cloud-based solutions, we believe the industry is prepared to benefit from these powerful tailwinds in the years ahead.

By various estimates, including ours, global semiconductor sales might double from about US$450 billion in 2019 to nearly US$1 trillion by 2030.

Capacity shortages are more COVID related than structural

A confluence of events has led to this global crunch, none of which we think are structural in nature or affect long-term demand. The automotive industry simply got caught flat-footed after canceling orders with manufacturers during the initial months of the pandemic. At the same time, the world went virtual, accelerating everything digital. This shift increased orders for chips used in personal computers, video game devices, home appliances and cloud-based applications.

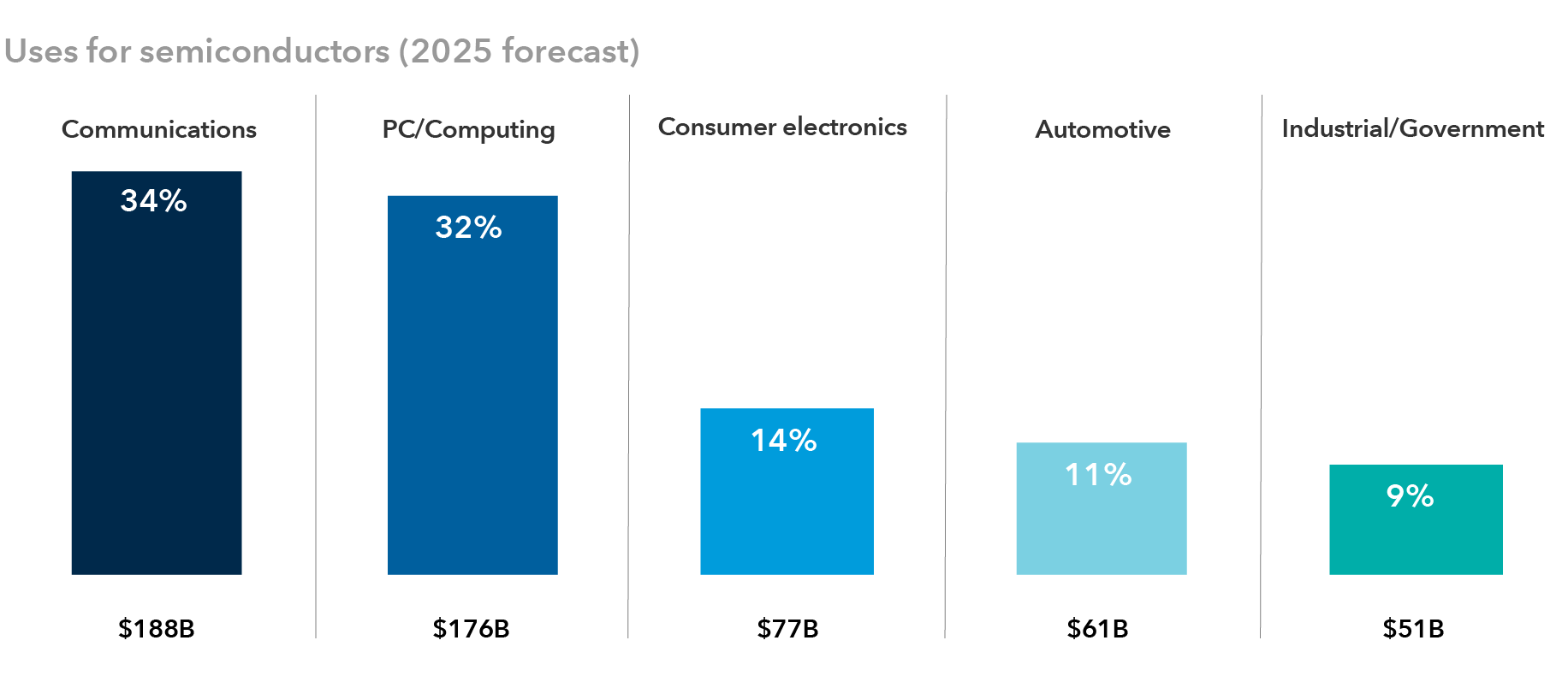

Personal computers are the most prominent example. While PCs still account for about a third of the overall semiconductor market, this had been an industry in slow decline over the past decade. This changed last year when the market grew at its highest rate in 10 years.

So, when automakers replaced their orders with manufacturers last fall, there was no capacity for them. Fortunately, the auto sector is a small percentage of the overall semiconductor market, even though it’s a future area of potential growth with the anticipated rise in electric vehicle production. Since it takes about four months to manufacture auto chips, the situation is likely to correct itself by the end of this year.

Semiconductors play integral role in global economy

Source: Bloomberg. Data represent the share of all semiconductor device applications in 2025, as forecast by Bloomberg. Values in USD.

AI and machine learning are powerful industry growth drivers

An increasing amount of data is being created every day. It started with social media and people posting pictures and videos of their children, food they ate at restaurants and places they visited. Then, in 2018, machines surpassed humans as the largest data creators. We believe this transformative shift will be a significant catalyst for the semiconductor industry.

Going forward, the majority of data will likely be created by machines that require massive amounts of processing power. The challenge will be in increasing processing power and lowering power consumption.

Enormous amounts of data won't reside in our phones, but in data centres. Today, data centres account for roughly 3% of global electricity consumption. If we do nothing to make them more efficient, they might account for 25% of electricity consumption in 10 years. Given this dilemma, the rule of thumb in semiconductor design is to try to reduce power consumption in these components by 30% every two years.

In our view, this is likely to drive growth for more advanced and complex chips used in high-end smartphones and data centres, which will drive up their semiconductor dollar content over the next five years.

A massive semiconductor spending cycle is coming

The world’s largest semiconductor companies are planning to spend billions of dollars on new manufacturing facilities to meet new demand, as well as to navigate geopolitical tensions with semiconductors being seen as a national security priority. The U.S. and Europe both seek to bring critical supply chains closer to home, given that Taiwan controls a majority of the high-end manufacturing production for semiconductors.

Industry bellwether Taiwan Semiconductor Manufacturing (TSMC) plans to spend US$100 billion through 2023 for new chip fabrication facilities, including a large site planned for Arizona. TSMC holds close to 80% market share for leading-edge chip production, and its clients include Apple, Qualcomm and Broadcom.

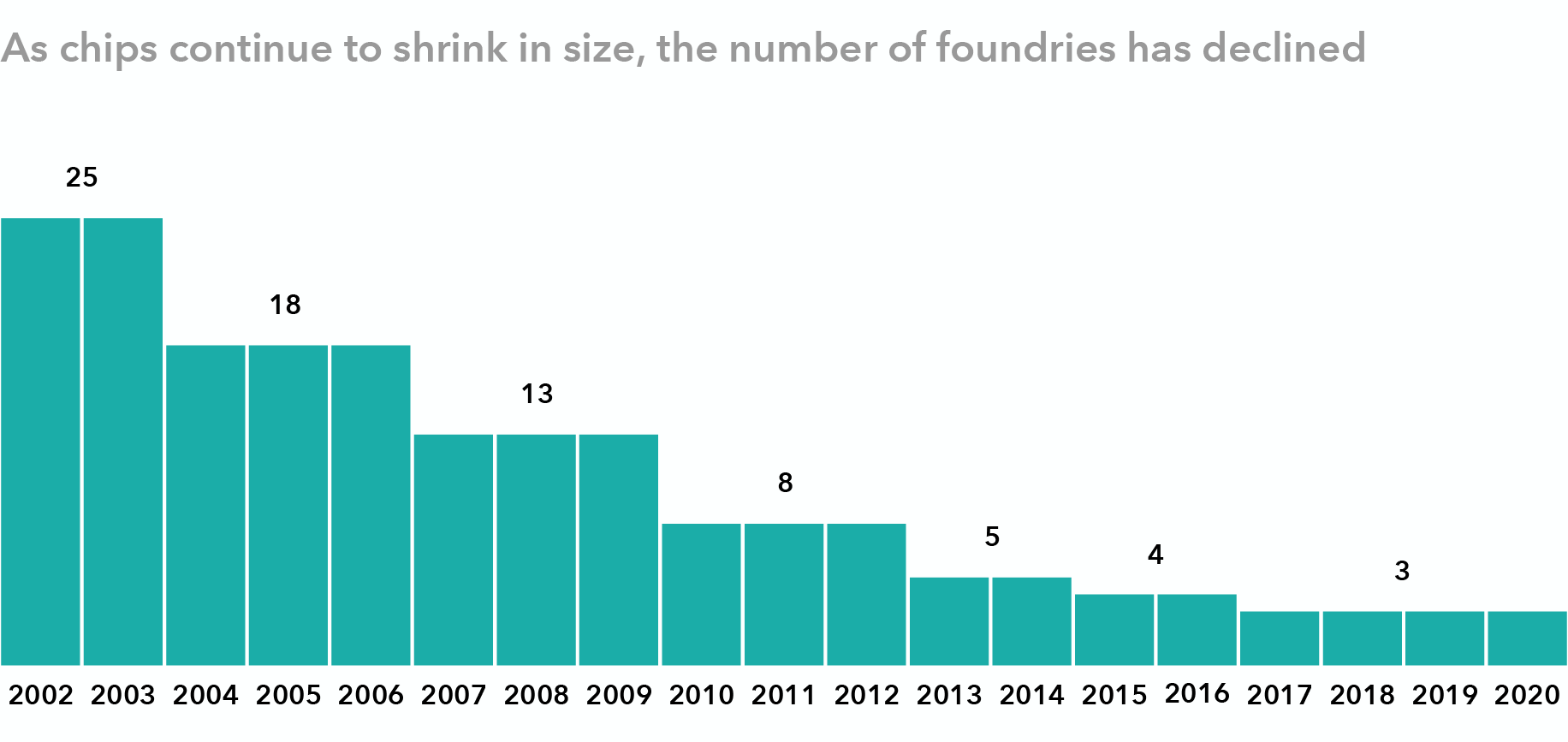

Semiconductor manufacturing has heavily consolidated

Source: Capital Group, Intel. Shows semiconductor companies capable of manufacturing the smallest chips available in each period. Data as of December 2020.

Meanwhile, Intel plans to spend US$20 billion on two new plants in Arizona, and Samsung Electronics is eyeing construction of a new manufacturing facility in Texas worth US$17 billion. Spending comes after a long period of capital discipline and industry consolidation, which has left the business with two dominant players: TSMC and Samsung, with Intel a distant third.

However, it’s unclear how these new foundries might benefit the industry longer term, and this is something we’ll be watching closely. Manufacturing processors in the U.S. will likely cost more than in Taiwan or Korea, where most of the current capacity lies. This could create market inefficiencies. It’s also unclear if U.S. semiconductor and technology companies, almost all of whom outsource the manufacturing of their chips to Asia, will want to bring it onshore.

Industry has consolidated across segments

Following several rounds of consolidation, each segment along the supply chain — the chip designers, chip equipment manufacturers, the foundries that make the chips and the companies that test the chips — is dominated by a few companies.

With highly specialized expertise in each of these areas, competitive moats have expanded. Many of these companies are well-managed, with a stronger grasp of customer demand patterns. Pricing power remains high and margins are attractive.

Semiconductor equipment makers: This market has heavily consolidated, with the top five companies controlling close to 75% market share, up from roughly 40% 15 years ago. These companies, including ASML in the Netherlands and Applied Materials and Lam Research in the U.S., have developed wide competitive moats, with each company developing its own specific niche within the semiconductor manufacturing and testing process.

As a result, they’ve become difficult to supplant given the complexities of their machines. For example, an extreme ultraviolet lithography (EUV) machine, used to make advanced chips, is made of more than 100,000 parts, costs approximately US$120 million and is shipped in 40 freight containers. ASML is essentially the only manufacturer of this equipment.

The equipment makers have further developed a servicing model with recurring revenue from machine maintenance. Operating margins have averaged 25% over the past five years and are on track to expand beyond 30% based on our estimates. In years past, they would dip into the single digits.

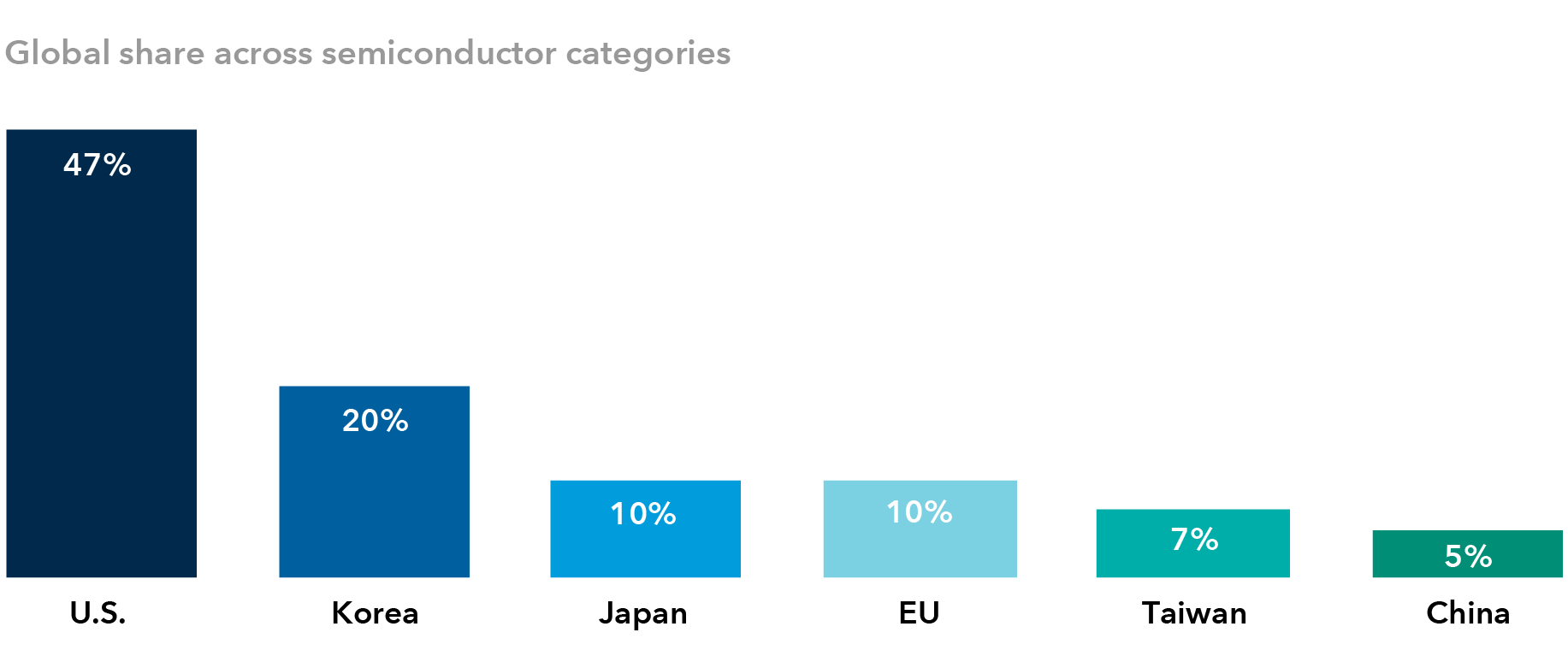

Memory chips: The industry structure has evolved, and it's become more attractive. Memory used to be a cyclical, commodity-like business. It’s shrunk from around 15 companies globally to three, the biggest being Korea’s Samsung Electronics. In turn, the industry has become more disciplined and rational. And memory chips remain a critical component for computing processors used in a wide range of devices. Although Korea accounts for almost three-fourths of global memory chips manufacturing, the U.S. still dominates the global semiconductor market with about 47% share due to its dominance in fabless, equipment and intellectual design segments.

U.S. semiconductor companies hold significant market share

Source: Semiconductor Industry Association, based on 2020 data.

Strategic importance stirs geopolitical frictions

As semiconductors have become strategically imperative, it has raised concerns among government officials in the U.S., China and Europe, who are all driven by their own motives.

The U.S. worries that while its companies are global leaders in chip design, the country ceded leadership in manufacturing years ago to Taiwan, namely TSMC. Currently, U.S. market share for chip manufacturing is 12%, down from 37% in 1990.

Meanwhile, Europe is concerned that it lacks any manufacturing capabilities for cutting-edge semiconductors. This became amplified during the recent chip shortage that hurt big German automakers.

For China, its leaders want to reduce the country’s dependence on U.S. semiconductors. Given current U.S. trade sanctions, China has defined semiconductors as a strategic imperative in its most recent five-year plan. It will take time, but with the money and resources that China is devoting to the effort, it will develop some capabilities, just as it has in other industries.

As semiconductor chips become integral to virtually every industry and are essentially the “brains” for most things we use, their importance will only grow. Whether the strategic imperatives that drive public policy chip away at some of the industry’s efficiency and execution prowess is a trend we will be closely watching.

Our latest insights

RELATED INSIGHTS

-

-

-

Economic Indicators

Commissions, trailing commissions, management fees and expenses all may be associated with investments in investment funds. Please read the prospectus before investing. Investment funds are not guaranteed or covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer. For investment funds other than money market funds, their values change frequently. For money market funds, there can be no assurances that the fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in the fund will be returned to you. Past performance may not be repeated.

Unless otherwise indicated, the investment professionals featured do not manage Capital Group‘s Canadian investment funds.

References to particular companies or securities, if any, are included for informational or illustrative purposes only and should not be considered as an endorsement by Capital Group. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds or current holdings of any investment funds. These views should not be considered as investment advice nor should they be considered a recommendation to buy or sell.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and not be comprehensive or to provide advice. For informational purposes only; not intended to provide tax, legal or financial advice. We assume no liability for any inaccurate, delayed or incomplete information, nor for any actions taken in reliance thereon. The information contained herein has been supplied without verification by us and may be subject to change. Capital Group funds are available in Canada through registered dealers. For more information, please consult your financial and tax advisors for your individual situation.

Forward-looking statements are not guarantees of future performance, and actual events and results could differ materially from those expressed or implied in any forward-looking statements made herein. We encourage you to consider these and other factors carefully before making any investment decisions and we urge you to avoid placing undue reliance on forward-looking statements.

The S&P 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2024 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

FTSE source: London Stock Exchange Group plc and its group undertakings (collectively, the "LSE Group"). © LSE Group 2024. FTSE Russell is a trading name of certain of the LSE Group companies. "FTSE®" is a trade mark of the relevant LSE Group companies and is used by any other LSE Group company under licence. All rights in the FTSE Russell indices or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indices or data and no party may rely on any indices or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company's express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. The index is unmanaged and cannot be invested in directly.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

MSCI does not approve, review or produce reports published on this site, makes no express or implied warranties or representations and is not liable whatsoever for any data represented. You may not redistribute MSCI data or use it as a basis for other indices or investment products.

Capital believes the software and information from FactSet to be reliable. However, Capital cannot be responsible for inaccuracies, incomplete information or updating of the information furnished by FactSet. The information provided in this report is meant to give you an approximate account of the fund/manager's characteristics for the specified date. This information is not indicative of future Capital investment decisions and is not used as part of our investment decision-making process.

Indices are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

All Capital Group trademarks are owned by The Capital Group Companies, Inc. or an affiliated company in Canada, the U.S. and other countries. All other company names mentioned are the property of their respective companies.

Capital Group funds are offered in Canada by Capital International Asset Management (Canada), Inc., part of Capital Group, a global investment management firm originating in Los Angeles, California in 1931. Capital Group manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

The Capital Group funds offered on this website are available only to Canadian residents.

Mathews Cherian

Mathews Cherian

Shailesh Jaitly

Shailesh Jaitly