Demographics & Culture

United States

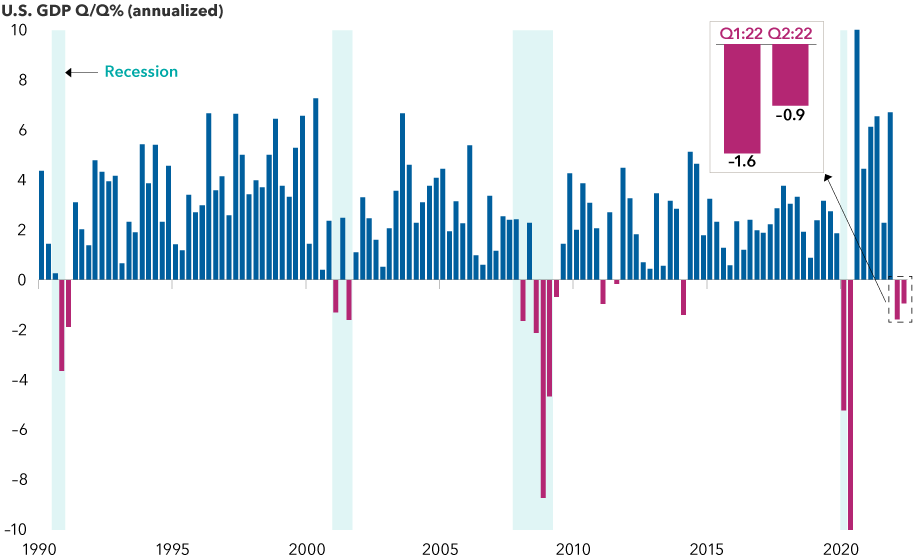

Is the U.S. economy in recession or not? That’s the question on the minds of many investors as U.S. gross domestic product (GDP) declined for two consecutive quarters in the first half of the year, a commonly cited definition of recession.

However, with consistently strong job growth, historically low unemployment and solid growth in consumer spending, that doesn’t sound like a recession most people would remember. So what’s the conclusion?

“It depends on who you ask,” says Capital Group economist Jared Franz. “With food, energy and shelter prices all rising faster than wages, the average American consumer would probably say yes. In my view, we are either on the edge of a recession or we are already tipping into it.”

To put things in perspective, over the past 70 years the average U.S. recession has lasted about 10 months and resulted in a GDP decline of 2.5%. In Franz’s estimation, the next one may be worse than average, if current trends persist, but still less severe than the Great Recession from December 2007 to June 2009.

Key economic indicators point to a potential recession

Sources: Capital Group, Bureau of Economic Analysis, National Bureau of Economic Research, U.S. Department of Commerce. Y-axis is limited to a range of –10% to +10% to represent a normalized range, but Q2:20 and Q3:20 exceed this range (at –35.7% and +30.2%) largely due to the pandemic. As of June 30, 2022.

When will we know for sure?

The official arbiter of U.S. recessions, the National Bureau of Economic Research (NBER), takes a while to share its view. The nonprofit group considers many factors beyond GDP, including employment levels, household income and industrial production. Since NBER usually doesn’t reveal its findings until six to nine months after a recession has started, we may not get an official announcement until next year.

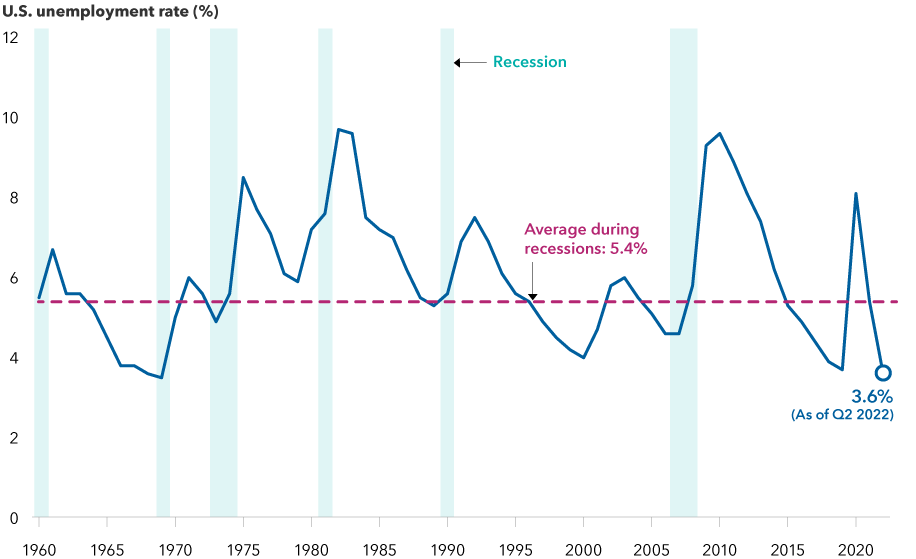

“It’s fair to say that most consumers probably don’t care what NBER thinks,” Franz adds. “They see inflation above 9%, sharply higher energy prices and declining home sales. They feel the impact of those data points. The labour market is one of the only data points that isn’t signaling a recession right now.”

The U.S. added 372,000 jobs in June, higher than most economists expected. The unemployment rate remained steady at 3.6%, close to a record low. However, as Franz explains, that number reflects a supply-demand mismatch in an economy that hasn’t fully recovered from the pandemic. In the months ahead, he expects greater numbers of jobseekers to return. That should increase the unemployment rate as companies reduce hiring.

One bright spot: A strong U.S. job market

Sources: Capital Group, Bureau of Labor Statistics, National Bureau of Economic Research, U.S. Department of Labor. As of June 2022.

Consumer spending, meanwhile, rose 1.1% in June. That’s a strong number on the surface, Franz says, but after adjusting for inflation, it’s essentially flat. It also reflects higher spending on necessities such as health care and housing while masking declines in discretionary categories such as clothing and recreation. That spending shift was underscored recently when Walmart and Best Buy issued profit warnings, noting that higher prices for food and energy were hurting sales of discretionary items.

“We haven’t seen overall consumer spending or employment levels decline yet,” Franz says, “but I think it’s just a matter of time.”

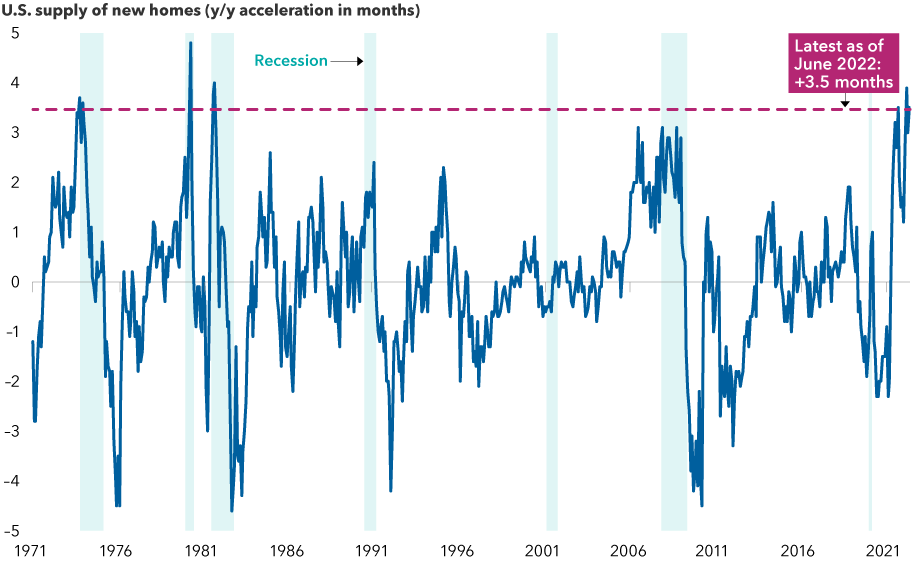

Housing comes under pressure

Another troubling sign is the rapid decline in new home sales. With the U.S. Federal Reserve aggressively raising interest rates to fight inflation, mortgage rates have soared in recent months, triggering a sharp reaction in the housing market.

New single-family home purchases fell last month by 8.1%, the biggest drop in more than two years. Sales of previously owned homes tumbled 5.4%, the fifth consecutive month of declines. Additionally, a dramatic rise in home prices during the pandemic raises concerns about the potential for a painful correction.

Rising home inventories suggest this recession could be more difficult

Sources: Capital Group, National Bureau of Economic Research, U.S. Census Bureau. As of June 2022.

“When it comes to the impact on the economy, the housing market punches far above its weight,” Franz explains. “I'm mulling the risk that a larger correction in this sector could increase the depth and duration of the next recession.”

Why inflation should subside

If we are heading into a recessionary period, the silver lining could be a reversal of the extreme inflation pressures witnessed over the past year. In fact, some argue that inflation has spiraled so far out of control it could take a substantial recession to bring it down to the Fed’s 2% target. In June, U.S. inflation hit a 40-year high of 9.1%.

“The pivotal question is: Are we in a new inflationary regime or not? I don’t think we are,” says fixed income portfolio manager Pramod Atluri. “Consumer prices are likely coming down over the next few months as the recession kicks in and demand wanes.”

What does that mean for the bond market — which, so far this year, has experienced the biggest decline in four decades? It means much of the pain may be over, Atluri says, as the Fed considers whether it can continue raising interest rates in the face of an economic downturn. In fact, the bond market is already pricing in expectations that the Fed will cut rates multiple times in 2023.

“There are a lot of signs that inflation has peaked,” Atluri adds, citing falling prices for gasoline since mid-June, as well as wheat, corn and other commodities since mid-May. “That may give the Fed the cover it needs to support economic growth while still taking inflation seriously.”

In the meantime, Atluri expects more volatility as the market adjusts to tighter monetary policy. In his portfolios, that means shifting toward higher quality investments, including U.S. Treasuries and agency mortgage-backed securities while also looking for opportunistic investments in corporate and emerging markets bonds where investors are being compensated for the rising recession risk.

Consider all-weather investing

Similarly in the equity markets, identifying high-quality companies with steady cash flows and reliable profit margins is key to surviving recessions, says equity portfolio manager Diana Wagner. Companies with solid and growing dividends are particularly attractive.

“In this environment, you want to invest in companies whose fundamentals will hold up relatively better. Pricing power and steady demand are big components of that,” Wagner said during a recent Capital Group webinar. “I prefer a relatively concentrated, all-weather portfolio that can thrive in a variety of market environments,” she adds. “My top holdings are health care, software and insurance companies. I also like consumer staples, but you have to be very selective in that sector because some valuations have become quite high.”

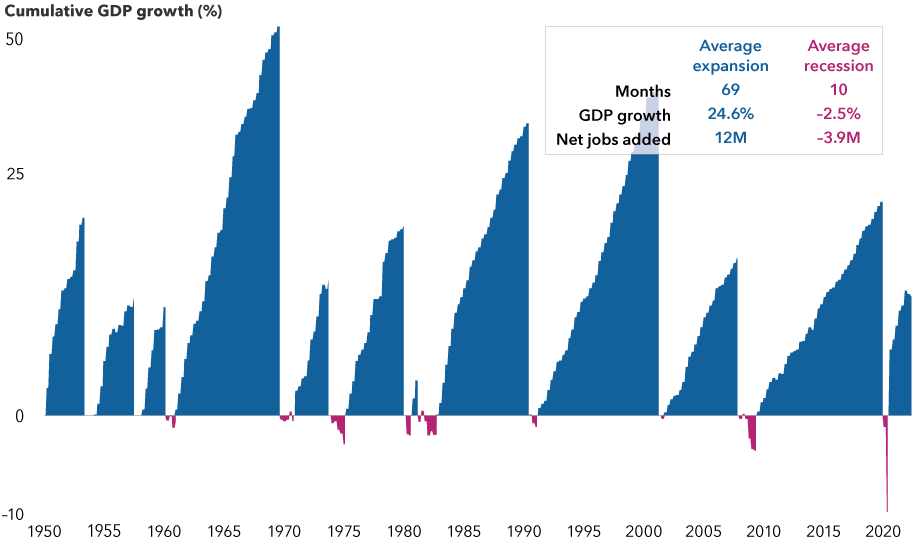

Recessions have been painful but less impactful than expansions

Sources: Capital Group, National Bureau of Economic Research, Refinitiv Datastream. Chart reflects latest U.S. GDP data available as of 6/30/22 and shown on a logarithmic scale. The expansion that began in 2020 is still considered current as of 6/30/22 and not included in the average expansion summary statistics. Since NBER announces recession start and end months, rather than exact dates, we have used month-end dates as a proxy for calculations of jobs added. Nearest quarter-end values used for U.S. GDP growth rates.

What type of recession is Wagner preparing for?

“There are a lot of mixed signals, but clearly the economy is slowing and I think the risk of stagflation is real,” she says, referring to a period of stagnant growth and high inflation in the 1970s. “Every recession is miserable in its own way, but I expect the next one to be less damaging than in 2008. The important thing for investors to remember is that recessions usually have been short-lived and expansions have been far more powerful.”

Our latest insights

-

-

U.S. Equities

-

Fixed Income

-

-

Economic Indicators

Commissions, trailing commissions, management fees and expenses all may be associated with investments in investment funds. Please read the prospectus before investing. Investment funds are not guaranteed or covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer. For investment funds other than money market funds, their values change frequently. For money market funds, there can be no assurances that the fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in the fund will be returned to you. Past performance may not be repeated.

Unless otherwise indicated, the investment professionals featured do not manage Capital Group‘s Canadian investment funds.

References to particular companies or securities, if any, are included for informational or illustrative purposes only and should not be considered as an endorsement by Capital Group. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds or current holdings of any investment funds. These views should not be considered as investment advice nor should they be considered a recommendation to buy or sell.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and not be comprehensive or to provide advice. For informational purposes only; not intended to provide tax, legal or financial advice. We assume no liability for any inaccurate, delayed or incomplete information, nor for any actions taken in reliance thereon. The information contained herein has been supplied without verification by us and may be subject to change. Capital Group funds are available in Canada through registered dealers. For more information, please consult your financial and tax advisors for your individual situation.

Forward-looking statements are not guarantees of future performance, and actual events and results could differ materially from those expressed or implied in any forward-looking statements made herein. We encourage you to consider these and other factors carefully before making any investment decisions and we urge you to avoid placing undue reliance on forward-looking statements.

The S&P 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2025 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

FTSE source: London Stock Exchange Group plc and its group undertakings (collectively, the "LSE Group"). © LSE Group 2025. FTSE Russell is a trading name of certain of the LSE Group companies. "FTSE®" is a trade mark of the relevant LSE Group companies and is used by any other LSE Group company under licence. All rights in the FTSE Russell indices or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indices or data and no party may rely on any indices or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company's express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. The index is unmanaged and cannot be invested in directly.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

MSCI does not approve, review or produce reports published on this site, makes no express or implied warranties or representations and is not liable whatsoever for any data represented. You may not redistribute MSCI data or use it as a basis for other indices or investment products.

Capital believes the software and information from FactSet to be reliable. However, Capital cannot be responsible for inaccuracies, incomplete information or updating of the information furnished by FactSet. The information provided in this report is meant to give you an approximate account of the fund/manager's characteristics for the specified date. This information is not indicative of future Capital investment decisions and is not used as part of our investment decision-making process.

Indices are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

All Capital Group trademarks are owned by The Capital Group Companies, Inc. or an affiliated company in Canada, the U.S. and other countries. All other company names mentioned are the property of their respective companies.

Capital Group funds are offered in Canada by Capital International Asset Management (Canada), Inc., part of Capital Group, a global investment management firm originating in Los Angeles, California in 1931. Capital Group manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

The Capital Group funds offered on this website are available only to Canadian residents.

Jared Franz

Jared Franz

Pramod Atluri

Pramod Atluri

Diana Wagner

Diana Wagner