Fixed Income

Monetary Policy

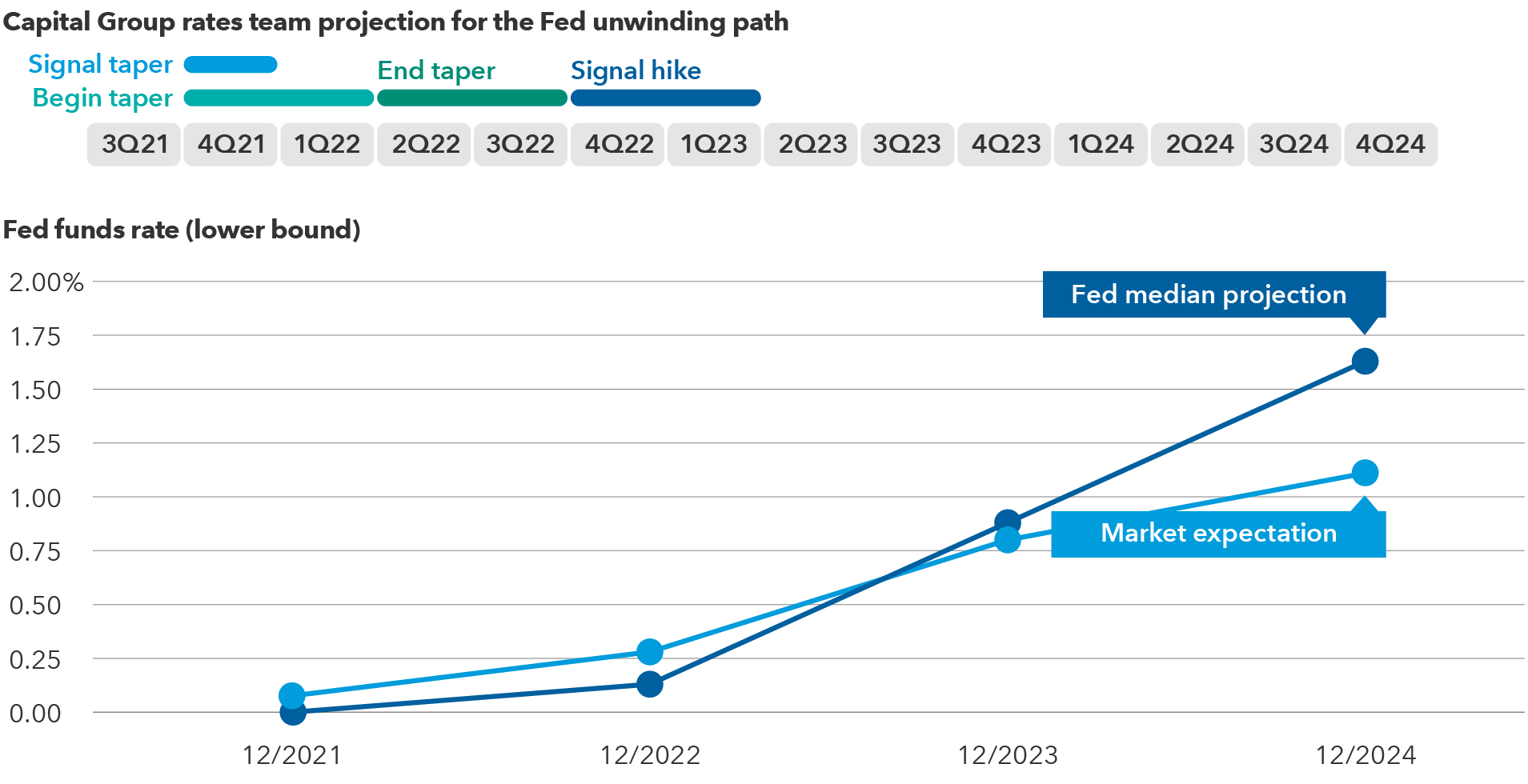

In the final months of this year, we expect the U.S. Federal Reserve to begin scaling back some of the extraordinary stimulus measures launched last year in the early stages of the pandemic. Although the Fed chose not to break any news about its first move at the September 2021 meeting, we already know the initial step. The central bank will begin by reducing, or tapering, the pace of its bond buying.

The last time the Fed tapered, it prompted the infamous Taper Tantrum of 2013. Markets were caught off guard and bond yields soared. With investors better prepared for tightening this time around, we don’t expect another tantrum. The Fed’s unwind has been well telegraphed with only the precise timing unknown. Let’s unpack that path and consider how it might affect fixed income markets.

Fed tapering soon but no hikes likely before late 2022

As recently as August 2021, some investors believed that the Fed could announce the start of its taper program at its September meeting. The relatively weak jobs report paired with a softer inflation rate reading in August closed the door on that possibility, however. We now believe the Fed will announce its intention to taper as soon as its November meeting, unless economic conditions deteriorate significantly before then.

The U.S. central bank will probably begin tapering assets in the weeks following that announcement. Once that begins, based on the Fed’s previous statements and its prior tapering program, we expect it to last roughly six to nine months, most likely ending sometime around the middle of 2022. Currently the Fed is buying US$120 billion of U.S. Treasuries and mortgage bonds each month. That amount will decrease gradually until the Fed is no longer adding any securities to increase the size of its balance sheet.

Once the taper has ended, the Fed will only buy assets sufficient to maintain the size of its balance sheet, replacing old securities that mature. At that time, the central bank will consider a three-part test prior to raising interest rates:

- Has the economy achieved maximum employment?

- Has core inflation — the rate that excludes food and energy prices — reached its 2% target?

- Is core inflation on track to exceed its 2% target?

We’ll dig into these conditions next. We believe the Fed isn’t likely to begin considering hiking rates until late 2022 at the earliest. Once it does allow short-term interest rates to drift higher, we expect it to do so in a very gradual manner, as it did from 2015 through 2018.

Sources: Capital Group, Bloomberg, Federal Reserve. As of 9/22/2021.

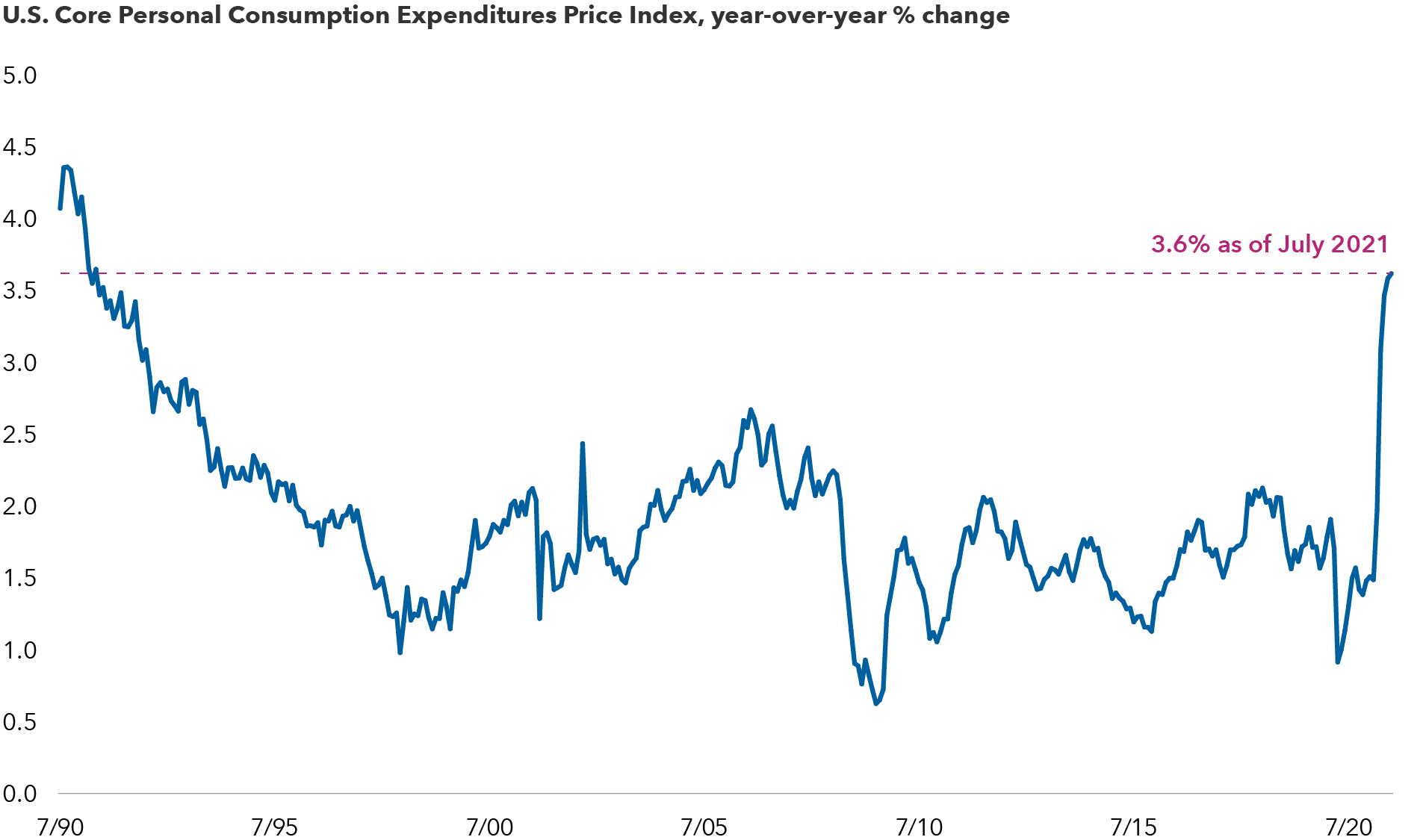

Why the Fed hasn’t hit the brakes, despite rising inflation rate

As most investors are aware, the inflation rate is not holding the Fed back. This year it has risen above the Fed’s 2% target. Consider the Fed’s favoured measure, the U.S. Core Personal Consumer Expenditures Price Index. Its July reading was 3.6%. That puts it well above target — at a level not seen since the early 1990s.

U.S. core inflation is the highest in three decades

Source: Bloomberg. As of 7/31/2021. Core inflation excludes food and energy prices.

But today’s inflation rate is not necessarily what matters when it comes to interest rate hikes. The Fed probably won’t begin considering that move until late next year. We’ll have to wait to see if the current high inflation rate is durable enough to last until then. If price growth recedes below its target, the Fed may have to wait longer.

On the other hand, inflation pressures could begin to look more severe. For example, we could see higher prices begin to bubble in areas like rent, housing and services. If the Fed begins to worry more about inflation running too hot, it may feel compelled to respond sooner.

The Fed is unlikely to signal interest rate hikes until there is a clearer employment outlook in the U.S.

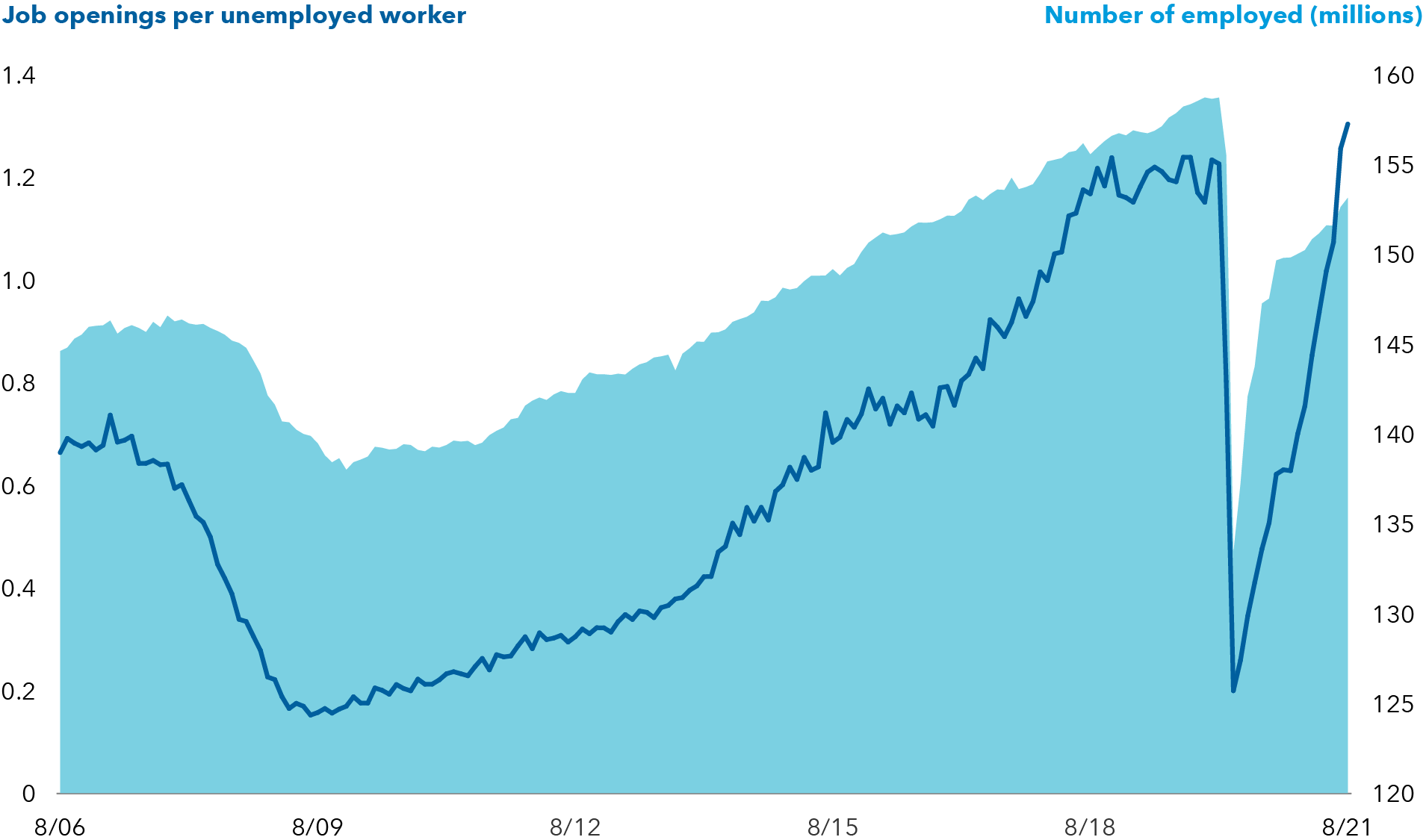

Full employment is tougher to measure. Right now, we’re seeing some real dislocations in the labour market. Payroll surveys show the U.S. had 5 million fewer people working this summer than it did in early 2020. And that doesn’t even account for the expected natural growth of 200,000 new workers each month. That widens the gap to at least 8 million fewer workers than full employment would imply.

But looking at wages and job openings complicates this picture. Lower wage workers have seen income gains exceeding 3% this year — well above average. We are also seeing 1.3 job openings for each unemployed worker. These factors would normally indicate a very strong labour market. Current trends paint a murky picture, however. For example, the labour market could look less healthy next year than those job openings and wage increases indicate, delaying the Fed’s first interest rate hike if the unemployment rate needs more time to heal.

Mixed signals: High job openings, low employment

Source: Bloomberg. As of 8/31/2021.

Why we don’t expect Taper Tantrum 2.0

Fixed income investors panicked when the Fed announced its last taper. We don’t expect that this time. First, investors have seen the Fed take such action before. They saw its impact and that broader normalization was far from catastrophic. Back in 2013, investors feared the Fed would eventually increase the federal funds rate from zero to a range of 4% to 5% over time. That didn’t happen. This time they’re not expecting the Fed to hike interest rates much above 2%.

Second, the market should not be caught by surprise once the process begins. The Fed has been very transparent with its plans. In numerous speeches and other communication, Federal Reserve Chair Jerome Powell and other governors have explained what to expect. As a result, the market isn’t likely to react as dramatically. Of course tighter financial conditions — through reduced liquidity and higher borrowing costs — will still have some negative impact on investors’ appetite for risk.

The Fed’s clarity has led current bond yields to already reflect the assumption of a taper announcement before the end of the year. After that happens, investors’ concerns will likely shift to how quickly the Fed reduces its asset purchases and when it will start hiking interest rates. If inflationary pressures persist and the labour market trends in the positive direction, we could begin to see Treasury yields rise across the maturity spectrum.

When the Fed begins raising short-term interest rates, shorter term yields may feel a more direct impact, prompting the yield curve to flatten. Historically, this is how we have seen it play out.

While yields throughout the market should rise over time as the Fed normalizes, the past 12 months have shown just how stubborn low yields can be. Concern about the longevity of robust economic growth has been one factor. Investors began to understand the persistence of COVID-19 when Delta and other strains caused new infection surges. The Chinese economy, a source of global economic strength over the past decade, has also been slowing. Lastly, investors believe the Fed’s inflation narrative — that the high rate we’re seeing is just transitory.

Some investors may fret or become nervous about the Fed pulling back. Yet, policymakers will only do so when they’re confident the economy can sustain it. Ultimately, normalization should help ease the concerns about inflation that have cast a long shadow over markets this year. Importantly, once the Fed has trimmed its balance sheet and, eventually, raised interest rates, it will be in a much stronger position to act when the next major economic challenge begins. Looking at the taper through the lens of a Fed that wants to maintain price stability should reassure investors: Core fixed income funds should continue to provide ballast in diversified portfolios.

Our latest insights

RELATED INSIGHTS

-

Fixed Income

-

Economic Indicators

-

The U.S. Core Personal Consumption Expenditures Price Index provides a measure of the prices paid by people for domestic purchases of goods and services, excluding the prices of food and energy. The core PCE is the Fed's preferred inflation measure.

Commissions, trailing commissions, management fees and expenses all may be associated with investments in investment funds. Please read the prospectus before investing. Investment funds are not guaranteed or covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer. For investment funds other than money market funds, their values change frequently. For money market funds, there can be no assurances that the fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in the fund will be returned to you. Past performance may not be repeated.

Unless otherwise indicated, the investment professionals featured do not manage Capital Group‘s Canadian investment funds.

References to particular companies or securities, if any, are included for informational or illustrative purposes only and should not be considered as an endorsement by Capital Group. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds or current holdings of any investment funds. These views should not be considered as investment advice nor should they be considered a recommendation to buy or sell.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and not be comprehensive or to provide advice. For informational purposes only; not intended to provide tax, legal or financial advice. We assume no liability for any inaccurate, delayed or incomplete information, nor for any actions taken in reliance thereon. The information contained herein has been supplied without verification by us and may be subject to change. Capital Group funds are available in Canada through registered dealers. For more information, please consult your financial and tax advisors for your individual situation.

Forward-looking statements are not guarantees of future performance, and actual events and results could differ materially from those expressed or implied in any forward-looking statements made herein. We encourage you to consider these and other factors carefully before making any investment decisions and we urge you to avoid placing undue reliance on forward-looking statements.

The S&P 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2024 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

FTSE source: London Stock Exchange Group plc and its group undertakings (collectively, the "LSE Group"). © LSE Group 2024. FTSE Russell is a trading name of certain of the LSE Group companies. "FTSE®" is a trade mark of the relevant LSE Group companies and is used by any other LSE Group company under licence. All rights in the FTSE Russell indices or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indices or data and no party may rely on any indices or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company's express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. The index is unmanaged and cannot be invested in directly.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

MSCI does not approve, review or produce reports published on this site, makes no express or implied warranties or representations and is not liable whatsoever for any data represented. You may not redistribute MSCI data or use it as a basis for other indices or investment products.

Capital believes the software and information from FactSet to be reliable. However, Capital cannot be responsible for inaccuracies, incomplete information or updating of the information furnished by FactSet. The information provided in this report is meant to give you an approximate account of the fund/manager's characteristics for the specified date. This information is not indicative of future Capital investment decisions and is not used as part of our investment decision-making process.

Indices are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

All Capital Group trademarks are owned by The Capital Group Companies, Inc. or an affiliated company in Canada, the U.S. and other countries. All other company names mentioned are the property of their respective companies.

Capital Group funds are offered in Canada by Capital International Asset Management (Canada), Inc., part of Capital Group, a global investment management firm originating in Los Angeles, California in 1931. Capital Group manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

The Capital Group funds offered on this website are available only to Canadian residents.

Timothy Ng

Timothy Ng

Tom Hollenberg

Tom Hollenberg