Demographics & Culture

Market Volatility

Stock markets around the world have continued to sell-off amid concerns that emergency measures by central banks and fiscal stimulus from governments will fail to ward off a global recession caused by the coronavirus outbreak.

The lack of liquidity in areas of bond markets and pricing discrepancies in pockets of the exchange-traded funds (ETF) markets led the U.S. Federal Reserve to act over the weekend with extraordinary measures to stabilize the economy. It delivered a package that is larger in aggregate than any single move in the past. The stimulus measures included a cut in the benchmark interest rate to near zero — the second emergency rate cut this month. In addition, the Fed announced a US$700 billion program to purchase U.S. Treasuries and mortgage-backed securities. It also cut the rate charged to banks in the U.S. for short-term emergency loans from its discount window and said it would activate swap lines with five other central banks.

On Tuesday March 17, the Fed announced a further measure to help companies with short-term funding to purchase commercial paper through a special credit facility. Fiscal stimulus may be on the way to help calm markets as well, with news reports suggesting that the Trump administration is pursuing a massive US$850 billion stimulus package.

The bond market is in uncharted territory. The 30-year U.S. Treasury yields recently touched yields below 1%, and the 10-year dipped below 0.5% for the first time. Against this backdrop, Mike Gitlin, head of fixed income, and portfolio manager Pramod Atluri discuss fixed income markets and the outlook for interest rates.

1. What is your outlook for U.S. interest rates, and what are your expectations from the Federal Reserve?

We believe the Fed will continue to act to support financial markets and the real economy in the coming weeks and months. As 2020 began, the market expected a pretty uneventful year from the Fed. Economic growth looked to be improving as U.S./China trade tensions eased and employment growth remained healthy.

Then the outbreak of COVID-19 and the extraordinary efforts to contain it changed everything. As the virus spread and its deadly nature became more evident, this initial supply disruption morphed into a massive demand disruption as businesses and consumers began to self-quarantine leading to reduced travel and consumption. This was then compounded by an oil price war between Saudi Arabia and Russia that led oil prices to fall more than 25% in a day, causing yet another disruption to financial markets.

Interest rates have fallen and credit spreads have widened, leading to a tightening of financial conditions. If left unchecked, this would hurt both businesses and consumers, and ultimately worsen the economic outlook.

In response, the Fed has conducted two emergency rate cuts totaling 150 basis points on March 3 and 15. This brought the monetary policy rate down to its zero bound, 0%–0.25%. Despite the cuts, financial conditions remain challenged as equity prices and credit spreads have continued to weaken. We believe the Fed will continue to act to support the economy using a variety of tools at their disposal, including a commitment to keeping rates low for the foreseeable future and potentially more large-scale asset purchases known as quantitative easing.

2. With rates in the U.S. already near zero, what other tools could the Fed employ?

Given the rapidly worsening economic outlook, the Fed was forced to act both quickly and forcefully as the sudden stop in economic activity by consumers and businesses roiled financial markets. But with the Fed funds rate now at 0% to 0.25%, we believe that reducing short-term interest rates will no longer be the primary tool of the Fed.

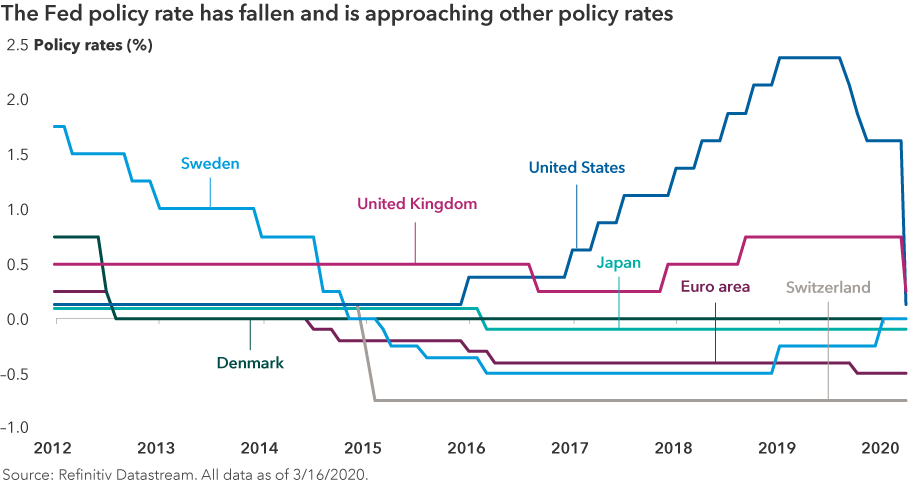

Many global central banks have pushed interest rates into negative territory. However, the Fed is reluctant to follow suit given differences in the structure of U.S. money markets as well as concerns over how negative interest rates would affect financial conditions in the banking system. Instead, it is more likely to lean more heavily on other tools.

Those include:

- Forward guidance: Telling the market to expect more stimulus in the future

- More quantitative easing: Expanding its balance sheet to buy assets

- Additional liquidity facilities: They may introduce additional such measures, perhaps targeting specific sectors that are facing the greatest stress

- Encouraging banks to lend: They may use their authority to encourage otherwise reluctant banks to extend credit

- Average inflation targeting: An explicit willingness to let inflation rise above its 2% target for a period of time, since it may be below target during another period

3. What is your outlook for credit? How do you distinguish between investment grade and high yield?

In times of enhanced uncertainty and volatility, the flight to quality is high as investors seek safety in U.S. Treasuries. If you look at credit markets, both high-yield and investment-grade bonds, the risk premium investors demand over U.S. Treasury yields can rise significantly. Corporate bonds tend to have a greater correlation to equities, so when equities decline in value, these bonds historically also decline, and high-yield bonds fall (credit spreads widen) typically much more than investment grade.

Given significant market volatility and the rapidly declining economic outlook, we are very cautious on the outlook for credit. We believe there are many scenarios where credit may continue to weaken before markets stabilize and prices improve. Over the past decade, corporations have tapped into the low interest rate environment and taken on a large amount of debt. Many companies are highly leveraged and will be vulnerable if credit spreads continue to widen. It is important to be very discriminating in the credit space, considering the increasing leverage we have seen over the past few years.

Overall, in our broad fixed income portfolios, we have generally had a long duration exposure, which translates into an exposure to interest rates, and a less-than-benchmark exposure to credit and mortgage-backed bonds. However, valuations are changing rapidly, and we are also likely to see a significant series of steps to help support markets and the economy from both central banks and fiscal authorities. Therefore, our analysts and portfolio managers look to take advantage of volatile markets to find investments in credits they like at more attractive valuations.

4. Given that we are in an environment facing constraints on both the supply side and the demand side of the economy, should investors brace for a recession in the U.S.?

Our economists believe that the U.S. has been in the late part of its economic cycle for some time. Before COVID-19 hit, investors anticipated modest growth might persist over the medium term. But the outbreak of COVID-19 and the Saudi/Russia oil shock have rapidly changed the economic outlook.

Suddenly, investors are faced with a grave new uncertainty that has caused significant disruptions. On the supply side, factories are experiencing stoppages, and both supply chains and global trade have been disrupted. On the demand side, nervous consumers and businesses may not spend as much as they would in normal times. And given the oil price collapse, the market is bracing for another wave of defaults from related sectors. This could particularly affect energy sector issuers in the high-yield market, as many of those issuers are already starting with more stretched balance sheets.

Additionally, liquidity is very challenged in the commercial paper market. If such pressures persist, they could force creditworthy businesses to issue shorter maturity commercial paper over a one- to seven-day horizon versus the usual one month. This could potentially constrain cash flows for companies even further as they would need to roll over their issuance of short-term debt more frequently. In response, the Fed has announced it will open a commercial paper lending facility for the banks.

The probability of a recession has increased dramatically from where it was just a few weeks ago. Investors should expect a period of heightened volatility. Knowing how much risk they are taking in their overall portfolio is essential, and they should consider upgrading their bond portfolios to hedge against the volatility of their equity portfolio.

5. How should investors position bond portfolios?

The recent drop in equities and rise in price of 10-year U.S. Treasuries is a timely reminder that high-quality bonds can help to stabilize investor portfolios against losses during volatile periods. In times of great uncertainty, investors should look to bond funds first and foremost as a way to diversify their portfolio and preserve capital. But not all bonds or bond funds are created equal. There are many broad bond funds which own significant amounts of lower quality bonds that may not provide the protection and stability investors need when risk assets decline.

We would encourage investors to do a health check and ensure the bonds in their core portfolios are high quality, like U.S. government bonds, AAA-rated mortgage bonds and investment-grade corporate credit. These bonds have historically been more resilient when shocks occur, helping to preserve investors’ capital while also providing some income.

While it can be tempting to increase holdings of riskier bonds like high-yield corporate debt in a reach for yield as interest rates fall, it is important that investors know that high-yield bonds can be highly correlated to equities. When equity prices fall, so do many high-yield bonds, which means investors have not really reduced risk in their overall portfolio.

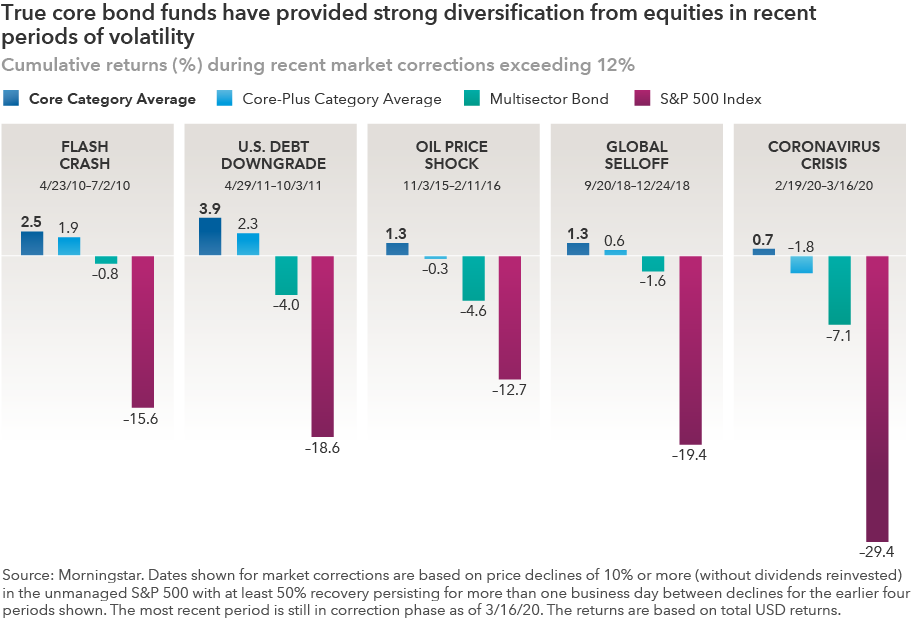

Consider the five deepest equity market corrections — those where the S&P 500 Index lost at least 12% — since the financial crisis ended. In each one, higher quality bond funds experienced solid absolute returns, on average. Importantly, during these stressed equity periods, higher quality funds as represented in the U.S. by Morningstar’s Intermediate Core category experienced stronger returns than the Intermediate Core-Plus and Multisector Bond categories that tend to be much more exposed to the higher risk end of high-yield bonds.

This demonstrates how a strong core bond allocation can act as a ballast in an investor’s overall portfolio. A fixed income allocation should zig when stocks zag to provide some shock absorption.

We would urge investors to focus on the important role of bonds in an overall portfolio. When the economic outlook becomes more uncertain, we believe investors should prioritize capital preservation and diversification from equities over adding a few more basis points of yield.

Since investors never know when volatility will hit or how bad it will get, and depending on their financial circumstances, maintaining an investment grade allocation may be their best defense against the unknown. This present episode of market volatility is not unique. Long-term investors know that bouts of volatility are a constant in the market. Even if the current scare fades, another will eventually take its place — and a recession at some point is inevitable. For this reason, we encourage investors to take a long-term view when making investment decisions and to consider whether their fixed income funds are positioned to serve their important role in maintaining a well-balanced portfolio.

Our latest insights

-

-

U.S. Equities

-

Fixed Income

-

-

Economic Indicators

Commissions, trailing commissions, management fees and expenses all may be associated with investments in investment funds. Please read the prospectus before investing. Investment funds are not guaranteed or covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer. For investment funds other than money market funds, their values change frequently. For money market funds, there can be no assurances that the fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in the fund will be returned to you. Past performance may not be repeated.

Unless otherwise indicated, the investment professionals featured do not manage Capital Group‘s Canadian investment funds.

References to particular companies or securities, if any, are included for informational or illustrative purposes only and should not be considered as an endorsement by Capital Group. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds or current holdings of any investment funds. These views should not be considered as investment advice nor should they be considered a recommendation to buy or sell.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and not be comprehensive or to provide advice. For informational purposes only; not intended to provide tax, legal or financial advice. We assume no liability for any inaccurate, delayed or incomplete information, nor for any actions taken in reliance thereon. The information contained herein has been supplied without verification by us and may be subject to change. Capital Group funds are available in Canada through registered dealers. For more information, please consult your financial and tax advisors for your individual situation.

Forward-looking statements are not guarantees of future performance, and actual events and results could differ materially from those expressed or implied in any forward-looking statements made herein. We encourage you to consider these and other factors carefully before making any investment decisions and we urge you to avoid placing undue reliance on forward-looking statements.

The S&P 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2025 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

FTSE source: London Stock Exchange Group plc and its group undertakings (collectively, the "LSE Group"). © LSE Group 2025. FTSE Russell is a trading name of certain of the LSE Group companies. "FTSE®" is a trade mark of the relevant LSE Group companies and is used by any other LSE Group company under licence. All rights in the FTSE Russell indices or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indices or data and no party may rely on any indices or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company's express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. The index is unmanaged and cannot be invested in directly.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

MSCI does not approve, review or produce reports published on this site, makes no express or implied warranties or representations and is not liable whatsoever for any data represented. You may not redistribute MSCI data or use it as a basis for other indices or investment products.

Capital believes the software and information from FactSet to be reliable. However, Capital cannot be responsible for inaccuracies, incomplete information or updating of the information furnished by FactSet. The information provided in this report is meant to give you an approximate account of the fund/manager's characteristics for the specified date. This information is not indicative of future Capital investment decisions and is not used as part of our investment decision-making process.

Indices are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

All Capital Group trademarks are owned by The Capital Group Companies, Inc. or an affiliated company in Canada, the U.S. and other countries. All other company names mentioned are the property of their respective companies.

Capital Group funds are offered in Canada by Capital International Asset Management (Canada), Inc., part of Capital Group, a global investment management firm originating in Los Angeles, California in 1931. Capital Group manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

The Capital Group funds offered on this website are available only to Canadian residents.

Pramod Atluri

Pramod Atluri