Client Relationship & Service

Capital Ideas

Investment Insights from Capital Group

Practice Management

- Clients want to know their RIA firm can serve them — and their family — beyond the original founders’ tenure.

- Gradual changes to a firm’s leadership allow clients to acclimate to new faces over time.

- Making collaboration part of a company’s culture is key during a succession.

Preparing clients for the future? That’s something PDS Planning has done for three decades. The RIA firm, though, is also thinking more about its own days ahead, showing it can keep serving clients for generations to come.

About three years ago, the company accelerated its succession plan — the process of handing control and management from the founding partners to a new set of owners. Lessons it learned can be applied by other RIAs thinking about their own futures.

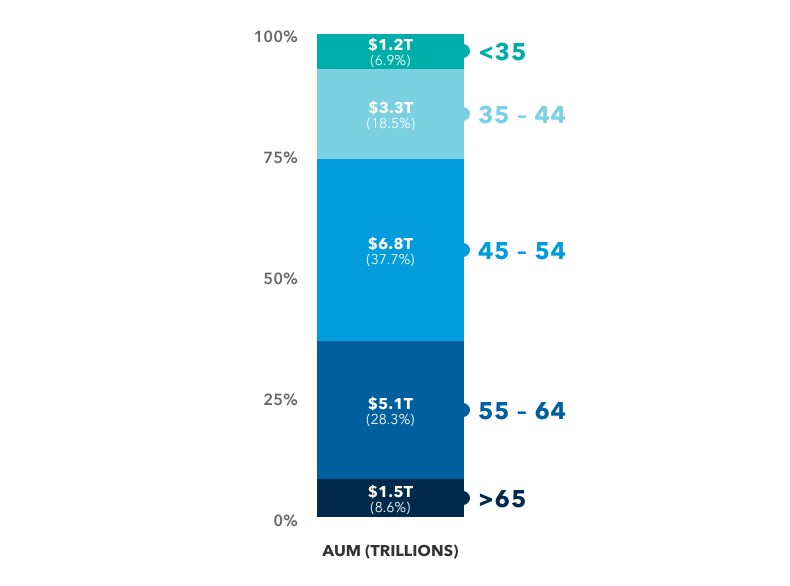

If succession isn’t already top of mind with advisors, it will be. The average advisor is 50 years old, and advisors age 55 and older manage 37% of assets, says Cerulli Associates’ U.S. Advisor Metrics 2017 report. Moreover, 28% of advisors within a decade of their planned retirement don’t have a succession plan in place, Cerulli found. Without a central practice for succession, as with many wirehouses, it’s incumbent on independent RIA firms to come up with their own plans.

The average advisor is 50 years old.

Advisors aged 55 and older manage more than a third of assets. Assets under management by advisor age.

Sources: Cerulli Associates, Meridian IQ, Investment Company Institute, Insured Retirement Institute, VARDS, Strategic Insight/SIMFUND, Investment News, Judy Diamond, Department of Labor, PLANSPONSOR, S&P Capital IQ MMD, Financial Planning, Financial Advisor Magazine, Investment Advisor Magazine, and Cerulli Associates, in partnership with the Investment Management Consultants Association, WealthManagement.com, and the Financial Planning Association® (FPA®)

PDS Planning — an RIA firm based in Columbus, Ohio, with more than $565 million in assets under management — got ahead of this. Kurt Brown, chief investment officer and one of the firm's three new owners, approached the leadership transition deliberately and carefully.

As with many RIAs firms with founders at the helm, PDS Planning needed a succession plan. The founders, who built the firm out of an accounting practice, started planning for the future years ago.

Enter Brown, 31. Having joined the firm 10 years ago as an intern, he was eager for more responsibility and saw a smooth transition as a way to extend the firm’s success and ensure clients’ needs are met into the next generation. More than half the firm’s assets under management are held by high net worth clients, so preserving relationships beyond the founders’ careers was key.

Clients “want to know that they’re not only going to have a trusted advisor there for them, but a trusted advisor there for their children,” says Brown.

Such transitions can be difficult, as clients have decades-long and personal relationships with the founders, who are taking a backseat role. But Brown says that correctly handled transitions get firms thinking about their future and offer big benefits to clients.

How did PDS pull off a successful transition? Brown offers several tips:

- Take a team approach. Brown says that for a successful transition, “The biggest piece of advice is to create a team structure.” It’s critical for clients to routinely meet with more than one member of the firm’s professionals. Doing this enables clients to interact with a deeper bench of professionals and allows “transition to the second generation of owners to be much more seamless.”

RIA firm owners that include other members of the firm, including those who could be the future owners, give clients time to build trust and bond with the next generation of leadership.

“When clients meet with us, they don’t just meet with Kurt. There’ll be other individuals in the room. It could be an associate advisor or could be a customer service relationship manager, that will also be involved in that meeting,” he says. Not having a team approach can limit the firm’s ability to evolve.

Members of the team still specialize. Brown manages investments for all clients as CIO. Another partner handles business functions as managing principal and a third partner is director of financial planning and marketing. “We all make decisions jointly, as one, but we think it’s important to have specializations,” he says.

- Go slow. Don’t make overnight changes to a practice when you decide you want to transition. Allow the new owners to gradually build their position in the firm and make incremental changes to the practice.

Making incremental changes not only allows clients to adjust to new faces but also for existing owners or founders to transfer knowledge to the new management team.

For nine years, Brown sat in meetings with the founders of the firm. “That allows us to learn from them and continue their legacy with our clients,” he says. That’s even more important as original owners visit the office less frequently.

- Anticipate questions from clients – and get ahead of them. Don’t wait for clients to ask you about changes they’re noticing at the firm. PDS Planning communicates with clients in a monthly newsletter, quarterly newsletter, quarterly webcast and annual meeting. These, in addition to in-person meetings, have been great ways to talk about changes at the firm, its personnel and the investment portfolio.

Be ready for anything clients might wonder — and ask — about. “Kurt, you’re a young individual. How can I have you manage our money?” was one of the most common questions clients asked. Part of this question was addressed over time as clients worked with the new team and newer team members.

Clients also asked how the firm is positioned over the next five, 10 and 20 years. This was an opportunity to discuss the age ranges of the new owners, now ranging from the early 30s to the early 40s. “We don’t have a bunch of owners who are 60, 70 or 75 years old,” Brown says.

- Protect your culture. During a transition, it’s easy for a firm to lose what made it successful. One way to safeguard against this from happening is to groom new owners from the inside over time. When you sell to an outside firm, it’s more likely the culture will change, which may not be the goal. “The founders have done an incredible job of building an incredible company,” he says. “We wanted to maintain that culture.”

The firm’s goal to preserve its culture is one thing that drew Brown to work there originally. He joined PDS Planning as an intern, but let the owners know he was looking to be more involved. As the son of an entrepreneur, Brown made it clear he wanted more responsibility and soon was joining client meetings.

- Build for the future. Pulling off a management handoff is just the first part of a successful transition. The new leadership needs to start pushing the firm into directions for growth — and to groom the next generation of owners and clients as the cycle continues.

Preparing for the future also means that RIAs must shift to meet their clients’ needs. For example, Brown sees a shift away from face-to-face meetings over the next two decades. “They still want a trusted advisor. They still want a person they can always contact, but it might not necessarily be an in-person meeting in the office,” he says. So PDS plans to explore new systems that will allow it to serve its clients remotely.

Video

RELATED INSIGHTS

-

How to create a repeatable, referral-generating onboarding process for new clients

-

Traits of Top Advisors

4 ways to build a brand that fits your client -

Practice Management

RIA leaders weigh in on three key industry issues

Use of this website is intended for U.S. residents only.

Kurt Brown

Kurt Brown