Client Conversations

Insights on Investors

We may one day remember the pandemic as a turning point for women and money. In a year of so much change, 2020 was marked not only by economic crisis, but also by a renewed quest for financial resilience and security.

In Women’s financial futures: New financial philosophies taking shape post COVID-19, Capital Group’s latest Wisdom of Experience investor survey of approximately 2,000 women and 500 men, we found that COVID had an outsized financial impact on women, particularly millennials and women of color. Since the early phase of the pandemic, women have been more likely than men to lose their jobs — and, many months later, to still be out of work.

“Women of color and millennial women are more likely to have known someone who experienced a job loss or financial hardship,” says Lorna Fitzgerald, senior market researcher at Capital Group,

Women are also more likely to be concerned about money, to let money worries affect their personal wellbeing, and to stop retirement plan contributions and take early withdrawals from qualified retirement accounts. In short, they are an investor base in need of financial advice from a qualified professional.

This presents several opportunities:

- Women represent a demographic with growing buying power and investable assets.

- They can be influencers among other powerful clients.

- Our findings indicate that many women view the pandemic experience as an opportunity to take control of their finances and build more resilient futures.

- Where women turn for financial advice differed greatly depending on age, wealth, race and other factors.

Financial professionals who are interested in serving these markets should be aware: Most of them won’t be found through the industry’s typical channels or approaches to client acquisition. To engage these women, you have to understand who they are, and where and how they seek advice. Here are four tips to help win women clients now.

1. Recognize the power of women’s increasing assets

Fitzgerald recalls working at IBM early in her career. A data scientist by trade, she knew enough about investing to regularly purchase shares of company stock, but not enough to efficiently manage her portfolio. “I was taking dividends in my 20s!” she says. “I didn’t know.”

She needed the help of a professional. But when she walked into a retail brokerage, Fitzgerald was politely dismissed as someone the bank could not help. “I was young. I was a woman. I was Black. They probably assumed there was no money,” she says.

Among other false assumptions, the brokerage failed to identify the power of increasing assets. The financial power of women today is hard to ignore. Although women may have felt more of a financial impact during the pandemic compared to men, as a demographic they may surprise:

- Women in the U.S. control roughly $11 trillion in assets and will inherit $30 trillion in the coming decades.*

- Non-white women’s buying power is currently pegged at around $1 trillion.**

- Millennial women represent a spending power of $170 billion per year, the largest of any generation, according to Merkle Inc.^

Anyone thinking of these women as housewives who are disinterested in wealth management could be missing out. Today, 44% of women earn more than their male partners, with 31% of Black women and 33% of Asian women out-earning their spouses.**

2. Meet women where they are

Where women get financial advice seems to hinge on existing networks and resources. “Many of the differences in the survey results boiled down to whether you were system connected or socially connected,” Fitzgerald says. These two groups can be described as:

System connected – seek financial advice from industry professionals, at work and other traditional financial resources.

Socially connected – more likely to turn to established social networks among family and friends as well as on social media, and to use other online or public sources of financial information.

Where do women get advice?

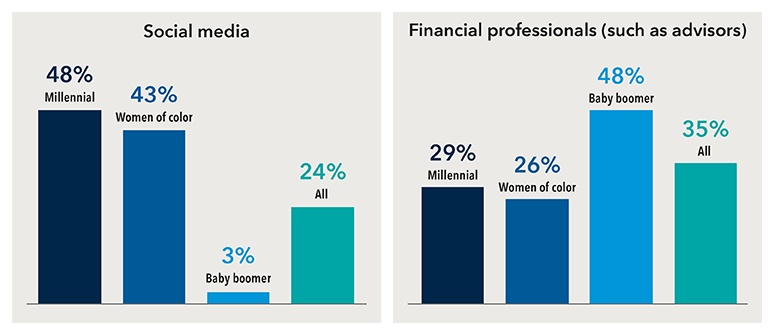

When asked about the most helpful sources for financial information, there were some notable differences depending on the woman’s generation and her race.

Source: Capital Group, Women’s financial futures: New financial philosophies taking shape post COVID-19, April 2021.

Although many of the surveyed women said they turn to family first for financial guidance, where they turn next depends on whether they tend to be more system or socially connected.

Baby boomers say they have relied on professionals to help them navigate the pandemic’s financial disruptions. They tend to be system connected.

Other groups of women who are less likely to work with financial professionals, such as millennial women, have turned to their established social networks and public sources of information. They are socially connected.

Women of color, who tend to be socially connected, usually turn to social media first, followed by family, financial websites, and then friends and financial professionals. For Black women, specifically, financial resources are most likely to come first from social media, followed by friends, financial professionals, family and finance websites. This was the only group to rank friends above family as a preferred source of financial information.

Millennial women, too, tend to be socially connected, but their preferred sources of financial help differ between older and younger members of that generation. Almost a third of older millennials (31%) list financial professionals as a top-five source of help and information, whereas only 22% of millennials under 30 say the same.

“Some groups, including white men and many white women, are both system connected and socially connected,” Fitzgerald says. “But what was missing for women of color and younger women is the system connection.”

How to meet women investors where they are

Women of color and millennials tend to be more socially connected and seek advice online. To reach them:

- Be active on social media: Younger consumers consider social media a place to shop and seek customer service. Being active and responsive on social media will appeal to this demographic.

- Offer education: Some advisors use content marketing to provide essential investor education as a way to improve their brand visibility and position in search engines. Creating educational content that speaks to this market could be a valuable way to extend your brand.

- Speak their language: Take a friendlier approach online. Most clients appreciate it when you keep sentences short and topics simple. If you are targeting these demographics, you can mirror some of their favorite online publications with financial angles that speak to them. Keeping an eye on social media can also give you an idea of what these audiences want to know about and their current knowledge level.

- Try new platforms: You don’t have to do a TikTok dance, but if you already have a robust social media strategy, you might experiment with building profiles on new platforms. According to Hootsuite, Pinterest has a 77% female ad audience, and Instagram has a user base that’s more female than male, mostly under 35.

- Have resources at the ready: You can’t serve every investor, but you can help extend system connections by finding ways to offer advice and information to people with different levels of assets. Helping to identify and recommend providers of advice or resources for these investors could make all the difference to women in need.

3. Reconsider millennials. They have more wealth than you think.

As a culture, we have engaged in mocking the “young, entitled” millennial for far too long. The generation born between 1981 and 1996 is turning 40, and it’s time to start taking them as seriously as they are taking their retirement savings.

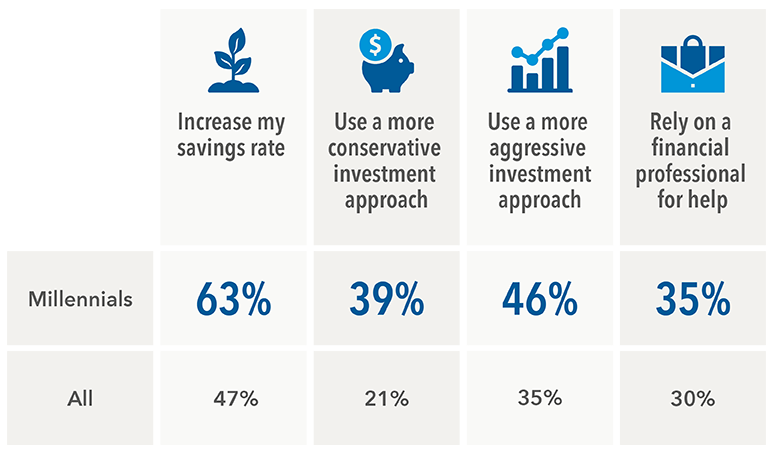

As a group, they seem most ready to receive financial advice. Nearly half of millennial women in our survey say they have now accelerated their timelines for saving, more than in any other group. They were also more likely to increase savings rates in the coming year, and to use both a more conservative investment approach and a more aggressive investment approach. Notably, they said they would be more likely to rely on a financial professional to build financial resilience.

A new generation of opportunity

When asked about post-pandemic plans, millennial women were found to be more likely to…

Source: Capital Group, Women’s financial futures: New financial philosophies taking shape post COVID-19, April 2021.

Financial professionals looking to acquire millennial women investors should be prepared to talk about essentials such as debt management, savings and retirement, but also about her holistic financial picture, including short- and long-term goals, risk tolerance and money fears, health and wellness, work-life balance and more. Millennials are the generation of women more likely to give financial assistance to those in their networks, according to our survey, which makes them thoughtful financial partners if not a potential source of client referrals. It also makes them more likely to value experience, expertise and trust.

4. Make diversity, equity and inclusion part of your practice

As with most industries today, the financial world is focused on increasing diversity, equity and inclusion in the workforce as well as the marketplace. According to a recent Diversity in Action report by the CFP Board, racial and gender diversity are crucial to the sustainability of the financial planning profession. If you are adding staff to your practice, keep in mind countless studies have found that diversity leads to stronger teams, greater perspective and increased innovation. It’s also important to some potential clients.

Increasing diversity in the profession will help to organically open up those systems and social connections to reach new types of prospective clients.

“One of the benefits of having a more diverse staff and different types of colleagues,” Fitzgerald says, “is you can learn about the social connections that are required to come into contact with these types of clients.”

*Women as the next wave of growth in wealth management, McKinsey 2020. https://www.mckinsey.com/industries/financial-services/our-insights/women-as-the-next-wave-of-growth-in-us-wealth-management

**Opportunities to Expand Your Business with Diverse Customers, Prudential Research, 2017. http://www.prudential.com/media/managed/totalmarket/tm-infographic-women-multicultural-market-opportunity.html

^Why Millennial Women Buy, Merkle Inc., 2018. https://www.merkleinc.com/thought-leadership/white-papers/why-millennial-women-buy

SUPPORTING MATERIALS

Lorna Fitzgerald

Lorna Fitzgerald