Client Relationship & Service

AdviserInstitutions & ConsultantsIndividual InvestorsInstitutions & ConsultantsFinancial IntermediariesIndividual InvestorsInstitutionelle Investoren & ConsultantsFinanzintermediärePrivatanlegerInstitutions & ConsultantsFinancial IntermediariesIndividual InvestorsInstitutions et consultantsIntermédiaires financiersInvestisseurs particuliersFinanciële tussenpersonenIndividual InvestorsFinancial AdvisorsInstitutions and ConsultantsParticuliersConseillers financiersInstitutions et consultantsFinancial IntermediariesIndividual InvestorsInstitutions & ConsultantsFinancial IntermediariesIndividual InvestorsInstitutions & ConsultantsFinancial IntermediariesIndividual InvestorsInstitutions & ConsultantsFinancial IntermediariesIndividual InvestorsInstitutions et consultantsIntermédiaires financiersInvestisseurs particuliersInstitutions & ConsultantsFinancial IntermediariesIndividual InvestorsInstitutionelle Investoren & ConsultantsFinanzintermediärePrivatanlegerFinancial IntermediariesIndividual InvestorsInstitutions & ConsultantsFinancial IntermediariesIndividual Investors機構投資者及顧問金融中介個人投資者Institutions & ConsultantsFinancial IntermediariesIndividual InvestorsInstitutions & ConsultantsFinancial IntermediariesIndividual InvestorsInstitutions & ConsultantsFinancial IntermediariesIndividual InvestorsClienti IstituzionaliIntermediari e Consulenti FinanziariInvestitori privatiJapanFinancial IntermediariesIndividual InvestorsFinanzintermediärePrivatanlegerInstitutions & ConsultantsFinancial IntermediariesIndividual InvestorsInstitutions et consultantsIntermédiaires financiersInvestisseurs particuliersInstitutionelle Investoren & ConsultantsFinanzintermediärePrivatanlegerInstitutions & ConsultantsFinancial IntermediariesInstitutions & ConsultantsFinancial IntermediariesIndividual InvestorsInstitutions & ConsultantsFinancial IntermediariesIndividual InvestorsInstitutions & ConsultantsFinancial IntermediariesIndividual InvestorsInstitutions & ConsultantsFinancial IntermediariesIndividual InvestorsInstitutions & ConsultantsFinancial IntermediariesIndividual InvestorsInstituciones y consultoresIntermediarios financierosInversores individualesInstitutions & ConsultantsFinancial IntermediariesIndividual InvestorsInstitutions & ConsultantsFinancial IntermediariesIndividual InvestorsInstitutions et consultantsIntermédiaires financiersInvestisseurs particuliersInstitutionelle Investoren & ConsultantsFinanzintermediärePrivatanlegerInstitutions & ConsultantsFinancial IntermediariesIndividual InvestorsInstitutions & ConsultantsFinancial IntermediariesIndividual InvestorsFinancial ProfessionalRIAIndividual InvestorPrivate ClientRetirement Plan InvestorInstitution or ConsultantEmployer or Plan SponsorThird-Party AdministratorU.S. Offshore AdvisorsOffshore de EE. UU.International - otherAsia - other

Portfolio Construction

From January 1 to March 31, 2023, Capital Group’s Portfolio Consulting and Analytics team analyzed 136 registered investment advisor (RIA) portfolios as part of its Portfolio Analysis Review service. The overall goal of these reviews is to help advisors gain a better understanding of how their portfolio exposure compares to their stated goals and objectives and to provide deeper insight on portfolio risk and positioning in the current environment. The team’s recent portfolio analyses highlight interesting data on duration and dividend quality mismatches between advisors’ portfolio objectives and the approaches they have taken to achieve them.

- RIA portfolios are short duration on average, yet the upward movement of yields makes it a good time to consider increasing duration through core fixed income vehicles.

- Inflation uncertainty has kept stock/bond correlations high, highlighting the need for alternative measures to assess how well advisors’ fixed income exposures are diversifying equity positioning.

- Embracing dividend-paying stocks can shift the process of de-risking equity exposures from a growth or value decision to one focused on quality. Higher quality dividend payers may offer a better hedge against volatility than higher yielding ones.

From January 1 to March 31, 2023, Capital Group’s Portfolio Consulting and Analytics team analyzed 136 RIA portfolios as part of its Portfolio Analysis Review service. The overall goal of these reviews is to help advisors gain a better understanding of how their portfolio exposure compares to their stated goals and objectives and to provide deeper insight on portfolio risk and positioning in the current environment. The team’s recent portfolio analyses highlight interesting data on duration and dividend quality mismatches between advisors’ portfolio objectives and the approaches they have taken to achieve them.

Among their findings, Capital Group’s portfolio consultants discovered that RIAs may be missing out on the yield opportunities available in a rising rate environment by limiting duration. They also found that advisors may be able to better de-risk their equity exposure by increasing exposure to quality, dividend-paying companies.

In our conversations with advisors, Capital Group’s portfolio specialists are hearing about the leading operational challenges to running a successful practice, notably the critical but often time-consuming nature of the investment process. Given current uncertainties around factor timing, inflation and terminal interest rates, we believe advisors could be well-served by considering flexible allocation portfolios that entrust more decisions to an active manager.

Consider lengthening duration

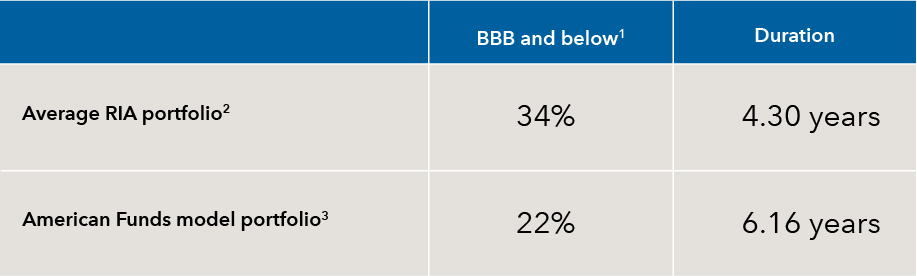

Given expectations for interest rate cuts after an aggressive period of monetary tightening, investors appear to be moving out of short-maturity into high-quality, long-maturity bonds. Despite strong flows industrywide into intermediate core and government bonds, advisors have remained short duration. This duration mismatch may be even greater than the table below shows given client cash held outside advisor portfolios.

Advisor portfolios are short duration and long lower quality credit

Sources: Capital Group, FactSet, and Morningstar. Data as of March 31, 2023.

Most advisors we work with view fixed income as a way to diversify equity risk and preserve capital. But our analysis shows advisor portfolios maintain above-average exposure to higher risk, lower quality securities, which reflects the tension between quality and duration. By reducing duration risk through interest rate management, many advisors may have unknowingly traded duration risk for credit risk.

The rapid upward movement of yields over the last year makes it a good time to consider increasing duration through core fixed income vehicles. Core and core-plus approaches can provide flexibility through changing bond environments. These strategies are active approaches that can take advantage of longer duration opportunities while also improving credit quality.

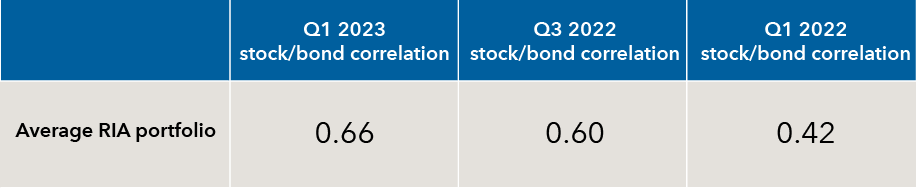

Alternative ways to gauge fixed income diversification

Ongoing inflation uncertainty has kept stock/bond correlations high, and advisor portfolio correlations remain slightly elevated in 2023. Higher correlations make equity risk mitigation more challenging. Stock/bond correlations may come down as inflation uncertainty wanes, but in the interim our analysis tools can assess how well your fixed income exposures have diversified equity positioning.

Our Portfolio Analysis Review service can examine rolling correlations, excess return correlations, scenario analysis and sector decomposition to gauge effective diversification of your portfolio and inform any potential changes to your fixed income exposures.

Stock/bond correlations remain high

Source: Morningstar. As of March 31, 2023. Stock/bond correlation represents the average 3-year correlation of advisors’ fixed income sleeves to the S&P 500 Index.

Not all dividends are created equal

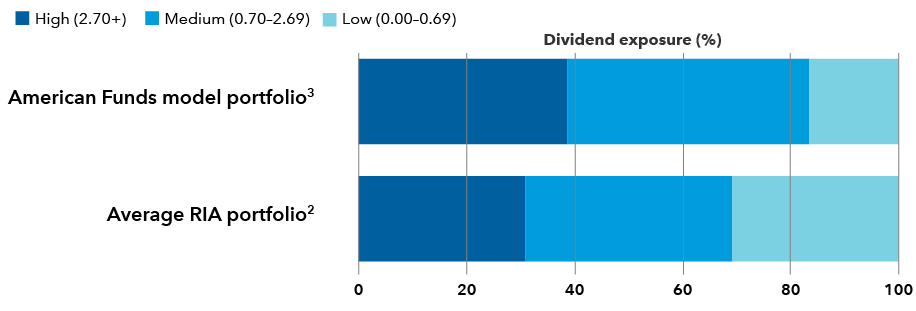

On the equity side, the recent trend in industry fund flows and within advisor portfolios has been toward de-risking. This has been characterized most by a move from growth to value. However, trying to time factor shifts can be a headwind to portfolio performance. An allocation to dividend-paying stocks may be a better option, moving the conversation from a choice between growth and value to a choice of quality.

RIA portfolios show room for more dividend exposure in equity positioning

Source: Morningstar. As of March 31, 2023.

The average RIA has a higher allocation to low- or no-dividend payers as well as lower average quality for the dividend payers they own — a combination that has contributed to higher overall portfolio volatility. If advisors are de-risking equity exposures and seeking to improve the quality of their portfolios, simply owning stocks that pay a dividend may not be enough.

Higher quality dividend payers (as measured by the debt rating of that company’s bonds) may be more favorable than those with the highest yields since they may provide better downside protection during equity drawdowns.

Another notable feature in advisors’ dividend allocations is a lack of international exposure. This can occur when utilizing a single international manager, which has tended to be more growth-oriented in recent years, for example. International indexes, meanwhile, are weighted toward value and dividend stocks. A more global orientation toward dividends can be achieved with growth and income strategies that allow the portfolio managers to seek what they believe are the best investment opportunities, flexing between growth or income based on their investment convictions.

Examine your clients’ portfolios to improve efficiency and avoid common pitfalls

Running a business while managing a robust investment program for your clients can be a tough balance. Would it be helpful to know how your portfolios stack up relative to other RIAs?

If you are an advisor seeking a detailed review of your client portfolios, Capital Group can help. Request a personal consultation from one of our portfolio specialists to help benchmark your client portfolios, address your client specific investment needs and goals and consider flexible portfolio solutions.

1 For American Funds, securities in the Unrated category have not been rated by a rating agency; however, the investment adviser performs its own credit analysis and assigns comparable ratings that are used for compliance with applicable investment policies.

2 The average advisor portfolio is representative of the aggregate exposures of advisor portfolios analyzed by Capital Group’s Portfolio Consulting and Analytics team from January 1, 2023, to March 31, 2023.

3 American Funds model portfolio represents the most recent available data as of March 31, 2023. This model aligns closely to the broad asset allocation of the average RIA portfolio.

To read the full article, become an RIA Insider. You'll also gain complimentary access to news, insights, tools and more.

RELATED INSIGHTS

-

How to create a repeatable, referral-generating onboarding process for new clients

-

Traits of Top Advisors

4 ways to build a brand that fits your client -

Practice Management

RIA leaders weigh in on three key industry issues