Retirement Income

Practice Management

RIAs’ exit options can be split into two main buckets: external sales or internal sales. Each path has its own unique features and requirements. While external sales tend to fetch the highest valuations and, therefore, the greatest immediate financial impact for owners, internal sales can be particularly valuable for legacy planning purposes and to effect a more gradual transition of ownership. But when it comes to choosing the ideal exit path, an RIA’s choice doesn’t necessarily have to be binary. With the right level of planning, a firm can lay the groundwork for an internal succession and still lead to a great eventual outcome through an external sale.

David DeVoe, a leading authority on RIA mergers & acquisitions (M&A) and a Capital Group RIA Advisory Board member, introduces the main paths for RIAs who are interested in exploring a sale, describes key considerations about each potential path and explains what advisors can start doing today to set themselves up for success in the future.

- Merger & acquisition (M&A) activity reached another record high in 2021, driven by RIAs’ interest in scale and need for succession-planning solutions.

- Buyers today are making it easier for RIAs to consider exit opportunities because they are strong organizations with sophisticated management teams, abundant access to capital and a thoughtful, strategic approach.

- The decision between an internal sale and external sale doesn’t need to be binary — firms that establish the next generation of leadership before pursuing an external sale can sell for premium valuations.

Merger and acquisition (M&A) activity has been extremely strong in the RIA industry. According to a December 2021 survey by DeVoe & Company, a leading consulting firm and investment bank focused exclusively on wealth management companies, the last eight years have seen record M&A activity among advisors.* And nearly two-thirds of the RIA leaders surveyed expect the record pace of deals to continue. Key drivers of M&A activity include high valuations, an aging founder demographic and critical need for succession planning, as well as continued growth in the pool of potential buyers — led by private equity-backed serial acquirers. But the number-one driver of M&A activity today may be something else entirely: advisors’ interest in scale.

If you are interested in selling your business — whether pursuing a minority sale to fuel continued growth, selling 100% of your company to walk away entirely, or something in-between — there are important questions to consider. Here, David DeVoe, a leading authority on RIA M&A and a member of Capital Group’s RIA Advisory Board, introduces the main paths for RIAs who are interested in exploring a sale. DeVoe also describes key considerations about each potential path and what advisors can start doing today to set themselves up for success in the future.

External sale: Trading long-term control for near-term impact

In an external sale, an RIA sells to a third party, such as a seasoned acquirer or another RIA. Compared to an internal transition of ownership, external sales tend to transact at higher valuations and, therefore, have a greater immediate financial impact on RIA owners (who generally trade the immediate cash impact for less participation in the future growth of the firm).

Selling to an external party, such as another RIA or a private equity-backed consolidator, has become an increasingly viable path for RIAs amid the uptick in deal activity. A general lack of succession planning is certainly influencing deal activity. But a more important driver has been advisors’ interest in scale. Firms recognize that joining a larger organization may relieve administrative headaches, provide broader access to products and services, enhance capabilities and provide further specialization that will allow them to better serve clients and improve their everyday lives.

One key consideration for RIAs is whether to pursue a minority sale or a controlling sale. In a minority sale, an RIA sells less than 50% of the company, retaining control over the firm, while in a controlling sale they sell more than 50%, relinquishing control. Minority sales can help with legacy planning — such as hiring the next generation of firm leadership and creating incentive programs to retain key employees. They can also be used to bring in a strategic, growth-oriented investor that can help fuel the continued growth of the firm. One key drawback of minority sales is that they tend to transact at lower valuations relative to controlling sales. In terms of tradeoffs for controlling sales, selling a majority stake in the firm may not be an attractive path for an RIA owner who wants to stay in the game for a number of years and whose true goals are to grow independently.

“The good news for potential sellers is that the buyer set is stronger and more sophisticated today than ever before, and many of these firms are paying very high valuations today.”

The types of buyers seeking to acquire RIAs has evolved and expanded in the last decade. The large consolidators have been very successful at acquiring and integrating RIAs and, thus, demonstrating the benefits of scale, which has validated the private equity-backed consolidator model. RIAs have taken notice of this success and have shown an interest in pursuing their own deals. According to research from DeVoe & Company, 60% of advisors said they plan to grow through acquisition in the next two years.* RIAs are interested in pursuing acquisitions for the primary reasons of acquiring talent and growing their number of clients and level of assets under management, as well as expanding their services and capabilities more broadly.

Buyers today are paving a smoother road for sellers to drive on. Most of the leading buyers today are strong organizations — they have sophisticated management teams, ready access to capital, and are thoughtful and strategic about differentiating their models and shaping the future of the industry.

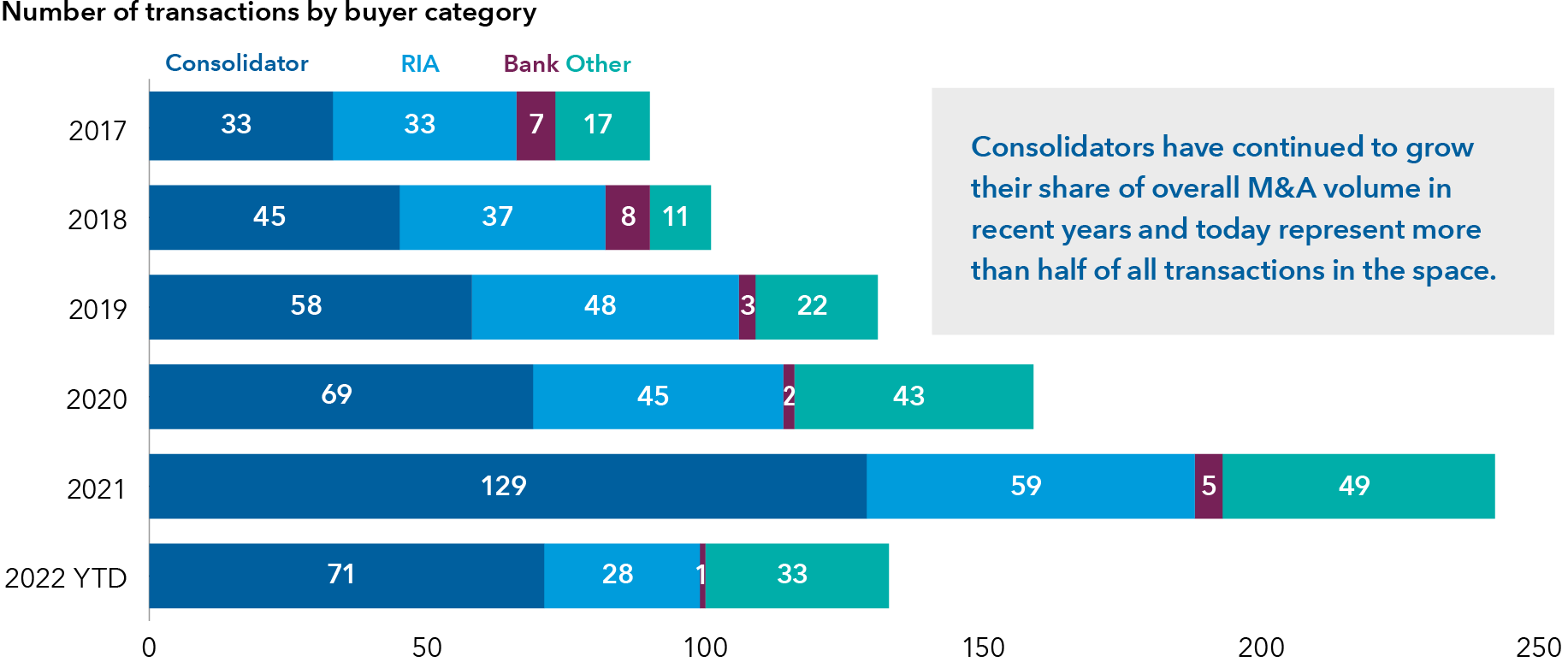

Consolidators lead buyer categories

Source: Q2 2022 DeVoe RIA Deal Book™. Data as of June 30, 2022.

So how can advisors prepare for an external sale? Before speaking with third parties and hiring an advisor, RIA owners should take time to think carefully about their specific goals, risks and challenges on both a professional and a personal level. It is crucial for the partners of an organization to align on their goals for the company and be very specific about the milestones they are trying to achieve and why. Beyond these goals for the business, it is critical for the management team to develop a clear understanding of their individual goals. Having clarity around what you’re good at, what you like and what you want to shift off your plate can help you identify the right partner.

“Deciding to sell your business isn’t just an economic question. These are life decisions that need to be approached with thoughtful self-reflecting and planning.”

Internal sale: Playing the long game

In an internal sale, an RIA’s ownership is sold to an individual or group of individuals within the firm. This type of transaction can serve as a powerful legacy planning tool that can help establish the next generation of leadership and maintain business as usual — which arguably should also help retain clients and staff. Compared to external sales, internal sales tend to transact at lower valuations, especially given today’s heightened valuation levels.

“The delta between external vs. internal sales can be as high as 2x. But if you have a rapidly growing business, patience may be your friend — you may be able to fetch a much higher valuation if you wait a few years and continue to grow.”

Despite the valuation gap, an argument can be made that the long-term value created through an internal sale may outweigh the immediate valuation bump achieved through an external sale. In addition to establishing the firm’s next generation of leadership and strongly incentivizing them to continue growing the business, internal sales tend to provide greater flexibility for current RIA owners to continue participating in the upside of the business even after they transition from day-to-day management of the firm. By retaining a stake in the firm as well as some level of control and strategic influence, existing owners may be able to generate outsized returns over the long term.

Another flavor of internal sales worth mentioning is the employee stock ownership plan (ESOP). An ESOP arguably takes the internal sale one step further, because the structure gives all employees a stake in the company’s ongoing success. The objective of an ESOP is to provide retirement benefits to employees through participation in the ownership of the company. The structure can be flexible to allow owners to transition their ownership and day-to-day responsibilities over time. However, the ESOP structure is highly regulated and, thus, requires careful planning.

Preparing for an internal sale requires a significant level of thoughtful planning to get the most out of the transaction. A key issue today is that for most firms, the next generation of leadership is not financially prepared to acquire their firm. This means that owners should take proactive steps to put successors in a position to meet the required sales terms, which can be accomplished by awarding small amounts of equity over time. Granting sweat equity in this way also helps employees begin thinking and acting like owners, which can lead to greater organic growth and eventually push the firm’s valuation higher.

A third path: The combination of an internal and external sale

The good news is that many advisors want to sell internally, and there are many ways to put that plan into action today. The bad news is that many advisors wait too long to set up an internal sale. The longer you wait, the shorter your list of options is likely to be. And if you wait too long, an internal sale can become too expensive for the internal team to handle.

Fortunately, the internal vs. external sale decision isn’t necessarily binary — it is possible to accomplish both an internal sale and external sale. The faster an RIA puts its succession plan in place, the more likely it is to increase the value of the firm in an eventual external transaction. By getting the future generation of leadership in place and helping them become equity shareholders, RIAs are better positioned to get a premium for the company in an external sale.

*Annual RIA M&A Outlook, DeVoe & Company, December 2021

To read the full article, become an RIA Insider. You'll also gain complimentary access to news, insights, tools and more.

Already an Insider?

David DeVoe

David DeVoe