Chart in Focus

Election

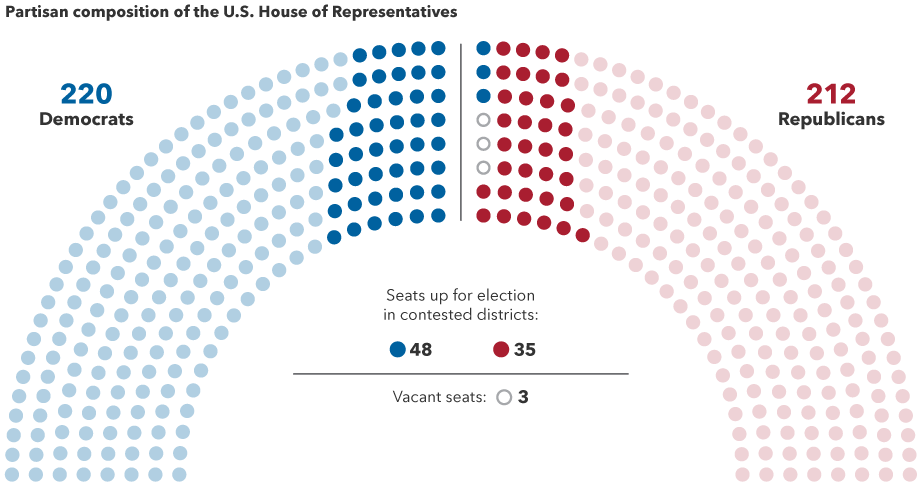

The buzz surrounding the U.S. midterm elections has picked up recently as pundits suggest the Republican Party may not win back the House of Representatives in a “red wave” widely expected just a few months ago.

My view: I still expect the GOP to win the House. That’s been my position since early in President Biden’s term — even before inflation rose to 40-year highs and Americans started worrying about a potential recession. The Senate, meanwhile, remains a toss-up that I think could go either way as races tighten in a number of key states.

I must stress, this is analysis not advocacy. It’s my job to advise Capital Group’s investment team on political and policy issues, and I strive to do so without bias or partisanship of any kind.

If I am right about the outcome of the November 8 elections, a Republican victory will mark the end of the affirmative phase of Biden’s presidency. From an investment point of view, flipping the House is really all that matters. With Republicans holding the purse strings, there would be no chance of passing ambitious legislation related to taxes, climate change or labor policy until at least 2025.

Democrats control the House by a slim margin. Is that about to change?

Sources: Capital Group, 270toWin, Cook Political Report, Office of Clerk of the U.S. House of Representatives. Number of competitive districts is the total number of upcoming House elections defined by 270toWin as either "likely," "leans," "tilt," or "toss-up," based on current consensus estimates from eight polling sources including Cook Political Report, FiveThirtyEight, Inside Elections, Fox News, Politico, Split Ticket, Elections Daily and Sabato's Crystal Ball. As of October 14, 2022.

It is true that Democrats have scored some legislative wins recently. They have also gained a degree of political momentum from the Supreme Court’s decision to overturn Roe v. Wade, the 1973 decision establishing federal abortion rights, as well as former President Trump’s legal woes. These events have given rise to a “comeback” narrative in the press that has led some outlets to argue that the House can be held.

I don’t believe it. Here’s why:

1. Republicans don’t need much

They must flip just five seats to win a majority in the House. Historically speaking, in the first midterm of a presidency, the opposition party wins many more than that.

2. Biden’s low approval rating is a bad sign

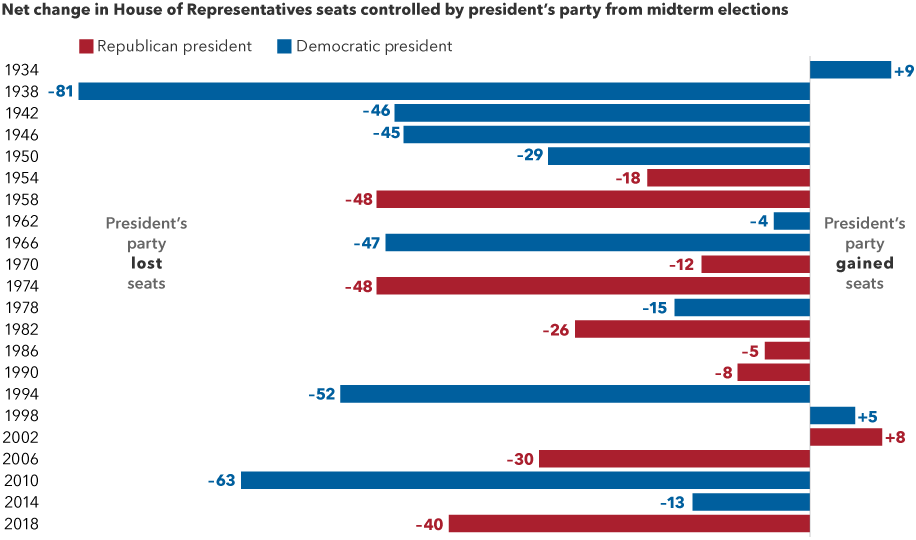

It’s ticked up from 38% in polling averages to the low 40s. If he rises to the high 40s or 50%, that might make a difference, but I’m skeptical he can get there in the short amount of time left. The low 40s is a very bad place to be going into a midterm election. As other analysts have noted, this is roughly where Ronald Reagan, Bill Clinton, Barack Obama and Trump were at the same point in their presidencies. They lost 26, 52, 63 and 40 House seats in their first midterms, respectively.

The party in power usually loses House seats in midterm elections

Source: "Seats in Congress Gained/Lost by the President's Party in Mid-Term Elections." The American Presidency Project.

3. The tightening “generic ballot” is misleading

Many observers rightly note that the “generic ballot” has tightened. This involves a common question pollsters ask about which party respondents would support if the election were held today, as opposed to which specific candidate. Looking at recent polling averages, Democrats have gained a one-point edge in the generic ballot, compared to a 2.5% deficit in early May.

That sounds like progress, and it is. But remember that in 2020 Democrats had a 7.3% lead in the generic ballot going into election day and Republicans picked up 14 House seats, contrary to the “blue wave” many were expecting. This understatement of GOP House support in polling also happened in 2014 and 2016.

4. Even respected “gurus” have been wildly wrong

The Cook Political Report is often seen as the leading election forecaster in Washington, D.C. I know and respect the people who run this organization. It caused a ripple last month when they moved five races in the Democrats’ direction and asserted that a GOP House win is “no longer a foregone conclusion.”

Commentators seizing on this latest call forget how wrong Cook was in 2020, when their final House call was that Democrats were poised to expand their majority by 10 to 15 seats — only to see Republicans gain 14. That’s a big miss. The work of experienced political analysts in Washington is useful input for assessing the race, but hardly the final word.

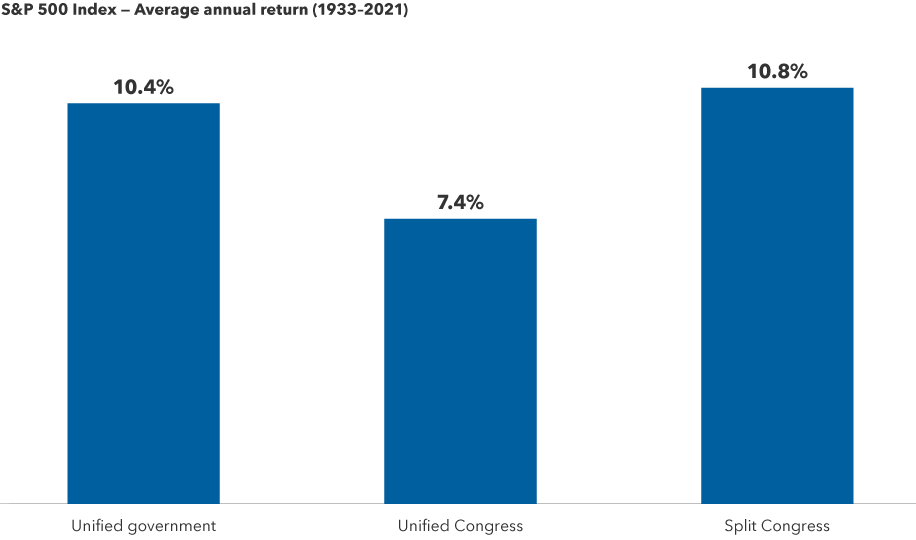

U.S. stocks have historically done well when Congress is split

Sources: Capital Group, Strategas. As of 12/31/21. Unified government indicates White House, House and Senate are controlled by the same political party. Unified Congress indicates House and Senate are controlled by the same party, but the White House is controlled by a different party. Split Congress indicates House and Senate are controlled by different parties, regardless of White House control. Past results are not predictive of results in future periods.

To be clear, I think this latest comeback narrative is a function of the national media’s thirst for a change in the story line. The Democrats are also moving aggressively to try to make the midterms more of a “choice,” and not just a referendum on the president. But as I read their work, thoughtful political analysts — even on the left — are mostly acknowledging that the House outlook remains firmly in the GOP’s favor.

What if Republicans win the House and the Senate?

That would probably result in some epic confrontations between Congress and the White House — including a potential showdown over a middle-class tax cut. Could Biden and the Democrats realistically oppose a tax cut for everyday folks as the presidential election approaches? It would be a tough call.

No doubt, such battle lines are already being drawn for 2024.

The S&P 500 Index is a market capitalization-weighted index based on the results of approximately 500 widely held common stocks. The index is unmanaged and, therefore, has no expenses. Investors cannot invest directly in an index.

The S&P 500 (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2022 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part is prohibited without written permission of S&P Dow Jones Indices LLC.

Matt Miller

Matt Miller