Client Relationship & Service

Planning & Productivity

Model portfolios have been on an upswing for a few years, and as more advisors learn about the benefits to clients, and themselves, it appears the surge will kick into overdrive in the coming years.

For advisors, the benefits of model portfolios can be significant. In a nutshell, models can help create a time savings in one aspect of your job that may no longer be a competitive differentiator, which is managing investments for clients. This time can be used instead to focus on other value-added services: communicating with more clients and aligning their investments with their goals. The result? A real opportunity to scale and grow your practice.

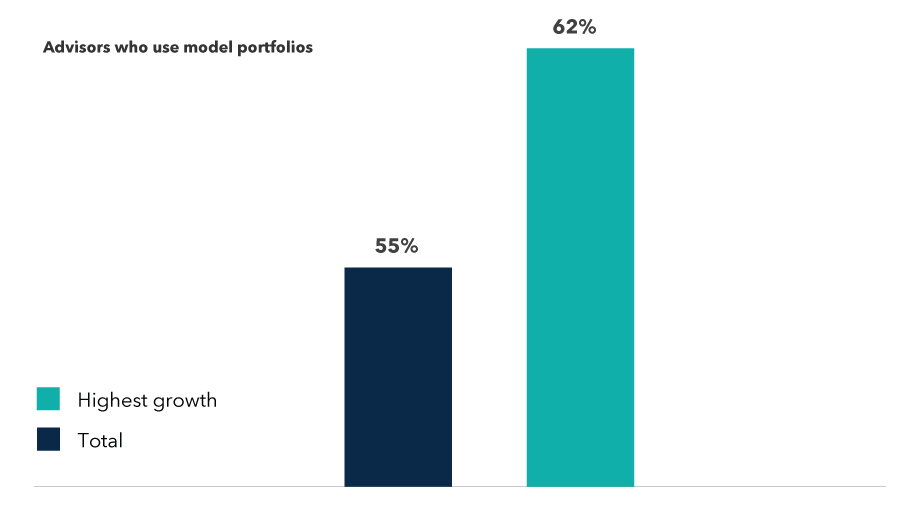

In our Pathways to Growth: 2021 Advisor Benchmark Study, 55% of all advisors surveyed were using model portfolios. Among the highest growth practices, 62% used models. Overall, the highest growth advisors in our study reported strategically spending considerably less time on activities that can scale, freeing up time for prospecting and allowing them to offer a broader array of financial planning services.

“Advisory practices are complicated enough given the balancing act of managing client relationships, investment management and business management,” said Kris Spazafumo, head of portfolio services at Capital Group. “And advisors are under pressure to grow, which requires scale,” she says. ”That ultimately leads them to ask the question, ‘What can I outsource?’”

Answering this question often starts with considering the tasks you most enjoy doing, as well as the skills that add the most value to the practice. “Most advisors would say their superpower is working with clients to foster strong relationships,” Spazafumo said. Indeed, 68% of advisors who outsource the investment management aspect of their jobs said it helps create stronger connections to clients, according to a study from AssetMark.1

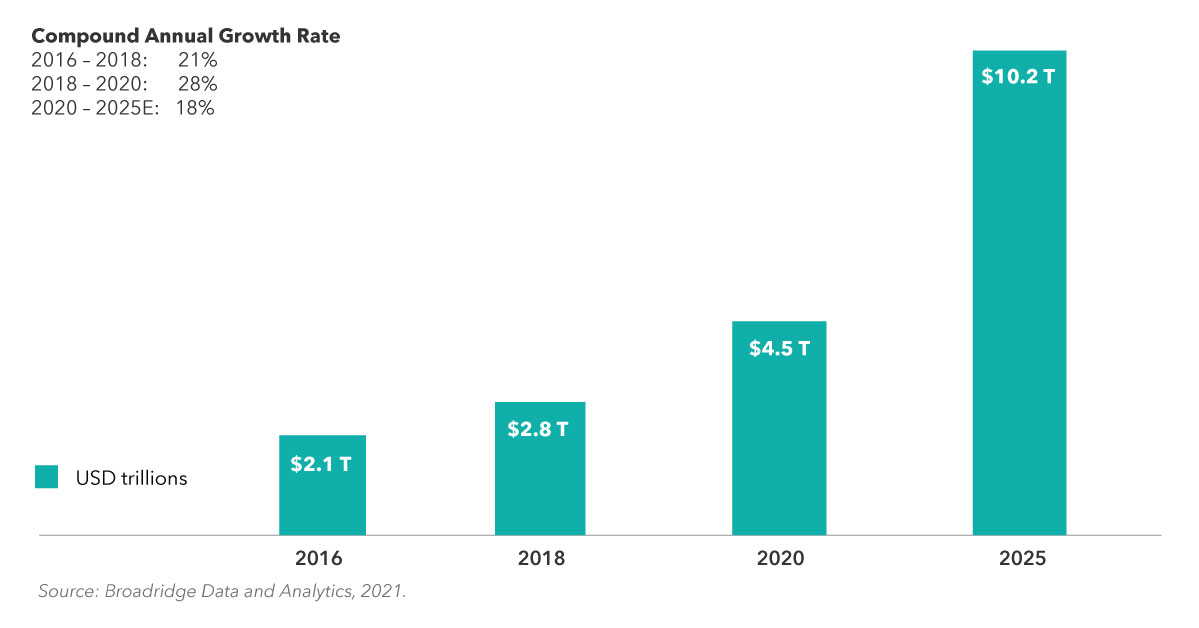

Given this potential, it may not be surprising that 53% of advisors plan to increase their use of models over the next two years, according to Broadridge Data and Analytics.2 For even more dramatic evidence of models’ popularity, consider fund flows. Over the past five years, Broadridge reports a 21% annual increase in assets in model portfolios industrywide, and estimates that those assets will continue to rise at an 18% annual clip for the next five years to reach $10 trillion.2 That’s a sizable number, considering the capitalization for the entire global equity market ended 2020 at $105.8 trillion, according to the Securities Industry and Financial Markets Association (SIFMA).3

Assets invested in model portfolios

The overall model portfolios market is projected to hit $10 trillion by 2025.

So how can you make the most of models? Here are three ways to use models to grow your practice.

1. Show investors how they can benefit from models

To incorporate model portfolios into your practice, the first order of business is to clearly articulate the benefits to clients. This may seem like a major change for many of them. For years, many advisors honed the message that they were highly skilled in creating investment portfolios tailored for clients’ specific needs. And now, they’re extolling the virtues of model portfolios, which at first blush can sound closer to a paint-by-number approach than a personalized investment mix.

Some advisors worry that they spent years preaching one concept to clients. Now, in order to promote models, they’ll need to reverse course, says Jan Gundersen, senior vice president, portfolio solutions and services at Capital Group. “They think, ‘I can’t shift midstream.’” But with a well-crafted message and a deft hand, he says, they can. That’s because model portfolios can offer what clients want most: more time to talk to their advisors about their needs and investments suited to them.

That’s precisely been the appeal for Blaire Greenwood, CEO of Greenwood Financial Group. In 2015, in the early days of the Department of Labor fiduciary rule, her practice started a conversion to fee business. That change entailed a move to model portfolios, which took close to two years. And even now, there are some “straggler accounts,” Greenwood says. But by and large, clients embraced the idea of models.

Models helped the practice focus on financial planning, which resonates with clients. Clients also like the transparency involved with any changes to the investment mix. As for the benefits to the practice? “Models make growth more feasible, while not giving up that level of service for clients,” Greenwood says.

2. Use the time saved to grow your practice

For advisors, one of the big benefits of using model portfolios is gaining extra time in your day, which can be used to meet with more clients and prospects to discuss their financial needs and objectives. As clients' needs have grown more complex over the years, they’ve demanded services like generational planning, tax and estate planning, and charitable giving, in addition to investment management. Catering to that demand is a key driver of growth for advisors.

Our benchmark study confirms this “relationship alpha,” finding that higher growth practices were especially attuned to these broader client needs and more likely to offer planning services. Moreover, our study finds that having more time to focus on client acquisition was a driver of growth. The highest growth segment has an always-on acquisition mindset, spending 45% more time on prospecting for new clients.

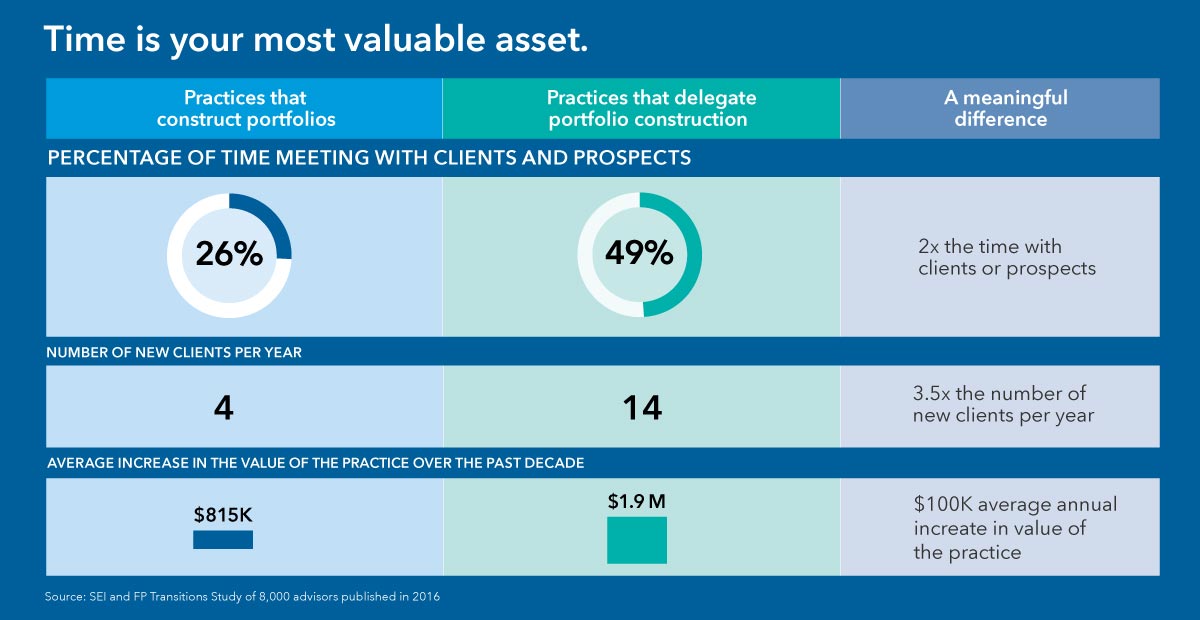

Research from FP Transitions and SEI 4 also suggests that using models can have a definite impact on your practice, even increasing its valuation over the long term. It found that practices that construct their own portfolios spend about 26% of their time with clients or prospects on average. Those that delegate the investment process spend about 49% of their time with clients and prospects. What’s more, those practices that delegate onboard 14 new clients a year, compared to four new clients for practices that construct their own portfolios. As for valuations, advisory practices that construct their own portfolios have seen valuations increase over the past decade by $815,000; those that delegate have seen increases of $1.9 million in the same time period. That’s a difference of more than $1 million in increased value, or $100,000 per year of the analysis. (As the study notes, valuations are complicated; and it focused only on new money from new clients.)

Source: “The Value of Time,” FP Transitions and SEI, 2016

3. Scale your investment expertise

Model portfolios, especially those from a large asset manager, offer another major benefit in the way of extra brain power you can tap into for insight on the markets and economy. Those third parties may have teams of analysts and portfolio managers that essentially allow you to scale up your expertise. A small advisory practice, or even a large one, will not often have that deep of a bench on their own staff.

Indeed, that was one of the attractions for advisor Jay Wheeler of Delaware-based Wheeler Financial. His team uses model portfolios for clients’ growth allocations (typically 10 years out and longer), and he says this greatly increases the brainpower that ultimately enhances his value proposition. “We think it's a good way to deliver extra value to our clients.” His team tries to spend as much time as possible on planning and the human relationship, he says. “If we can save time on investment management, we will.”

Greenwood’s clients also understood that model portfolios help make use of a natural division of labor. “We’re advisors, but we’re not day traders or portfolio analysts. Our job is to manage these funds based on the clients’ goals and risks,” Greenwood says. “Clients get that; they know we can’t be all things to all people.”

Allison Lane, Greenwood’s chief operating officer, emphasizes this point. “At the end of the day, everyone’s good at what they’re good at. I don’t pretend to do taxes; I talk to people about reaching their financial objectives,” she says.

Model for growth

Use of model portfolios was a growth factor for advisors in our latest benchmark study.

Source: Pathways to Growth: 2021 Advisor Benchmark Study, Capital Group.

Keep the end goal in mind: client relationships and practice growth

To be sure, there will still be some advisors who enjoy selecting investments. Some miss the days when there was a lot of chatter at dinner parties based on returns, Gundersen noted. That competitive fodder isn’t completely disappearing, but if you keep your eye on the big picture and recognize how model portfolios can help align your expertise with your clients’ needs, you may find yourself chatting instead about the growth of your practice.

1.AssetMark, “The Power of Outsourcing Investment Management,” 2020

2.Broadridge Advisor Solutions, “Distribution Insight –Model Portfolios,” Q4 2020

3.SIFMA, “Capital Markets Fact Book,” 2021

4.FP Transitions and SEI, “The Value of Time, Quantifying How Client Focus Increases the Value of Your Business,” 2016

Kris Spazafumo

Kris Spazafumo

Jan Gundersen

Jan Gundersen