Municipal Bonds

Investors are accustomed to volatility in stocks, but 2022 brought unprecedented challenges to the bond market as well. The U.S. Federal Reserve raised rates aggressively to fight inflation, battering both equity and fixed income investments. By year-end, those efforts helped to bring inflation from a peak of 9.1% in mid-2022 to 6.0% in February 2023, as measured by the Consumer Price Index.

For fixed income investors, the worst may be behind us. Fed funds futures — the market’s expectations of the federal funds rate — reflect a terminal (peak) rate around 5.0% by midyear. The federal funds rate is the interest rate at which depository institutions trade federal funds (balances held at Federal Reserve Banks) with each other overnight. While stocks remain volatile and the possibility of recession weighs on the minds of investors, that light at the end of the tunnel helped bonds to realize some positive returns for a few months in the wake of the turmoil. Following the collapse of SVB Financial, parent company of Silicon Valley Bank, and other banking sector pressures, lending has tightened. This may result in the Fed's monetary policy having a more meaningful impact on slowing economic growth.

As the International Monetary Fund signals slowing growth and the economy potentially enters a period of market contraction, municipal bonds could be a relative bright spot. Munis offer strong fundamentals, have historically held up well versus other asset classes during periods of market difficulty and can now provide strong income to help cushion price volatility.

Strength in numbers: Munis dig deep with meaningful fundamental data

The federal government disbursed billions of dollars to state, local and tribal governments via pandemic relief programs. By doing so according to formulas rather than state by state, the funds benefited all states to a degree, even helping lead some (like California) to report budget surpluses.

State balance sheets matter to the general obligation (GO) portion of the municipal market. These bonds typically provide municipalities with funding for varied needs, paid back by property, income and sales taxes. Another category of munis, revenue bonds, fund specific projects and are paid back by related revenue streams.

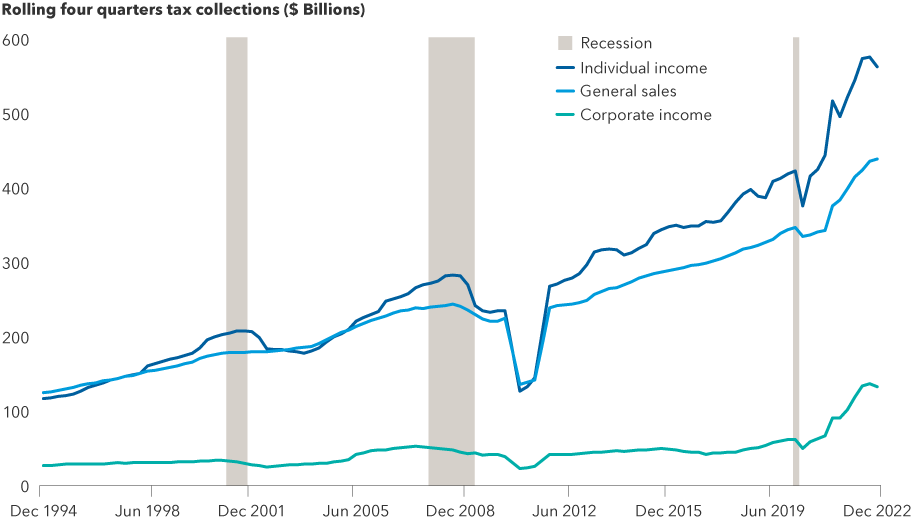

Many states now face a boon, which is good news for GOs. The National Association of State Budget Officers (NASBO) reports fiscal 2021 delivered record-breaking increases in general fund revenue and spending in fiscal 2022. According to NASBO, “States [in aggregate] saw two consecutive years of double-digit percentage revenue growth and collections far exceeding budget forecasts in fiscal 2021 and fiscal 2022.”

State tax revenues at record highs

Sources: Capital Group, Bloomberg, United States Census Bureau, National Bureau of Economic Research. Data as of 12/31/22. Past results are not predictive of results in future periods.

Despite healthy balance sheets, credit research remains essential, notes Karl Zeile, fixed income portfolio manager for The Tax-Exempt Bond Fund of America®. “Analyzing the strength of sector trends as well as issuer fundamentals is key to uncovering opportunities that can enhance a portfolio.”

For revenue bonds, the impact of interest rates is a two-sided coin. On one side, issuers came to market and borrowed at very low rates. This locked in a relatively low fixed cost for them to finance capital expenditures and infrastructure. Unlike corporate bonds, munis also typically don’t require refinancing on a regular basis. Muni projects come to market with decades-long, fixed-rate debt issuance aligned to the useful life of the project.

Now flip the coin for those issuers: Inflation results in rising revenues from these projects. Toll roads are an example of this. “When the toll price increases, greater revenues provide an incremental cushion against a fixed debt service cost. Issuers with growing revenues and low fixed costs can create attractive opportunities for muni bond managers,” Zeile explains.

Munis positioned for resilience in a recessionary environment

According to Moody’s Investors Service, broadly speaking, defaults have been rare for municipals. The average five-year U.S. municipal default rate since 2012 is 0.1%, in contrast to the average five-year global corporate default rate of 7.2% (Moody's Investors Service, April 21, 2022). But their potential resilience is even more notable in a contracting economy.

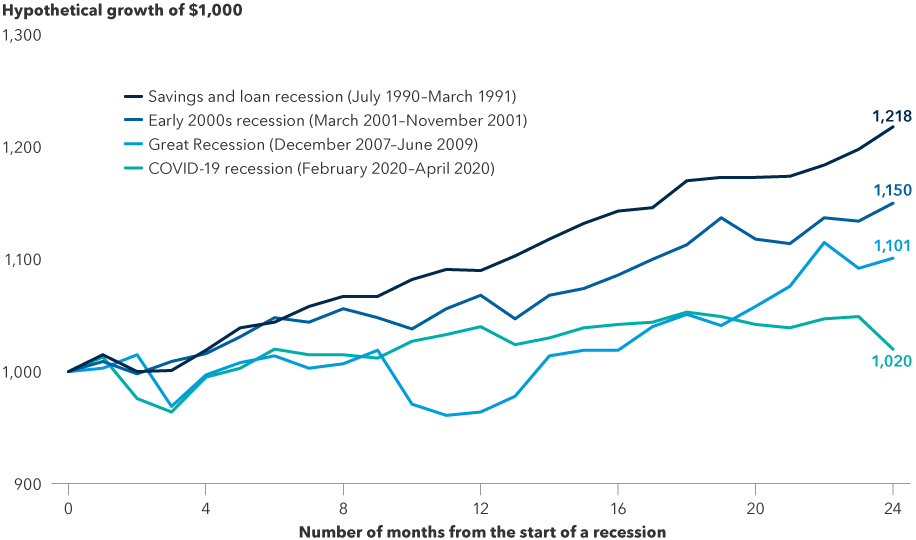

”Should we enter a recession, it does not seem likely to be driven by the excesses of a bubble," Zeile says. “It would potentially be a more traditional recession. I would expect equities to experience a correction due to the pressure on earnings. The job market may weaken, causing a cash crunch for consumers, and economic growth would further contract. We can’t predict the depth or length of a recession, but historically, munis have shown strong recovery after recessionary periods.”

Munis historically have recovered amid recession

Sources: Capital Group, Bloomberg, National Bureau of Economic Research. Data as of 1/31/22. Growth represented by Bloomberg Municipal Bond Index. Past results are not predictive of results in future periods.

Municipal credit quality is supported by an important economic benefit in recessions: Muni-related services are typically the “last skipped bill” as most revenue bonds, which make up approximately two-thirds of the muni market, are supported by essential services that tend to have high collection rates and thus are less sensitive to economic indicators.

“When recession knocks at the door with a car payment, credit card and a water bill due, everyone wants the ability to take a shower. People might not dine out at a restaurant, but they will open their wallets for water, electricity and gas to avoid shut-off,” says Greg Ortman, an investment director focused on the municipal bond market.

“Trash isn’t trash,” Ortman adds. “For-profit companies, such as those in waste management, hold contracts with local city governments, and they issue muni debt to help finance operations. Trash pickup has been very recession resistant, and it’s typically a much higher priority than a store credit card.”

The same principle applies for GO property taxes. Property taxes fund schools, police, parks and other local infrastructure. People may want to go on a shopping spree to decorate their home, but they need to pay their property taxes to keep their home.

In a recession, munis also tend to have a benefit shared by other fixed income sectors with interest rate sensitivity. The Fed could start cutting rates as the economy falters. Bond prices move inversely to interest rates. Falling interest rates would drive up bond prices, creating a tailwind for municipals.

This doesn’t mean every muni receives an automatic gold star. During the pandemic, some transportation agencies faced significant declines in ridership, resulting in significantly more volatility than in a traditional market.

“As we analyze sectors and sense weakness, we may shift holdings. Health care, and certainly hospitals, represent essential services. But are they as strong as they were before the pandemic? In broad strokes, I am a bit concerned about health care for a combination of reasons: the soaring cost of nursing care and a nursing shortage that does not have an easy fix. It’s expensive to hire, and you can’t train someone in two weeks. Even with those considerations, selectivity is possible. For example, to skirt some risk and consider credit quality, investigate a multi-state system or an integrated provider versus a single-site, standalone hospital,” Zeile says.

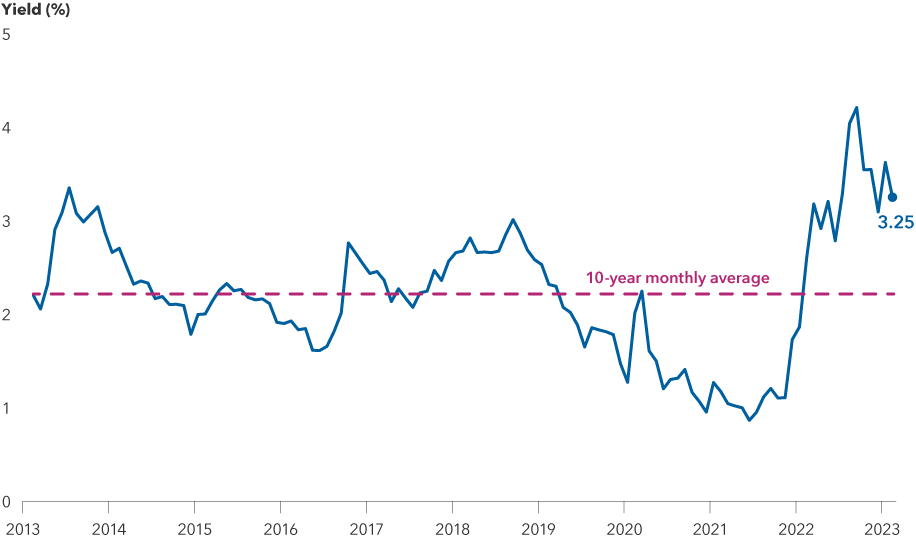

Higher income can serve as a shock absorber

Should volatility move center stage once again, munis have another advantage: Bond yields are near or above decade highs. The Bloomberg Municipal Bond Index began 2023 2.5 percentage points higher than the start of 2022. The lack of income provided by munis at the start of last year is part of the reason returns were so dire once rates began sharply rising. The bonds had very little income return to cushion the negative price return impacts from rising rates.

Municipal yields higher now than in the past decade

Sources: Capital Group, Bloomberg. Data as of 03/31/23. Yield represented by Bloomberg Municipal Bond Index. Past results are not predictive of results in future periods.

A painful road? Yes, but today’s rates can furnish greater shock absorption. If unexpected shocks hit markets and impact munis, the likelihood of negative returns is more distant with a stronger income component to soften the blow. The yield to worst of the Bloomberg Municipal Bond Index (representing the broad muni market) was 3.25% at the end of March. For periods when the yield was in this range (+/– 0.3%), the five-year forward return was 4.3% (according to an analysis of Bloomberg data over the past 20 years). When investing at yields observed in recent months, munis have traditionally experienced solid returns.

Contracting markets result in anxious investors, even if it’s part of the normal market cycle. You can’t have an expansion without the rubber band eventually snapping back. In recessionary periods, many high-quality bond sectors may fare well relative to equities. However, munis offer some unique advantages, including strong fundamentals, distinctive characteristics that provide some resistance to recessionary impact and higher current yields to act as a buffer. For investors seeking tax-exempt income, munis warrant consideration, particularly if growth continues to slow and recession fears grow.

Yield to worst is the lowest yield that can be realized by either calling or putting on one of the available call/put dates, or holding a bond to maturity.

Bloomberg Municipal Bond Index is a market-value-weighted index designed to represent the long-term investment-grade tax-exempt bond market.

Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services.

Karl Zeile

Karl Zeile

Greg Ortman

Greg Ortman