Retirement Income

Defined Contribution

- Measuring participants’ readiness for retirement is difficult since plan sponsors don’t have data outside the plan.

- Setting meaningful and measurable goals can maximize participant outcomes.

- Repeating the measurement of goals is an important part of continuous improvement.

The goal of an employer-sponsored retirement plan is to help employees accumulate sufficient savings for a successful retirement. But can this objective be measured?

Each participant’s retirement needs are unique. Because plan sponsors don’t have information about participants’ finances outside the plan, it is impossible to draw conclusions about their retirement readiness. Plan sponsors cannot measure success by looking at account balances.

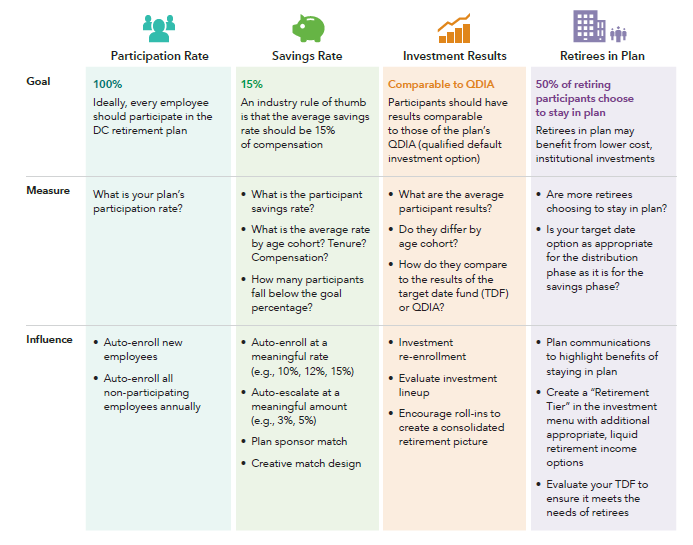

The best way to ensure participant success is to focus on plan success, in the areas the employer can control:

- Set meaningful and measurable goals to optimize participant outcomes.

- Act to achieve an impact in the areas a sponsor can influence.

- Measure and remeasure as part of an ongoing process.

How sponsors can influence participant success

Plan sponsors have the tools to influence participant outcomes. They can measure the success of those efforts, act on those measurements and measure again.

What follows are sample goals that demonstrate how plan sponsors can have a positive impact. Note that each plan should develop its own set of goals.

How diverse goals affect plan design

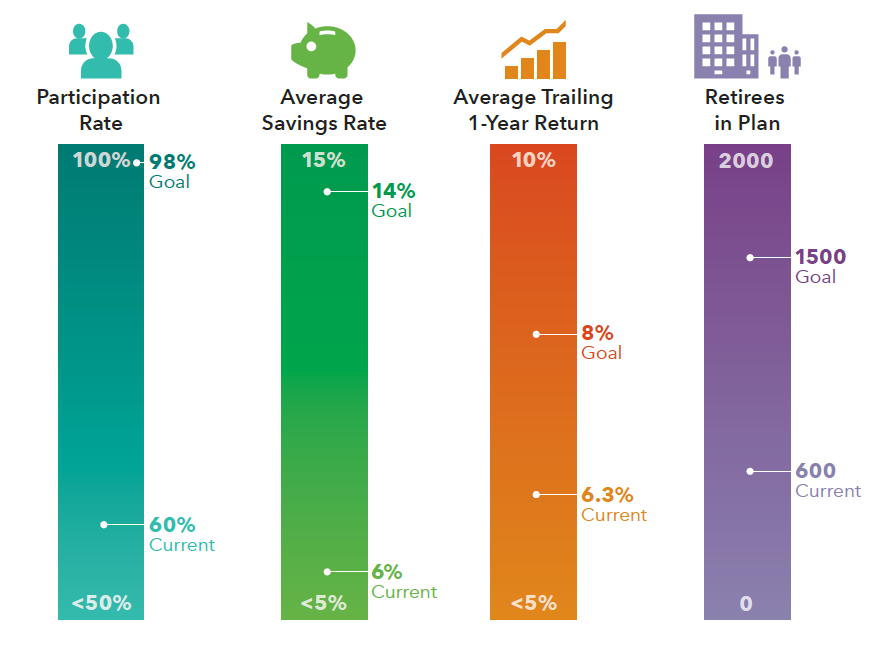

Case study: XYZ Corporation

A company with 6,500 participants and $850 million in retirement plan assets wanted its defined contribution plan to serve participants through both the saving and distribution phases.

The company closed its defined benefit plan in 2008 and wanted to help participants achieve a more “defined benefit–like” experience within the defined contribution plan. Objectives included:

- Providing a means for participants to save enough

- Using behavioral finance to promote successful outcomes

- Letting retirees take scheduled distributions while benefiting from plan features

Targeted strategies to improve participant success

The company worked with its plan consultants to develop actionable strategies to match these objectives. They focused on the areas they could influence:

- Increase participation through auto-enrollment of new and existing participants.

- Increase the savings rate with an 8% default, company match and auto-escalation.

- Improve investment results through investment re-enrollment and regular QDIA re-evaluation.

- Increase the number of retirees in the plan by eliminating withdrawal fees, enabling scheduled payments and establishing a retirement tier to the investment structure.

Success metrics

These measurable objectives allowed XYZ Corporation to chart the progress from its current state to the future goal in each of the four areas of focus.

Repeat the process regularly

The process of filling the gap between where the plan is now and where the sponsor wants it to be involves constant measurement — and continuous improvement. If the plan does not meet its initial success objectives, sponsors may want to take additional steps to make it stronger. These should then be measured — and measured again regularly.

Consistent evaluation is important

Taking action

Working with their consulting and recordkeeping partners, sponsors can develop and implement plan changes that can improve participation, savings, returns and retiree involvement. The steps are:

- Measure plan

- Set plan goals

- Direct your efforts toward plan goals

- Measure again — and again and again!

Start now with year-end planning to implement measures that can encourage success for all your DC plan participants.

Conclusion

Concerns about participant retirement readiness have driven many plans to take actions such as participant education to improve decision-making. The results of such efforts are mixed because they rely on participants taking action.

Participants will be have better chances of succeeding if plans are successful. Plan sponsors, by focusing on the things they themselves control, can help drive more successful participant outcomes.