Fixed Income

Election

- President Biden’s policy agenda got a significant boost from Georgia voters.

- Large tax increases still look like an uphill climb, but no longer appear impossible.

- Technology companies are likely to face more regulatory risk.

As President Joe Biden takes office, the prospects for his policy agenda appear more robust than previously thought, following a Georgia runoff election that flipped control of the U.S. Senate.

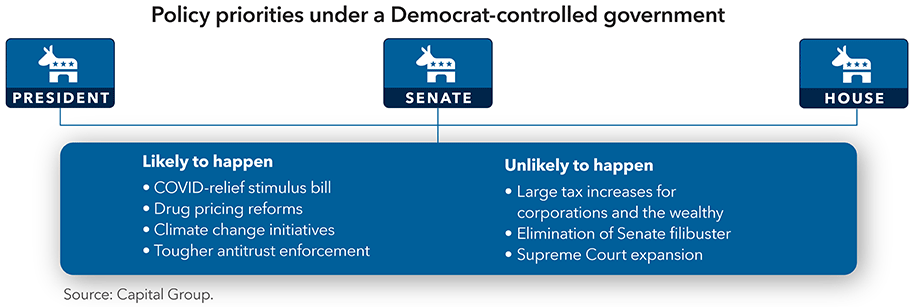

With Democrats now in charge of the White House, Senate and House of Representatives, some of Biden’s top legislative priorities may encounter less opposition between now and the 2022 midterm elections. But a 50-50 split in the Senate, with Vice President Kamala Harris as the tiebreaker, still means that major new legislation may require some degree of bipartisan support.

Without a commanding Democratic majority, the most ambitious elements of Biden’s agenda are likely to face a difficult, but not impossible, path to approval. That includes large tax increases for corporations and the wealthy, which some moderate Democrats may oppose along with many Republicans, especially while the U.S. economy continues to struggle with the COVID crisis.

“This is not a blue wave scenario,” says John Emerson, Vice Chairman of Capital Group International, Inc.SM and a former U.S. Ambassador to Germany. “With thin Democratic margins in the House and a 50-50 Senate, Democratic moderates will have a moderating influence on legislation. President Biden will work hard to gain bipartisan support where he can.”

Emerson also noted that, historically speaking, the U.S. stock market has performed well regardless of which party controls Washington. That includes many periods when Democrats ruled the White House and both houses of Congress — highlighted by a 26% return in USD for the Standard & Poor’s 500 Composite Index coming out of the global financial crisis in 2009.

U.S. stocks have moved higher since the January 5 runoff election in Georgia, as well. In that race, Republicans unexpectedly lost both Senate seats, resulting in a 50-50 tie. With Vice President Kamala Harris’ pivotal role as tiebreaker, Democrats now control the Senate by a razor-thin margin. U.S. stocks rose to an all-time high on January 8, and continue to post modest gains on a year-to-date basis.

U.S. stocks have rallied under Democratic rule

U.S. economic outlook

In addition, the outlook for the U.S. economy is marginally better under a political power structure where Democrats may be able to push through larger stimulus bills and higher spending on infrastructure projects, among other spending priorities, says Capital Group economist Jared Franz.

With a vaccine-assisted recovery already underway, Franz expects the U.S. economy to grow at a greater than 3% pace in 2021 — and potentially 4% — depending on how quickly and effectively the government moves to distribute stimulus checks and vaccines to the public.

“Reaching 4% growth is entirely possible, driven by government stimulus efforts, rapid vaccinations and organic recovery from the 2020 downturn,” Franz explains. “My concern, however, is with the unemployment rate (currently 6.7%). I think it will come down slower than most economists expect amid rising layoffs and the retooling of the economy to a post-pandemic labour-light regime.”

Policy landscape takes shape

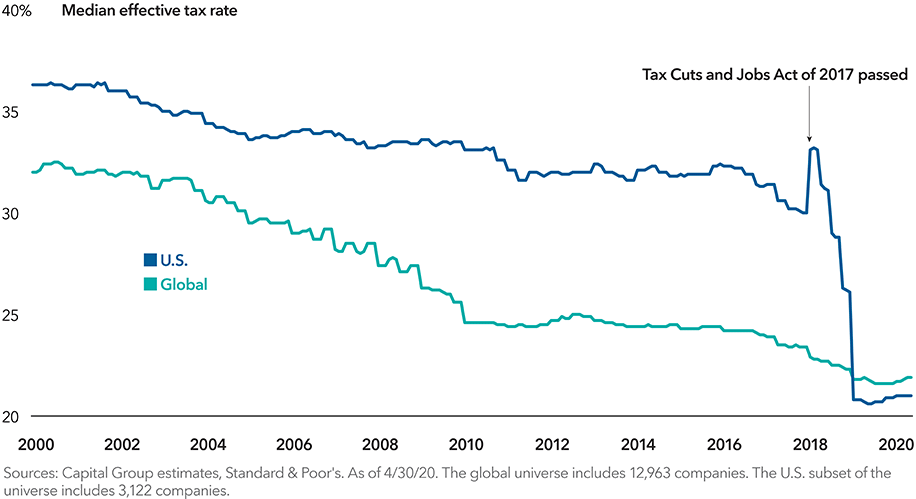

High-priority policy initiatives under the Biden administration are likely to include a modest corporate income tax hike, which previously appeared to be off the table when Republicans controlled the Senate.

The Tax Cuts and Jobs Act of 2017 — the most significant piece of legislation passed under President Trump — reduced corporate income tax rates to roughly 21% from 32%. Under the new administration, there is a decent chance of that number moving up in a phased approach to approximately 25%, rather than the 28% tax rate that Biden proposed during the campaign, says Capital Group political economist Matt Miller.

“There probably will be corporate tax hikes at some point, but I think they will be tempered by the concerns of centrist Democrats who don’t want to go too far too fast,” Miller says. “A 50-50 plus the VP majority in the Senate is a different world compared to a 55-seat majority, and I think the outcome of Biden’s policy agenda will reflect that.”

Modest corporate tax increases could be on the way

The same holds true for many other hot-button issues, such as levying higher taxes on wealthy individuals and raising the federal minimum wage, both of which were high on the list of Biden’s campaign promises. “Remember, some of these Democratic Senators will be up for reelection in 2022, and they may not want to run on a platform of higher taxes,” Miller notes, “especially at a time when the Senate and House majorities are so narrow.”

The environment and climate change could move front and centre, as well, including policies to encourage green investing and more disclosure requirements for public companies related to environmental, social and governance (ESG) matters.

Is Big Tech in big trouble?

Another issue that will likely arise during Biden’s first year in office is greater regulation of the technology industry. Both Democrats and Republicans have supported cracking down on Big Tech in various ways, including more aggressive antitrust enforcement and eliminating some long-standing legislative protections for internet companies.

This is another area where the Georgia runoff election has had a big impact, Miller says, because a Republican Senate could have blocked Biden’s appointments to the Federal Trade Commission and the U.S. Department of Justice Antitrust Division, but that won’t happen in a 50-50 Senate.

“I think those appointments will be a lot more aggressive than they would have been if Georgia had gone the other way,” Miller says. “And that means, yes, there will likely be a renewed focus on tech regulation. I don’t know yet how much of a threat it poses to their business models, but it’s something we’ll need to watch closely. At a minimum, I think it will be more difficult for tech firms to gain government approval to grow by acquiring promising competitors.”

Ramped up COVID relief

Of all the issues competing for Biden’s attention, however, none will get higher priority than the COVID relief and economic recovery efforts already under way.

As the president laid out in a January 14 2021 announcement, he will seek rapid approval of a US$1.9 trillion spending package that includes US$400 billion for vaccine deployment and school reopening, US$350 billion to help state and local governments, and US$1,400 direct payments to individuals, among other assistance for displaced workers.

The announcement came one day after the House moved to impeach Trump, meaning a Senate trial, if it happens, could compete for time with COVID-relief deliberations and result in legislative delays.

“For Biden’s first 100 days in office, the priority will be COVID, COVID, COVID,” Emerson stressed, “for the simple reason that everything else depends on it.”

Our latest insights

RELATED INSIGHTS

-

Fixed Income

-

-

Economic Indicators

Commissions, trailing commissions, management fees and expenses all may be associated with investments in investment funds. Please read the prospectus before investing. Investment funds are not guaranteed or covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer. For investment funds other than money market funds, their values change frequently. For money market funds, there can be no assurances that the fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in the fund will be returned to you. Past performance may not be repeated.

Unless otherwise indicated, the investment professionals featured do not manage Capital Group‘s Canadian investment funds.

References to particular companies or securities, if any, are included for informational or illustrative purposes only and should not be considered as an endorsement by Capital Group. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds or current holdings of any investment funds. These views should not be considered as investment advice nor should they be considered a recommendation to buy or sell.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and not be comprehensive or to provide advice. For informational purposes only; not intended to provide tax, legal or financial advice. We assume no liability for any inaccurate, delayed or incomplete information, nor for any actions taken in reliance thereon. The information contained herein has been supplied without verification by us and may be subject to change. Capital Group funds are available in Canada through registered dealers. For more information, please consult your financial and tax advisors for your individual situation.

Forward-looking statements are not guarantees of future performance, and actual events and results could differ materially from those expressed or implied in any forward-looking statements made herein. We encourage you to consider these and other factors carefully before making any investment decisions and we urge you to avoid placing undue reliance on forward-looking statements.

The S&P 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2024 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

FTSE source: London Stock Exchange Group plc and its group undertakings (collectively, the "LSE Group"). © LSE Group 2024. FTSE Russell is a trading name of certain of the LSE Group companies. "FTSE®" is a trade mark of the relevant LSE Group companies and is used by any other LSE Group company under licence. All rights in the FTSE Russell indices or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indices or data and no party may rely on any indices or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company's express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. The index is unmanaged and cannot be invested in directly.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

MSCI does not approve, review or produce reports published on this site, makes no express or implied warranties or representations and is not liable whatsoever for any data represented. You may not redistribute MSCI data or use it as a basis for other indices or investment products.

Capital believes the software and information from FactSet to be reliable. However, Capital cannot be responsible for inaccuracies, incomplete information or updating of the information furnished by FactSet. The information provided in this report is meant to give you an approximate account of the fund/manager's characteristics for the specified date. This information is not indicative of future Capital investment decisions and is not used as part of our investment decision-making process.

Indices are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

All Capital Group trademarks are owned by The Capital Group Companies, Inc. or an affiliated company in Canada, the U.S. and other countries. All other company names mentioned are the property of their respective companies.

Capital Group funds are offered in Canada by Capital International Asset Management (Canada), Inc., part of Capital Group, a global investment management firm originating in Los Angeles, California in 1931. Capital Group manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

The Capital Group funds offered on this website are available only to Canadian residents.

John Emerson

John Emerson

Jared Franz

Jared Franz

Matt Miller

Matt Miller