Client Relationship & Service

Practice Management

- It’s a “seller’s market” for RIAs looking to combine with another firm.

- RIAs have many options, including an equity-based approach, to structure sales transactions.

- Retaining equity can allow RIAs to stay involved in the business even after a sale.

Matt Cooper knows the perks of being an independent RIA. But he also appreciates the benefit of plugging into a larger firm.

Solving that paradox — allowing RIAs to keep autonomy yet tap into a larger infrastructure — challenged Cooper to find a new path for selling.

The result? Cooper, president of Beacon Pointe Wealth Advisors, in Newport Beach, Calif., devised an equity-based sales method. Instead of cashing out, RIAs maintain an ownership stake that can be converted to cash later. “Most RIAs don’t want to cash out and walk away,” Cooper says. “By simply engaging in an equity swap … it allows them to continue what they do but have maybe the tools and scale of a much larger firm.”

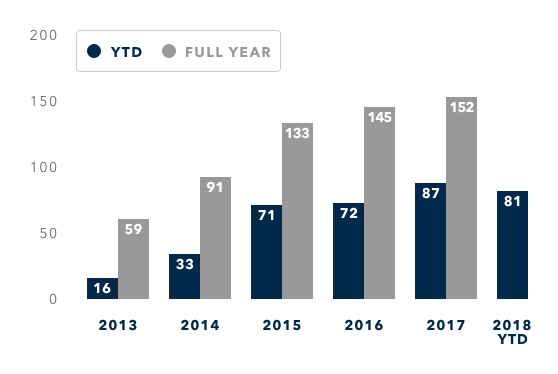

RIAs are increasingly open to the idea of selling their businesses. So far this year, through the second quarter, 81 RIAs sold stakes in their firms, which is quadruple the number of deals during the same time five years ago, according to DeVoe & Company, which provides consulting services to RIAs. Last year was a banner year for RIA sales transactions, topping 152 deals.

RIA M&A transaction volume has risen steadily

Number of deals

Source: DeVoe & Co.

More RIAs are pondering selling. Nearly half, 45%, of RIAs are open to talking about selling a stake in their company, up sharply from the 27% who were warm to the conversation just two years ago.

RIAs looking to sell have many options as buyers are eager to find compatable partners. Sixty percent of independent RIAs are open to either buying another practice or are actively seeking targets to buy, Cerulli says. It’s a seller’s market, though, as just 8% of RIAs say they plan to retire in five years or less.

Enter Beacon Pointe, founded in 2002 and with nearly $8 billion in assets under management in its affliated companies including Beacon Pointe Advisors and Beacon Pointe Wealth Advisors. It thinks it has a solution.

The firm’s equity sale structure is something RIAs might consider instead of a straight cash sale, Cooper says. This type of transaction allows RIAs to:

- Boost focus on clients – not infrastructure.

Equity sale transactions are structured to allow RIAs to stay involved in the business. Following a deal, sellers concentrate on helping clients rather than getting distracted managing the business. RIA owners that sell to Beacon Pointe “enjoy the business, they like the lifestyle it provides, they like the work that they do, and I think most importantly, they really enjoy their clients,” Cooper says.

Beacon Pointe, though, handles the back-office task with the efficiency of a firm with billions in assets under management. Individual RIAs can hand over management and upgrades of the customer relationship management system, for instance, or investment management. Increasingly important Twitter and LinkedIn posts are handled by Beacon Pointe centrally along with branding and other marketing tasks such a pitchbooks.

Allowing RIAs to keep control of things they care about — but hand over worries of infrastructure — is how an equity sale makes sense. “I’m freed up as an advisor, not having to deal with compliance, or when the copier breaks, or trying to find new office space, or recruiting other people to my office,” Cooper says. “I can spend more time with you, my client, that’s the number one outcome from the whole event.”

By sharpening the focus on clients, practices can grow faster than they would have otherwise, Cooper says.

- Gather best practices.

Sellers in a equity-based deal with Beacon Pointe are integrated into the partnership in about eight or 10 weeks. As soon as a sale is completed, sellers become part of Beacon Pointe’s board of managing directors. Beacon Pointe’s financials are transparent and managing directors share what’s working — and what’s not working — in their individual practices.

Currently, Beacon Pointe has 18 managing directors and offices up and down California as well as in Texas, Arizona, Pennsylvania and New England. Partners meet twice a year in person and twice a year on conference calls. Partners get an exclusive territory geographically, and Beacon Pointe is also looking to create subject-area niches.

Individual RIAs benefit and boost the partnership as a whole.

- Put a succession plan in place.

For advisors looking to create a growth path for their businesses sometime in the future, an equity model can make sense. Of the firm’s equity partners, nearly all are under the age of 55. Unlike other approaches to selling, Beacon Pointe is focused on building a growing sustainable business. “We’re not looking for a liquidity event,” Cooper says.

Above all, Cooper says he’s looking to connect other like-minded advisors who are enthusiastic about how liberating the RIA model can be. Cooper started in the business right out of college in an insurance firm that developed into an RIA. He liked the ability to forge relationships with clients, but wasn’t an owner in the firm. That’s what he’s looking to change for the industry with Beacon Pointe.

“Our model is all about allowing somebody to continue in a business that they really love and enjoy and then later exit with cash,” Cooper says. “It’s about people who are future based and excited about the future.”

Video

Why to Consider an Equity-Based Acquisition

Matt Cooper:

I mean, I, I think in general, um, you know, one of our tenants or beliefs is most RIAs don’t want to cash out and walk away. I mean, they really, they enjoy the business. They like the lifestyle it provides. Um, they like the work that they do, and I think, most importantly, they really enjoy their clients. And so, by simply engaging in an equity swap or an equity type of arrangement, it, it uh, allows them to continue what they do but have maybe the tools and scale of a much larger firm and focus where the value is created, which is with the clients and deepening the relationship with the clients. And not worry about other stuff, which is compliance and, and things of this nature so, uh, our model is all about, yeh, allowing someone to continue in a business that they really love and enjoy and then later exit with cash at the price that they, you know, want, fair market value.

RELATED INSIGHTS

-

-

Traits of Top Advisors

-

Practice Management

Use of this website is intended for U.S. residents only.

Matt Cooper

Matt Cooper