Client Relationship & Service

Demographics & Culture

- HNW women constitute a growing client opportunity. Wealth-X’s research shows they tend to display greater loyalty to and advocacy of their trusted advisors.

- Seek to understand them and help them as individuals. Although as a cohort HNW women are demographically different from their male counterparts, their individual needs and desires for their wealth are just as unique.

- Don’t underestimate a wife/partner’s role as decision maker in their relationship with your male clients. Use their greater tendency toward advisor loyalty to minimize the risk of losing assets during wealth transfer events.

Women are becoming wealthier and constitute a growing segment of the HNW population. But what do they look like as a group and how should advisors approach HNW women?

A group not to miss out on

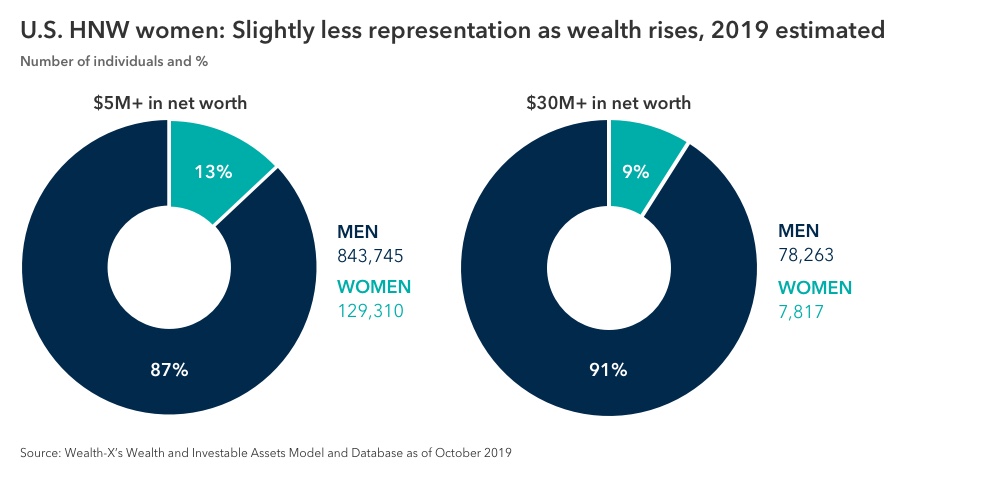

Wealth demographics change over time and this is certainly true of women, who, Wealth-X research shows, are outpacing the male population in terms of growth in the number of wealthy individuals. According to Wealth-X’s proprietary data assets on the wealthy, women now account for 13% of those with $5M+ in net worth, with wealth at $2.1T − and we expect this to continue growing over time.

More women are launching their own business ventures − and this is gradually being reflected in the numbers. Still, as a source of wealth, inheritance also continues to be important, and many HNW women are recipients of family wealth that is passed down.

Interestingly, there is slightly less representation among women further up the wealth pyramid − for example, among those with $30M+ in net worth, just 9% are women. Yet, this is not altogether unsurprising: Wealth takes time to grow and accumulate and it will, therefore, take longer for increased female entrepreneurialism to feed into the higher wealth echelons.

What this means for RIAs:

This growing cohort is an opportunity you cannot afford to ignore. Female clients are valuable for another reason: Surveys of HNW women and interviews with wealth management executives1,2 suggest that female clients display greater loyalty to and advocacy of their trusted advisors. Developing great relationships with clients in this segment could yield significant dividends in both the short and long run.

Demographically, female clients are different from their male counterparts

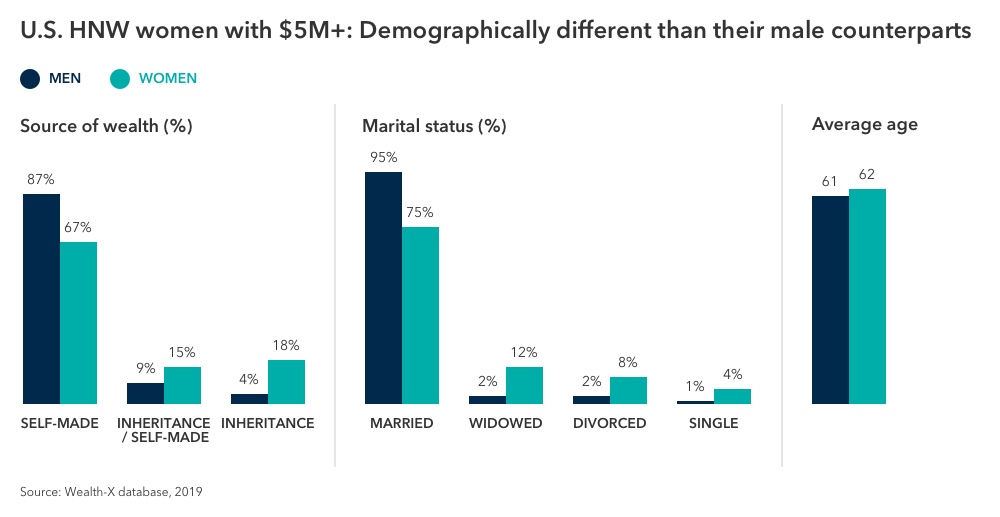

While they share many similarities, HNW women do have different demographic profiles than their male peers. Firstly, how they became wealthy differs. The vast majority of those with $5M+ in net worth have created their fortunes via their own efforts, but almost one-fifth of HNW women have acquired their wealth through inheritance.

With regard to the primary industry among men, banking and finance leads, but among women, nonprofit and social organizations ranks highest, accounting for over a quarter of main occupations. This may point to a greater interest in not-for-profit causes among this segment, but is also likely related to a greater share of inherited wealth, with these individuals in particular tending to devote the largest share of their professional time toward such causes.

While the average age of HNW women and men is similar (early 60s), marital status is dramatically different. While 75% of HNW women are married, the percentage of married HNW men is far greater, at around 95%. Twelve percent of the group of married women are widowed, in contrast to just 2% of men, likely explained by the former’s longer life expectancy.

What this means for RIAs:

RIAs should look to understand and help HNW women as individuals. As women tend to demonstrate greater advisor loyalty than men, don’t underestimate their role as decision makers in their relationships with your male clients. Make sure you establish a relationship with each spouse individually. You don’t want to lose management of these assets during inevitable wealth transfers.

For those offering advisory services, look to ensure that you have a diverse representation of advisors. Women may not need to have a female advisor, but they are likely to feel more comfortable knowing that their advisor’s company has awareness and experience beyond working with a wealthy male client.

1 EY. Harnessing the power of women investors in wealth management: A look at the North American market, 2016.

2 WealthBriefing. Winning Women: Key Insights for Wealth Firms Targeting Today's Dynamic Female Clients, December 2017.

RELATED INSIGHTS

-

-

Traits of Top Advisors

-

Practice Management

For financial professionals only. Not for use with the public.