Client Relationship & Service

Practice Management

To-do list: How to take your practice to the next level

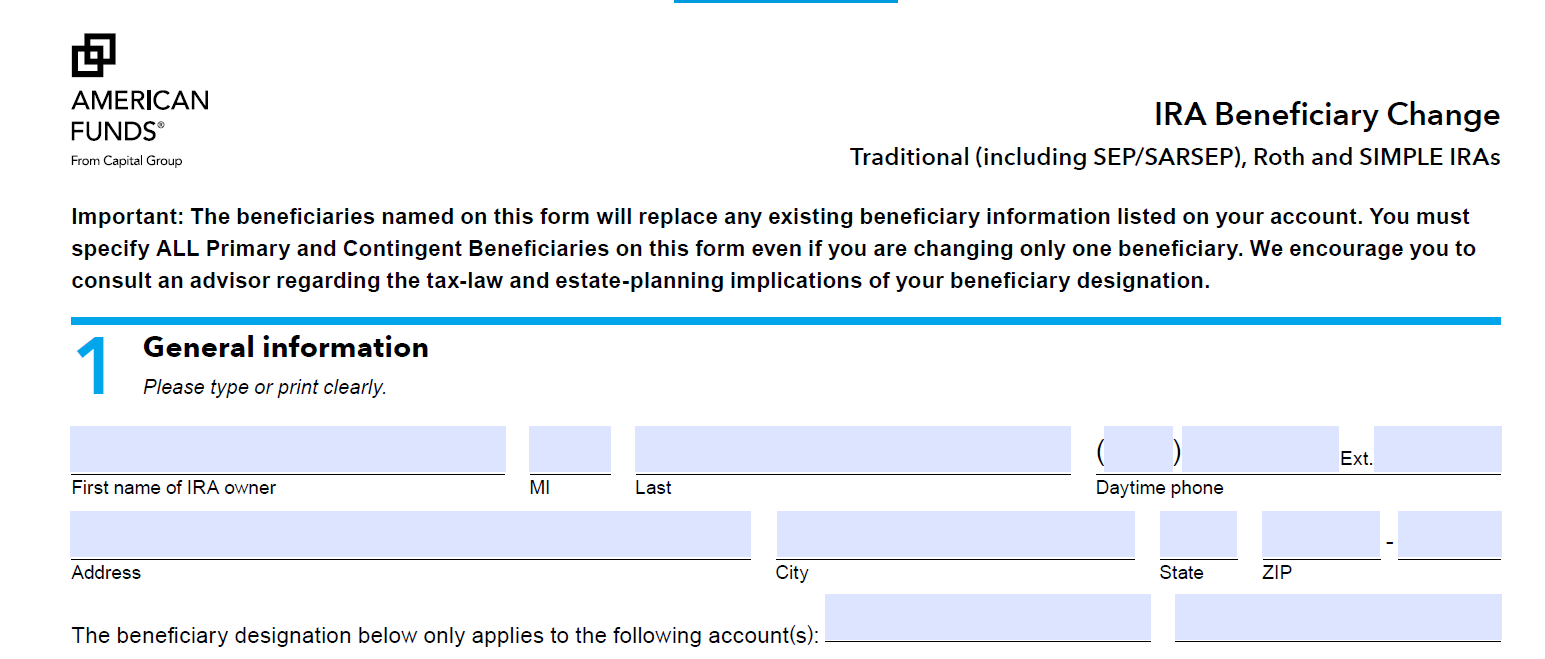

- Retirement planning: Review beneficiary designations on IRAs and retirement accounts and collaborate with clients’ estate planning counsel to determine whether the designations are consistent with estate planning objectives.

- Estate and financial planning: Monitor changes in clients’ personal, financial or legal situations, update information in a central place, and collaborate with clients’ tax advisors and estate planning counsel to determine if clients should have a new estate plan or modify an existing one.

- Wealth transfer planning: Monitor contributions to 529 plans, and collaborate with client’s tax advisors to determine if gift tax returns are needed.

Advisors: Stop limiting yourself to just managing your clients’ investments. Plenty of other good advisors representing high net worth clients can craft asset allocations, build financial models and carry out portfolio rebalancing, too. Truly great advisors take it to the next level by adding value to client relationships beyond just investment management — crossing the aisle to help clients’ estate and tax planning professionals.

“For the most part, every financial advisor has the same investment services at their fingertips,” says Steven Price, former senior vice president at Capital Group Private Client Services. “What sets them apart from other advisors is the ability to offer a broader view.”

Price asked a prominent estate planning lawyer in the Los Angeles area what it would take for the lawyer to refer business to the advisor. “He told me that he could have three meals a day, five days a week paid for by financial advisors who talk about their investment services and platforms,” Price says. “But this lawyer was looking for an advisor who could help him solve his clients’ estate planning challenges. He could care less about investment offerings and platforms. Then he’ll give you a referral.”

You don’t have to be a trust or estate planning lawyer to tap into your clients’ “centers of influence,” or a network of specialized professionals focused on tax, trust and estate planning. Just listen carefully for opportunities to work with the tax and estate planning specialists before issues turn into problems. “It’s the ability to ‘pull on clients’ heartstrings,’ by asking probing questions, where advisors can stand apart,” Price says. “Clients’ centers of influence want to work with people who are ‘interested in their audience,’ not those trying to be ‘interesting’ with a sales pitch on financial products,” Price says.

Here are three ways to better serve clients and set your firm apart at the same time:

To-do item #1: Examine the beneficiary designations of retirement accounts — especially when wills and revocable trusts are created or updated.

What good advisors do: Good advisors are well versed on the age 70½ required minimum distribution rules and the exceptions to the 10% penalty on withdrawals prior to age 59½. Most advisors will also generate a prudent risk-adjusted portfolio. But that’s just the price of admission and won’t help you stand out.

At a recent Capital Group event, three advisors were asked how they would help a prospective client with a $2 million retirement account. The first advisor talked about building an asset allocation model for the hypothetical prospect, and the second advisor discussed risk tolerance and time horizons. That was solid advice, but it didn’t set them apart from the competition. The third advisor, who won the contest by overwhelming votes from her peers, asked nothing to do with investment management but instead asked the prospect: “What are your estate planning goals with your IRA?” Price says, recalling the event.

Beneficiary designations need to work in concert with clients’ overall estate plans. Consider an IRA owner who updated his estate planning documents to create a revocable living trust that divided the trust estate into a marital trust and an exemption trust upon his death. Then, he changed the IRA beneficiary designation from his spouse to the revocable trust. When the IRA owner passed away, the surviving spouse was surprised that she was unable to rollover the IRA and achieve the benefits of income-tax deferral because the trust was the beneficiary. Even worse consequences, including a needless probate, would have been the outcome if the IRA owner named his estate as the IRA beneficiary.

What great advisors do: There are scores of mistakes when it comes to naming beneficiaries for retirement accounts. But great advisors head those off by listening. When clients create or update their estate plans, they’re telling you — without actually telling you — it’s time to examine what beneficiaries are named in their IRAs. That’s when great advisors will measure how large a clients’ retirement assets will be and whether the entire amount will be needed. Great advisors will also proactively review clients’ beneficiary designation forms to examine who is named as beneficiaries and coordinate these designations with the client’s estate-planning counsel. “Review your clients’ beneficiary designations with their estate planning attorney to make sure it is consistent with the overall estate planning objectives,” Price says.

Action item: Pay attention for broader issues when clients update or create their estate plan. Start by downloading the beneficiary designation forms on file from the retirement account custodians. Also view American Funds’ IRA Beneficiary Change and Required Minimum Distribution (RMD) Request forms

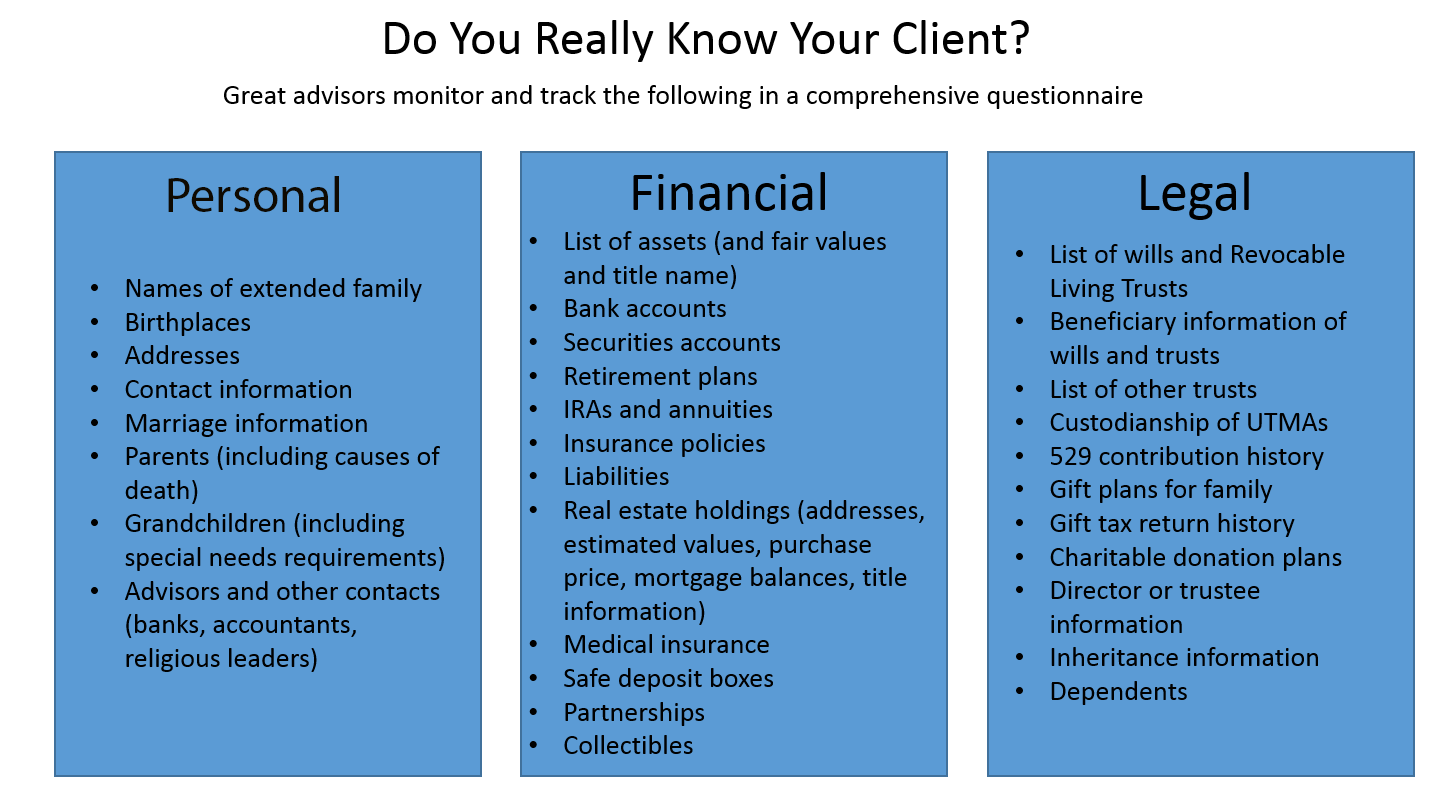

To-do item #2: Get client facts — not just account numbers.

What good advisors do: Most financial planners maintain a list of clients’ investment accounts for purposes of building an asset allocation model. Good advisors also gather personal information on clients and their primary accounts as they build a relationship, starting with the first meeting.

What great advisors do: “Advisors who set themselves apart see any opportunity to create a comprehensive document that will not only help the client, but the client’s family, tax advisor and estate planning attorney. This document must track all aspects of clients’ lives connected with their personal relationships, financial and legal facts,” says David Unanue, senior vice president of American Funds. Tracking a full picture of the clients’ situation, in one place, can help an advisor be a go-to person, not just a small piece of a team.

“Don’t hit clients with the entire form right away, but collect data and look for events over time and know life or economic events that trigger needed updates,” Price says.

Action item: “Great advisors know recent tax law changes create a natural opportunity to revisit a client’s investment inventory plan,” Price says. For instance, married couples with a net worth in the range of the increased combined exemption amount of $22,400,000 in 2018 should have their estate planning attorney review existing estate plans. But it’s much more than that. Any changes to the personal facts in a client’s life — marriages, births, deaths and divorces — have broad meaning well beyond the asset allocation. For example, perhaps the client is concerned about the long-term stability of her child’s recent marriage. The client may wish to leave that child assets in a trust rather than outright. Changes in financial facts are important, too, including increases in net worth, changes in asset mix or any increase or decrease to the client’s income statement.

Asking clients to fill out a form that lists all this information, keeping it up to date and making sure the right people have a copy is one of the fundamental ways a financial advisor can reach into the world of trust and estate planning professionals. “It sounds so simple, but few people do it,” Unanue says, “your clients will thank you.”

Advisors might build their own inventory sheets using client accounting software, or they can use this form that Capital Group created.

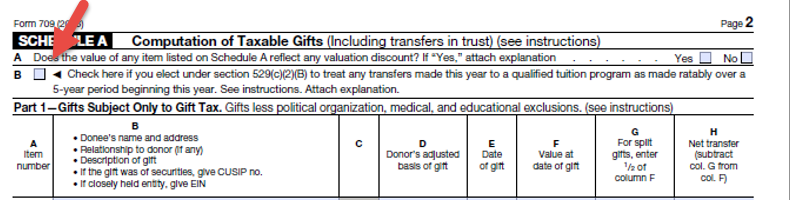

To-do item #3: Review wealth transfer strategies, such as 529 contributions, for unintended consequences.

What good advisors do: 529s are great ways to make tax efficient gifts to children and grandchildren. Good advisors help clients build prudent asset allocations, run financial models on tuition costs and talk to clients about the benefits of “front-loading” contributions. High net worth clients often take advantage of the Federal gift tax rules that allow them to put five year’s worth of annual gifts into a 529 at one time, for a $75,000 one-time contribution in 2018 ($15,000 times five years).

What great advisors do: Front-loading 529 contributions is a powerful tool, but one that can cross over to estate planning and give the financial advisor a way to stand apart from peers. Great advisors know that if a client front-loads 529 contributions, it can trigger the need to file a gift tax return to elect front loading. This requires checking box B on Schedule A on IRS Form 709, which is the required gift-tax return.

Action item: Collaborate with clients’ tax advisor. A client who makes a $75,000 front-loaded contribution for a beneficiary without checking the box on the 709 is in for a surprise. Turns out just $15,000 of the contribution qualifies for the annual exclusion. That means the remaining $60,000 contribution is taken from the client’s lifetime exemption ($11.2 million in 2018). “Taking it the extra step and communicating with the tax advisor about the gift-tax return filing requirements not only adds value to the client relationship, but also enhances the networking opportunity with an integral member of your client’s team,” Price says.

Idea in action

Advisors often look to connect with accountants and estate planning attorneys for access and referrals to high net worth clients. “But taking them out to lunch isn’t how it’s done,” Price says. Let other advisors feed these professionals. Rather, be a great advisor who can help the centers of influence help their clients by listening to what’s important. This can help the estate and tax planning processes and increase clients’ tax savings. But you also help the client’s other centers of influence, which makes you an advisor they want to work with and refer clients to in the future.

Remember if you’re doing it right you should be “interested, not interesting,” Price says.

RELATED INSIGHTS

-

-

Traits of Top Advisors

-

Practice Management

Use of this website is intended for U.S. residents only.