Global Equities

- Growth stocks have continued to outpace value stocks during recent market volatility

- Quality Growth, a subset of the growth universe, has shown relative resilience

- Experienced management, solid balance sheets and strong cash flows characterize Quality Growth companies

Growth stocks have continued to outpace value in the market decline and subsequent recovery following the COVID-19 outbreak. In our view, growth will continue to command a higher premium relative to other investment opportunities for two reasons:

- True growth investment opportunities are fewer in a world of low economic growth rates.

- An ultra-low interest rate environment reduces the discount rate to evaluate stocks. This allows investors to extend time frames, which tend to favour growth opportunities.

Since the 2008—2009 financial crisis, the premium placed on growth companies has been most pronounced in non-U.S. markets, but it has been a rising trend in the U.S. as well. That said, sources of economic growth are likely to change and, in some areas, be redefined over the next few years on the path to recovery. Capital Group’s fixed income specialists similarly see this era of low rates continuing for an extended period due to powerful deflationary forces such as technological advances and aging populations in developed countries.

Key ingredients of Quality Growth

As the economic environment has become more challenged, members of our investment team are finding that not all growth opportunities are on equal footing. Increasingly, many of our portfolio managers are focusing on a subset of growth companies that they view to be Quality Growth. While there is no perfect screen or set of rules that can embody all aspects of what we’re referring to, the following exhibit summarizes some key aspects that we believe define Quality, Growth and Quality Growth companies.

Clearly, not all of these characteristics are exclusive to Quality Growth companies — strong balance sheets and high-quality, experienced management teams are traits that portfolio managers look for across all types of companies. But when these traits are found in companies that also have attractive business models or are tapping into secular growth opportunities with a long runway, they can potentially make for attractive investment opportunities.

One example of a strong secular growth trend is subscription-based businesses. They have compounding characteristics that have been attractive in most market conditions, often gaining share even in periods of economic slowdowns as consumers and enterprises shift behavior.

An emerging participant is ServiceNow, which creates workflow management software that helps enable efficiency. ServiceNow has seen a rise in the use of its tools by the customer service functions of many corporations, as the software can handle and sort phone, chat and email inquiries.

A more familiar name is Microsoft. Its business has benefited from sticky subscriptions through the Windows Operating System, a ubiquitous suite of Office products and its Azure cloud service. Collectively, these features help create a durable business model.

Another example is online payments, where significant and durable shifts in how consumers and merchants transact business are fueling growth. PayPal has been among the market leaders.

Are these all-weather stocks?

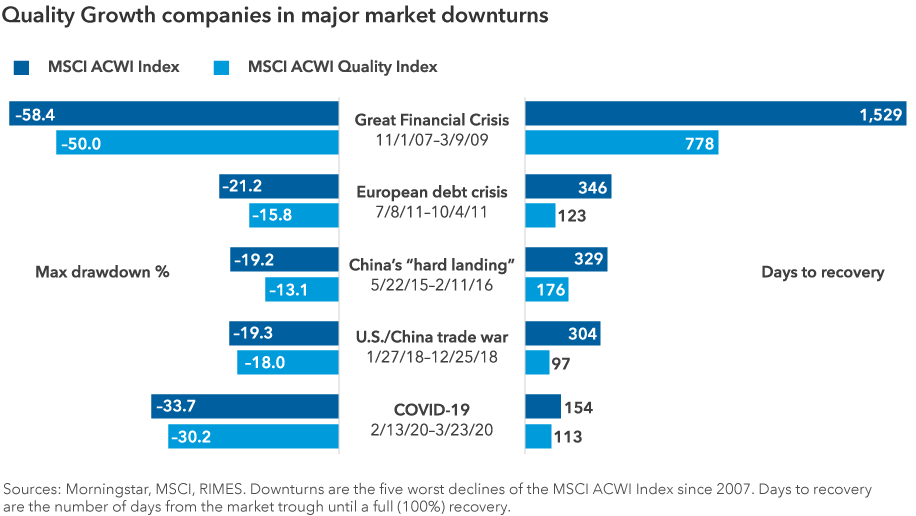

An interesting aspect of many Quality Growth companies is that they have shown greater resilience and quicker recoveries versus the broader market. This chart shows the MSCI ACWI Quality Index as a proxy of Quality Growth companies. The companies in this index are selected based on high return on equity, stable year-over-year earnings growth and low financial leverage.

While Quality Growth companies, as a group, have often held up relatively well during market downturns, it is important to remember that their ability to do so has been largely predicated on their ability to continue growing, even when many other companies cannot.

Therefore, the cause of the downturn is an important consideration, and some quality growth companies may fare better than others in some downturns. Moving forward, some potential beneficiaries in the aftermath of COVID-19 may be businesses who operate in areas of video streaming and gaming, grocery delivery, automation and biotech.

Our latest insights

-

-

Currencies

-

Market Volatility

-

Market Volatility

-

Markets & Economy

RELATED INSIGHTS

Commissions, trailing commissions, management fees and expenses all may be associated with investments in investment funds. Please read the prospectus before investing. Investment funds are not guaranteed or covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer. For investment funds other than money market funds, their values change frequently. For money market funds, there can be no assurances that the fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in the fund will be returned to you. Past performance may not be repeated.

Unless otherwise indicated, the investment professionals featured do not manage Capital Group‘s Canadian investment funds.

References to particular companies or securities, if any, are included for informational or illustrative purposes only and should not be considered as an endorsement by Capital Group. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds or current holdings of any investment funds. These views should not be considered as investment advice nor should they be considered a recommendation to buy or sell.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and not be comprehensive or to provide advice. For informational purposes only; not intended to provide tax, legal or financial advice. Capital Group funds are available in Canada through registered dealers. For more information, please consult your financial and tax advisors for your individual situation.

Forward-looking statements are not guarantees of future performance, and actual events and results could differ materially from those expressed or implied in any forward-looking statements made herein. We encourage you to consider these and other factors carefully before making any investment decisions and we urge you to avoid placing undue reliance on forward-looking statements.

The S&P 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2025 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

FTSE source: London Stock Exchange Group plc and its group undertakings (collectively, the "LSE Group"). © LSE Group 2025. FTSE Russell is a trading name of certain of the LSE Group companies. "FTSE®" is a trade mark of the relevant LSE Group companies and is used by any other LSE Group company under licence. All rights in the FTSE Russell indices or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indices or data and no party may rely on any indices or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company's express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. The index is unmanaged and cannot be invested in directly.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.msci.com)

Capital believes the software and information from FactSet to be reliable. However, Capital cannot be responsible for inaccuracies, incomplete information or updating of the information furnished by FactSet. The information provided in this report is meant to give you an approximate account of the fund/manager's characteristics for the specified date. This information is not indicative of future Capital investment decisions and is not used as part of our investment decision-making process.

Indices are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

All Capital Group trademarks are owned by The Capital Group Companies, Inc. or an affiliated company in Canada, the U.S. and other countries. All other company names mentioned are the property of their respective companies.

Capital Group funds are offered in Canada by Capital International Asset Management (Canada), Inc., part of Capital Group, a global investment management firm originating in Los Angeles, California in 1931. Capital Group manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

The Capital Group funds offered on this website are available only to Canadian residents.

David Polak

David Polak

Steven Sperry

Steven Sperry