Politics

Stop us if you’ve heard this one before: U.S. lawmakers are clashing over a legislative action to raise the federal debt ceiling. The issue has been percolating for months but could come to a head this summer as the U.S. Treasury starts running out of money to pay its bills.

The decision to increase the nation’s debt limit is often a routine one — except in years when Congress is divided, like it is now. With Republicans controlling the House of Representatives and Democrats in command of the Senate, the scene is set for what could be one of the most contentious debt ceiling showdowns in recent history.

So far, Democrats have said they won’t negotiate on the issue, while many Republicans have said they won’t vote to lift the debt limit without some additional agreements to curb federal spending.

“This could be the worst standoff we’ve ever witnessed,” says Capital Group political economist Matt Miller. “It certainly has the potential to be at least as bad as 2011.”

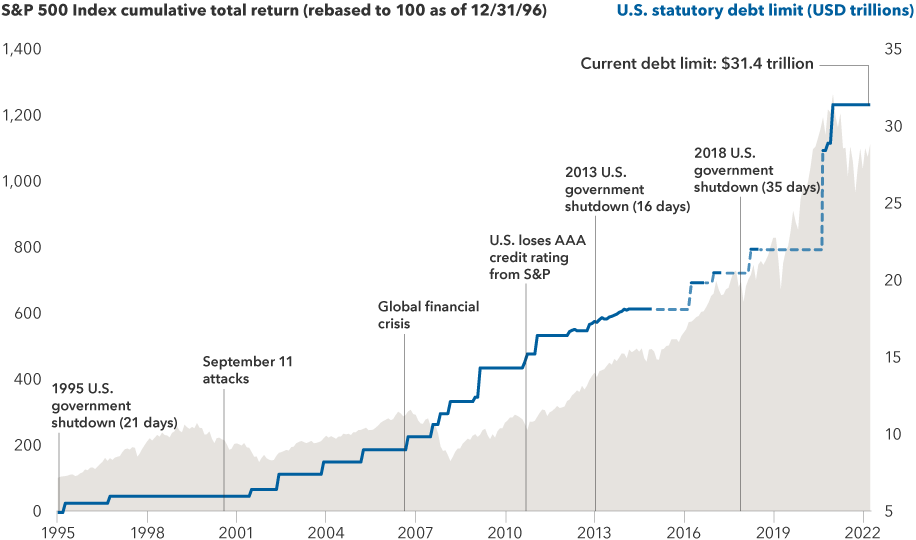

That’s the year Standard & Poor’s cut the United States’ prized AAA credit rating to AA-plus (where it remains) amid concerns about the government’s budget deficit, a growing long-term debt burden and political conflicts over raising the debt limit. The move unnerved U.S. financial markets for a time, but they quickly recovered.

A U.S. debt ceiling standoff could get ugly, but markets have historically powered through

Sources: Capital Group, Refinitiv Datastream, Standard & Poor's, U.S. Department of the Treasury, U.S. Office of Management and Budget. Periods in which the statutory limit has been suspended are reflected by the dotted lines. These periods include February 4, 2013, through May 18, 2013; October 17, 2014, through March 31, 2017; September 30, 2017, through March 1, 2019; and August 2, 2019, through July 31, 2021. Data as of March 31, 2023. Past results are not predictive of results in future periods. Based in USD.

In fact, not long after the 2011 credit rating action, U.S. stocks embarked on one of the longest bull markets in history — a virtually uninterrupted run from 2011 until the start of the COVID-19 pandemic.

“I think the lesson from 2011, and a subsequent debt ceiling impasse in 2013, is that these events can disrupt markets for a while — sometimes even weeks or months — but if we look at history, they don’t tend to have a lasting impact on investors,” Miller says. “That’s assuming we get a reasonable resolution.”

In mid-April House Speaker Kevin McCarthy unveiled legislation that would raise the debt limit by US$1.5 trillion. The bill also includes several other provisions to curtail federal spending. It remained unclear whether there were enough votes to pass the bill in its current form.

What happens if the U.S. defaults on its debt?

Of course, the worry is that the U.S. could — in the middle of a particularly nasty debt ceiling impasse — wind up in technical default on its many debt obligations, including payments to bond holders. It’s hard to predict what might happen next, but there are many who say it would roil the financial markets and jeopardize the U.S. dollar’s status as the world’s reserve currency.

The chances of a technical default — which would occur should a bond payment be missed or even delayed — are very low but not zero, according to Tom Hollenberg, a Capital Group fixed income portfolio manager.

“It's important to make a distinction between the situation we are facing in the U.S. and something much worse, like an Argentina-style default, where investors lose their savings. Nobody seriously believes that will happen here,” Hollenberg says. “In the U.S., the probability of even a technical default, or a delayed payment, is between 5% and 10%, in my view. It’s certainly not my base case, but it’s something I can’t ignore either.”

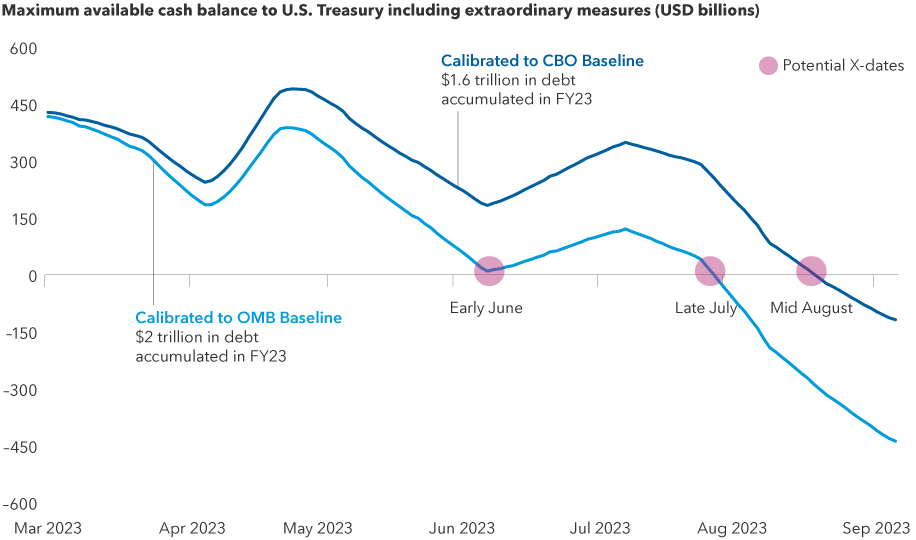

When will the U.S. Treasury run out of money?

Sources: Capital Group, Congressional Budget Office (CBO), Office of Management and Budget (OMB), Piper Sandler. Cash balance figures reflect estimates from Piper Sandler based on debt forecasts from the CBO and OMB, respectively. Estimates assume extraordinary measures are fully deployed and that the Treasury will not allow cash balances below US$25 billion. "X-dates" refer to the date on which the U.S. government will be unable to pay all its obligations. Cash balance path is smoothed. As of April 12, 2023.

If the U.S. missed a payment on a short-term note due in June, for example, it would spark an outcry in the markets, accompanied by extreme volatility for a day or two, Hollenberg explains, and then the debt ceiling impasse would likely come to an end.

“When you reach a crisis, that tends to put the political gears in motion,” he adds. “If that happened, I think Congress would very quickly come together and raise the debt limit, and investors would be made whole.”

The law of unintended consequences

That doesn’t mean there would be no consequences for a technical default. The rating agencies could slash the U.S. credit rating again. Investors could drive up the cost of future U.S. debt issuances. And, perhaps worst of all, some investors may no longer regard U.S. Treasuries as the safest investment in the world.

“We don’t really know what the downstream implications would be,” Hollenberg says. “For example, there are banks whose ratings are somewhat linked to U.S. sovereign ratings. There are insurance companies in the same situation, as well as agencies like Fannie and Freddie. It’s difficult to know what would happen to them if one or more of the rating agencies were to downgrade the U.S. again.

“We could wind up with cascading downgrades, and that would be a real problem for some financial institutions,” he warns. “It’s not something we can just gloss over, and it’s why we need a timely resolution. I do think we will get one, I just hope it comes before we encounter any unintended consequences.”

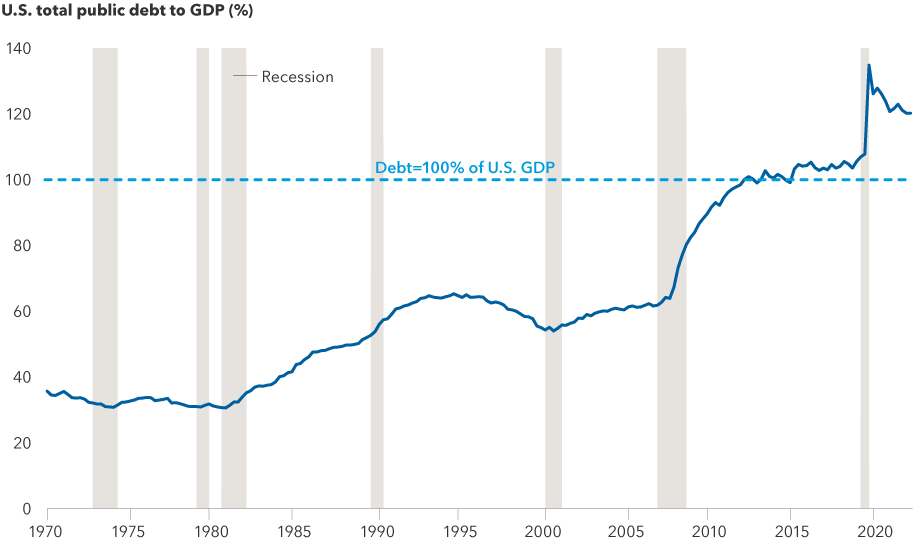

U.S. long-term debt has risen steadily over the past half century

Sources: Capital Group, National Bureau of Economic Research, U.S. Treasury Department. As of December 31, 2022.

How much debt is too much?

From the point of view of an equity investor, the U.S. debt ceiling debate makes for interesting political theater, but it’s not something that weighs too heavily on investment decisions, says Steve Watson, portfolio manager for Capital Group Capital Income BuilderTM (Canada) and Capital Group Monthly Income PortfolioTM (Canada).

“At the same time, I don’t think it’s necessarily a bad idea to have an occasional reminder that the United States is more than US$30 trillion in debt,” Watson notes. “Maybe it’s time to engage in a serious discussion about long-term fiscal responsibility.”

The S&P 500 Index is a market capitalization-weighted index based on the results of approximately 500 widely held common stocks. The index is unmanaged and, therefore, has not expenses. Investors cannot invest directly in an index.

Our latest insights

-

-

Currencies

-

Market Volatility

-

Market Volatility

-

Markets & Economy

RELATED INSIGHTS

-

-

Global Equities

-

Economic Indicators

Commissions, trailing commissions, management fees and expenses all may be associated with investments in investment funds. Please read the prospectus before investing. Investment funds are not guaranteed or covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer. For investment funds other than money market funds, their values change frequently. For money market funds, there can be no assurances that the fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in the fund will be returned to you. Past performance may not be repeated.

Unless otherwise indicated, the investment professionals featured do not manage Capital Group‘s Canadian investment funds.

References to particular companies or securities, if any, are included for informational or illustrative purposes only and should not be considered as an endorsement by Capital Group. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds or current holdings of any investment funds. These views should not be considered as investment advice nor should they be considered a recommendation to buy or sell.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and not be comprehensive or to provide advice. For informational purposes only; not intended to provide tax, legal or financial advice. Capital Group funds are available in Canada through registered dealers. For more information, please consult your financial and tax advisors for your individual situation.

Forward-looking statements are not guarantees of future performance, and actual events and results could differ materially from those expressed or implied in any forward-looking statements made herein. We encourage you to consider these and other factors carefully before making any investment decisions and we urge you to avoid placing undue reliance on forward-looking statements.

The S&P 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2025 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

FTSE source: London Stock Exchange Group plc and its group undertakings (collectively, the "LSE Group"). © LSE Group 2025. FTSE Russell is a trading name of certain of the LSE Group companies. "FTSE®" is a trade mark of the relevant LSE Group companies and is used by any other LSE Group company under licence. All rights in the FTSE Russell indices or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indices or data and no party may rely on any indices or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company's express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. The index is unmanaged and cannot be invested in directly.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.msci.com)

Capital believes the software and information from FactSet to be reliable. However, Capital cannot be responsible for inaccuracies, incomplete information or updating of the information furnished by FactSet. The information provided in this report is meant to give you an approximate account of the fund/manager's characteristics for the specified date. This information is not indicative of future Capital investment decisions and is not used as part of our investment decision-making process.

Indices are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

All Capital Group trademarks are owned by The Capital Group Companies, Inc. or an affiliated company in Canada, the U.S. and other countries. All other company names mentioned are the property of their respective companies.

Capital Group funds are offered in Canada by Capital International Asset Management (Canada), Inc., part of Capital Group, a global investment management firm originating in Los Angeles, California in 1931. Capital Group manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

The Capital Group funds offered on this website are available only to Canadian residents.

The Capital Group funds offered on this website are available only to Canadian residents.

Matt Miller

Matt Miller

Tom Hollenberg

Tom Hollenberg

Steve Watson

Steve Watson