Fixed Income

Capital IdeasTM

Investment insights from Capital Group

Asset Allocation

To say this has been an interesting year in financial markets is an understatement. Equities have been stronger than most expected, and the 10-year US Treasury yield is up 40 basis points as of 13 September. So where are we now as we head into the homestretch of 2023? I believe we’re on the cusp of a major transition, one where long-term investors can find attractive income opportunities as central banks pivot from restrictive monetary policy to something that looks much more benign.

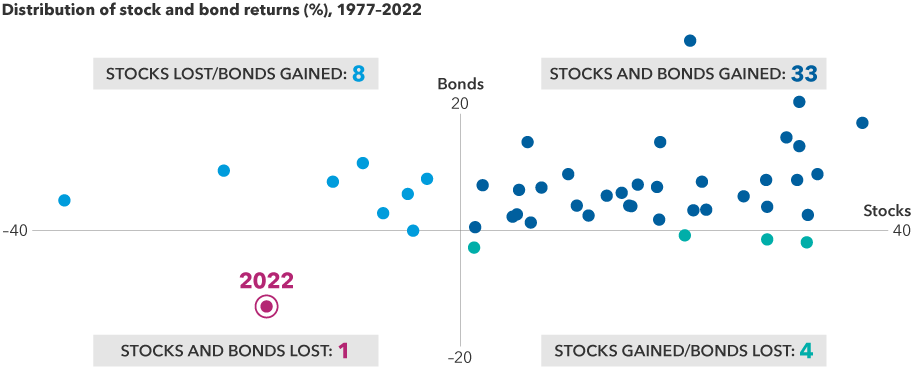

Last year was shocking to many in the investment community: It marked the first time in at least 45 years that stocks and bonds both posted negative returns in a calendar year. Battling high inflation, the US Federal Reserve (Fed) and other central banks raised interest rates aggressively. Those hikes hurt absolute results across the board. The usual role of high-quality bonds to provide diversification from stock market volatility — something investors rely on — broke down.

Most investors had never faced a year as challenging as 2022

Sources: Capital Group, Bloomberg Index Services Ltd., Standard & Poor's. Each dot represents an annual stock and bond market return from 1977 through 2022. Stock returns represented by the S&P 500 Index. Bond returns represented by the Bloomberg US Aggregate Index. Past results are not predictive of results in future periods.

Turbulent markets in 2022, plus the prospect of relatively high yields in money markets, led investors to flock to cash-like alternatives. Money market funds were at an all-time high of US $5.6 trillion as of 6 September, according to the Investment Company Institute. Cash investments still look compelling to many investors today, but the Fed appears to be nearing a turning point. History teaches us that this may be an opportune time to shift back to stocks and bonds.

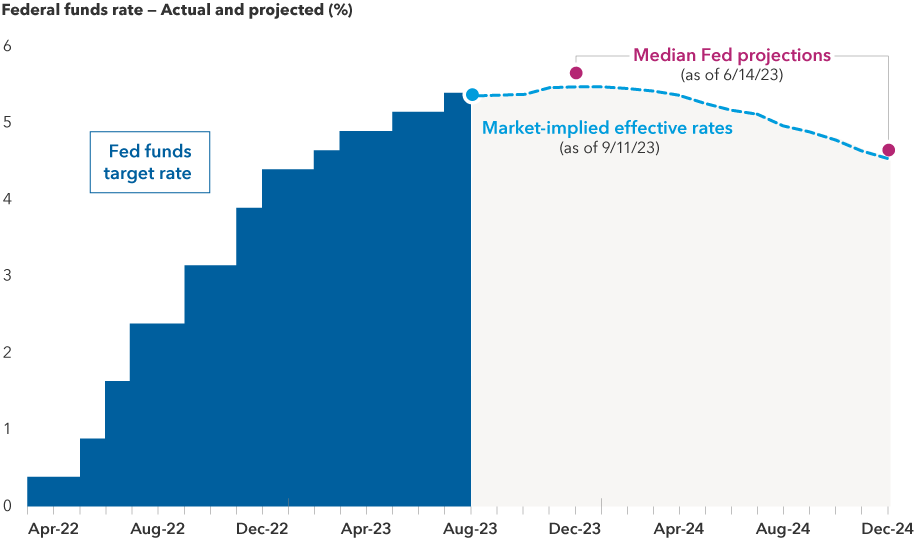

Will the Fed raise interest rates again?

Nobody knows exactly when the Fed will stop raising rates. However, both markets and the Fed itself project its key policy rate to peak near current levels and then decline around 100 basis points by the end of 2024.

Both the market and Fed project lower rates in 2024

Sources: Bloomberg, Federal Reserve. The fed fund target rate shown is the midpoint of the 50 basis-point range that the Federal Reserve aims for in setting its policy interest rate. Market-implied effective rates are a measure of what the fed funds rate could be in the future and is calculated using fed fund rate futures market data.

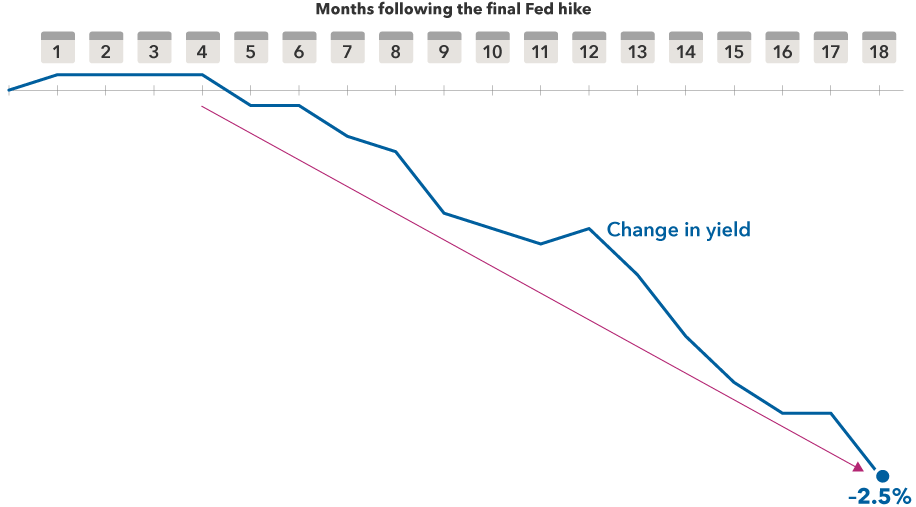

If you believe the Fed is finished or nearly there, what does history tell us? An analysis of the end of the last four Fed hiking cycles shows that yields on cash investments decayed while stocks and bonds flourished.

History shows cash yields have decayed when Fed hikes end

Sitting in money market funds today may feel comfortable with a roughly 5% yield, based on the benchmark three-month US Treasury, especially after an extended period of experimental zero interest rate policy post-global financial crisis. But the benefit of remaining in cash at current yields is eroded by today’s moderate inflation. Additionally, these cash-like holdings may see little additional upside as the Fed finishes hiking rates.

There is where the maths matters. History shows that in the 18 months after the Fed ended hikes in the last four cycles, yields on cash-like investments have traditionally decayed rapidly. The three-month US Treasury yield, a benchmark security with a yield similar to cash-like investments, fell an average of 2.5%. If history were to repeat itself, money market fund yields would decline, and investors would be better served by being actively invested in stocks and bonds.

3-month T-bill yields declined sharply following the Fed’s final hike in the last four cycles

Sources: Bloomberg, Federal Reserve. As of 30/6/23. Chart represents the average decline in 3-month Treasury bills starting in the month of the last Fed hike in the last four transition cycles from 1995 to 2018. Past results are not predictive of results in future periods.

Where to invest cash today

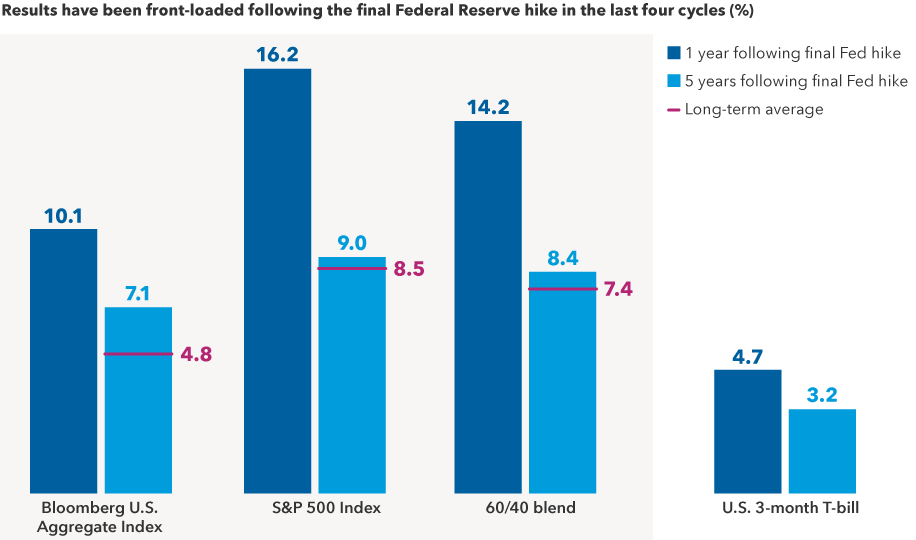

If you agree that the Fed is nearly finished hiking and that cash yields may decline over time, the question is: Where to invest today? After the Fed’s final hike in the last four cycles, equity and fixed income returns were both strong in the year that followed. Importantly, for long-term investors, these sectors maintained relative strength over a five-year period.

After Fed hikes ended, long term results outpaced cash, with the first year contributing most

Sources: Capital Group, Morningstar. Chart represents the average returns across respective sector proxies in a forward extending window starting in the month of the last Fed hike in the last four transition cycles from 1995 to 2018 with data through 30/6/23. The 60/40 blend represents 60% S&P 500 Index and 40% Bloomberg US Aggregate Index, rebalanced monthly. Long-term averages represented by the average five-year annualised rolling returns from 1995. Past results are not predictive of results in future periods.

Today, fixed income is living up to its name again by providing solid income potential to investors. The Bloomberg US Aggregate Index, which we are using as a proxy to represent high-quality global bonds, had a yield-to-worst (the lowest possible yield that can be received on a bond that fully operates within the terms of its contract without defaulting) of 5.0% at the end of August. That’s roughly double its 10-year average, as highly accommodative policy weighted on yields during the past decade. This income potential today provides a solid starting point for total return.

The same exposure to interest rates that hurt bonds in 2022 would benefit bonds if rates begin to fall. Here’s a hypothetical example of how that could work. The index’s duration, a measure of interest rate sensitivity, is 6.25 years. That means if yields decline by nearly 100 basis points in 2024, investors could see upside of 6.25% in positive price return, all else being equal. Together, those income and price return components would equate to a hypothetical one-year return that could venture into double digits, assuming credit doesn’t deteriorate meaningfully. Under that same scenario, money market fund yields would drop below 5%.

For stocks, when the Fed stops tightening policy, one risk for the financial system dissipates. And as companies and consumers see their borrowing costs stabilise and eventually begin to decline, it provides a boost to the economy and corporate profits. Historically, equity investors have seen the benefit.

At this time, a balanced strategy could also be attractive for more cautious investors. A balanced portfolio tends to hold more defensive positions in dividend-paying stocks and high-quality bonds. And if the economy slows or falls into recession, it could provide some resilience.

It takes courage to take action

Inertia can be a very powerful force, especially 5% cash yield-induced inertia. Investor emotions are real. Past losses sting for a long time, and today’s seemingly attractive rates on money markets feel good. But as investors, we know that markets don’t idle for long. Investors could become stuck in cash if they wait too long to get back into the market, as better potential opportunities emerge.

At Capital Group, we focus on helping investors achieve long-term success. I firmly believe that the best path toward that goal is through stock and bond markets. Our analysts and portfolio managers are scouring the world to find new investment ideas, regardless of market ups and downs. We’re optimistic about what the future has in store and committed to improving people’s lives through successful investing.

Our latest insights

-

-

-

Long-Term Investing

-

Fixed Income

-

Hear from our investment team.

Sign up now to get industry-leading insights and timely articles delivered to your inbox.

Past results are not predictive of results in future periods. It is not possible to invest directly in an index, which is unmanaged. The value of investments and income from them can go down as well as up and you may lose some or all of your initial investment. This information is not intended to provide investment, tax or other advice, or to be a solicitation to buy or sell any securities.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. All information is as at the date indicated unless otherwise stated. Some information may have been obtained from third parties, and as such the reliability of that information is not guaranteed.

Capital Group manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

Mike Gitlin

Mike Gitlin