THE CAPITAL SYSTEM

Our system prioritizes superior and repeatable fund results.

1961: Jonathan Bell Lovelace, Capital Group’s founder, with colleagues Chuck Schimpff, Coleman Morton, Jim Fullerton and Mary Bauer.

Early in Capital Group history, our leaders realized that their funds would outlast the professionals who managed them.

They believed they had a responsibility to provide stability and management continuity to investors, so they asked a key question: If a portfolio manager left the firm, could they keep portfolios going strong?

They pioneered a plan. By dividing portfolios into sections and giving each existing manager a portion to oversee, no portfolio would be dependent on a single person.

This distinctive way of managing assets became The Capital System™. By incorporating the highest conviction investment ideas of each manager in a portfolio, we aim to both increase portfolio diversification and reduce volatility, which can give investors a smoother ride in bumpy markets.

The best of both worlds.

The Capital System offers the best of both worlds: high-conviction ideas and the power of collaboration.

While portfolio managers share insights, each has the freedom to pursue their own ideas. The resulting portfolios are a diverse collection of investments, not a product of one manager’s perspective. This approach aims to reduce volatility and avoid disruptions such as manager turnover and style drift. It also allows individual managers to focus on a small number of high-conviction ideas — ideas they’ve explored inside and out. That’s the strength of The Capital System.

For illustrative purposes only.

Analysts are investors, too.

Founder Jonathan B. Lovelace, centre, meets with Capital Group researchers in the 1950s.

At most firms, analysts only recommend investments to portfolio managers. At Capital Group they often have the opportunity to invest a portion of a portfolio in their highest conviction ideas.

Many Capital Group funds have a Research Portfolio — a sleeve of investments within a portfolio — managed by our investment analysts. They’re not just offering ideas to managers: they’re active investors in the portfolio. This helps to signal their highest convictions to portfolio managers, and it provides years of investing experience before they join portfolio management teams.

Our history of results.

Our portfolios aim to provide consistent long-term results helping you stay on the path to achieving your financial goals.

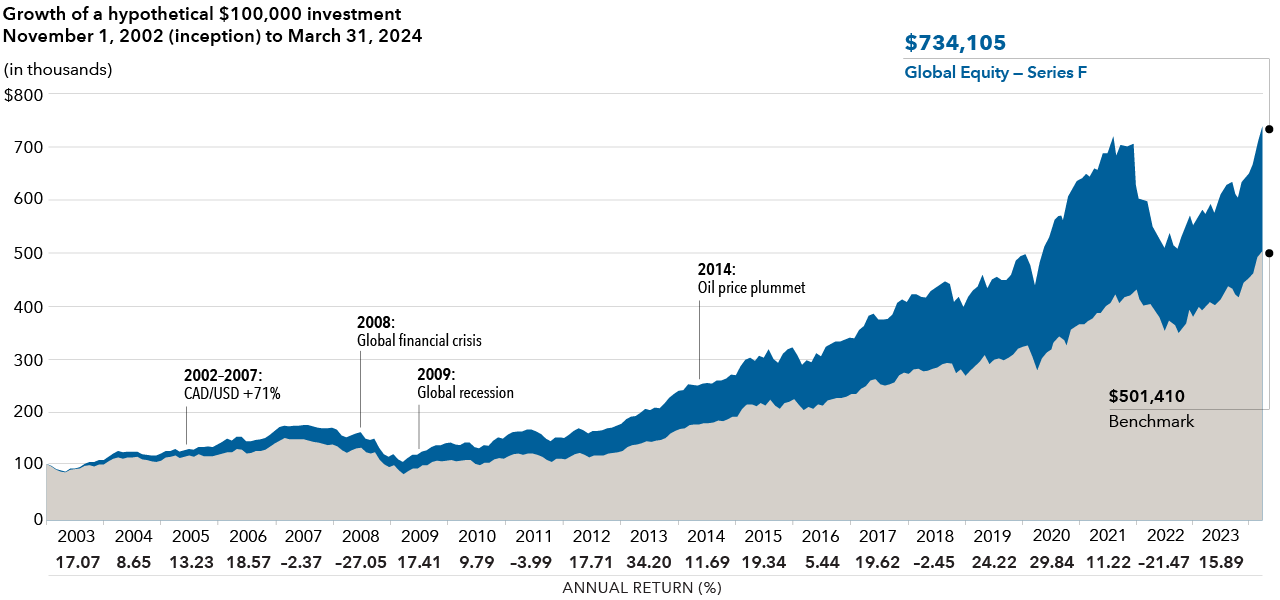

As an example, look at the results of a $100,000 hypothetical investment in our Global Equity portfolio over its lifetime, compared to a global equity index.*

Capital Group Global Equity FundTM (Canada), Series F

Hypothetical growth is calculated by accumulating an initial investment of $100,000 based on monthly returns of Capital Group Global Equity Fund (Canada) – Series F (assumes reinvestment of all distributions and no withdrawals). Benchmark index returns reflect MSCI World Index (net dividends reinvested) from fund inception to May 31, 2011, and MSCI ACWI (net dividends reinvested) thereafter.

This hypothetical illustration is for informational purposes only and is not intended to provide tax, legal or financial advice. We assume no liability for any inaccurate, delayed or incomplete information, nor for any actions taken in reliance thereon. The information contained herein has been supplied without verification and may be subject to change. Capital Group funds are available in Canada through registered dealers. For your individual situation, please consult your financial and tax advisors.

Our system was designed for consistency.

Capital Group Global Equity Fund (Canada) — Series F has outpaced its benchmark index* in 17 out of 19 year-end rolling 3-year periods and 15 out of 17 year-end rolling 5-year periods since its 2002 inception.

This includes the period of unprecedented Canadian dollar appreciation from 2003 to 2007 and the global financial crisis following 2008. This pattern of returns reveals the consistency and repeatability of Capital Group’s investment process.

Built to last.

The Capital System has stood the test of time.

An innovative idea then and now, our proprietary multiple portfolio manager system has become a defining feature of our success. Distinct in the market and diverse in its strategy, The Capital System has helped many investors meet their long-term financial goals.

See current results for all of

our portfolios and series.

What makes Capital Group different

Your goals power ours

We have four distinctive qualities central to helping you succeed.

More ways in which we are different

INDEPENDENT AND PRIVATE

GLOBAL SCALE

*Annualized compound returns as of March 31, 2024, including reinvestment of all distributions, for Capital Group Global Equity Fund (Canada) Series F vs. the benchmark index: 1 year: 24.28% vs. 23.21; 3 years: 4.32% vs. 9.62%; 5 years: 11.01% vs. 11.20%; 10 years: 11.28% vs. 10.90%; fund lifetime (since November 1, 2002): 9.76% vs. 7.82%. Benchmark index returns reflect MSCI World Index (net dividends reinvested) from fund inception to May 31, 2011, and MSCI ACWI (net dividends reinvested) thereafter. Results vary by series primarily due to differences in fees and expenses. For all series, see capitalgroup.com/ca. Indices are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment. There have been periods when the fund has lagged the index. MSCI has not approved, reviewed or produced this report, makes no express or implied warranties or representations and is not liable whatsoever for any data in the report. You may not redistribute the MSCI data or use it as a basis for other indices or investment products.

Commissions, trailing commissions, management fees and expenses all may be associated with investments in investment funds. Please read the prospectus before investing. The indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Investment funds are not guaranteed or covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer. For investment funds other than money market funds, their values change frequently. For money market funds, there can be no assurances that the fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in the fund will be returned to you. Past performance may not be repeated.

Capital Group funds are offered in Canada by Capital International Asset Management (Canada), Inc., part of Capital Group, a global investment management firm originated in Los Angeles, California in 1931. Capital Group manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

All Capital Group trademarks are owned by The Capital Group Companies, Inc. or an affiliated company in Canada, the U.S. and other countries. Capital Group funds offered on this website are available only to Canadian residents.