Global Equities

You may have heard this before: Valuations on many international stocks are cheap and there may be opportunities for better growth potential in international markets.

But a robust U.S. equity market in the past decade has partly meant that financial professionals have allocated for domestics stocks over international equities by a 2.6-to-1 margin, according to a Capital Group analysis of 187 RIA portfolios from mid-October 2020 to mid-February 2021.

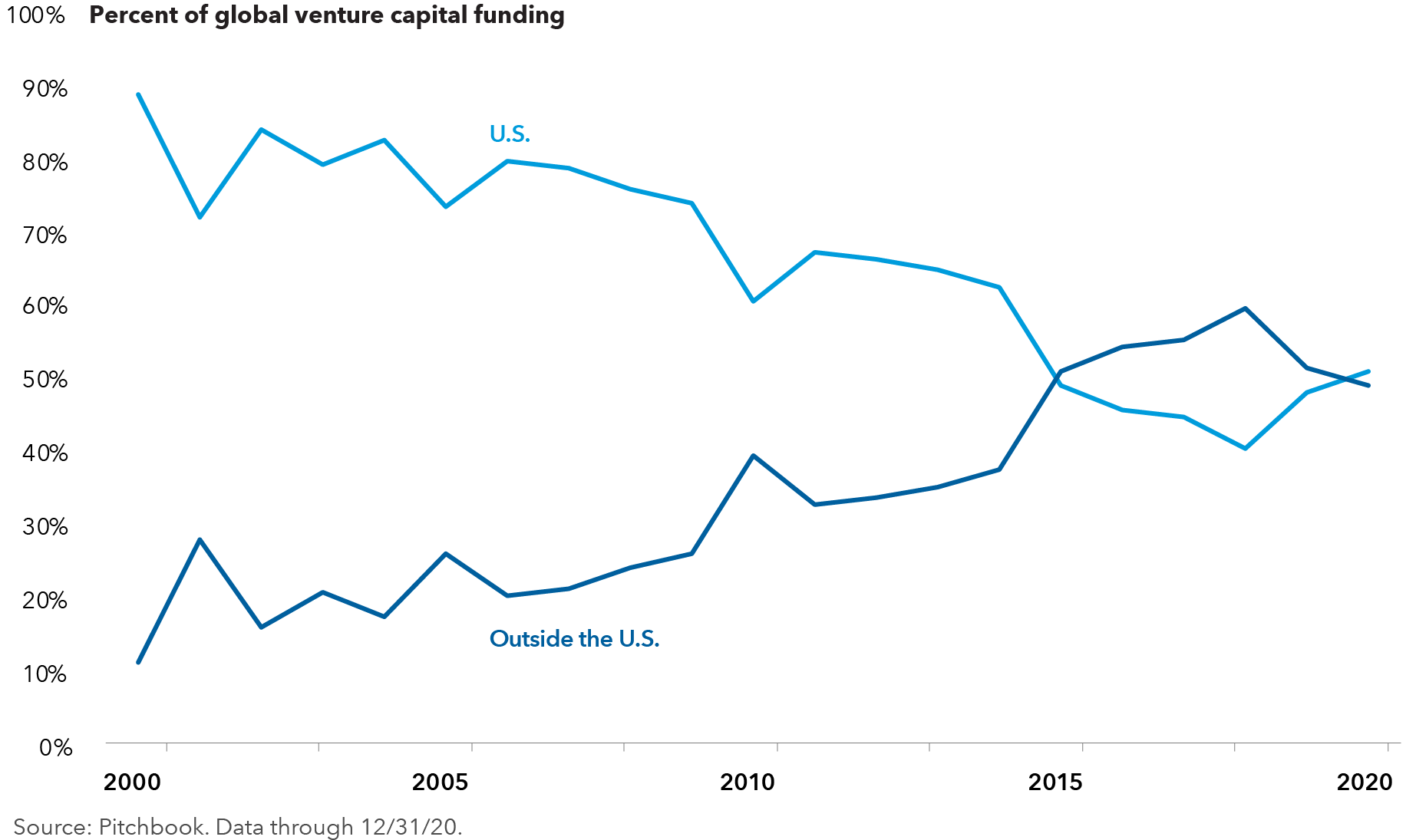

Despite this trend, the time could be right to consider adding international stocks to your investment strategy. One potential harbinger: recent trends in venture investment. Typically, venture capital is deployed to support the development of technological innovation, itself the feedstock of the world’s fastest growing companies. And those firms have historically been based in the U.S.

That’s changing. In the last several years, venture funding has been growing at a faster pace outside the U.S. That’s partly because company valuations are generally cheaper, but the pivot toward funding international innovation illustrates the potential opportunity in investing in those companies.

Venture capital is funding innovation outside the U.S.

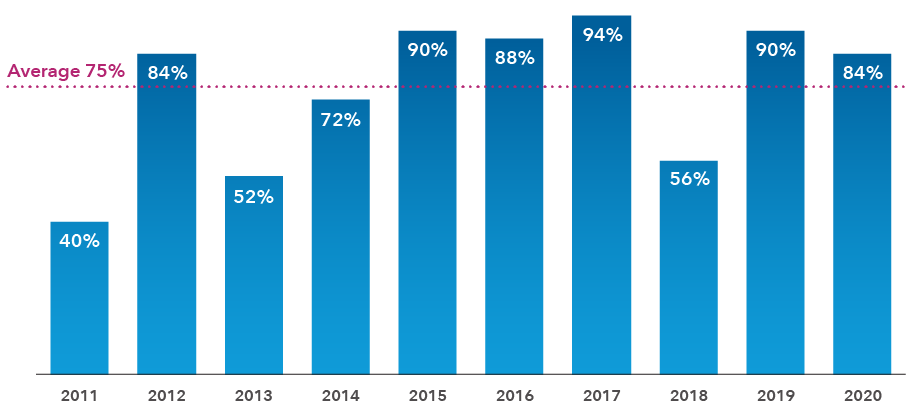

Related to this shift toward international firms is that while international and emerging markets indexes have lagged U.S. markets over the past decade, not all the best-returning stocks are in the United States. On a company-by-company basis, the individual stocks with the best returns have been overwhelmingly located in non-U.S. markets.

Non-U.S. companies have dominated the list of best performers over the past decade

In every year since 2011, the majority of the best-performing companies have been located outside the U.S. In the previous decade, an average of 75% of the top 50 best-performing companies each year in the MSCI ACWI Index were non-U.S. companies.

Share of top 50 performers in MSCI ACWI Index represented by non-U.S. companies

Sources: RIMES, MSCI. Data as of 12/31/2020

Lastly, another reason to consider international stocks is China. Although it was among the first economies to shut down and suffer from an economic slowdown in response to COVID-19’s spread, today China has largely reopened and economic growth is bouncing back, with GDP growing 6.5% in the fourth quarter of 2020.1

Though the Chinese consumer has yet to resume spending at pre-COVID levels, “credit growth is strong and likely to provide a nice tailwind for growth over the next six to nine months,” said Stephen Green, Capital Group’s chief China economist. “With the economic recovery well underway, the government has shifted back toward pre-COVID policies aimed at deleveraging and de-risking the economy, particularly in the property sector.”

Global economies are still dealing with pandemic outbreaks, possible new shutdowns and stock market volatility. But now that vaccines are rolling out, it is a good time to review portfolios and their allocation to equities.

A selective approach can help to uncover investments where attributes specific to companies ─ not those of countries, sectors or industries ─ could drive stock success. Companies can be headquartered in one country, but may produce their product in another country and have their main customer base in a third country altogether. Examples such as those illustrate the need to understand company fundamentals.

To find out if your portfolio could benefit from additional international equity holdings, schedule a portfolio consultation with one of Capital Group’s investment professionals.

1WRAPUP: China’s Q4 GDP growth beats f’cast, ends 2020 in solid position after COVID-19 shock. Reuters, January 17, 2021.

Standard & Poor’s 500 Composite Index is a market capitalization-weighted index based on the average weighted results of approximately 500 widely held common stocks. The S&P 500 is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. © 2021 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

MSCI ACWI is a free float-adjusted market capitalization-weighted index that is designed to measure equity market results in the global developed and emerging markets, consisting of more than 40 developed and emerging market country indexes.

MSCI ACWI ex USA Index is designed to measure equity market results in the global developed and emerging markets, excluding the United States.

MSCI has not approved, reviewed or produced this report, makes no express or implied warranties or representations and is not liable whatsoever for any data in the report. You may not redistribute the MSCI data or use it as a basis for other indices or investment products.

©2021 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.