Portfolio Construction

AdviserInstitutions & ConsultantsIndividual InvestorsInstitutions & ConsultantsFinancial IntermediariesIndividual InvestorsInstitutionelle Investoren & ConsultantsFinanzintermediärePrivatanlegerInstitutions & ConsultantsFinancial IntermediariesIndividual InvestorsInstitutions et consultantsIntermédiaires financiersInvestisseurs particuliersFinanciële tussenpersonenIndividual InvestorsFinancial AdvisorsInstitutions and ConsultantsParticuliersConseillers financiersInstitutions et consultantsFinancial IntermediariesIndividual InvestorsInstitutions & ConsultantsFinancial IntermediariesIndividual InvestorsInstitutions & ConsultantsFinancial IntermediariesIndividual InvestorsInstitutions & ConsultantsFinancial IntermediariesIndividual InvestorsInstitutions et consultantsIntermédiaires financiersInvestisseurs particuliersInstitutions & ConsultantsFinancial IntermediariesIndividual InvestorsInstitutionelle Investoren & ConsultantsFinanzintermediärePrivatanlegerFinancial IntermediariesIndividual InvestorsInstitutions & ConsultantsFinancial IntermediariesIndividual Investors機構投資者及顧問金融中介個人投資者Institutions & ConsultantsFinancial IntermediariesIndividual InvestorsInstitutions & ConsultantsFinancial IntermediariesIndividual InvestorsInstitutions & ConsultantsFinancial IntermediariesIndividual InvestorsClienti IstituzionaliIntermediari e Consulenti FinanziariInvestitori privatiJapanFinancial IntermediariesIndividual InvestorsFinanzintermediärePrivatanlegerInstitutions & ConsultantsFinancial IntermediariesIndividual InvestorsInstitutions et consultantsIntermédiaires financiersInvestisseurs particuliersInstitutionelle Investoren & ConsultantsFinanzintermediärePrivatanlegerInstitutions & ConsultantsFinancial IntermediariesInstitutions & ConsultantsFinancial IntermediariesIndividual InvestorsInstitutions & ConsultantsFinancial IntermediariesIndividual InvestorsInstitutions & ConsultantsFinancial IntermediariesIndividual InvestorsInstitutions & ConsultantsFinancial IntermediariesIndividual InvestorsInstitutions & ConsultantsFinancial IntermediariesIndividual InvestorsInstituciones y consultoresIntermediarios financierosInversores individualesInstitutions & ConsultantsFinancial IntermediariesIndividual InvestorsInstitutions & ConsultantsFinancial IntermediariesIndividual InvestorsInstitutions et consultantsIntermédiaires financiersInvestisseurs particuliersInstitutionelle Investoren & ConsultantsFinanzintermediärePrivatanlegerInstitutions & ConsultantsFinancial IntermediariesIndividual InvestorsInstitutions & ConsultantsFinancial IntermediariesIndividual InvestorsFinancial ProfessionalRIAIndividual InvestorPrivate ClientRetirement Plan InvestorInstitution or ConsultantEmployer or Plan SponsorThird-Party AdministratorU.S. Offshore AdvisorsOffshore de EE. UU.International - otherAsia - other

Investment Menu

Steve Fox

Steve Fox

Ann Gookin

Ann Gookin

Schedule a portfolio analysis.

A comprehensive review of your portfolio with personalized suggestions to refine your investment approach to help your clients achieve their goals.

Registered investment advisers (RIAs) are increasingly inquiring about alternative investments, or simply “alternatives” or “alts.” In part, this reflects an industry-wide shift. Some asset managers contend that alternatives have transitioned from an option to an essential portfolio component. Yet, alternatives can be complex instruments. They come in many forms, function differently in portfolios, pose unique risks and may not be appropriate for all investors.

This article examines advisors’ growing interest in alternative investments, why they may be worth RIAs’ consideration, and the risks and requirements to consider before offering alternatives to clients.

- While alternatives constitute a relatively small part of the investable universe, AUM has risen significantly in recent years, heightening RIA attention on alternative assets.

- Alternatives span a broad range and can play a beneficial role, but they may carry unique liquidity, regulatory and transparency risks, warranting extra care when integrating them into a portfolio.

- Firms considering alternatives should review the technology and knowledge requirements and prepare to educate clients on the role and attributes of these assets.

RIAs are increasingly inquiring about alternative investments, or simply “alternatives” or “alts.” In part, this reflects an industry-wide shift. Some asset managers contend that alternatives have transitioned from an option to an essential portfolio component. Yet, alternatives can be complex instruments. They come in many forms, function differently in portfolios, pose unique risks and may not be appropriate for all investors.

“In the RIA space, our research has shown a ton of interest in alternative investments, but that hasn’t translated to as much adoption as you might expect,” said Steve Fox, PhD, head of Client Analytics at Capital Group. “This makes sense when you consider the legwork that’s required: To manage alternative investments, RIAs need to conduct deep analysis and build technological and analytical capabilities that may be expensive or impose a significant learning curve.”

Capital Group’s Client Analytics team has conducted a great deal of research on the alternative investment landscape. Below, our Client Analytics team leverages its research to highlight several key things RIAs should know before pursuing alternative investments. In addition, Ann Gookin, managing director and head of investments at Freestone Capital Management and a member of Capital Group’s RIA Advisory Board, shares insight on how her firm has navigated the alternative investment opportunity set.

What exactly are alternative investments?

Alternatives comprise a wide variety of investments distinguished from long-only, publicly traded investments in stocks, bonds and cash. The alternatives landscape includes some of the world’s oldest investments, such as real estate and commodities, as well as nontraditional vehicles including private equity, private debt, and hedge funds that often employ derivatives and leverage.

Alternatives are generally actively managed and highly specialized, particularly in comparison to mutual funds. The investments underlying alternatives may be as diverse as the real economy. Examples range from private stakes in disruptive technology “moonshots,” to funds comprised of distressed municipal bonds, to direct investments in emerging real estate sectors.

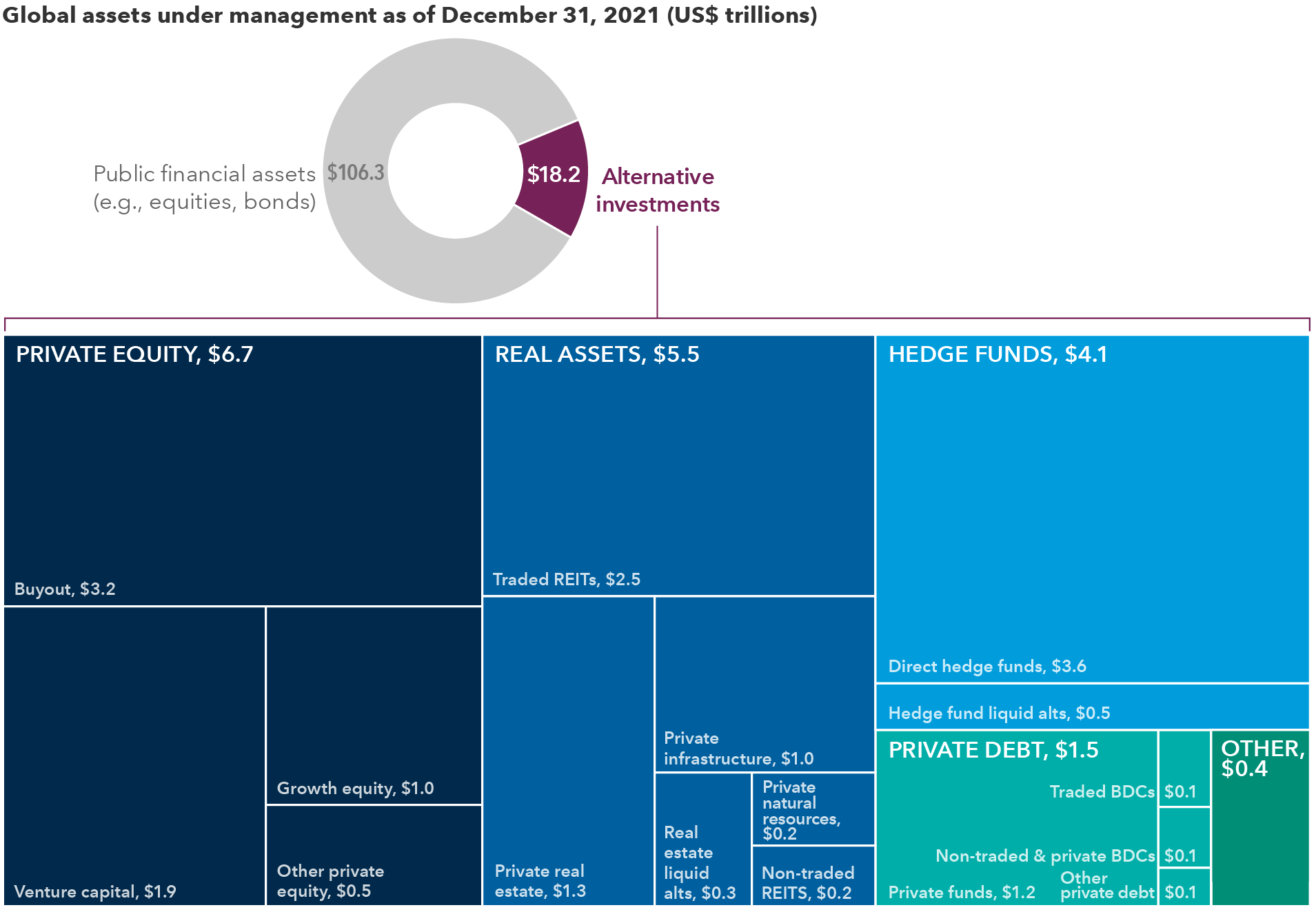

“Assets under management in alternatives have risen and are projected to continue climbing, although they still account for a small proportion of the overall investment universe,” Fox said. Global AUM in alternatives grew to $18.2 trillion in 2021.1

“To manage alternative investments, RIAs need to conduct deep analysis and build technological and analytical capabilities that may be expensive or impose a significant learning curve.”

— Steve Fox, PhD, Head of Client Analytics at Capital Group

Who is investing in alternatives?

Alternatives have traditionally been considered the domain of institutional investors, yet ultra high net worth investors (with investable assets over $30 million) have dramatically increased their positions, and allocations tend to be highest among the very wealthy. By one estimate, alternatives account for at least half of assets at family offices managing more than $1 billion.2 Meanwhile, an expanding range of products is making alternatives an option for millions of people who would not have been able to access them before, helping to boost AUM. Private equity (PE) is the largest category, followed by real assets and hedge funds.

Alternative investment AUM overview

Sources: Preqin, Cerulli, eVestment, McKinsey, Eversheds Sutherland, Morningstar, EPRA. REITs that are invested in mutual funds and ETFs are double counted. BDCs primarily invest in private debt, but can also invest in private equity. Other includes commodities, currency and cryptocurrency.

Why consider allocating to alternatives?

The potential reasons for pursuing alternative investments vary, but tend to focus on a few key themes. “Managers most often use alternatives to seek diversification, enhance returns or provide income — or a combination of these three objectives,” Fox noted.

An investment in real assets, such as energy, may negatively correlate with equity returns, potentially providing diversification and income. A hedge fund allocation may have the potential to boost returns over time while diversifying a portfolio. Real estate vehicles that collect rent from tenants may provide vital income for retirees when interest rates are low, while offering the possibility of capital gains.

Of course, none of these benefits is guaranteed, and there are numerous factors to consider before deploying such strategies.

“We believe in encouraging clients to worry less about real-time changes and instead focus on living their lives, and allocations to alternatives can help achieve those goals.”

— Ann Gookin, Managing Director and Head of Investments, Freestone Capital Management

What are some of the risks inherent in alternatives?

Because alternatives include such a broad variety of investments, their risk profiles run the gamut as well. “There are a variety of factors that raise the risk profile of many alternatives, particularly for clients that are less knowledgeable, patient or wealthy,” Fox added.

Alternatives tend to be less regulated than traditional investments and offer less transparency. Because they are relatively new and most aren’t publicly traded, historical risk and return data may be limited. Alts often carry higher fees, including performance fees that are triggered when an investment exceeds an annual return threshold. They may also raise complex legal and tax considerations. For instance, many are structured as limited partnerships, which issue K-1 forms that must be reported on tax returns. These challenges alone are enough to drive some RIAs away from investing in many alternative asset classes like hedge funds and private equity partnerships.

A longer time horizon is often a key feature of alternatives, and many strategies therefore restrict investor liquidity. This and their regulatory status may limit their suitability — or even accessibility — to clients with investable assets of at least $1 million, or in some cases $5 million.

In recent years, fund sponsors have launched various “liquid alts” that invest in alternatives but offer daily liquidity. Liquid alts include publicly traded REITs, business development companies (BDCs), ETFs, mutual funds, closed-end funds and other vehicles investing in private equity, hedge funds and other strategies. These strategies have enabled less affluent clients to access alternatives, helping to boost asset flows. AUM in liquid alts rose by 33% from 2020 to 2021, but remained below $1 trillion.3

Critics point out that liquid alts essentially take assets that are inherently illiquid and wrap them in liquid packaging. If a relatively large number of investors seek to exit a fund, managers may face a liquidity crisis or be forced to sell the underlying assets at a significant discount. This could lead to price volatility, significant losses or even redemption restrictions. “It’s critical to understand the structural nuances between different flavors of alternative investments, because issues can arise — especially during periods of extreme volatility — that can negate the potential benefits of pursuing certain alternatives,” Fox added.

What should RIAs consider before offering access to alternatives?

Before expanding into alternative asset classes, RIAs need to examine which capabilities and resources they will need in order to successfully offer alternatives. Many advisors begin the process by developing an alternatives team to study the market and understand which investments are promising and may be appropriate for their clients. In addition to market expertise, such teams should seek to integrate a deep understanding of the firm’s client base, including their goals, needs and risk tolerance.

Offering alternatives may also require a firm to invest in analytics resources and ensure they have adequate trading capabilities and platforms. Due-diligence capabilities are paramount, as are portfolio and reporting technologies. Systems like Addepar and Orion can help with data aggregation and reporting for alternatives.

Ann Gookin, managing director and head of investments at Freestone Capital Management, stresses the importance of building an approach based on your clients’ goals and your firm’s internal capabilities and resources. After analyzing the various potential paths to investing in alts, Gookin’s firm elected to invest directly in alternative investing strategies rather than pursue partnerships with alternative investment managers.

“While many RIAs seek exposure to alternatives by allocating to third-party managers, the best path for us was to form limited partnerships in-house and manage them entirely by our team of investment professionals,” Gookin said. “This may not be practical for all RIAs because it’s expensive and requires substantial resources, but it allows us to better meet the needs of our clients, particularly in terms of managing risk and having more direct control over the underlying investments.”

RIAs will likely also need to educate clients on the role that alternatives play in their portfolio. A counter-cyclical investment in energy, for instance, may perform poorly during a rally in equities, but divesting from such a position under client pressure could be counterproductive in the long term. Some firms are developing webinars to help advisors communicate about alternatives. A thoughtful, consistent narrative can help ease any confusion or client resistance.

Gookin recognizes the value that alternatives can add in helping clients stay committed to their long-term financial plans. One key benefit in this regard is alternatives’ lagged performance reporting. “If you have a long-term approach, then it can be a benefit — not a bug — that the investor is shielded from play-by-play knowledge of exact theoretical pricing, as that can just be market noise,” she noted. “We believe in encouraging clients to worry less about real-time changes and instead focus on living their lives, and allocations to alternatives can help achieve those goals.”

Examine the role of alts in context

RIAs interested in thinking strategically about alternatives should consider reaching out to Capital Group for a consultation with a portfolio specialist. Our portfolio consultants utilize risk-factor analyses to examine alternative investments as part of our portfolio review process, and we would be happy to share more insights from our Client Analytics team’s alts research to help inform your approach.

1 Sources: Preqin, Cerulli, eVestment, McKinsey, Eversheds Sutherland, Morningstar, EPRA

2 “The Wisdom of Compounding Capital.” KKR Global Institute, February 2021.

3 “Liquid Alternatives in 2021.” Calamos Investments, January 25, 2022.

Steve Fox is a client analytics director with 29 years of industry experience (as of 12/31/2023). He holds a PhD in economics from the University of California, Santa Barbara and a bachelor’s degree in economics and mathematics from the University of California, Davis.

Ann Gookin is the managing director of the investment team at Freestone Capital Management and a member of the firm’s leadership team. Prior to joining Freestone in 2016, Ann spent her career in business operations and strategy roles, the bulk of which was spent with the D. E. Shaw group in New York and in London. She is an inaugural member of Ethic’s Client Advisory Council, the tech-driven asset management platform focused on sustainable investing, and is also a member of Capital Group’s RIA Advisory Board.

To read the full article, become an RIA Insider. You'll also gain complimentary access to news, insights, tools and more.

RELATED INSIGHTS

-

Portfolio makeover: Using active ETFs to reduce risk, save advisors time

-

Investing Strategy

2024 Outlook: 6 themes to guide your client conversations -

Planning & Productivity

Business planning essentials for financial advisorsPaul Cieslik

This material does not constitute legal or tax advice. Investors should consult with their legal or tax advisors.

©2023 Morningstar, Inc. All Rights Reserved. Some of the information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar, its content providers nor Capital Group are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results. Information is calculated by Morningstar. Due to differing calculation methods, the figures shown here may differ from those calculated by Capital Group.

For financial professionals only. Not for use with the public.