Fixed Income

Global Equities

- Because this economic decline is policy driven, a solid recovery is likely as lockdowns end.

- Easy monetary policy, aggressive fiscal policy and zero-bound interest rates should continue to support equity markets.

- It’s not too late to upgrade your fixed income allocation as rates are likely to remain lower for longer.

U.S. Midyear Outlook: From recession to recovery

In the opening weeks of 2020, investors had very few hints of the daunting events to come in this most unusual year. The U.S. economy was humming along nicely. Unemployment levels declined to 50-year lows. And the stock market hit record new highs almost like clockwork.

That was then. This is now.

Over three challenging months, coronavirus-induced lockdowns have wreaked havoc on the U.S. and global economies. Millions have filed for unemployment benefits. COVID-19 infections appear to have peaked in many places, but the risk of secondary outbreaks remain. Meanwhile, widespread civil unrest in many American cities has added a volatile new element to an already high level of uncertainty.

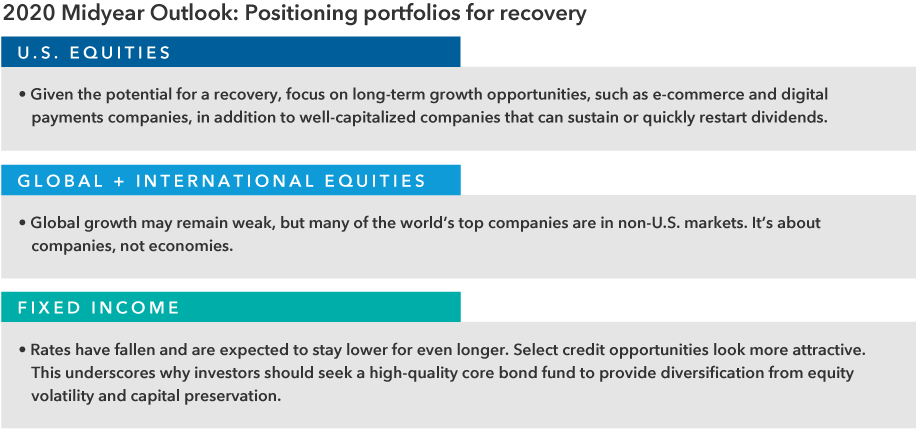

Despite all of this, many stocks are down on a year-to-date basis but not necessarily out, as many investors optimistically look ahead to an eventual recovery. Their hopes are underpinned by massive government stimulus measures and ultra-low interest rates. Some companies perceived to be benefiting from stay-at-home mandates — including e-commerce, video streaming and food delivery firms — have rallied in the face of the worst market and economic environment since the 2008–09 global financial crisis.

As Capital Group vice chairman and portfolio manager Rob Lovelace has noted in recent investors calls, there is a unique aspect of this downturn: It was self-imposed by governments in response to a global health crisis. As such, it is not difficult for investors to imagine an end to this chapter and look forward to a post-COVID recovery period, which may have already started.

“This is different than the 2008 financial crisis — we can see the other side of the valley,” says Lovelace, a portfolio manager of Capital Group Canadian Focused Equity Fund™ (Canada), “It’s hard to know how wide the valley is, but I believe we will end up in a better place two years from now.”

.png)

Positioning for a market recovery

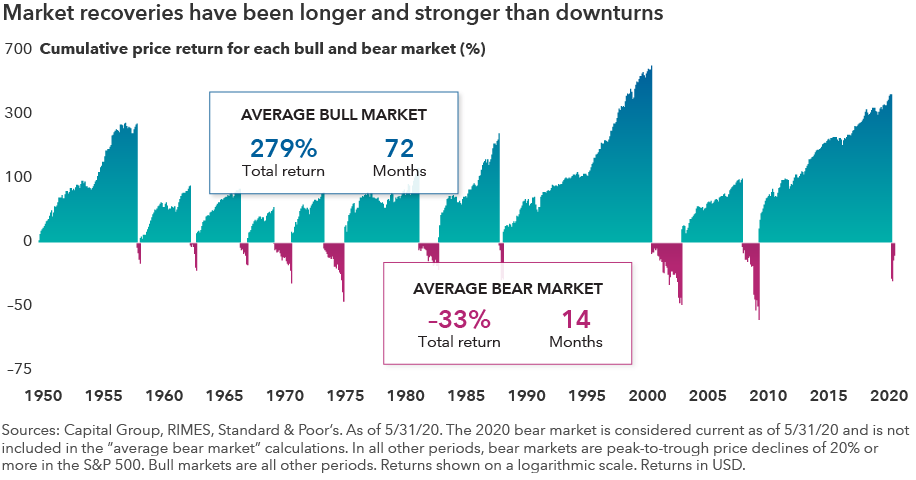

Bear markets are painful, no doubt about it. And when you’re in the middle of a sharp decline like the one we saw in March, it feels like it’s never going to end. But it’s important to remember that during the post-World War II era, bull markets have been far more robust than bear markets, and they’ve lasted considerably longer as well.

While every market decline is unique, over the past 70 years the average bear market has lasted 14 months and resulted in an average loss of 33%. By contrast, the average bull market has run for 72 months — or more than five times longer — and the average gain has been 279%.

Moreover, returns have often been strongest right after the market bottoms, as investors learned in the last severe downturn. After the carnage of 2008, U.S. stocks finished 2009 with a 23% gain. Missing a bounce back can cost you, which is why it’s important to consider staying invested through even the most difficult periods.

Dividends and the downturn

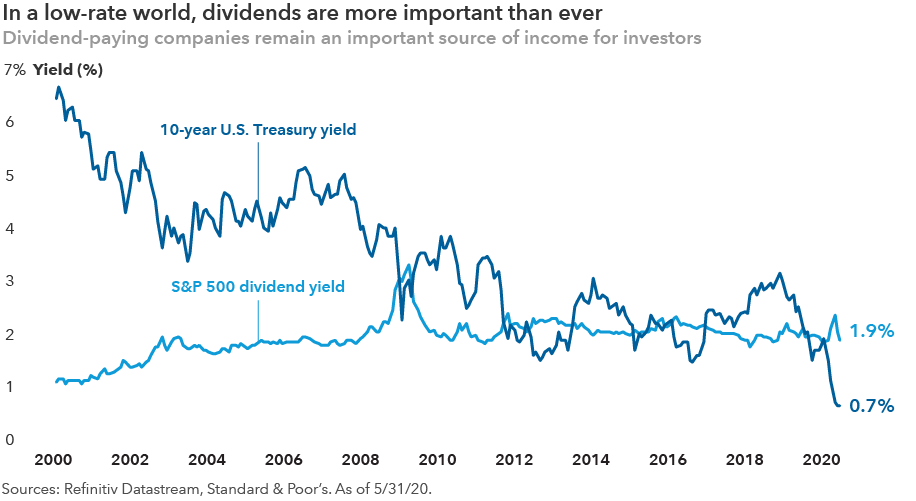

Another important difference in this downturn is that prospects for some dividend-paying stocks have changed dramatically. During previous bear markets, dividend stocks in aggregate have generally helped to provide a cushion against rapidly falling equity prices. Not so this year as many previously reliable dividend-paying companies have suspended or cut those payments in a bid to preserve capital.

However, rather than avoiding income stocks altogether, investors should instead consider the fundamental strengths and weaknesses of each company with an eye toward dividend sustainability going forward, notes Joyce Gordon, a portfolio manager of Capital Group Capital Income Builder™ (Canada).

Indeed, select companies across various sectors — including Apple, Costco, Procter & Gamble and UnitedHealth — have actually increased their dividends this year. “The key is to be really selective in this environment,” Gordon says. “Not all dividend-payers are created equal. Companies with high debt levels and a deteriorating credit outlook are particularly unattractive, in my view.”

International outlook: Seek opportunities beyond borders

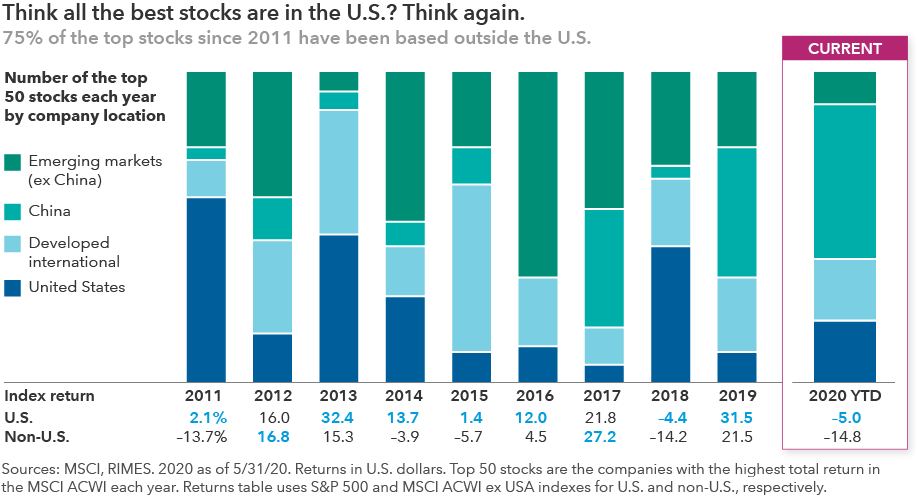

If you’re convinced that all the best stocks are in the U.S., then it’s time to take a closer look at the issue.

While it’s true that U.S. market indices have generated greater returns than international indices over the past decade, indices don’t tell the whole story. In fact, on a company-by-company basis, the picture changes drastically: The stocks with the best annual returns have been overwhelmingly located in non-U.S. markets.

That trend was even more pronounced in the first quarter of 2020. The list of investable companies with the best returns was dominated by Chinese firms. Not surprising, given that China was the first country to get hit by the COVID-19 outbreak, and among the first to emerge from lockdown. While one quarter is a very short time frame, the trend has broadly played out over other years as well, through generally smaller non-U.S. companies in fast-growing emerging markets.

Why? It’s all about opportunity set. There are roughly three times as many foreign stocks as domestic. So why fish in a smaller pond when there are great companies all over the world? When markets are uncertain, it’s important to have flexibility. Consider selecting global funds that give managers the ability to choose from among the best companies, no matter where they are located.

Fixed income outlook: Focus on core strength

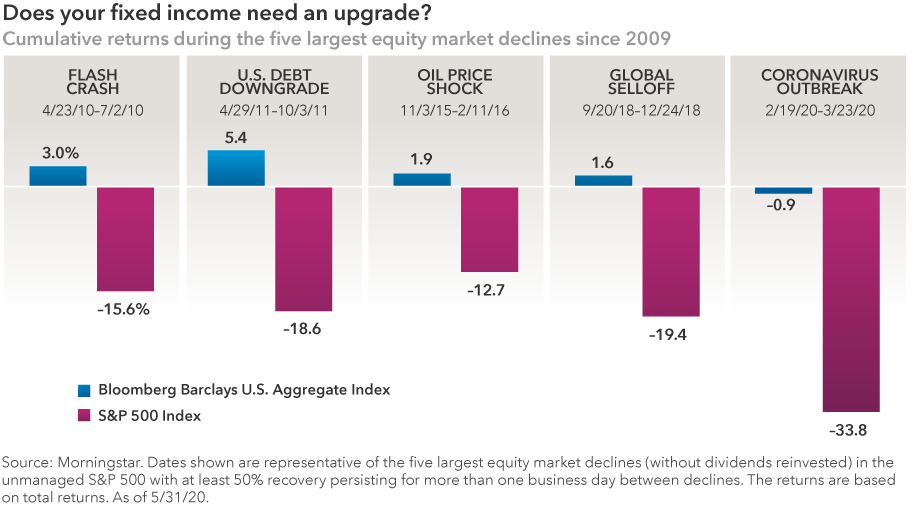

Stock market turmoil has hammered home one crucial lesson: the importance of investment-grade bonds in a diversified portfolio. If you owned a core bond fund that provided capital preservation and diversification from equities when the stock market plummeted in the first quarter, then you probably feel pretty good about your decision.

From peak to trough, equities fell more than 30%, while core bond returns — as measured by the Bloomberg Barclays U.S. Aggregate Index — were close to flat. By contrast, many widely bond mandates, which rely more heavily on higher risk bonds, failed to perform these critical roles, and investment returns suffered.

“We talk all the time about the four roles of fixed income in a balanced portfolio. They are diversification from equities, income, inflation protection and capital preservation,” explains Mike Gitlin, Capital Group’s head of fixed income. “There is no fifth role for replicating equity risk across your entire bond portfolio. We believe investors should take measured risks in their equity portfolios and consider dedicating a portion of their bond portfolios to those four very important roles.”

If you didn’t follow that approach, you might think it’s too late to upgrade your bond portfolio. It isn’t, Gitlin notes. Even though U.S. government bond yields have fallen sharply, the market expects them to remain low. Easy monetary policy, low growth and near-term muted inflation prospects imply that significantly higher rates aren’t a major risk today.

The potential shock absorption that a quality-oriented core bond fund can help provide still matters. Stock market volatility may not be over. While many investors expect the global economy to recover eventually, the timing isn’t certain and, therefore, a solid dose of downside protection remains a vital part of any fixed income allocation.

Our latest insights

RELATED INSIGHTS

-

Fixed Income

-

-

Economic Indicators

Commissions, trailing commissions, management fees and expenses all may be associated with investments in investment funds. Please read the prospectus before investing. Investment funds are not guaranteed or covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer. For investment funds other than money market funds, their values change frequently. For money market funds, there can be no assurances that the fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in the fund will be returned to you. Past performance may not be repeated.

Unless otherwise indicated, the investment professionals featured do not manage Capital Group‘s Canadian investment funds.

References to particular companies or securities, if any, are included for informational or illustrative purposes only and should not be considered as an endorsement by Capital Group. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds or current holdings of any investment funds. These views should not be considered as investment advice nor should they be considered a recommendation to buy or sell.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and not be comprehensive or to provide advice. For informational purposes only; not intended to provide tax, legal or financial advice. We assume no liability for any inaccurate, delayed or incomplete information, nor for any actions taken in reliance thereon. The information contained herein has been supplied without verification by us and may be subject to change. Capital Group funds are available in Canada through registered dealers. For more information, please consult your financial and tax advisors for your individual situation.

Forward-looking statements are not guarantees of future performance, and actual events and results could differ materially from those expressed or implied in any forward-looking statements made herein. We encourage you to consider these and other factors carefully before making any investment decisions and we urge you to avoid placing undue reliance on forward-looking statements.

The S&P 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2024 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

FTSE source: London Stock Exchange Group plc and its group undertakings (collectively, the "LSE Group"). © LSE Group 2024. FTSE Russell is a trading name of certain of the LSE Group companies. "FTSE®" is a trade mark of the relevant LSE Group companies and is used by any other LSE Group company under licence. All rights in the FTSE Russell indices or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indices or data and no party may rely on any indices or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company's express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. The index is unmanaged and cannot be invested in directly.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

MSCI does not approve, review or produce reports published on this site, makes no express or implied warranties or representations and is not liable whatsoever for any data represented. You may not redistribute MSCI data or use it as a basis for other indices or investment products.

Capital believes the software and information from FactSet to be reliable. However, Capital cannot be responsible for inaccuracies, incomplete information or updating of the information furnished by FactSet. The information provided in this report is meant to give you an approximate account of the fund/manager's characteristics for the specified date. This information is not indicative of future Capital investment decisions and is not used as part of our investment decision-making process.

Indices are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

All Capital Group trademarks are owned by The Capital Group Companies, Inc. or an affiliated company in Canada, the U.S. and other countries. All other company names mentioned are the property of their respective companies.

Capital Group funds are offered in Canada by Capital International Asset Management (Canada), Inc., part of Capital Group, a global investment management firm originating in Los Angeles, California in 1931. Capital Group manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

The Capital Group funds offered on this website are available only to Canadian residents.

Joyce Gordon

Joyce Gordon

Rob Lovelace

Rob Lovelace