Fixed Income

Technology & Innovation

High tech, high reward?

It was anything but in 2022, no question about that. The crucial question for technology investors today is: Where do we go from here?

“Last year investors recognized that historically low interest rates produced many excesses, including high-flying stocks without the earnings to support them,” says Carl Kawaja, portfolio manager for Capital Group Global Equity Fund™ (Canada).

“That said, the fundamental tenet of buying companies whose return is going to come from generating superior growth over time still makes sense for long-term investors. You just need to be more selective today.”

Indeed, many well-known technology companies have been repriced to account for a more expensive cost of capital. Going forward, proven earnings growth will likely be a bigger driver of returns, Kawaja says. The good news is that technology companies with growth potential will probably come from a broader range of industries and regions — not just the U.S.

Markets are moving from narrow to broader leadership

Sources: Capital Group, Refinitiv Datastream, Standard & Poor’s. As of 12/31/22. Indexed to 100 as of 1/1/05.

“We're moving from what had been a very binary world — you invested in one sector and avoided others, you invested in the U.S. and avoided non-U.S. — to a more balanced environment with a broader sense of opportunity,” explains Martin Romo, portfolio manager for Capital Group U.S. Equity Fund™ (Canada).

Here — Romo, Kawaja and Cheryl Frank — share their views on how technology investing is evolving, where they are looking for opportunity and how they are preparing for the next bull market.

1. The AI inflection point is here

Martin Romo, portfolio manager, Capital Group U.S. Equity Fund (Canada), 31 years of investment experience

Tech stocks have been punished, and in many cases that was warranted. But in some cases, I think the market is throwing out the baby with the bathwater. When nearly everyone says that the world has changed and what was true over the last 10 years can’t be true going forward — I think that is a mistake. The market may be overlooking continued strength in some well-positioned companies.

What’s more, the pace of innovation around the world is picking up. Several colleagues and I recently spent a few weeks in Silicon Valley meeting with public companies and venture capital firms, and I came away believing we are at an inflection point with artificial intelligence (AI). Innovative uses of AI are happening all around.

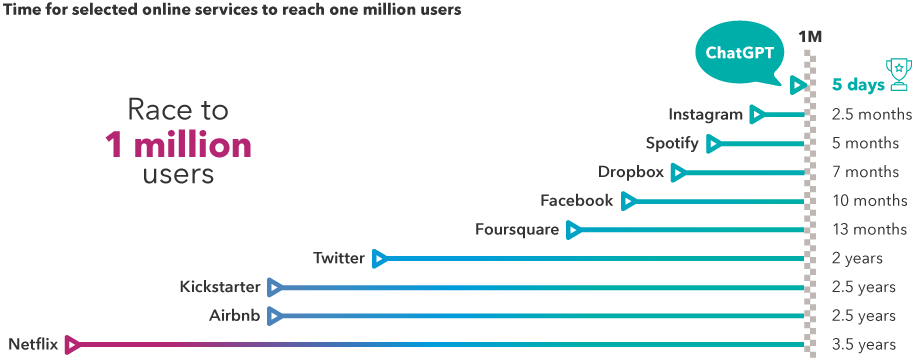

The speed of adoption for new technologies is picking up

Source: Statista. As of 12/31/22. Kickstarter refers to number of backers. Airbnb refers to number of nights booked. Foursquare and Instagram refer to number of downloads.

Companies like Microsoft are using AI technology to help differentiate their offerings and deliver enhanced productivity to customers. Microsoft has already issued a limited test release of its Bing search engine that harnesses ChatGPT, a chatbot developed in partnership with OpenAI. Microsoft has also disclosed plans to include the technology in its widely used Office software suite, its Teams platform and its GitHub code-development service.

Wider adoption of AI technology will require massive computing power, providing tailwinds for cloud services and the semiconductor industry. Nvidia, which develops semiconductors and computing hardware, already uses AI to improve the speed of its own product development and recently disclosed an AI distribution partnership with Microsoft. Semiconductor maker Broadcom, which helped develop AI chips for Google in 2016, has since introduced more advanced AI chips.

The key takeaway for me is that we are very early in the development of this technology. It feels like the early days of mobile and cloud as they entered an era of hyper-charged growth. Right now, there’s a lot of hype surrounding AI and questions about the accuracy of chatbots. Despite a challenging environment, I remain very excited about the long-term investment opportunities on the horizon.

2. ‘Picks and shovels’ across industries

Cheryl Frank, portfolio manager, 24 years of investment experience

One lesson I’ve learned in my career is to closely track capital floods and droughts. When capital floods into a sector, it usually drives increased investment that can lead to opportunities for suppliers in that industry. These are what I call pick-and-shovel companies. Investors sometimes overlook these businesses, but they often have more stable cash flows and lower risk profiles compared to the companies they service.

Consider how much money has flowed into health care research and development (R&D). This has been going on for a few years, but it was turbocharged during the pandemic. Pharmaceutical companies that successfully developed COVID vaccines and anti-viral treatments, such as Pfizer and Moderna, piled up cash. Much of this capital will be funneled into more R&D.

Pick-and-shovel companies like Danaher and Thermo Fisher Scientific, which provide drugmakers with testing equipment, reagents and diagnostics, could see demand for their services rise as R&D investment grows.

By contrast, in the energy sector we saw a years-long capital drought as energy prices touched levels near zero. Then, as soon as supplies got tight and prices rose, capital flooded back in. Record-breaking cash flow over the last 12 months has left oil producers with some of the strongest balance sheets in history.

Even though energy does not belong in the technology sector, I believe there are opportunities in it. When energy companies profit, they typically expand exploration and production, which requires more machinery and services. This could be a source of growth for companies that provide technology, products and services to the industry.

3. Global champions get stronger as the dollar weakens

Carl Kawaja, portfolio manager, Capital Group Global Equity Fund (Canada), 36 years of investment experience

Last year, for the first time in almost a decade, U.S. stocks trailed markets in other major regions of the world. The odds that this trend can continue are reasonably good, in my view, simply because we've been in a long upcycle for U.S. stocks and the U.S. dollar.

For companies outside the U.S., dollar strength tends to be a headwind. At some point, I believe the U.S. Federal Reserve will have to cut rates. And when that happens, I think we may see further dollar weakness. So I’m optimistic about the prospects for international investing.

Regardless of whether economies in Europe or Asia do well, there will be great companies in those regions with solid business prospects. I often use a basketball analogy to help describe this dynamic. I’m struck by how international the National Basketball Association (NBA) has become. In a sport that was first championed in the U.S. and Canada, the NBA now features something like 120 international players from 40 countries, including some of the biggest superstars in the game.

Today I think there are select companies outside the U.S. that have been waking up to their opportunity globally. They are refocusing on generating value for shareholders during a time that is much more beneficial for their currency. In other words, like basketball, the world catches up, and some of the superstar companies are based in other countries.

Consider ASML, the world’s leading provider of manufacturing equipment for the most advanced semiconductors. It just happens to be based in the Netherlands. ASML has developed unique technology for making advanced chips. As its market share grew, it aggressively invested in developing its technological advantage. Right now, many chip stocks are down and the industry is struggling with oversupply. But taking a multi-year view, I think the industry is well-positioned for a strong cyclical recovery.

Another example is in drug discovery. We are in the middle of a golden age of health care innovation. Many of the recent advances in treatments for cancer and pathogens like the COVID virus have been developed by U.S. companies. But there is also a Danish pharmaceutical company, Novo Nordisk, that has developed therapies to treat diabetes and obesity. Again, interest in this company has less to do with whether European markets can outpace U.S. markets and more to do with a worldwide increase in diabetes and obesity and the potential to improve patients’ lives.

Why experience matters during volatile markets

All three of these seasoned investors believe the keys to navigating volatile markets are patience, experience and a long-term perspective. “There are lots of questions today about inflation, the Fed and recession,” Romo says, “But if we look over the horizon and focus on durable investment themes over the next few years, then I see lots of opportunity ahead.

Seeking to invest in companies with superior long-term prospects is as relevant today as ever.

Equally or perhaps more relevant, is choosing a style-agnostic investment vehicle that has the scope of mandate and flexibility to capture tomorrow’s potential technology winners around the world.

It’s also worth noting that sector-specific funds such as those that invest in technology and/or health care may — whether passive or active funds — may disappoint due to their single focus if U.S. interest rates continue to climb or, in the case of energy pick-and-shovel companies, miss opportunities altogether. Further, due to the fast-moving nature of technology itself it may prove beneficial to choose active mandates with advanced investment research capabilities as portfolio managers can increase and/or decrease exposures to certain technology industries and companies based on current and future market outlooks.

MSCI All Country World Index (ACWI) is a free float-adjusted market capitalization-weighted index designed to measure equity market results in the global developed and emerging markets, consisting of more than 40 developed and emerging market country indexes. The index is unmanaged and, therefore, has no expenses.

MSCI has not approved, reviewed or produced this report, makes no express or implied warranties or representations and is not liable whatsoever for any data in the report. You may not redistribute the MSCI data or use it as a basis for other indices or investment products.

The S&P 500 Index is a market capitalization-weighted index based on the results of approximately 500 widely held common stocks.

The S&P 500 Equal Weight Index is the equal-weight version of the widely used S&P 500 Index. The S&P 500 Equal Weight Index includes the same constituents as the capitalization weighted S&P 500 Index, but each company in the S&P 500 Equal Weight Index is allocated a fixed weight, or 0.2% of the index total at each quarterly rebalance.

Our latest insights

RELATED INSIGHTS

-

Global Equities

-

-

Long-Term Investing

Commissions, trailing commissions, management fees and expenses all may be associated with investments in investment funds. Please read the prospectus before investing. Investment funds are not guaranteed or covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer. For investment funds other than money market funds, their values change frequently. For money market funds, there can be no assurances that the fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in the fund will be returned to you. Past performance may not be repeated.

Unless otherwise indicated, the investment professionals featured do not manage Capital Group‘s Canadian investment funds.

References to particular companies or securities, if any, are included for informational or illustrative purposes only and should not be considered as an endorsement by Capital Group. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds or current holdings of any investment funds. These views should not be considered as investment advice nor should they be considered a recommendation to buy or sell.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and not be comprehensive or to provide advice. For informational purposes only; not intended to provide tax, legal or financial advice. We assume no liability for any inaccurate, delayed or incomplete information, nor for any actions taken in reliance thereon. The information contained herein has been supplied without verification by us and may be subject to change. Capital Group funds are available in Canada through registered dealers. For more information, please consult your financial and tax advisors for your individual situation.

Forward-looking statements are not guarantees of future performance, and actual events and results could differ materially from those expressed or implied in any forward-looking statements made herein. We encourage you to consider these and other factors carefully before making any investment decisions and we urge you to avoid placing undue reliance on forward-looking statements.

The S&P 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2024 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

FTSE source: London Stock Exchange Group plc and its group undertakings (collectively, the "LSE Group"). © LSE Group 2024. FTSE Russell is a trading name of certain of the LSE Group companies. "FTSE®" is a trade mark of the relevant LSE Group companies and is used by any other LSE Group company under licence. All rights in the FTSE Russell indices or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indices or data and no party may rely on any indices or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company's express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. The index is unmanaged and cannot be invested in directly.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

MSCI does not approve, review or produce reports published on this site, makes no express or implied warranties or representations and is not liable whatsoever for any data represented. You may not redistribute MSCI data or use it as a basis for other indices or investment products.

Capital believes the software and information from FactSet to be reliable. However, Capital cannot be responsible for inaccuracies, incomplete information or updating of the information furnished by FactSet. The information provided in this report is meant to give you an approximate account of the fund/manager's characteristics for the specified date. This information is not indicative of future Capital investment decisions and is not used as part of our investment decision-making process.

Indices are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

All Capital Group trademarks are owned by The Capital Group Companies, Inc. or an affiliated company in Canada, the U.S. and other countries. All other company names mentioned are the property of their respective companies.

Capital Group funds are offered in Canada by Capital International Asset Management (Canada), Inc., part of Capital Group, a global investment management firm originating in Los Angeles, California in 1931. Capital Group manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

The Capital Group funds offered on this website are available only to Canadian residents.

Cheryl Frank

Cheryl Frank

Carl Kawaja

Carl Kawaja