Client Relationship & Service

Practice Management

- Assessing the impact of volatility and dividends is essential to determining the optimal time to exercise stock options.

- Advisors need to keep in mind the tax consequences and practical limitations that executives face when exercising options and selling company stock.

- There are four primary elements to evaluate when maximizing the value of options in the context of an executive’s broader investment portfolio.

Executive compensation packages have become more complex since the financial crisis as more firms look to further align executive compensation with shareholders’ goals. Restricted stock and restricted stock units have grown in popularity, partly because options have come under increased shareholder scrutiny and tighter financial regulation. Still, options remain a central element of equity-related packages, and companies are increasingly using performance-based vesting schedules.

As options packages become more complex, there is a greater need for financial advisors who can guide executive clients through decisions about when to exercise their options and whether to cash out or hold the underlying stock after exercising. This allows executives to avoid the mental shortcuts they often default to when facing such decisions. For example, executives who want to diversify their portfolios typically cash out at vesting, whereas those seeking to delay taxes often wait until shortly before expiration. The problem with following such broad rules of thumb is that they can lead options holders to either cash out too quickly or hold on too long, thus running the risk of leaving money on the table or letting their options expire worthless.

At Capital Group, we have developed an approach to help maximize the value of options within the context of an executive’s broader investment portfolio. To implement this approach as an advisor, you need to focus on four primary elements:

- Analyzing the intrinsic and time values of the options

- Assessing the impact of volatility and dividends

- Identifying the client’s objectives and restrictions

- Evaluating the tax consequences

Let’s examine some of the practical considerations that you need to think about when guiding executives through each of the four steps

Analyzing the intrinsic and time values of the options

The first, and most well-known, step in advising clients on their stock options is to analyze the option’s overall value specifically its intrinsic value and time value. As a reminder, intrinsic value (or “bargain element”) is the value of the option’s strike price relative to the current market price. Time value is the value that could be gained by holding on to the option rather than exercising it. An option that expires in 10 years will typically have considerable time value, as events could take place in that time that would make the option’s exercise especially profitable. Conversely, an option that expires in a week will generally have very little time value.

There are many methods that you can use to analyze the value of an option, though Black-Scholes has become the industry standard method over the years. When using Black-Scholes, there are multiple tools available to perform the calculation, ranging from free online calculators or Excel spreadsheets that you can download to high-priced, subscription-based tools, such as a Bloomberg Terminal. Bloomberg provides a robust solution for three reasons. First, Bloomberg’s tool incorporates implied volatility, which represents expectations of future price fluctuations and projected dividend yields. Many of the online calculators or Excel tools only use historical volatility and the actual dividend yield. Another advantage of Bloomberg’s tool is that it uses a yield curve for the interest rate component, as opposed to just one risk-free rate. Bloomberg’s third advantage is that it allows you to choose from either European-style exercise or American-style exercise for each option. Employee stock option grants are typically American-style, which allows the option holder to exercise at any point prior to expiration. European-style options, by contrast, can only be exercised at maturity.

Of course, a Bloomberg Terminal subscription is expensive. As an alternative, the free online Black-Scholes tools generally do a fine job of providing the information you need to analyze the value of the option.

Assessing the impact of volatility and dividends

Identifying the option’s intrinsic value and time value is just a starting point. We have found that including assumptions about the underlying stock’s yield and examining its relationship with volatility provides insight into when to exercise options.

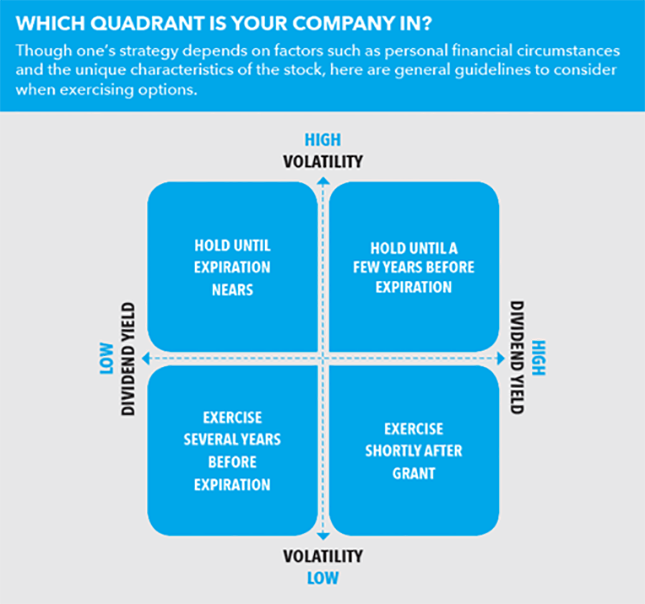

We examined all S&P 500 constituents over a 10-year period (2006–2016) and placed them into one of four categories, or quadrants: those with high dividends and low volatility; low or no dividends and high volatility; high dividends and high volatility; and low or no dividends and low volatility. On average, the stocks in each of these quadrants displayed unique characteristics different from the other quadrants that may help signal when exercise is appropriate. Of course, our analysis is based on past results, which are not predictive of results in future periods. The quadrants are discussed in detail below.

- High dividend, low volatility. Rule of thumb: Exercise options well before expiration. The two main reasons are that historically low-volatility stocks are, on average, relatively unlikely to plummet or surge in price. Therefore, the upside of continuing to hold an in-the-money option for too long can be modest compared with the potential benefit of collecting dividends over time. Second, options become increasingly more risky over time. The longer an option is held, the greater the potential for the option to be underwater at expiration.

- Low or no dividend, high volatility. Rule of thumb: Hold the options as expiration nears to benefit from possible increases in the stock price. Exercising the option early and holding the stock won’t generate much income. As with all options, however, there is a risk of holding for too long and that is especially true in this quadrant, where stocks have high volatility. Therefore, while it may be advisable to consider exercising nearer to the expiration date relative to the other quadrants, don’t wait until just before.

- High dividend, high volatility. Rule of thumb: Here you need to compare the benefit of collecting dividends to the risk of owning the stock. In general, the volatility will favor holding on to the option. However, this decision should be reassessed frequently in light of the outlook for the company and the client’s personal goals. Executives who choose to hold onto their options should reassess no later than a few years before expiration.

- Low dividend, low volatility. Rule of thumb: As with the high-dividend/high-volatility quadrant, there is a bit of a juggling act when both volatility and dividends of a stock are low. This is highly dependent on the specific stock and the executive’s circumstances. In general, these options should be exercised toward the middle of their term, as there is less benefit to holding until expiration.

Identifying the client’s objectives and restrictions

Analyzing the financial characteristics of options is just half of the battle. You also need to understand the client’s mind-set about these options and any potential restrictions that could limit their ability to sell the stock. As an advisor, it’s important to research and ask the right questions of the executive to form a complete picture of all of the different considerations that may affect his or her decision-making.

Our research has found that most executives don’t want to hold more company stock than they are required, but that is not always the case. Some clients prefer to build a position in the stock. Others like to reduce their exposure but face restrictions on when and how much stock they can sell. These may be contractual or they may be related to market perception.

We have also found that even executives who oversee multi-billion-dollar corporate balance sheets can have the same behavioral biases as any other client. As their advisor, you can help guide them through these decisions and protect them from making potentially costly mistakes because of mental shortcuts or behavioral biases.

Evaluating the tax consequences

Minimizing the tax impact is one area where corporate executives broadly feel like they need the most help from financial advisors when it comes to stock options. While knowing when to exercise and sell the underlying stock is important, most executives feel fairly confident making those sorts of decisions. But when it comes to maximizing their wealth after taxes, executives report a desire for help.

Being well versed in the nuances of incentive stock options (ISOs) and nonqualified stock options (NQSOs), and, in particular, understanding the rules for qualifying dispositions versus disqualifying dispositions are critical. When it comes to ISOs, pay careful attention to the Alternative Minimum Tax (AMT). Although the bargain element (the difference between the exercise price and the market price on the date of exercise) isn’t taxable at exercise if the stock is held for at least one year after exercise and two years after the grant date, it is considered a tax-preference item for AMT purposes.

In cases where one holds both ISOs and NQSOs, tandem exercise is worth considering. This typically involves having a holder exercise ISOs and enough NQSOs so that the AMT liability associated with the exercise of ISOs is reduced or eliminated. Though this may seem counterintuitive given that the exercise of NQSOs will generate more income tax in the year of execution, it works by attempting to reduce the total tax liability by bringing forward the tax on the NQSOs, assuming the stock appreciates and the options are exercised at some point in the future anyway.

It is difficult to generalize about taxes, and that is why clients tend to need individual help with this more than any other factor. You will need access to information about each specific grant in order to walk the client through the potential tax consequences.

Positioning yourself as an expert on stock options

Having deep expertise related to stock options creates a powerful opportunity for you to distinguish your practice and bring on high-value clients. Maximizing the value of stock options requires more than just analyzing the financial value of the options. You need to focus just as much on the client’s mind-set and any elements that may restrict his or her ability to sell the underlying stock. By focusing on the four steps described above, you can expertly guide executive clients through the process of deciding whether and when to exercise their options.

RELATED INSIGHTS

-

-

Traits of Top Advisors

-

Practice Management

Use of this website is intended for U.S. residents only.

Michelle J. Black

Michelle J. Black