Fixed Income

Global Equities

- Financial exchanges have been all-weather stocks with countercyclical qualities.

- These businesses have been profitable and have generated strong cash flows.

- Competitive moats have widened, driven by industry consolidation.

Financial sector headlines are often dominated by banks and insurers. But there is one area that has emerged as a steady grower and dividend payer: financial exchanges. And it’s not just a U.S. phenomenon. In fact, some financial exchanges outside the U.S. are experiencing more rapid and sustained growth.

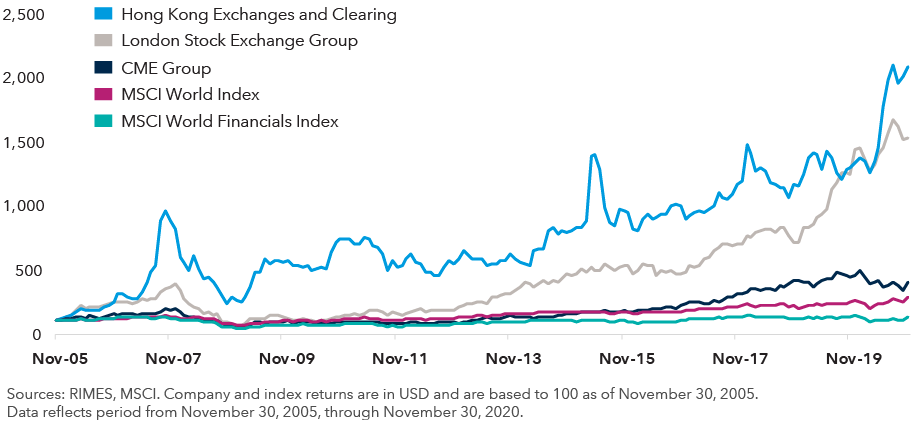

Exchanges’ gains contrast against steep declines in the broader financials sector, where traditional banks in particular have grappled with ultra-low rates and a slowing global economy. Over the past several years, both U.S.- and non-U.S.-listed exchange operators have seen strong share price rises, including Nasdaq, the London Stock Exchange Group and Hong Kong Exchanges and Clearing.

Exchanges offer a number of attractive characteristics for both growth- and income-oriented portfolios. These businesses typically have high barriers to entry, high margins, low capital spending needs and strong free cash flows. They have returned plenty of capital to shareholders, and shares of most companies provide some yield. And compared to banks, exchanges have required less operating capital and have provided greater returns on invested capital.

Financial exchanges have outpaced the broader market

Three growth pillars

The global exchange industry has undergone a major transformation over the past 20 years.

Some exchanges went from being public utilities to publicly traded commercial enterprises. Trading shifted from crowded pits on exchange floors to high-speed online networks. Several rounds of consolidation swept the industry. There’s also been a data boom from algorithmic and quant trading. At the same time, the investing class has grown around the world, and exchanges have seen rising trading volume from both retail and institutional investors.

Going forward, we believe three industry growth pillars are:

1. Trading

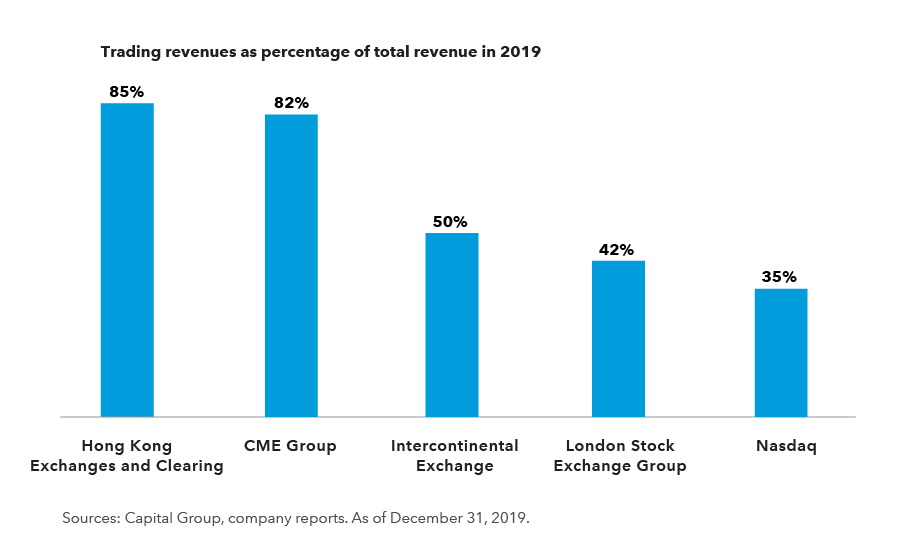

Trading is a high-margin business, with EBIT (earnings before interest and taxes) margins averaging 60% for the industry. Futures are the largest and most attractive asset class, while cash equities are mature with stable pricing. These high margins require low levels of capital and yield healthy amounts of free cash flow.

In terms of trading, CME Group, parent of Chicago Mercantile Exchange, dominates futures trading for example and its shares have offered an attractive yield.

The operator of the Hong Kong Stock Exchange, Hong Kong Exchanges and Clearing, is another example of a company that relies heavily on trading for its overall revenue. The exchange has played an important role in facilitating Chinese corporate access to foreign capital, and it’s not easy to replace it with the Shanghai or Shenzhen exchanges, making it unique among global exchanges and giving it a monopoly-like stature. Trading volumes are likely to increase through the addition of more Chinese technology companies such as recently listed Alibaba and Meituan Dianping, as well as a trading link that connects the Hong Kong Stock Exchange with institutional investors in mainland China.

2. Services

Exchanges are not just trading venues ― they are Market Infrastructure Providers (MIP) that provide mission-critical services across the trading life cycle to buy-side and sell-side firms.

The MIP industry, which includes data vendors, custodians, infrastructure and financial technology providers, has a revenue pool six to seven times larger than trading. There’s been strong organic growth fueled by demand for data, automation and outsourcing. And exchanges have been leveraging their dominant position in trading to expand to adjacent MIP industries.

3. Mergers and acquisitions

Exchanges are well-positioned to do M&A given their strong balance sheets, high free cash flow conversion rate and a monopoly position in their trading businesses.

Mergers have transformed the global exchange space. All of the major exchange companies are the result of multiple mergers. Overall, the economic rationale for M&A is significant: an exchange can largely retain revenues and cut a third of the costs of the acquired business.

There is a long runway for consolidation in the large and fragmented MIP industry, where companies provide an array of products and services including trading, clearing, custodian, indexing and data. Recent examples include the London Stock Exchange Group buying out data powerhouse Refinitiv; Deutsche Bourse buying Axioma, a deal creating a leading index business; and Nasdaq acquiring Verafin, a cloud-based platform to help detect and report money laundering and financial fraud.

Fixed income is another area to watch. Electronic fixed income trading has lagged equity markets because of liquidity and structural differences, but electronification is inevitable due to clear cost efficiency and more transparency around pricing and liquidity. U.S.-based MarketAxess may find opportunities to build on its leadership position in this space.

Industry revenue has been diversifying and less dependent on trading

Valuations: Placing a premium on pivots and M&A

All exchanges are conglomerates with assets in trading, data and technology. We’ve found in our research that the business mix is a key determinant of valuation. In particular, exchanges that are well-positioned to pivot and have demonstrated a strong M&A track record deserve to trade at a premium valuation.

Pivot premium

In the exchange business, successful business transformations are more common than other sectors for two reasons: exchanges have strong cash flows to do strategic pivot acquisitions, and they are well-placed to leverage their dominant positions in capital markets to expand into adjacent industries such as data and software.

London Stock Exchange Group (LSEG) is an example of a company that has significantly re-rated, recently trading at around 30 times forward earnings versus 10 times in 2008. Through a series of acquisitions over the past decade, LSEG has transformed from being a regional equities exchange to a global financial data provider with products that rival Bloomberg. Along those lines, data analytics is now LSEG’s primary revenue driver, with trading revenue accounting for approximately 42% of the company’s total revenue, down from 80% in 2008.

M&A premium

M&A has been — and is expected to continue to be — a major driver of growth. The scalability of exchange business models encourages M&A, and deals in the sector have created a lot of value for shareholders. In our view, exchange groups with strong M&A track records deserve to trade at a premium. Nasdaq, Intercontinental Exchange (which bought the New York Stock Exchange) and London Stock Exchange Group have been those leading the consolidation charge.

Financial exchanges: invest for yield or for growth?

Traditionally, the large money centre banks were viewed as steady sources of dividend income. That changed with the financial crisis of 2008, and banks have never quite regained their status as steady yield providers. The ultra-low interest rate environment makes it even more challenging for banks to pay out dividends. Their dividends have even come under regulatory pressure. For instance, European governments that had backstopped bank balance sheets with large aid packages in 2020 had stipulated that dividends be halted; that restriction was recently lifted.

The financial exchanges provide contrast to this. Trading volumes can spike in periods of rising markets and falling markets. Meanwhile, recurring revenues from ancillary services provide a cushion that can enable the exchanges to maintain or grow dividends.

Organic growth rates for the industry could slow as the shift to electronic trading has largely been completed. That said, earnings quality is likely to improve as a result of more diversified revenue sources and reduced competition from further consolidation. Diversification and consistent free cash flow growth could provide a greater valuation premium. In Asia, exchanges are at the centre of public financial markets that are expanding, providing a tailwind of secular growth. As such, financial exchanges have found a place in both growth portfolios and income-oriented equity portfolios at Capital Group.

Our latest insights

RELATED INSIGHTS

Commissions, trailing commissions, management fees and expenses all may be associated with investments in investment funds. Please read the prospectus before investing. Investment funds are not guaranteed or covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer. For investment funds other than money market funds, their values change frequently. For money market funds, there can be no assurances that the fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in the fund will be returned to you. Past performance may not be repeated.

Unless otherwise indicated, the investment professionals featured do not manage Capital Group‘s Canadian investment funds.

References to particular companies or securities, if any, are included for informational or illustrative purposes only and should not be considered as an endorsement by Capital Group. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds or current holdings of any investment funds. These views should not be considered as investment advice nor should they be considered a recommendation to buy or sell.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and not be comprehensive or to provide advice. For informational purposes only; not intended to provide tax, legal or financial advice. We assume no liability for any inaccurate, delayed or incomplete information, nor for any actions taken in reliance thereon. The information contained herein has been supplied without verification by us and may be subject to change. Capital Group funds are available in Canada through registered dealers. For more information, please consult your financial and tax advisors for your individual situation.

Forward-looking statements are not guarantees of future performance, and actual events and results could differ materially from those expressed or implied in any forward-looking statements made herein. We encourage you to consider these and other factors carefully before making any investment decisions and we urge you to avoid placing undue reliance on forward-looking statements.

The S&P 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2024 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

FTSE source: London Stock Exchange Group plc and its group undertakings (collectively, the "LSE Group"). © LSE Group 2024. FTSE Russell is a trading name of certain of the LSE Group companies. "FTSE®" is a trade mark of the relevant LSE Group companies and is used by any other LSE Group company under licence. All rights in the FTSE Russell indices or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indices or data and no party may rely on any indices or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company's express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. The index is unmanaged and cannot be invested in directly.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

MSCI does not approve, review or produce reports published on this site, makes no express or implied warranties or representations and is not liable whatsoever for any data represented. You may not redistribute MSCI data or use it as a basis for other indices or investment products.

Capital believes the software and information from FactSet to be reliable. However, Capital cannot be responsible for inaccuracies, incomplete information or updating of the information furnished by FactSet. The information provided in this report is meant to give you an approximate account of the fund/manager's characteristics for the specified date. This information is not indicative of future Capital investment decisions and is not used as part of our investment decision-making process.

Indices are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

All Capital Group trademarks are owned by The Capital Group Companies, Inc. or an affiliated company in Canada, the U.S. and other countries. All other company names mentioned are the property of their respective companies.

Capital Group funds are offered in Canada by Capital International Asset Management (Canada), Inc., part of Capital Group, a global investment management firm originating in Los Angeles, California in 1931. Capital Group manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

The Capital Group funds offered on this website are available only to Canadian residents.

Marc Nabi

Marc Nabi

William Pang

William Pang