Demographics & Culture

Europe

August 24 marks six months since Russia invaded Ukraine, unleashing a geopolitical crisis that is still reverberating through the global economy. Europe has been on the frontlines of the war, taking in Ukrainian refugees and committing financial and military support as part of the Western alliance for Ukraine.

But Europe’s economy is heavily exposed to the negative impact of the spike in global energy prices, which is partly due to the European Union’s embargo of Russian energy and the threat that Russia may choke off gas supplies in coming months. This has squeezed the real incomes of European residents, who regularly cite the cost of living among their top concerns.

Furthermore, Europe’s unity of purpose at the onset of the war has started to give way to the usual squabbles over member states’ national interests. For instance, there are differences of opinion on both the level and types of sanctions on energy. And some EU member states are questioning burden-sharing in the event of a gas supply shortfall this winter.

How long can the European Union sustain a united front?

I am being asked by clients, my colleagues and other observers if Europe will withdraw from the current policy of backstopping Ukraine financially and militarily, and show a greater willingness to appease Russia — including by rolling back sanctions.

I do not expect Europe to pull back from its stance of non-appeasement. I believe Brussels will paper over the EU’s emerging cracks and navigate a bumpy road. Europe’s solidarity was never as great as the initial emotional response to the war may have led us to believe, nor is it likely to wilt quickly in favor of a negotiated settlement that doesn’t hold Russia to account.

In my meetings with key European policymakers, I am struck by the extent to which they see this moment as a strategic opportunity to pivot away from Russia, which has long been a source of division among EU member states.

Several of Europe’s actions, including the agreement to send arms to Ukraine, its unprecedented sanctions (including a seventh round just weeks ago), the looming accession of Finland and Sweden to NATO, and the decision to give Ukraine candidate status for the EU all underscore Europe’s commitment and agreement on key issues.

Russian President Vladimir Putin may be banking on EU ruptures to yield an eventual land-for-peace settlement on his terms. Western leaders know this and, despite differences over the appropriate strategy to force an end to the war, are buckling down. Notwithstanding domestic political pressures, they don’t see appeasement as an option. The current sanctions mix on Russia is therefore likely to remain, regardless of how or when the conflict ends, and I believe that Europe’s decision to end its dependence on Russian energy is irreversible.

European majority supports stance against Russia

European policymakers recognize they are in for a tough war of attrition and are trying to communicate resolve, warning against the perils of failing to hold the line. Meanwhile, concerns around energy and food supply serve to heighten the European public’s anxieties.

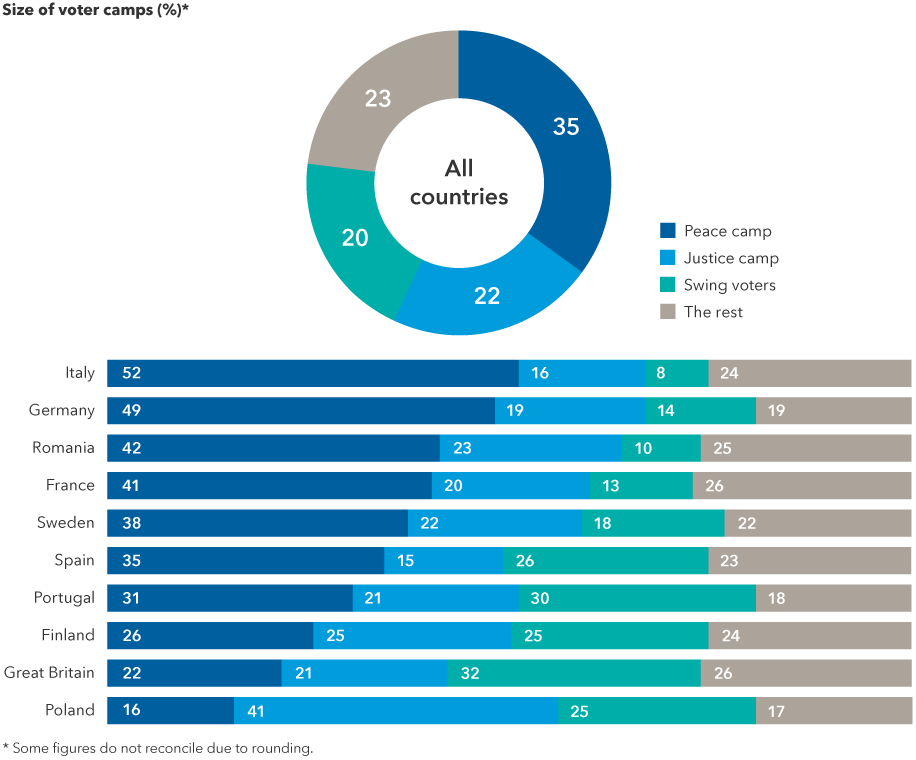

That has left European voters split on the way forward. While polling has shown that more than a third of the public leans toward ending the war as soon as possible (peace camp), there are significant divergences among countries. Voters in Italy and Germany — economies highly reliant on Russian energy — strongly favor a peaceful resolution in the near term, while Poland, which shares a more than 300-mile-long border with Ukraine, leans strongly toward a more punitive stance on Russia (justice camp).

European voters weigh in on the war

Sources: European Council on Foreign Relations, Datapraxis, YouGov. As of May 11, 2022. “All countries” in the upper chart refers to the aggregate of the 10 countries listed in the lower chart.

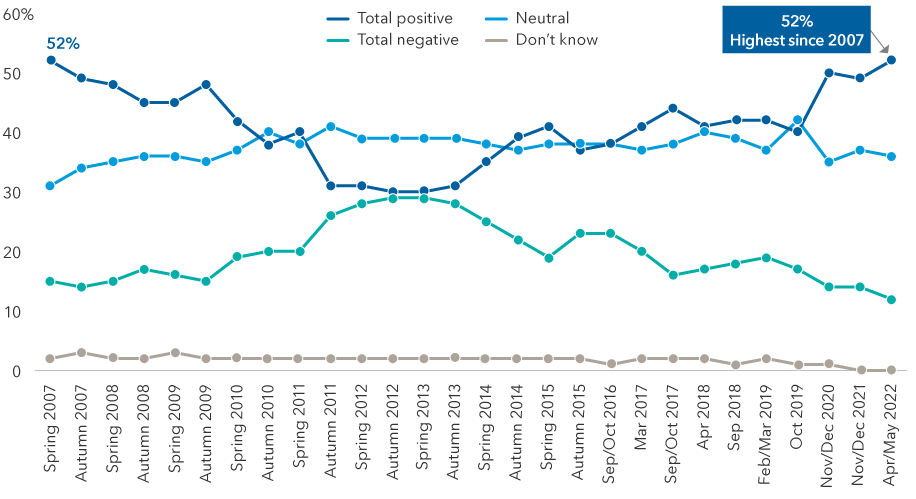

In a good sign for European solidarity, the percentage of EU citizens that holds positive views of the EU is at the highest level since 2007. Even as 40% say that fallout from the war in Ukraine has already reduced their standard of living and will continue to do so over the next year, 59% say the defense of common European values, such as freedom and democracy, must be a priority. So, while there is some evidence of war fatigue and a sizeable portion of people desiring its end, the majority are willing to sacrifice their standard of living to defend against the perceived threat to their shared values.

Favorable views of the EU reach multiyear highs

Source: Eurobarometer survey of European Union residents commissioned by the European Parliament. As of May 2022.

Implications for investors

Despite this broad support, the energy price shock arising from the war continues to weaken consumer sentiment, drive up inflation and place Europe at risk of recession by the end of the year. But a lot of this downside risk appears to be reflected in asset prices. Amid concerns over Europe’s outlook, the MSCI Europe Index is down around 18% in U.S. dollar terms year to date, after a modest rally took hold in July, and European sovereign bond yields have soared.

I believe these gyrations have created opportunities for investors focused on security selection and a long-term time horizon. There are many fundamentally attractive European companies with global earnings that could benefit from a weaker euro. Several European pharmaceutical giants have relatively modest exposure to cost inflation and have continued to report strong sales. Some large luxury goods companies have been generating double-digit sales growth from strong consumer demand despite the negative impact of pandemic-related lockdowns in China. Environmental regulations in Europe and the pivot toward greater energy security are, in my view, creating opportunities for a host of companies across industries, from industrials and infrastructure to energy and mining. From a longer-term perspective, I believe investors need to assess the impact of Europe’s challenging adjustment to higher energy costs.

I expect European markets to remain responsive to military and diplomatic developments, as well as fluctuations in the cost of energy. Any hint at peace talks would almost surely drive a relief rally in European stocks.

Source: BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

This report, and any product, index or fund referred to herein, is not sponsored, endorsed or promoted in any way by J.P. Morgan or any of its affiliates who provide no warranties whatsoever, express or implied, and shall have no liability to any prospective investor, in connection with this report. J.P. Morgan disclaimer: https://www.jpmm.com/research/disclosures.

Talha Khan

Talha Khan