Actively managed exchange-traded funds (ETFs) are becoming an increasingly popular tool for financial professionals. So it’s important for advisors to understand the three main structures available: fully transparent (or simply “transparent”), semi-transparent and non-transparent.

Each type of active ETF has different requirements related to the disclosure of portfolio holdings, where they can invest and the use of “custom baskets”— which has potential ramifications for tax efficiency.

This article explains what advisors should know about the three active ETF structures and why Capital Group has chosen full transparency for our initial suite of ETFs.

Actively managed ETFs are becoming an increasingly popular tool for financial professionals. While they had only a 5.4% market share based on assets at the end of 2022, they accounted for 14.4% of inflows last year.1 Indeed, the inflows to active were among the strongest trends in the ETF market in 2022.

Given the rise of active ETFs, it’s important for advisors to understand the three main structures available: fully transparent (or simply “transparent”), semi-transparent and non-transparent. Although semi-transparent and non-transparent ETFs are sometimes grouped together, in this article we consider them two distinct categories.

Each type of active ETF has different requirements related to the disclosure of portfolio holdings, where they can invest and the use of “custom baskets” — which may have ramifications for tax efficiency.

This article explains what advisors should know about the three active ETF structures and why Capital Group has chosen full transparency for our initial suite of ETFs.

Full transparency predominates

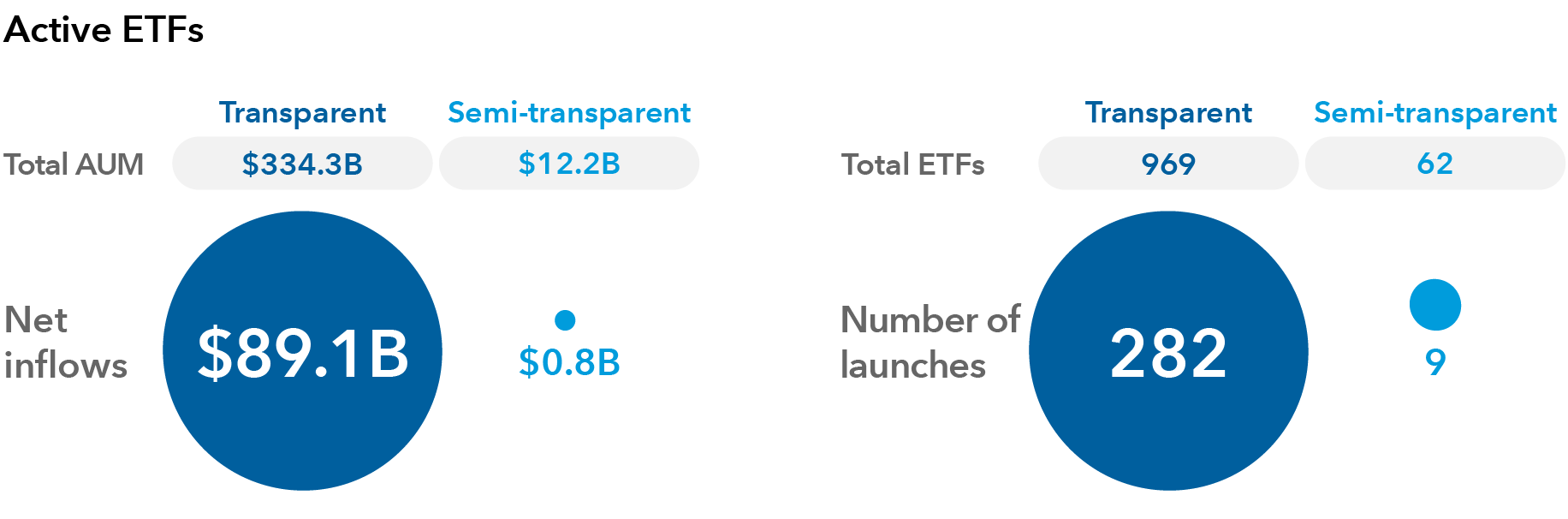

Most actively managed ETFs are fully transparent. Semi-transparent and non-transparent ETFs, which have been around for only a few years, represent a small portion of the market. Based on 2022 inflows and fund launches, it’s clear that investors and managers are continuing to flock to fully transparent active ETFs.

Three approaches to transparency

Each active ETF structure has different requirements related to the disclosure of holdings and and the types of securities they can hold.

Transparent

FEATURES

- Fully transparent: Holdings are disclosed daily, which potentially allows for tighter bid/ask spreads compared with other active ETF structures

- Ability to invest in fixed income securities

- Ability to invest in non-U.S. securities (ADRs aren’t required by the structure)

CONSIDERATIONS

- The underlying investment strategy may not be suitable for daily holdings disclosure

Semi-transparent

FEATURES

- Helps shield the manager’s activities by disclosing holdings monthly or quarterly

(and may also disclose a mix of actual and proxy portfolio holdings on a daily basis)

CONSIDERATIONS

- Offers less transparency than is typical for ETFs

- Currently, no ability to invest in bonds or non-U.S. equities*

Non-transparent

FEATURES

- Provides the most protection for the intellectual capital of the strategy by disclosing holdings on a quarterly basis

CONSIDERATIONS

- Offers less transparency than is typical for ETFs

- Not widely accepted by the industry or wealth managers

- Currently, no ability to invest in bonds or non-U.S. equities*

*To invest in non-U.S. equities, semi- and non-transparent ETFs must use American Depositary Receipts (ADRs), which may have less liquidity or could be subject to greater price fluctuations than the non-U.S. security itself.

Visibility

As their name suggests, fully transparent ETFs provide the most portfolio disclosure. This typically involves posting all portfolio holdings and their weights on the manager’s website on a daily basis. Therefore, investors know exactly what they are holding at all times.

Semi-transparent and non-transparent ETFs may disclose their holdings on a monthly or quarterly basis, so investors have less visibility. Semi-transparent ETFs may also release “proxy portfolios” that may not include all of the actual portfolio holdings.2 This may limit an investor’s ability to make decisions related to broader portfolio management and tax optimization, among other potential issues.

Flexibility

Managers who want to keep their portfolios confidential in a semi- or non-transparent ETF may face some restrictions on the types of securities they can invest in.2 For example, managers may not be able to invest in bonds and non-U.S. stocks. These structures must use American Depositary Receipts (ADRs), or in some cases only foreign stocks that trade while the U.S. market is open, to gain exposure to non-U.S. stocks.

Active ETFs that are not fully transparent “limit portfolio managers’ palette,” notes Ben Johnson, CFA®, head of client solutions at Morningstar. “In order to help ensure that these funds’ prices closely mirror their net asset values and that bid-ask spreads are reasonable, they are currently limited to investing in securities that trade at the same time as the funds themselves.”3

Johnson added that “depending on the strategy, investing within one time zone may be a significant constraint on a manager’s ability to invest in their best ideas.”3

Tax efficiency

Tax efficiency is one of the most popular benefits of ETFs. That is why capital gains distributions passed along by shareholders in semi-transparent and non-transparent ETFs have attracted notice. For instance, 10 of 19 active ETFs listed in 2021 that weren’t fully transparent made a year-end capital gains distribution that year.4

These distributions could be driven by a lack of redemptions, limitations on non-transparent ETFs’ use of custom baskets and other factors. Active ETFs often have high turnover. Limits on custom baskets for ETFs that aren’t fully transparent may hinder their ability to sell low-cost-basis stock. This may result in distributions and taxable events for shareholders.

Why we chose full transparency for our active ETFs

When Capital Group decided to offer ETFs, we committed to providing what we believe is the best experience for investors. That’s why we opted for the transparent structure.

Full transparency gives investors and their advisors the most visibility into what they own. According to a recent survey, 86% of advisors said daily transparency of underlying holdings is a very important or somewhat important attribute of an ETF.5 This importance can be heightened during volatile markets. Daily visibility into a client’s exposure — or lack of exposure — to specific companies or issuers can help advisors have more meaningful conversations and address their concerns.

The fully transparent structure allows us the broadest investment universe — including fixed income and non-U.S. holdings — to express our highest conviction ideas. And it works well with The Capital System™, our signature approach to investing.

Learn more about our full suite of actively managed equity and fixed income ETFs.

1 “A Brutal Year in the Markets Doesn’t Rattle ETF Investors.” Morningstar.com, January 3, 2023.

2 “Statement of Commissioners Jackson and Lee on Non-Transparent Exchange Traded Funds.” SEC.gov, November 15, 2019.

3 “Active Non-Transparent ETFs: What Are They Good For?” Morningstar, July 28, 2020.

4 “Non-transparent ETFs face up to first big tax test.” Financial Times (Ignites), December 23, 2021.

5 “U.S. Exchange-Traded Fund Markets 2021.” Cerulli Associates, 2021.

Scott T Davis is an ETF director at Capital Group, home of American Funds. He has 18 years of industry experience and has been with Capital Group for 17 years. Prior to his current role, Scott led product development across Capital Group. Earlier in his career he held various strategy and finance roles for Capital Group, Hostess Brands and Boeing. He holds an MBA from University of Southern California and a bachelor's degree in management science from University of California San Diego. Scott is based in Los Angeles.

Paul Santoro is a senior ETF sales manager at Capital Group, home of American Funds. He has 29 years of investment industry experience and has been with Capital Group for 23 years. Earlier in his career at Capital, Paul was director of European distribution. Before that, he focused on advisor and shareholder education in the Boston area, as well as dealer relations where he worked closely developing broker-dealer relationships. Prior to joining Capital, Paul was a regional manager at Lord Abbett & Co. He holds a bachelor’s degree in history and art history from Western Maryland College. Paul is based in Los Angeles.

Scott Davis

Scott Davis

Paul Santoro

Paul Santoro