Global Equities

As artificial intelligence (AI) takes the investment world by storm, a growing number of investors are wondering how to take advantage of it, beyond considering poster child Nvidia and other tech superstars in the Magnificent Seven.

“AI is creating opportunities for companies well beyond the big, early winners,” says Jeremy Burge, portfolio manager of Capital Group Global Equity FundTM (Canada).

The watershed moment for AI was the launch of Open AI’s ChatGPT. At the heart of ChatGPT is generative AI. Unlike traditional AI which is focused on solving specific tasks within well-defined boundaries, generative AI simulates human-like understanding and produces well-crafted, original text, images, computer code or other content. From its November 2022 launch, ChatGPT raced to a million users in five days — and 100 million by January 2023.

Although the overall market potential is still up for debate, it appears to be huge. Fundamentally, AI has the potential to help workers become more efficient and businesses more productive across all sectors of the market, across all industries and across all regions of the world. What's more, the implementation and economic impact of AI may occur faster than technological innovations in the past because AI is software-based and can be rolled out quickly on the internet.

“It has the potential to transform our world at great speed and scale,” says Burge.

The global AI market is projected to reach nearly US$2 trillion by 2030

.png)

Sources: Next Move Strategy Consulting, Statista. Years 2023 through 2030 are estimated. Lighter blue boxes represent estimates. Data as of January 2023. CAGR = compound annualized growth rate. Dollar values in USD.

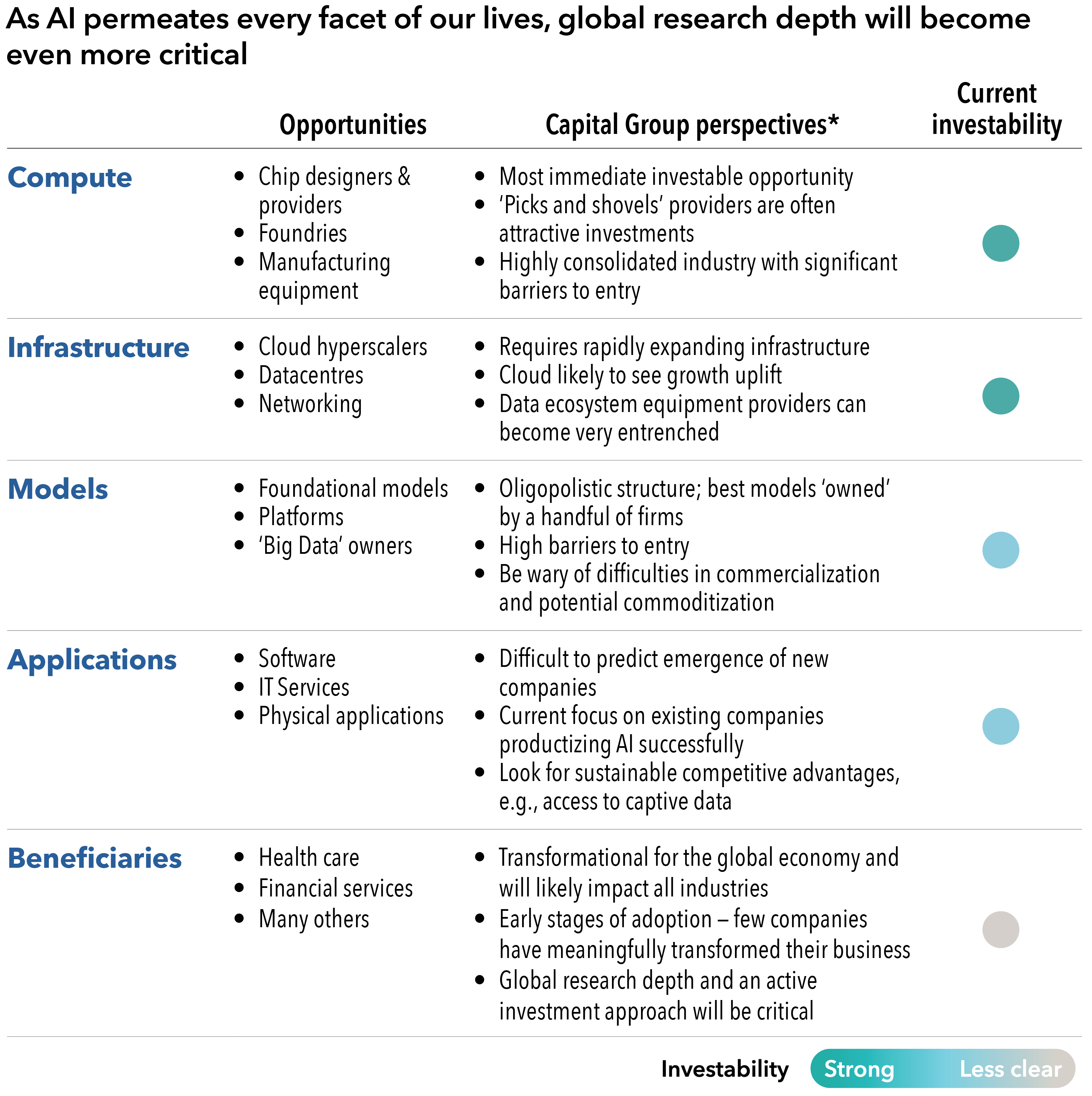

As fast as AI is growing, it still has a long way to go before it becomes mainstream. As it matures, a deep, growing set of investment opportunities is emerging up and down the value chain.

“The key as fundamental investors is to get into the nuance and ask the right questions: Which parts of the value chain are poised to benefit and in what order? Which geographies are going to be further ahead or behind on adoption? Which companies are poised to lead as critical suppliers or makers of the necessary tools and equipment? Who’s going to be hurt? And which companies stand to benefit from secondary and tertiary knock-on effects?” says Burge.

Compute

The most immediate investable opportunity has been concentrated in the compute segment related to the AI build-out. Constituents are semiconductor chip designers, equipment manufacturers, foundries and other highly specialized companies. Not surprisingly, many of these companies are already big stock market winners: Nvidia is a prime example, designing graphic processing units (GPUs) that have seen a surge in demand from companies that look to build and train AI models. Capacity for compute businesses is difficult to scale quickly given capital intensity and specialization within highly connected global supply chains. Going beyond this first layer, we anticipate investment opportunities across a broader set of “picks-and-shovels” equipment providers. This may include complements, such as semiconductor equipment makers (Applied Materials), chip foundries (TSMC), suppliers of memory chips (SK Hynix), and server-makers able to meet artificial-use cases (Dell). We may also see chip alternatives emerge: “x”PUs with distinctive features such as higher specialization, lower cost or higher electricity efficiency (Broadcom). Other opportunities may be in the ecosystem of companies that provide specialty chemical solutions, for example.

Infrastructure

Other investment opportunities reside in the rapidly growing infrastructure segment. It’s primarily made up of cloud companies, data centres and networking firms: all necessary enablers making AI possible. Due to the explosive growth in AI, global spending on data centre construction is expected to reach $US49 billion by 2030, according to McKinsey & Company. This may benefit suppliers beyond compute. For example, the centres have enormous power needs, which is favourably impacting electricity providers — both traditional and renewable. In June of last year, Constellation Energy, one of the largest electricity providers in the U.S., agreed to sell Microsoft nuclear power for its data centre in Virginia. More recently in January, U.S. construction-equipment maker Caterpillar, which already has a 60% share of the back-up power generation market for data centres, announced a successful test of its hydrogen fuel cell technology at a centre. This, says the company, opens the door to possibly using large-format hydrogen fuel cells to supply backup power for data centres.

Staying focused on real investment opportunities

*Views of individual Capital Group investment professionals will vary.

Models

AI models are the programs trained on a set of data to recognize certain patterns or make certain decisions without further human intervention. They require large datasets, a lot of computing power and specialized engineers. Microsoft-backed Open AI’s model is called GPT4, Meta’s is Llama and Alphabet’s (Google) is Gemini, to name a few. Each of these companies has invested billions of dollars on foundation models trained on broad data, designed for generality of output, and adoptable to a wide range of tasks. These types of models provide a broad set of potential opportunities for commercialization/monetization. Time will tell which companies are best positioned to benefit.

Applications

The application segment of the AI value chain may be the most exciting and broadest in terms of investment opportunities. An early example is CoPilot, now embedded in Microsoft Office for a higher subscription fee. In time, beneficiaries may span all GICs sectors, industries and sub industries around the world due to the broad spectrum of potential use cases.

In health care, AI is already aiding diagnostics, drug discovery and patient care. Startups and established players are leveraging the technology to analyze medical images, predict disease outcomes and personalize treatment plans. U.S.-based Eli Lilly and Swiss-based Novartis have, for example, inked a deal with Alphabet’s digital biotech AI company Isomorphic aimed at accelerating the companies’ drug discovery processes.

Targeting precision

Meantime, advertising and marketing companies are using AI to personalize ads, optimize campaigns, and predict consumer behaviour. France’s Publicis Groupe, one of the world’s largest advertising agencies, has made AI the core of its business personalizing content, optimizing campaigns, and predicting consumer behaviour across its data base of 2.3 billion profiles of people around the world.

In financials, a range of banks, insurance companies, and investment firms are starting to integrate AI into their operations using algorithms to analyze market data, optimize portfolios and detect fraudulent transactions. JP Morgan has, for instance, rolled out a “Cash Flow Intelligence” AI tool to about 2,500 corporate customers to help them with forecasting. The company says the software has reduced human work in this area by 90% and may charge for it in the future.

“The approach towards innovation, the role of regulation, ability to source scarce inputs, competitive pressures and customer preferences all play a role creating differentiated opportunities and risks for companies,” says equity investment specialist Kathrin Forrest.

Management is crucial

High-quality management execution will be crucial for success with the emerging technology.

“At a company level, AI looks to be a source of disruption creating both opportunities and threats for management. It’s not so much a separate issue but rather something that has the potential to impact everything, everywhere. Thinking about AI in an integrated fashion — including management — may help paint a more nuanced, company-specific picture of a company’s potential going forward,” Forrest adds.

A final point regarding the AI opportunity as it relates to Capital Group Global Equity Fund (Canada) is that it’s not just about picking stocks, it’s about building a portfolio. Global Equity is a portfolio that considers more than just one market theme and is positioned to deliver against its objectives as it seeks to provide long-term, superior results. That means a diversified, balanced approach with many opportunities.

“We need to get more than just AI right,” says Burge.

Our latest insights

-

-

Currencies

-

Market Volatility

-

Market Volatility

-

Markets & Economy

Get The Long View: 4 megatrends to watch

RELATED INSIGHTS

-

Economic Indicators

-

U.S. Equities

-

Global Equities

Commissions, trailing commissions, management fees and expenses all may be associated with investments in investment funds. Please read the prospectus before investing. Investment funds are not guaranteed or covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer. For investment funds other than money market funds, their values change frequently. For money market funds, there can be no assurances that the fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in the fund will be returned to you. Past performance may not be repeated.

Unless otherwise indicated, the investment professionals featured do not manage Capital Group‘s Canadian investment funds.

References to particular companies or securities, if any, are included for informational or illustrative purposes only and should not be considered as an endorsement by Capital Group. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds or current holdings of any investment funds. These views should not be considered as investment advice nor should they be considered a recommendation to buy or sell.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and not be comprehensive or to provide advice. For informational purposes only; not intended to provide tax, legal or financial advice. Capital Group funds are available in Canada through registered dealers. For more information, please consult your financial and tax advisors for your individual situation.

Forward-looking statements are not guarantees of future performance, and actual events and results could differ materially from those expressed or implied in any forward-looking statements made herein. We encourage you to consider these and other factors carefully before making any investment decisions and we urge you to avoid placing undue reliance on forward-looking statements.

The S&P 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2025 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

FTSE source: London Stock Exchange Group plc and its group undertakings (collectively, the "LSE Group"). © LSE Group 2025. FTSE Russell is a trading name of certain of the LSE Group companies. "FTSE®" is a trade mark of the relevant LSE Group companies and is used by any other LSE Group company under licence. All rights in the FTSE Russell indices or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indices or data and no party may rely on any indices or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company's express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. The index is unmanaged and cannot be invested in directly.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.msci.com)

Capital believes the software and information from FactSet to be reliable. However, Capital cannot be responsible for inaccuracies, incomplete information or updating of the information furnished by FactSet. The information provided in this report is meant to give you an approximate account of the fund/manager's characteristics for the specified date. This information is not indicative of future Capital investment decisions and is not used as part of our investment decision-making process.

Indices are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

All Capital Group trademarks are owned by The Capital Group Companies, Inc. or an affiliated company in Canada, the U.S. and other countries. All other company names mentioned are the property of their respective companies.

Capital Group funds are offered in Canada by Capital International Asset Management (Canada), Inc., part of Capital Group, a global investment management firm originating in Los Angeles, California in 1931. Capital Group manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

The Capital Group funds offered on this website are available only to Canadian residents.

Jeremy Burge

Jeremy Burge

Kathrin Forrest

Kathrin Forrest