OPPORTUNITIES

Higher yields uncover fresh opportunities

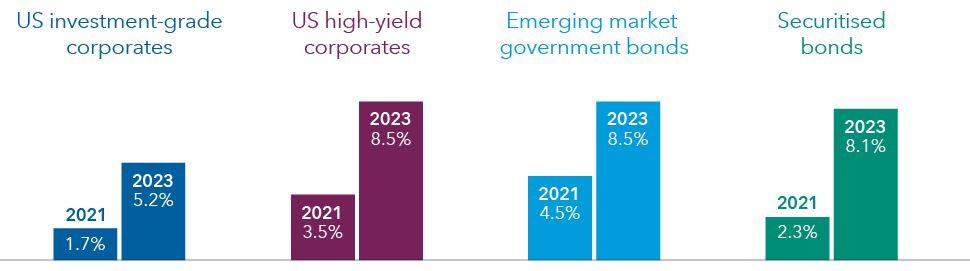

With bonds offering higher yields across the full spectrum of the fixed income asset class, there is now greater potential to derive a meaningful level of income from your fixed income investments.

-

-

Income is back in fixed income

It’s clear that the yields have risen significantly across different areas of fixed income markets since their low points in 2021.

Past results are not a guarantee of future results.

2021 bars are the low points: 3 January (US investment-grade corporate bonds); 6 July (US high-yield corporates); 4 January (emerging market government bonds); 3 August (securitised bonds). 2023 bars are as at 30 June 2023. The indices of the respective fixed income sectors are outlined in footnote 1 (securitised bonds represented by Bloomberg US CMBS ex-AAA Index). Yield refers to Yield to Worst, a common measure of yield. Source: Bloomberg

-

But diversification is key

While income opportunities are abundant, diversification remains as important as ever as no single sector has been able to deliver the best result year after year. Focusing on a single sector could result in a bumpy ride.

.png)

This illustration analyses the calendar-year returns from the above four fixed income sectors each year since 2008. Past results are not a guarantee of future results.

Investors cannot invest directly in an index.

Data as at 30 June 2023 in USD terms. Based on the four fixed income sectors and their respective indices as outlined in footnote 1 (securitised bonds represented by 80% Bloomberg US CMBS ex-AAA Index and 20% Bloomberg ABS Ex AAA Index). Sources: Bloomberg, Capital Group

-

THE POWER OF 4

Capital Group Multi-Sector Income Fund (AU)

A fund that combines the four sectors in a single portfolio offers the potential to benefit from attractive income along with a smoother ride. Click below to watch video.

ESG FOCUS

ESG integration and beyond

ESG is woven into our investment process through three tightly integrated components: investment frameworks, monitoring and engagement.

We believe that incorporating ESG considerations is key to successful investing. Our robust approach focuses on material ESG risks and opportunities.

EXPERIENCE COUNTS

Managed by an experienced and specialist team

Each of the four sectors is managed by an experienced sector specialist portfolio manager. They are supported by large, dedicated investment analyst teams that help create a portfolio built on deep insights into each of the securities the fund invests in.

Damien J. McCann

Principal Investment Officer

23 years with Capital

23 years of industry experience

Shannon Ward

US High Yield

6 years with Capital

30 years of industry experience

Scott Sykes

US investment-grade corporates

17 years with Capital

22 years of industry experience

Kirstie Spence

Emerging markets debt

27 years with Capital

27 years of industry experience

Xavier Goss

Securitised credit

2 years with Capital

19 years of industry experience

Years of experience as at 31st December 2022.

WHY CAPITAL GROUP

A leader in global investing

For more than 90 years, we’ve been searching the world for long-term opportunities, making Capital one of the oldest global investors. We have also grown to become one of the world’s largest active fixed income fund managers.

Global investing credentials

US$2.5T

in total assets managed

26 years

average investment experience of our fixed income portfolio managers

US$498.0B

Fixed income assets managed*

*Assets under management by Capital Fixed Income Investors.

Data as at 31 December 2023

Capital Group Multi-Sector Income Fund (AU)

We're here with the support and solutions you need.

Don't hesitate to reach out if you have questions or need assistance.

Jorden Brown

Managing Director

Financial Intermediaries

(Australia & New Zealand)

+61 407 464 003

Jorden.Brown@capitalgroup.com

Douglas Frewin

Director Distribution

(QLD)

+61 476 901 279

Douglas.Frewin@capitalgroup.com

David Miller

Director, Distribution

(NSW)

+61 405 611 580

David.Miller@capitalgroup.com

Zoe Alexander

Director, Distribution

(VIC, TAS & WA)

+61 408 330 213

Zoe.Alexander@capitalgroup.com

All data as at 31 December 2022 and attributed to Capital Group, unless otherwise specified.

- Indices used to represent US high yield corporates: Bloomberg US High Yield Index 2% Issuer Cap; US investment-grade corporates: Bloomberg US Corporate Index; emerging market government bonds: JPMorgan EMBI Global Diversified Index

- Reference index: 45% Bloomberg US High Yield Index 2% Issuer Cap; 30% Bloomberg US Corporate Index; 15% JPMorgan EMBI Global Diversified Index; 8% Bloomberg CMBS Ex AAA Index; 2% Bloomberg ABS Ex AAA Index

Risk factors you should consider before investing:

- The value of investments and income from them can go down as well as up and you may lose some or all of your initial investment.

- Past results are not a guarantee of future results.

- If the currency in which you invest strengthens against the currency in which the underlying investments are made, the value of your investment will decrease. Currency hedging seeks to limit this, but there is no guarantee that hedging will be totally successful.

- The Prospectus – together with any locally-required offering documentation – sets out risks, which, depending on the fund, may include risks associated with investing in fixed income, derivatives, emerging markets and/or high-yield securities; emerging markets are volatile and may suffer from liquidity problems.

- The fund may invest in financial derivative instruments for investment purposes, hedging and/or efficient portfolio management.

Past results are not a guarantee of future results.

.png)

.png)

.png)

.png)