Client Relationship & Service

Practice Management

- Joining civic organizations can help you meet potential clients, but only if you’re genuinely interested in the work of the organization.

- Focus on the long term, not with the intent of getting new business immediately, but rather to form important relationships that could develop into business down the line.

- Let others talk more than you do, focus on learning about them, and look for ways to make small commitments and follow up.

One of the biggest challenges every advisor faces when seeking to start or grow a practice is attracting new clients. You can have a terrific investing record, a well-trained staff and a top-notch back office, but building a successful business ultimately depends on your ability to introduce qualified new people to your firm.

Advisors commonly attempt to do that through membership in civic entities, charitable boards or social organizations such as wine clubs or book groups. The goal is to gain access to people with wealth and to parlay those newly minted relationships into business. The number of wealthy households has been rising, as shown in the chart below, and many members of these households partipate in civic activities. Social involvement certainly can be a fruitful way to expand your circle of connections. I’ve developed a number of client relationships through my involvement in various entities.

The key, however, is to do it subtly and delicately. I’ve seen many situations in which people work feverishly to join an organization but ultimately come away disappointed with no business from it. More often than not, this is because they fail to follow a few simple rules that I’ve found to be very helpful over the years.

Growing opportunities for high net worth advisors

The number of wealthy households has increased steadily in recent years

Source: Spectrem Group

Join groups you’re genuinely interested in

The most basic rule is this: Don’t join an organization simply to draw business. You can’t allow people to think that you’re there to boost your client roster. People smell that a mile away, and it’s a major turnoff. In fact, some clubs and organizations will kick you out if that’s what they think is going on. This is an example of what economist John Kay discussed in his book Obliquity: Why Our Goals Are Best Achieved Indirectly when he wrote that opportunities will occur as you focus on things you’re passionate about.

To that end, get involved with groups in which you have a true interest unrelated to business. By sharing common interests with fellow members, you can develop relationships casually and organically. I’ve cared deeply about the mission of every organization I’ve been engaged with.

Friendships will develop over time and, as they do, you’ll have opportunities to talk about your business. Folks may ask you, “So what do you do for a living?” Be prepared with a brief, yet effective, response using a credibility statement. If you haven’t encountered it yet, Chris Gies does a wonderful job of laying out the science of this approach in his article “Why Every Advisor Needs a Credibility Statement” on Capital Group’s Practice Excellence Center. In essence, it helps you design the “Here’s what I do, here’s how I help my clients, here’s what I love about it” message in an effective way. Then end the discussion. Plant the seed but don’t push. People with wealth, particularly if they’ve had it for a while, presumably already have a financial advisor. Typically, the only reasons they make a change is because they’ve had a liquidity event or have become unhappy with their current advisor. When I ran a large wealth management firm, it would sometimes be months or even years before I’d have a real conversation with a social contact about helping them to manage their wealth. But by letting people know what you do in a relaxed way, you put yourself in a position to engage in those conversations down the line.

It’s better to listen than to speak

Whatever the situation — whether it’s with fellow board members you see every month or people you meet once at a party — ask questions. Find out what they’re interested in, what their concerns are, what they care about. Find out about their families, and chat casually as you would at a barbeque. It’s more important that you are learning from them than that they’re hearing from you about the great asset management skills you have. There’s plenty of time for that later. Remember that no one ever thought a meeting where they did most of the talking was a bad meeting. And no one cares what you know until you demonstrate that you care.

Another rule I follow is that it’s much better to get a business card than to give a business card. Also, keep track of the business cards you get. How many times have you come back from an event with 15 cards in your pocket and you have no idea who most of those people are? Whenever I get a business card, I jot down on it one or two points about the person. It may be “baseball” or “ABC museum opening” or maybe just “tall guy with glasses.” Anything to help me remember them.

Because you’ve gained a sense of their personal interests when meeting these new contacts, don’t hesitate to follow up. Send them articles that may be interesting. If you see a story in the newspaper or on the Internet that pertains to them, “thinking of you” is one of the most powerfully psychological statements you can make. A short message such as, “I thought you may be interested in this” can have a profound effect. Also, put them on your holiday card list and let them feel they have insight into you as a person and your family.

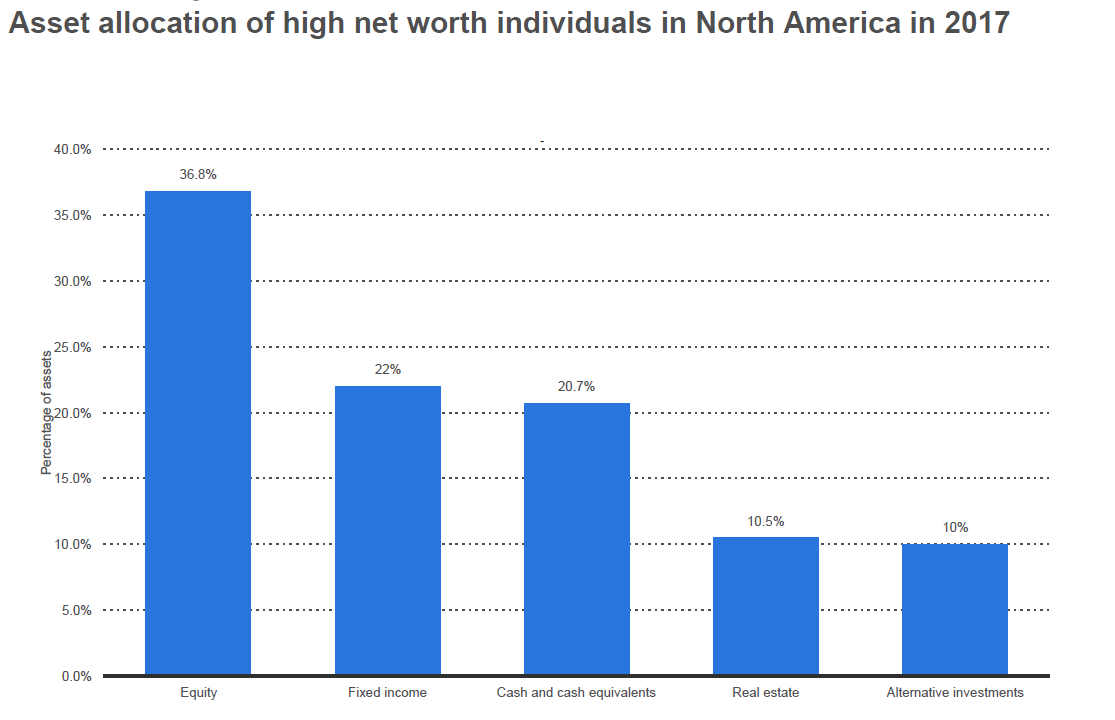

As they get to know you and what you do for a living, at some point, if something interesting is happening in the markets, you can share that with them: “Hey, you know what I heard the other day? I was talking to one of our portfolio managers and here’s what I learned.” Just leave it at that. You’re sharing a piece of information (and by that I do not mean stock tips) you hope they would find interesting or useful. Since high net worth investors typically have more than a third of their assets in stocks, many will be naturally interested in what’s going on in the markets.

Though I’m focusing here on attracting new prospects, it’s equally important to follow these rules to maintain relationships with existing clients because, as you know, your best client is someone else’s best prospect.

How the wealthy invest

High net worth investors have more than one-third of their assets in stocks and one-fifth in cash

Source: Capgemini

Get to know family, friends and advisors

Once a potential business opportunity arises, it’s important to handle it correctly. Let’s say a prospective client asks to chat. He or she may bring along a spouse or children or even other advisors. When you’re in that meeting, don’t make the mistake of just looking exclusively at the person you perceive to be the most powerful person in the room. You may be wrong. The actual decision maker may not be the one with the money. The matriarch or patriarch of a family may care more about whether their spouse, children or grandchildren connect with you. Be sure to make eye connect with everyone in the room and engage them all in conversation. There’s a reason the prospective client brought these people along ― because they care about their opinions and whether they feel a connection to you.

As in all interactions, it’s essential to be an active listener; to ask questions; to gain an understanding about their hopes, fears and objectives. Then when you respond you are not just saying what any advisor would say. You’re responding in a way that shows you’ve heard each of them in a manner that’s going to resonate with them.

In any encounter I have, I am always completely straightforward, and I would urge you to do the same. Represent yourself candidly and don’t overpromise. Remember that the wealth advisory business is ultimately based on trust. The more people feel you’re someone they can trust, they more likely they are to do business with you.

RELATED INSIGHTS

-

-

Traits of Top Advisors

-

Practice Management

Use of this website is intended for U.S. residents only.

John Emerson

John Emerson