Market Volatility

Market Volatility

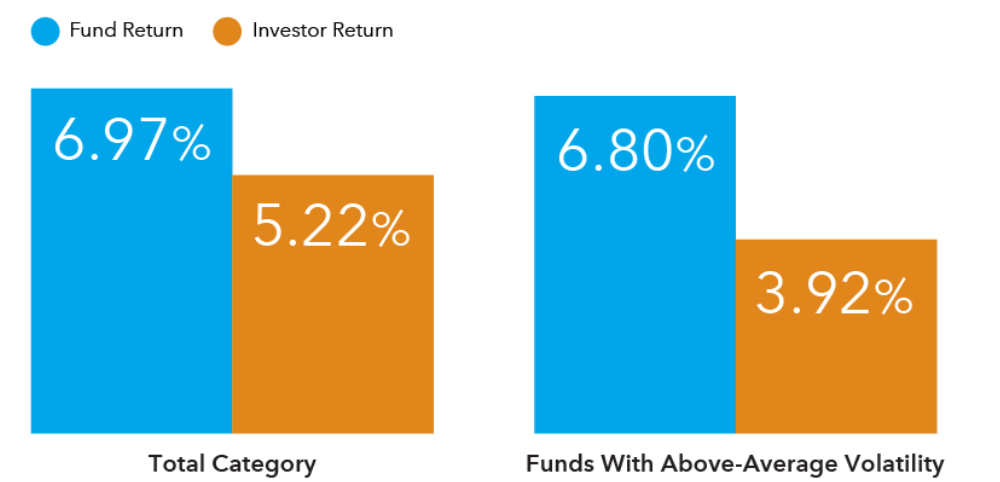

10-year annualized returns in the U.S. Large-Blend category

Sources: Capital Group, Morningstar as of 6/30/17. Returns based on equal weighted averages of funds within the Morningstar U.S. Large-Blend category. Investor Return measures the experience of the average investor in a fund and incorporates the impact of cash inflows and outflows from purchases and sales.

Are your clients concerned about volatility in their equity portfolio? Their attempts to time the markets probably aren’t the answer. Data from Morningstar shows that, on average, investor returns lag fund returns. A fund’s investor return includes the impact of purchases and sales of the fund. The difference between the two return measures is considered a proxy for investors’ ability to time markets. Investor returns lagged because many investors chase past performance and end up buying funds too late or selling too soon. This effect is amplified in higher volatility funds, which are more prone to periods of sharp declines that could cause investors to sell prematurely and miss a subsequent rebound.

Remind clients that they should consider a more disciplined, long-term approach to investing and avoid jumping from fund to fund, especially when faced with higher volatility.

Use of this website is intended for U.S. residents only.