Fixed Income

Markets & Economy

The world has changed.

We are living through a pivotal time in history, marked by geopolitical realignment, high inflation, volatile financial markets and the end of a 40-year period of declining U.S. interest rates. The title of this new era could be Brave New World or Back to the Future. But I think the title I would select is Revenge of the Boomers, because a lot of these events rhyme with the past, particularly the early 1960s. That’s when we saw interest rates bottom out after decades of decline, as well as the rise of the Cold War era, which is unfortunately rearing its head again in some respects.

Despite these challenges, I remain optimistic about the investing environment for several reasons. First, there are still signs of growth as the global economy recovers from the pandemic. Second, I believe corporate earnings will be the driving force of equity markets going forward, as opposed to multiple expansion, and that signifies a welcome return to fundamentals. Multiples needed to contract, and that is what we’ve seen over the past few months.

Third, I think we will experience a healthy recession in the next year or two. That’s right, a healthy recession. Despite all the worry about it, I see a moderate recession as necessary to clean out the excesses of the past decade. You can’t have such a sustained period of growth without an occasional downturn to balance things out. It’s normal. It’s expected. It’s healthy.

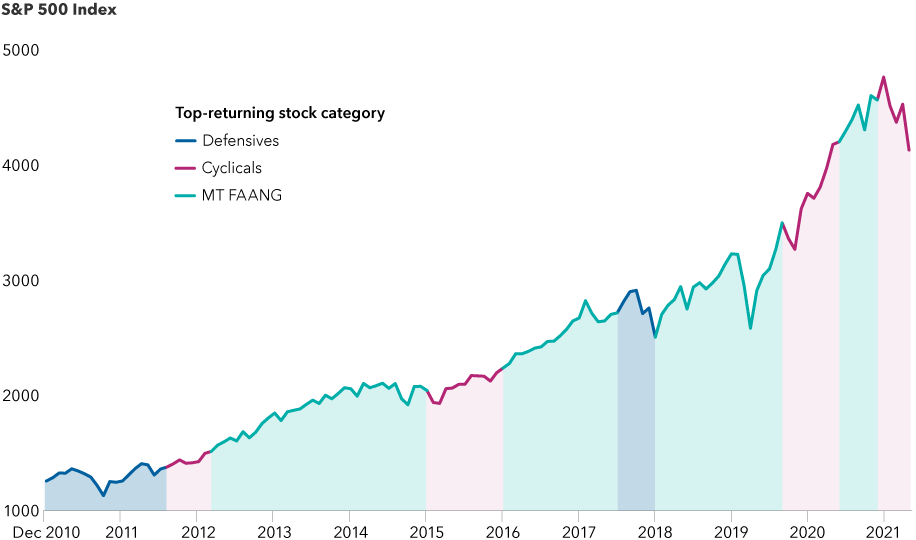

We’ve seen market leadership change in the U.S. in recent months

Sources: Capital Group, FactSet, MSCI, Standard & Poor’s. MT FAANG represents the collective price performance of shares of Microsoft, Tesla, Meta (Facebook), Amazon, Apple, Netflix and Alphabet (Google). Defensive stocks typically generate relatively stable returns regardless of the state of the economy or the overall markets. Cyclical stocks tend to move up or down roughly in line with economic growth or contraction cycles. or values do not reflect the impact of dividends. Data shown as of 4/30/22. Based in USD.

What this means for stock markets

In my view, we are heading into a period of real change, a fundamentally different marketplace where different leadership will emerge. That’s in sharp contrast to the 2020 COVID-19 downturn, which was really just a temporary blip in a decade-plus bull market. We know this because the same stocks that led the bull market — a relatively small group of tech-related companies — did so on the way back up.

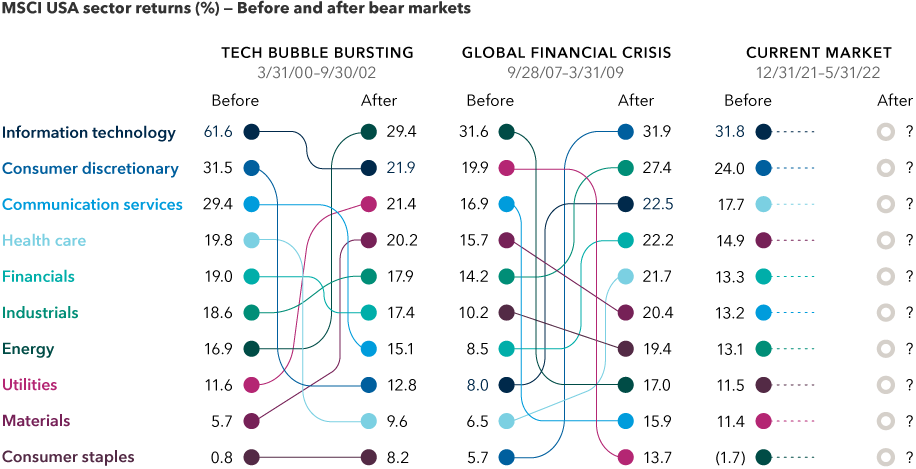

In a true market shift, the leadership coming out of a bear market is usually a new sector or a new group of companies. And it’s not necessarily the same group that led on the way down. For instance, in the current environment, energy stocks have staged a remarkable rally. Do I think the energy sector is going to drive the next bull market? I do not.

Market leaders before and after a bear market are rarely the same

Sources: Capital Group, MSCI, Refinitiv Datastream. Returns are absolute total returns in U.S. dollars. The periods covered are: the tech bubble, December 31, 1996 to May 31, 2000 (before bear market) and September 30, 2002 to December 30, 2005 (after bear market); the global financial crisis, December 31, 2003 to September 28, 2007 (before) and May 31, 2009 to December 31, 2013 (after); and the current market, December 31, 2021 to May 31, 2022.

That said, I wouldn’t count out the FAANG (Facebook, Amazon, Apple, Netflix, Google) stocks, but I think it’s going to be a very different market going forward. It won’t be driven by a small set of stocks anymore. It won’t be characterized by growth vs. value, or U.S. vs. international. Those binary concepts don’t make sense in this environment. I think the market will be less one dimensional, and I expect a broader mix of stocks to lead us out of this downturn.

What this means for bond markets

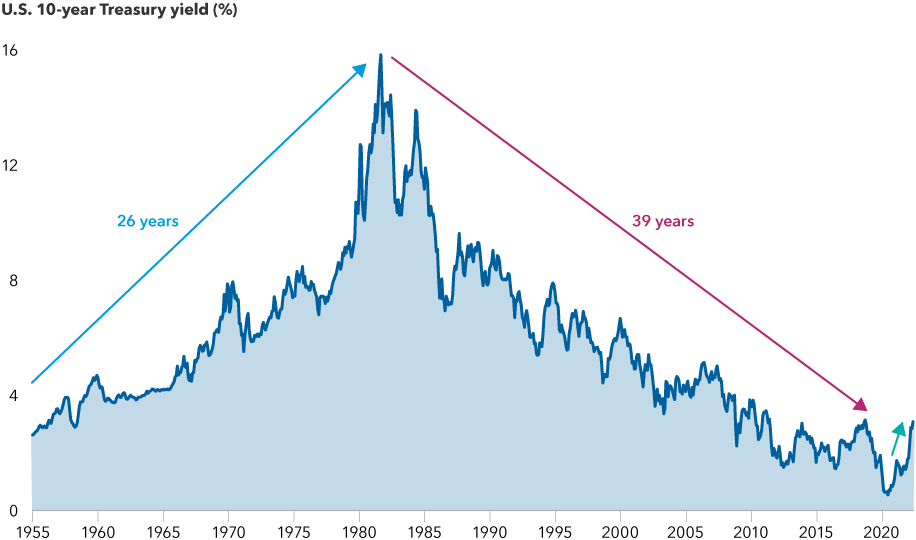

We are also seeing a profound shift in bond markets in the U.S. as we reach the end of a 40-year path of falling interest rates. Sharply higher inflation levels, not seen since the 1980s, are forcing the Federal Reserve and other central banks to aggressively tighten monetary policy. The Fed is behind the curve, which means rates are probably going to move higher from here.

However, that doesn't mean we are going back to exceedingly high inflation and interest rates. It just means that, for decades, we have lived in a declining rate environment that has been highly supportive of markets. That’s all changed. Things are likely to be more difficult going forward. But even amid these headwinds, opportunities will emerge.

Is this the end of a 40-year declining rate period in the U.S.?

Sources: Capital Group, Refinitiv Datastream. Data shown as of 6/23/2022.

That’s one reason I like to call this era “Revenge of the Boomers,” because it’s so reminiscent of the 1960s. Interest rates moved higher, but they didn’t spike to 16% overnight. It took decades for that to happen, and there were many policy mistakes along the way. Throughout the 1960s, rates stayed in the 3% to 6% range. It was a volatile period, but overall it was still a good environment for investing. The real trouble came later. Hopefully we’ve learned some lessons from the past and we won’t repeat the 1970s.

In the meantime, it’s important to remember that higher nominal interest rates are good for savers. This is a novel concept for younger folks, but boomers grew up in a world where interest rates were sufficient to earn a decent return on savings accounts and money market funds. That’s a positive change. It makes people feel better about saving, and I see it as a solid underpinning for the market.

Over time, higher rates will also bring income back to the fixed income markets — something that has been sorely missed in the era of easy money. The importance of that shift cannot be overstated. It should eventually restore bonds to their rightful role providing diversification from equity risk.

Along those same lines, some inflation is actually a good thing. It allows well-positioned companies to raise prices, and it results in generally higher wages. That makes people feel better about their jobs and progress. It is hard to predict what will happen to real purchasing power, but we have seen in the past decade that without a little inflation, people feel like they’re not getting ahead.

What this means for investors

Maintaining a balanced, “all-weather” portfolio makes sense in any environment, but particularly this one. Earlier this year I reminded investors to keep an eye on valuations and prepare for a market correction. I remarked that I was buying a raincoat, but not putting it on yet. Turns out, it’s nice to have that raincoat handy. Market volatility has returned, but that’s no reason to be discouraged.

At Capital Group, our fundamental, bottom-up investment approach leaves us well-positioned to identify specific companies that can generate strong earnings growth. We remain confident that we have the right people in place making decisions based on deep, company-specific research, which has always formed the basis of our long-term investment philosophy.

Indeed, the world has changed dramatically. But, for selective investors, change creates opportunity.

MSCI USA Index is a free float-adjusted, market capitalization-weighted index that is designed to measure the U.S. portion of the world market.

S&P 500 Index is a market capitalization-weighted index based on the results of approximately 500 widely held common stocks.

Our latest insights

RELATED INSIGHTS

Commissions, trailing commissions, management fees and expenses all may be associated with investments in investment funds. Please read the prospectus before investing. Investment funds are not guaranteed or covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer. For investment funds other than money market funds, their values change frequently. For money market funds, there can be no assurances that the fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in the fund will be returned to you. Past performance may not be repeated.

Unless otherwise indicated, the investment professionals featured do not manage Capital Group‘s Canadian investment funds.

References to particular companies or securities, if any, are included for informational or illustrative purposes only and should not be considered as an endorsement by Capital Group. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds or current holdings of any investment funds. These views should not be considered as investment advice nor should they be considered a recommendation to buy or sell.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and not be comprehensive or to provide advice. For informational purposes only; not intended to provide tax, legal or financial advice. We assume no liability for any inaccurate, delayed or incomplete information, nor for any actions taken in reliance thereon. The information contained herein has been supplied without verification by us and may be subject to change. Capital Group funds are available in Canada through registered dealers. For more information, please consult your financial and tax advisors for your individual situation.

Forward-looking statements are not guarantees of future performance, and actual events and results could differ materially from those expressed or implied in any forward-looking statements made herein. We encourage you to consider these and other factors carefully before making any investment decisions and we urge you to avoid placing undue reliance on forward-looking statements.

The S&P 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2024 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

FTSE source: London Stock Exchange Group plc and its group undertakings (collectively, the "LSE Group"). © LSE Group 2024. FTSE Russell is a trading name of certain of the LSE Group companies. "FTSE®" is a trade mark of the relevant LSE Group companies and is used by any other LSE Group company under licence. All rights in the FTSE Russell indices or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indices or data and no party may rely on any indices or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company's express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. The index is unmanaged and cannot be invested in directly.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

MSCI does not approve, review or produce reports published on this site, makes no express or implied warranties or representations and is not liable whatsoever for any data represented. You may not redistribute MSCI data or use it as a basis for other indices or investment products.

Capital believes the software and information from FactSet to be reliable. However, Capital cannot be responsible for inaccuracies, incomplete information or updating of the information furnished by FactSet. The information provided in this report is meant to give you an approximate account of the fund/manager's characteristics for the specified date. This information is not indicative of future Capital investment decisions and is not used as part of our investment decision-making process.

Indices are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

All Capital Group trademarks are owned by The Capital Group Companies, Inc. or an affiliated company in Canada, the U.S. and other countries. All other company names mentioned are the property of their respective companies.

Capital Group funds are offered in Canada by Capital International Asset Management (Canada), Inc., part of Capital Group, a global investment management firm originating in Los Angeles, California in 1931. Capital Group manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

The Capital Group funds offered on this website are available only to Canadian residents.

Rob Lovelace

Rob Lovelace