Aerospace

Witnessing an F-35 jet fighter take off vertically as it rapidly achieves speeds beyond the sound barrier and then swiftly returns to earth in a vertical descent is a stunning experience, according to equity portfolio manager Jason Smith.

“I have seen an F-35 take flight a few times,” says Smith, who attended a demonstration in July at the Farnborough International Airshow outside London. “It’s hard not to be awestruck every time.”

Smith, who is a portfolio manager on Capital Group Canadian Focused Equity FundTM (Canada) and who also covers European industrials, airlines, aerospace and defence companies as an analyst, didn’t attend the event simply for the spectacle. He and eight colleagues went to see the latest advancements in commercial aviation, meet with management teams and gain insights into the industry overall.

“Getting out on the road to kick the tires and meeting face-to-face with management are cornerstones of our research process,” says Lara Pellini, an equity portfolio manager based in London who accompanied Smith.

“During the pandemic we managed with virtual meetings, but Farnborough was a great opportunity to harvest and replenish relationships, and take the temperature of the commercial aircraft market,” she explains.

Here, Smith and Pellini identify six key insights from their trip to Farnborough.

1. There’s no substitute for being there

The aerospace and defence industry hosts shows all over the world, but the two most important are held in Farnborough and Paris in alternating years. At these events leading companies gather to meet with customers and investors, announce major business deals and showcase the latest technological advances. The 2022 event featured Airbus and Boeing, engine makers Safran and Rolls Royce, and defence companies Lockheed Martin, Rheinmetall and BAE Systems — among others.

While much can be learned by reading industry research, constructing models and learning about addressable markets, it is hard to fully understand whether a plane or helicopter lives up to the hype by watching a video on YouTube.

“There really is no substitute for being there,” says Pellini. “I may already have a point of view but traveling with our investment analysts to see the companies we might invest in, visiting their operations and interacting with management helps crystalize my thinking and provides a better frame of reference going forward.”

During the show, the portfolio managers and analysts boarded several aircraft, including an Airbus A400M military transport plane. They sat in the cockpit and toured the crew’s sleeping quarters in an A350-900 wide-body jet and had every feature of a H145 helicopter explained in detail.

Day three featured the F-35 demonstration. “When the jet took off, it blasted noise limits,” says Smith. “Before we departed, we also observed the amazing maneuverability of Boeing’s double rotor Chinook helicopter, which performed a series of twists, turns and steep climbs.”

Hands-on experiences can help investors get a better grasp of concepts like fuel efficiency, for example, and track the impact of innovation and disruption over time.

“Simply boarding the plane and witnessing how the cabin is optimized to keep it compact can give you a sense of how fuel efficient a plane might be,” Pellini says. “I also was struck by how much these companies have picked up from the gaming industry. In some new simulation machines, the pilot wears a helmet with a headset and sees only what is in the helmet, much like a virtual reality gaming system.”

2. Air travel is taking off again

In the case of this trip, the simple act of getting there offered anecdotal evidence about the health of global travel. Smith, who is based in New York, said his flight to London was full, the airport was packed and security delays were long. “Anyone who has been in a plane the last few months — and recent data suggests many have been — can appreciate that airfares have probably never been higher.”

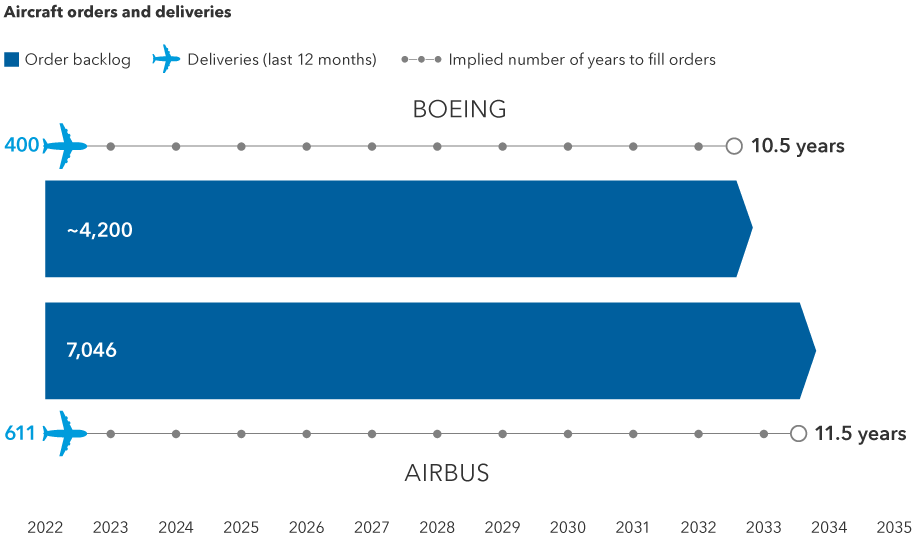

This bodes well for the aerospace industry as well as the airlines. After two years of mostly empty skies and a COVID-related freeze on plane orders, the airlines are now scrambling to get planes delivered and replace others with newer, more fuel-efficient models. In fact, the world’s two major aircraft makers, Airbus and Boeing, have order backlogs totaling more than 10.5 years of production.

A long runway for commercial aircraft production

Sources: Capital Group, company reports. Boeing's last reported order backlog is over 4,200, while Airbus has an order backlog of 7,046 planes. As of June 30, 2022.

These numbers were supported by conversations and announcements at the air show. To be sure, the overall tone was somewhat subdued compared to pre-pandemic shows, says Pellini. At times temperatures reached 120 degrees Fahrenheit on the tarmac. Attendance was down and companies hosted fewer meetings. And while the announced orders were lighter than pre-COVID events, a few were significant.

Another key takeaway: “Many people told us they were surprised at how quickly corporate travel has rebounded,” says Smith. “With working from home more accepted or simply necessary, there were fears that we'd be down 20% or 30%. In some markets it’s returned to 2019 levels and in others it’s down only 10% to 15%. That suggests that Zoom fatigue has set in. People want to get out and travel.”

3. Certain companies may benefit from a defence “super-cycle”

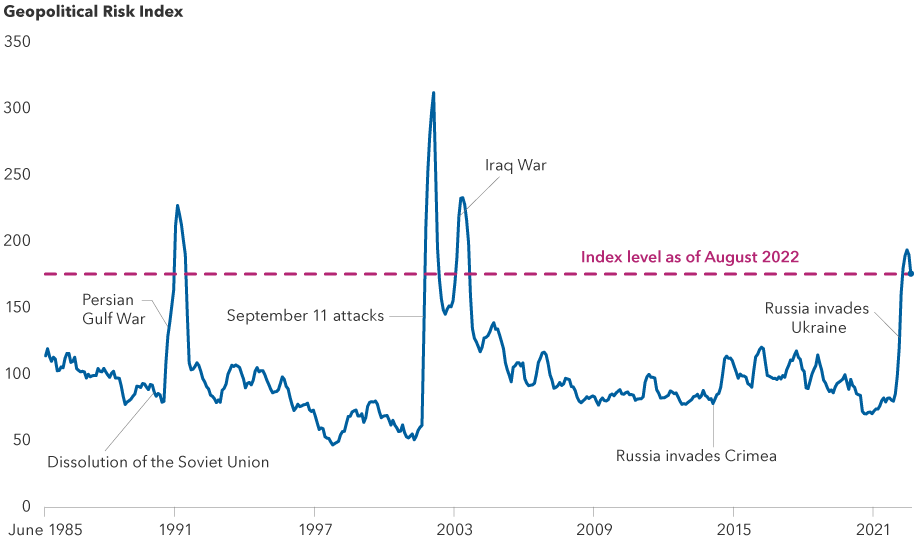

One consistent insight that came out of nearly every conversation is that geopolitical tensions are growing, not just in Europe but across the globe. This, of course, has been in news headlines for some time. Indeed, Germany recently disclosed plans to spend 100 billion euros in the next four years on defence, its biggest shift in foreign policy since World War II. Japan indicated it would double its budget.

“Whether in the Pacific, or Eastern Europe, a common theme is that the divide between the East and the West has resurfaced and is widening,” Pellini says. “The world is less safe. This is unfortunate, but it does present opportunity for defence contractors. With security now top of mind for politicians, voters and even some investors, I believe we may be at the start of a super cycle for defence.”

But not all defence companies will benefit, says Pellini. The key is to understand which specific companies have the most useful innovations, are well-positioned to execute on their business plan and can overcome challenges like supply chain disruptions.

The world is becoming more dangerous

Sources: Capital Group; Caldara, Dario and Matteo Iacoviello (2022), “Measuring Geopolitical Risk,” American Economic Review, April, 112(4), pp.1194-1225. The Geopolitical Risk Index is a measure of adverse geopolitical events and associated risks based upon the tally of newspaper articles covering geopolitical tensions, using a sample of 10 newspapers going back to 1985. Index level values reflect a six-month smoothed average of monthly data. As of August 2022.

4. Face-to-face meetings sharpen the picture

Rising demand for air travel and higher defence spending are well known. What’s not as clear, though, are which companies are best positioned to take advantage of these secular trends. That’s why research trips like this one to Farnborough are so important to build a better understanding of business models, assess company operations and products, and determine whether a management team can execute.

According to Pellini CEOs and CFOs are more willing to share information, and offer opinions about competitors when they are speaking directly with you. “It’s easier to ask tough questions and pick up nuances in their tone of voice, as well as non-verbal cues.”

“Once a manager is more relaxed, they often become more engaged and willing to be open about what keeps them up at night or what they’re excited about,” Smith adds.

“There were a number of candid conversations that we came away from with more certainty about the sincerity of a manager’s upbeat forecast or their reports about strengthening demand. This is something you can’t get from a Zoom encounter, and these conversations were very useful in confirming our investment theses.”

While meetings with CEOs and CFOs are important, sometimes the most compelling or useful insights can be gleaned in conversations with line managers and other executives. For example, during a Farnborough meeting, the executive vice president of an engine maker explained how key industry participants are aligning to achieve carbon neutrality by 2050.

“He really knew his stuff and presented it so well,” said Smith. The executive, whose background is in space and hydrogen, identified three levers his company can use to achieve new emissions standards: burn less fuel, burn better fuel and make everything lighter.

“We spent a lot of time talking about the innovation timelines required to make their target,” adds Smith. “The most fascinating part of the conversation was how this executive was able to explain the complexities of developing hydrogen into a safe, reliable and green fuel source to a layman like me.”

5. The lightbulbs shine in the meeting after the meeting

The bus ride to and from Farnborough and the hotel in London took as much as 90 minutes to two hours depending on traffic. That often was when the light bulbs shined the brightest.

When nine people share a confined space for that much time, they can strategize for upcoming meetings. They might decide what key information they want to get from a particular meeting, key questions to be asked and who should do the asking.

“We used the bus ride back to the hotel as a debriefing period, where we discussed what we liked and didn't like,” says Smith. “The group shared differing perspectives on what they thought were the crucial takeaways. And between the nine of us, we came away with a broad spectrum of answers, views and concerns. So it really is a useful process — and one we've used for years.”

6. Research trips can lead to better investment decisions

Overall, the group came away from Farnborough feeling constructive about several companies in the aerospace and defence industry, even if major economies were to slip into recession in the coming year.

“The pandemic prompted the worst recession in the history of the commercial aircraft industry,” Pellini says. “Today the industry is recovering — and a number of tailwinds are supporting the recovery.”

Before COVID, passenger growth had been resilient to external shocks. In fact, over the last 50 years, the industry has been growing at a compounded annual growth rate of 5%. Airbus, for example, has at least 17 years of consistent aircraft deliveries. After delaying plane deliveries for two years, many airlines today are ordering planes five years out.

“I would argue that the pent-up demand for planes has never been stronger,” Pellini adds.

To be fair, consistent deliveries in past downturns did not prevent share prices from meaningfully falling. The industry faces other challenges, including supply chain constraints and a U.S. labour shortage that's hurting engine manufacturers, which in turn is impacting both Airbus and Boeing.

“Nevertheless, despite the muted tone at the air show, there was also a generally relaxed feeling,” Smith concludes. “Passengers are flying again, airlines are placing orders, and as long as supply chains can improve and companies can continue to meet demand, the outlook for the next three to five years appears positive.”

Our latest insights

-

-

Currencies

-

Market Volatility

-

Market Volatility

-

Markets & Economy

RELATED INSIGHTS

-

Global Equities

-

Market Volatility

-

Market Volatility

Commissions, trailing commissions, management fees and expenses all may be associated with investments in investment funds. Please read the prospectus before investing. Investment funds are not guaranteed or covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer. For investment funds other than money market funds, their values change frequently. For money market funds, there can be no assurances that the fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in the fund will be returned to you. Past performance may not be repeated.

Unless otherwise indicated, the investment professionals featured do not manage Capital Group‘s Canadian investment funds.

References to particular companies or securities, if any, are included for informational or illustrative purposes only and should not be considered as an endorsement by Capital Group. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds or current holdings of any investment funds. These views should not be considered as investment advice nor should they be considered a recommendation to buy or sell.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and not be comprehensive or to provide advice. For informational purposes only; not intended to provide tax, legal or financial advice. Capital Group funds are available in Canada through registered dealers. For more information, please consult your financial and tax advisors for your individual situation.

Forward-looking statements are not guarantees of future performance, and actual events and results could differ materially from those expressed or implied in any forward-looking statements made herein. We encourage you to consider these and other factors carefully before making any investment decisions and we urge you to avoid placing undue reliance on forward-looking statements.

The S&P 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2025 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

FTSE source: London Stock Exchange Group plc and its group undertakings (collectively, the "LSE Group"). © LSE Group 2025. FTSE Russell is a trading name of certain of the LSE Group companies. "FTSE®" is a trade mark of the relevant LSE Group companies and is used by any other LSE Group company under licence. All rights in the FTSE Russell indices or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indices or data and no party may rely on any indices or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company's express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. The index is unmanaged and cannot be invested in directly.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.msci.com)

Capital believes the software and information from FactSet to be reliable. However, Capital cannot be responsible for inaccuracies, incomplete information or updating of the information furnished by FactSet. The information provided in this report is meant to give you an approximate account of the fund/manager's characteristics for the specified date. This information is not indicative of future Capital investment decisions and is not used as part of our investment decision-making process.

Indices are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

All Capital Group trademarks are owned by The Capital Group Companies, Inc. or an affiliated company in Canada, the U.S. and other countries. All other company names mentioned are the property of their respective companies.

Capital Group funds are offered in Canada by Capital International Asset Management (Canada), Inc., part of Capital Group, a global investment management firm originating in Los Angeles, California in 1931. Capital Group manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

The Capital Group funds offered on this website are available only to Canadian residents.

Lara Pellini

Lara Pellini

Jason Smith

Jason Smith