Demographics & Culture

Market Volatility

Russia’s military aggression against Ukraine, Europe’s largest ground war in generations, has impacted millions of people and triggered a large-scale humanitarian crisis.

The conflict also carries wide-ranging geopolitical implications for the future of European cooperation, the changing posture of U.S. foreign policy toward Russia and China, and the reversal of globalization trends that have transformed the world since the end of the Cold War. What follows are a range of views from across Capital Group’s investment team including those of a political economist and equity and fixed income portfolio managers.

Conflict highlights need for fiscal pragmatism Europe

Talha Kahn European economist

The world has changed in a matter of weeks, with geopolitical and economic consequences that will reverberate for years to come. Russia’s invasion of Ukraine marks the end of an era of relative stability and peace since the fall of the Berlin Wall and opens a period of geopolitical peril.

Putin crossed the Rubicon once he decided to invade, but he seems to have badly misjudged both the resistance the Russian forces would face as well as the manner in which the Transatlantic Alliance has come together in pushing back.

He has managed to do in just over a week and a half what Western leaders have failed to do in over three decades of painstaking progress on European cohesion. However, we need to be careful in assessing how this conflict ends. In my mind, Ukraine is not going to retain the territorial borders it had before the invasion, and the world will not return to the status quo. Even if Putin backs down, we're likely to see lasting structural changes.

On fiscal policy, I expect greater flexibility for the foreseeable future. It appears the European Union’s fiscal rules will be suspended for another year at least. And I believe the debate over revising the fiscal framework will take greater urgency. The threat from Putin’s Russia has also highlighted the need to shore up military and energy security. Years of underspending on defence means that European countries are far behind where they should be and need to invest a lot more. So far, Germany is the most prominent example of this shift in thinking.

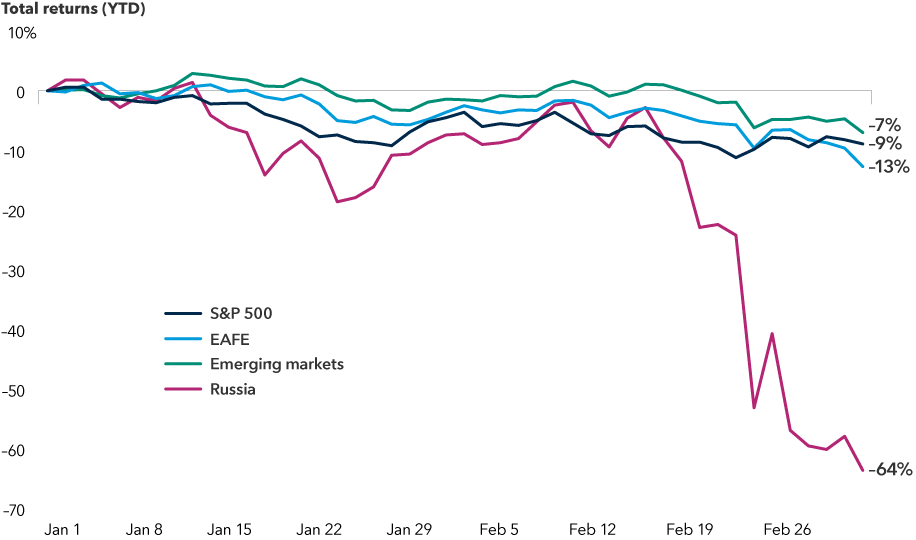

Pandemic, inflation, war: It’s been a tough start to the year

Sources: MSCI, RIMES, Standard & Poor’s. As of 3/4/22. Returns are in USD.

Calibrating fixed income investments in this new world

Rob Neithart, fixed income portfolio manager

Russia’s invasion of Ukraine is a geopolitical and economic shock, no doubt. Rising commodity prices will feed into inflation and act as a dampener on global growth. That said, we have entered this period with an upswing towards growth in many economies.

The United States was leading the growth recovery mainly because its fiscal and monetary policy actions have been so supportive. On the other hand, China has been working hard to slow things down and tighten financial conditions. Europe was somewhere in between — recovering but not as strongly. And finally, there is a wide dispersion across emerging markets, with many economies just beginning to see a post-COVID recovery.

Given this backdrop, our fixed income team is of the view that in the U.S., the U.S. Federal Reserve will largely stay on its path of lifting interest rates to contain inflationary pressures as labour markets remain strong and economic growth prospects are modest but positive. Our fixed income portfolios generally favour a short duration stance, especially in the three- to five-year part of the yield curve. Longer term interest rates are likely to remain anchored by investors seeking the safety of U.S. government debt. The Fed has signaled that inflation momentum is fairly entrenched in the U.S., and with these shocks, it could become even more so. The central bank still has a way to go before financial conditions are considered tight. So, in absolute terms, we're still looking at sharply negative real interest rates.

In Europe, the European Central Bank may take a more cautious approach given Europe’s greater exposure to Russia’s economy and its dependence on Russia for gas.

In emerging markets debt, risk premiums have adjusted, and we are seeing very high yields across the universe — somewhere in the 7% to 8% range in U.S. dollar terms. Despite the extremely severe situation in Russia and Ukraine, most emerging markets have continued to function well, maintaining continued liquidity. Investors that have a longer time frame will probably see very good returns, even though short-term volatility may be significant.

Our fixed income team still favours local currency emerging markets debt given valuations and where many of these credits are in the economic cycle. Many emerging markets have continued to function in a way that resembles developed markets.

Russian and Ukrainian debt markets are a different story. Before the invasion, Russia had one of the strongest credit profiles in emerging markets. It is not financially dependent on external debt markets and was a net creditor — meaning its hard currency assets vastly exceeded its liabilities. Russia had issues with its slow-growing economy, but the financial strength of its balance sheet had always been a positive. Ukraine, on the other hand, was moving to an improving credit and taking policy actions that looked positive for the credit profile over the long term. It had moderate levels of debt, and it did not appear to be in a situation where financial sustainability was in question.

Now, obviously, everything has completely changed. Russian debt markets are priced for certain default. Ukrainian bonds are priced higher, but they’re still at a default level. There is no market making in these investments, partly due to sanctions.

There are scenarios where markets might begin to function, even in the midst of sanctions. There might be peer-to-peer trading that gets set up, as happened after the invasion of Crimea in 2014. It is unlikely this would facilitate any significant change in liquidity, but it would help with price discovery.

China is likely to accelerate development of import substitution

Victor Kohn, equity portfolio manager

We are looking at the potential impact of these developments across emerging markets and broader capital markets. Clearly, the fallout related to oil and gas and commodities more broadly is significant. Net commodity-exporting countries like Indonesia will be beneficiaries, while countries with a large oil import bill such as India will face challenges. Russia and Ukraine have been major exporters of agricultural commodities such as wheat and precious metals such as titanium. For example, by some rough estimates, about a third of the world’s titanium comes from Russia.

Beyond commodities, I think this will accelerate the trend towards lesser dependence on cross-border sourcing for critical supply chain components. I believe countries will look to increase domestic production where they have capabilities. This will be particularly true for China.

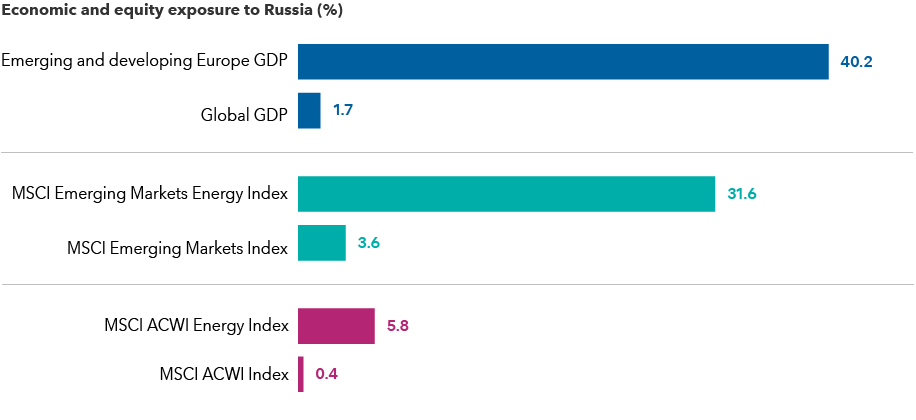

Exposure to Russia looms large for Europe, less so for the world

Sources: Capital Group, IMF World Economic Outlook, MSCI, RIMES. As of December 31, 2021. GDP figures are annual. “Emerging and developing Europe” includes Albania, Belarus, Bosnia and Herzegovina, Bulgaria, Croatia, Hungary, Kosovo, Moldova, Montenegro, North Macedonia, Poland, Romania, Russia, Serbia, Turkey and Ukraine. Exposure to equity indices reflects the percentage of indices market value represented by Russian companies within listed indices.

The invasion of Ukraine and subsequent sanctions by Western nations will potentially be a further catalyst for China’s party leadership to accelerate the country’s domestic capabilities in areas such as technology, pharmaceuticals and consumer-related products. They could also seek to secure energy and metal sources.

China is likely to increase financial support for its leading domestic companies to develop a more localized supply chain that relies less on foreign multinationals. It had already been making this transition in its dual circulation strategy. It took on greater urgency after the U.S. banned telecommunications giant Huawei in 2019 and pressed other countries to do the same.

Across markets, I will be looking to see which companies could benefit from import substitution and which could be challenged — and accordingly adjust portfolios.

MSCI EAFE (Europe, Australasia, Far East) Indice is a free float-adjusted market capitalization-weighted indice designed to measure developed equity market results, excluding the United States and Canada.

MSCI All Country World Indice (ACWI) is a free float-adjusted market capitalization-weighted indice designed to measure equity market results in the global developed and emerging markets, consisting of more than 40 developed and emerging market country indices.

MSCI Emerging Markets Indice is a free float-adjusted market capitalization-weighted indice designed to measure equity market results in the global emerging markets, consisting of more than 20 emerging market country indices.

MSCI Russia Indice is designed to measure the performance of the large- and mid-cap segments of the Russian market.

MSCI ACWI Energy Indice is designed to measure results of large- and mid-cap energy securities from 23 developed markets and 25 emerging markets.

MSCI Emerging Markets Energy Indice is designed to measure results of large- and mid-cap energy securities from 25 emerging markets countries.

Standard & Poor’s 500 Composite Indice is a market capitalization-weighted indice based on the results of approximately 500 widely held common stocks.

Our latest insights

-

-

U.S. Equities

-

Fixed Income

-

-

Economic Indicators

Capital Group investments in Belarus, Russia and Ukraine

Commissions, trailing commissions, management fees and expenses all may be associated with investments in investment funds. Please read the prospectus before investing. Investment funds are not guaranteed or covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer. For investment funds other than money market funds, their values change frequently. For money market funds, there can be no assurances that the fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in the fund will be returned to you. Past performance may not be repeated.

Unless otherwise indicated, the investment professionals featured do not manage Capital Group‘s Canadian investment funds.

References to particular companies or securities, if any, are included for informational or illustrative purposes only and should not be considered as an endorsement by Capital Group. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds or current holdings of any investment funds. These views should not be considered as investment advice nor should they be considered a recommendation to buy or sell.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and not be comprehensive or to provide advice. For informational purposes only; not intended to provide tax, legal or financial advice. We assume no liability for any inaccurate, delayed or incomplete information, nor for any actions taken in reliance thereon. The information contained herein has been supplied without verification by us and may be subject to change. Capital Group funds are available in Canada through registered dealers. For more information, please consult your financial and tax advisors for your individual situation.

Forward-looking statements are not guarantees of future performance, and actual events and results could differ materially from those expressed or implied in any forward-looking statements made herein. We encourage you to consider these and other factors carefully before making any investment decisions and we urge you to avoid placing undue reliance on forward-looking statements.

The S&P 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2025 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

FTSE source: London Stock Exchange Group plc and its group undertakings (collectively, the "LSE Group"). © LSE Group 2025. FTSE Russell is a trading name of certain of the LSE Group companies. "FTSE®" is a trade mark of the relevant LSE Group companies and is used by any other LSE Group company under licence. All rights in the FTSE Russell indices or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indices or data and no party may rely on any indices or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company's express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. The index is unmanaged and cannot be invested in directly.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

MSCI does not approve, review or produce reports published on this site, makes no express or implied warranties or representations and is not liable whatsoever for any data represented. You may not redistribute MSCI data or use it as a basis for other indices or investment products.

Capital believes the software and information from FactSet to be reliable. However, Capital cannot be responsible for inaccuracies, incomplete information or updating of the information furnished by FactSet. The information provided in this report is meant to give you an approximate account of the fund/manager's characteristics for the specified date. This information is not indicative of future Capital investment decisions and is not used as part of our investment decision-making process.

Indices are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

All Capital Group trademarks are owned by The Capital Group Companies, Inc. or an affiliated company in Canada, the U.S. and other countries. All other company names mentioned are the property of their respective companies.

Capital Group funds are offered in Canada by Capital International Asset Management (Canada), Inc., part of Capital Group, a global investment management firm originating in Los Angeles, California in 1931. Capital Group manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

The Capital Group funds offered on this website are available only to Canadian residents.

The Capital Group funds offered on this website are available only to Canadian residents.

Talha Khan

Talha Khan

Rob Neithart

Rob Neithart

Victor Kohn

Victor Kohn