Global Equities

Market Volatility

Keeping clients focused on long-term goals can become more difficult during times of market volatility. Several advisors share best practices on how to keep clients calm and committed to their plan during turbulent market periods.

Only two calls.

Even as the equity market suffered its first 10% correction since 2016 — erasing more than $5.2 trillion in market value from global markets in early February — just two of Paul Schatz’ 130 clients called with concerns or even questions about it. One called to thank him.

Schatz, president of Heritage Capital, a registered investment advisory firm, was pleased but not entirely surprised with clients’ being relatively calm. The reason? He had already prepared them with a system he has in place to communicate during periods of high volatility.

Schatz, like most advisors, is happy to pick up the phone if clients call. But he sees the silence as evidence clients don’t need in-person meetings and calls if you’re reaching out to them quickly, openly and digitally. “Our practice in good markets and bad is to overcommunicate,” Schatz says. “People want to know there’s someone behind the wheel. They don’t want a vacuum of information.”

Paul Schatz

President, Heritage Capital

Schatz is one of a number of RIAs who have developed systems and procedures to communicate with clients so they’re not caught off-guard when markets get rocky or have their offices flooded with nervous investors.

Many of these can be adopted into advisor practices.

Communicate with clients early and often

It might be tempting to avoid discussing market volatility as to not worry clients. But Ben Pace, chief investment officer at HPM Partners in New York, says clients want you to be proactive in reaching them, all the time, but especially during downturns.

As soon as volatility picked up, Pace was ready. He emailed a two-page market analysis titled “Comments on Recent Market Volatility.” He was candid and blunt. “The sharp selloff in equities over the past week has wiped out all the January gains with markets actually in the red year to date as of this writing,” he wrote.

He followed up three days later with another market update titled, “Be Careful What You Wish For.” In the three-page note, Pace drilled in with further detail on the role higher interest rates are playing in driving down stock prices.

He directly answered clients’ top-of-mind question, is this going to turn into something worse? “While it is always difficult to predict the end of this episode of increased market volatility, the onset of a bear market is always precipitated by an economic recession that appears some ways off considering the global strength we continue to see at this time.”

Ask clients before they ask you

Certainly, regular digital communications are the norm with RIAs. As a normal course of business, Schatz posts daily on social media, writes blog posts on his website two to four times a week and sends a full newsletter to clients a few times a month. That’s on top of quarterly meeting with clients.

But he turns up the frequency a notch during volatile times, emailing clients three to five times during the week to describe his views on the market. He also polled clients to see how often they want to be contacted during the volatility.

On Feb. 7 he e-mailed a poll to clients with three questions:

1. When the financial markets are volatile or chaotic, how would you like to be communicated with?

Email updates

Phone calls

Meetings

Social Media

Comments

2. When the markets are volatile, how often would you like to be communicated with?

Daily

Few times a week

Weekly

Monthly

Never

Comments

3. Do you find the email updates helpful?

YES

NO

Why or why not?

More than 70% of clients responded to the poll and nearly all clients, 90%, wanted emails not phone calls. “Nobody wants social media,” he says. Nearly all the clients most appreciated the more frequent number of weekly email updates during the market turbulence.

Schatz found the responses to the comments section he attached to bottom of the poll to be equally enlightening. Nearly all clients said things like, “I appreciate your efforts to articulate what’s going on,” he says. Hearing from him without having to call, they said, reduces any temptation to panic.

Show, don’t just tell

Clients want to see numbers to understand what’s going on so they can mentally rationalize it, says Philip Chao, of RIA Chao & Co with 23 clients and assets under management of $150 million. Not just any numbers — their own numbers.

Philip Chao

CIO, Chao & Co.

During the market downturn, Chao pulled year-to-date, three-year trailing returns and five-year trailing returns of all his clients and sent those datapoints in a secure e-mail to them. Seeing the data presented this way underscores what’s happening in the market. When looked at within a portfolio, they see it “is not significant,” he says. Only one client emailed back with a joke: “So I’m ok,” Chao says. “That was it.”

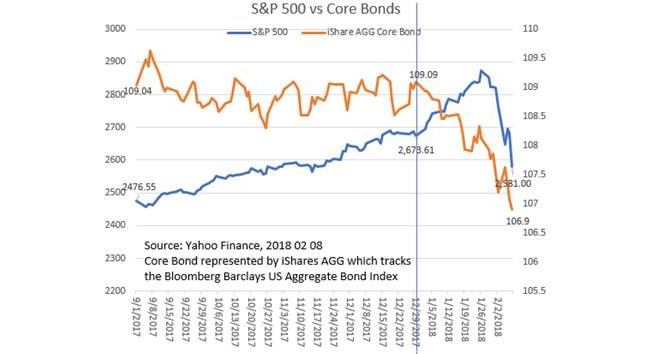

As the volatility continues, Chao sees opportunities to educate his clients about market events — again with data. He created a number of charts that concisely explain market trends and will send them to clients with a short note. A chart plots the Standard & Poor’s 500 next to the Bloomberg Barclays US Aggregate Bond index. This chart shows the decrease in bond prices this year being closely correlated to the selling in the equity market. It’s a way to show clients that the fear of higher rates is unnerving stock investors, he says, rather than just telling them.

Show investors reasons stocks are struggling

Chao’s chart to clients helps them see how falling bond prices are correlated with falling equity prices

Source: Chao & Co.

Stay uniformly consistent

Just five clients out of 400 called Omega Wealth Partners during the week after the volatility picked up. Four of the five wanted to ask about investing more money, not take it out, says Tom Hardgrove, managing partner at Omega, a dual-registered RIA based in Fort Worth, Texas with roughly $750 million in assets. Seeing panicked clients? “We don’t have that problem.”

He credits an often repeated and consistent message. In quarterly letters and annual meetings, Hardgrove and the firm’s co-owner John Dickens remind clients that the only time to change a financial plan is when client goals change. “We don’t let markets, policy changes or rates disrupt the plan we have in place for clients,” he says.

Consistency needs to be everywhere. The firm intentionally doesn’t try to chase tactical asset allocation shifts by buying and selling different mutual funds, as that would only encourage clients to question the long-term durability of the plan. They instead use mutual funds that give portfolio managers leeway in making those decisions. Both Hardgrove and Dickens also make sure they’re completely in sync with their message to clients. “You can’t have clients call someone else and get a different story,” he says.

The bottom line

Clients abhor silence from their financial advisors and expect them — especially during volatility — to proactively reach them and not wait to be called. Regular digital contact, especially via email, is what clients want as phone calls and in-person meetings become less important.

Reminding clients that large downturns are just a part of investing, just as large upturns are, is the underlying message of communication. After a good year in the markets, Chao’s clients often thank him. That’s another time to remind clients that markets are lumpy. “I tell them to keep those thanks, I’ll use them later.”

Any reference to a company, product or service does not constitute endorsement or recommendation for purchase and should not be considered investment advice.

RELATED INSIGHTS

-

-

Client Relationship & Service

-

Traits of Top Advisors

Use of this website is intended for U.S. residents only.