Interest Rates

Bonds

Interest rates around the world remain ultra-low, fiscal stimulus in many countries may be near a peak and major economies' monetary policy will likely become less accommodative. We asked Capital Group global bond manager Andrew Cormack how he is investing in these markets. Five key themes emerged.

1. U.S. Treasuries: Biased in favor of a yield curve flattener

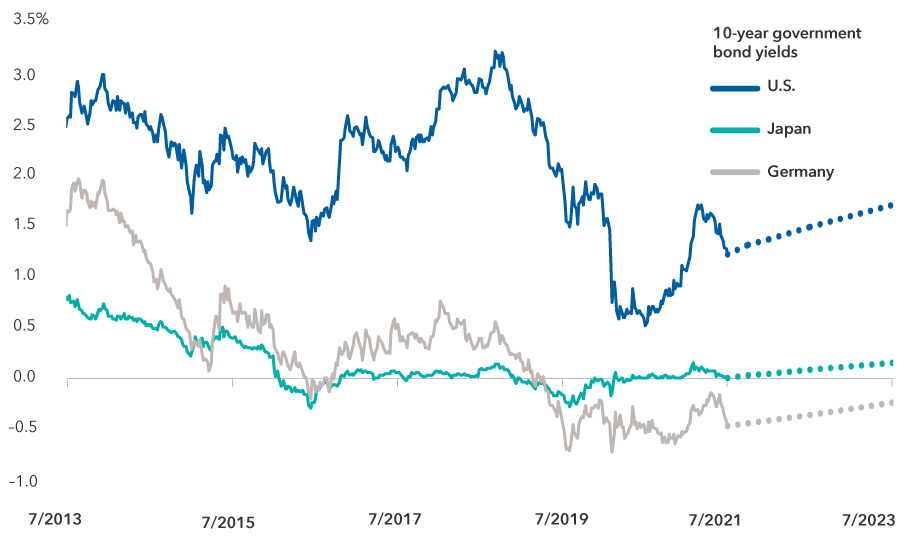

At its June meeting, the Federal Reserve gave us a clear signal that it will become less accommodative. It makes me less constructive on the short end of the Treasury yield curve. But it also reduces the likelihood of an inflation spiral, which is why we saw Treasury yields come down in July and August. That probably reduces term premiums and provides support for long-term rates, which leaves me with a bias for a flatter yield curve in the U.S. over the medium term. Treasuries also continue to be supported by the interest rate differential to other developed markets such as Europe and Japan, where yields remain negative across much of the yield curve. We continue to see strong demand for Treasuries from pension funds and foreign buyers.

Fed policy influences not just the U.S., but the global economy and markets. The Fed in my mind is essentially the global central bank, since it prints the global reserve currency. Fed policy is exported globally through many financial channels. Since June, the Fed has become more attentive to inflation; it has tempered inflation fears, which in turn has alleviated pressure to tighten policy on other central banks, such as the Bank of Canada, the Norges Bank and even the European Central Bank (ECB). And bond yields have declined around the world.

Treasuries benefit from interest rate differentials and sustained investor demand

Source: Bloomberg. As of 7/31/21. Dotted lines are market expectations.

2. European sovereign debt can provide value despite negative yields

As a global bond investor, I can invest in any part of the world. I don’t totally agree with European policy and market rates staying this low for this long. Negative rates have hampered the banking system, and in turn, the robust flow of credit into European economies. Does that mean I avoid negative-yielding bonds in Europe? The answer is no, because I don't have to hold those bonds to maturity.

If the funding rate is ‒0.5% and I can buy a negative-yielding short-maturity bond for ‒0.1%, then that bond is going to have what we call a positive roll-down. So, it can still generate a positive capital gain as long as I am careful about selling at the right time. And fortunately, there's a large, price-agnostic buyer in the market: the ECB. Through its quantitative easing program, the ECB has facilitated this opportunity in European bond markets. That said, with yields having come down in most markets since the start of the COVID-19 pandemic, these bonds have become less profitable as an investment as yield curves have flattened.

Looking at the non-core markets in Europe, I am more cautious. As inflation comes closer to its target, the ECB probably needs to start tapering the Pandemic Emergency Purchase Program (PEPP). If that starts to push European yields higher, some countries that have benefited from the PEPP may struggle to finance their debts. For example, Italy’s gross debt stands at about 150% of gross domestic product. That level of debt is only sustainable for Italy if yields remain very low. It's probably not something to worry about over the next six to 12 months, but it’s something I am closely monitoring.

3. China debt provides yield as well as portfolio diversification

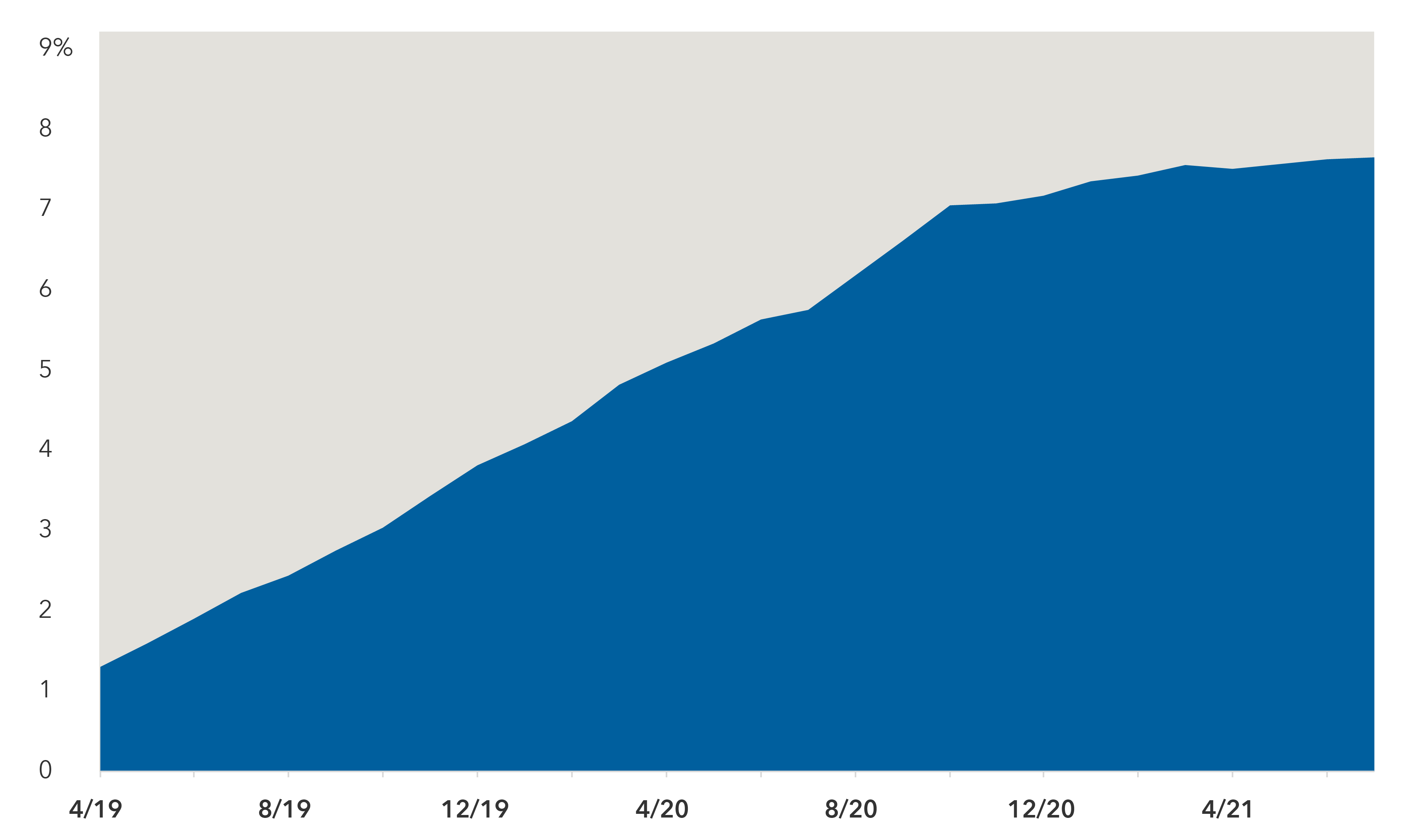

China is becoming an important part of global fixed income markets and our global bond portfolios. Since China debt entered the Bloomberg Barclays Global Aggregate Index in 2019, it has grown to about 7% of the index. That has attracted a broad spectrum of investors, adding to the market’s depth and liquidity. I am also increasingly viewing China bonds as developed-market debt. Currency volatility was something I worried about in the past. But the country’s authorities are keen to promote the stability of the renminbi, positioning it as an alternative to the U.S. dollar as a reserve currency and a store of value. Since China is relying less on exports and more on domestic demand, Beijing sees the benefits of stability outweighing benefits of trying to devalue the currency to boost exports. Therefore, the government has an incentive not to monetize its debt to the extent that it is happening in the U.S., Europe and Japan.

Given these dynamics, China debt has become an important part of our global bond portfolios. I also find it to be a good diversifier as its correlation to developed-market government bonds — U.S. Treasuries, German bunds — has been very low (meaning their prices do not move in lockstep), and can contribute to improving the information ratio of the portfolio. (The information ratio measures how consistently a portfolio has exceeded its benchmark.) I view it as a core bond market with yields that have been essentially double those of U.S. Treasuries.

The rapid rise of China's bond market

China's share of the Bloomberg Barclays Global Aggregate Index has increased substantially in 28 months

Source: Bloomberg Index Services Ltd. As of 7/31/21

4. Corporate bonds provide selective opportunities amid tight spreads

The quality of the broad global investment-grade (rated BBB/Baa and above) universe is lower today than it has been historically, especially since the duration of the corporate bond index has gone up as well. If you adjust for both quality and duration, we are at very tight spread levels. It’s quite remarkable, considering that we have just emerged from one of the worst economic downturns in living memory. There is so much liquidity in the system, leading to an insatiable grab for yield. The valuations make me cautious, but I don’t want to be underweight corporate bonds in my portfolios because I also have to take into account the current middle phase of the economic cycle, which has historically been a period of modest excess returns for corporate bonds.

So, I am less focused on the credit beta, or getting broad credit exposure, and much more focused on credit selection. Fortunately, we have a large team of credit analysts who generate lots of specific ideas. I continue to like parts of the energy sector in the U.S. Also, Asian credit markets provide a reasonable yield advantage compared to the broad U.S. investment-grade universe. Our analysts are also finding solid companies in the emerging markets that I find interesting.

In the high-yield market, there are many companies that were downgraded from investment-grade, the so-called fallen angels. Many of these companies are big beneficiaries of economies reopening. So, it’s an area with select opportunities, but with yields on broad high-yield indexes at just above 4%, the valuations are at a point where I am inclined to reduce rather than add to most high yield credits.

5. Emerging markets are a source of yield amid an upcycle in commodities

I continue to like emerging markets debt as a source of yield. Amid a rebound in global growth, our economists expect a relatively stable dollar, which can be a positive backdrop for emerging markets currencies. I tend to favor currencies and bonds of countries whose central banks have been orthodox in their approach to fighting inflation. Russia and Mexico are two examples, but obviously our investments will depend on valuations. Many economies and currencies also stand to benefit from the upswing in the commodities cycle. Asian markets that have lower yields but also tend to be less volatile are another area of interest.

Overall, in managing investments, I start with the objective and guidelines of the portfolio. To help improve the information ratio, I determine my risk budget. For example, if I have a portfolio where I am seeking to generate 150 basis points of excess return above the benchmark, and I think that I can achieve that over a market cycle with an information ratio of 0.5, then I need to be taking about 300 basis points of tracking error risk. (Tracking error measures how much the portfolio deviates from its benchmark.) Once I have the risk function defined, I look for investment ideas. Investing in bonds that have the potential for positive total returns is obvious. But I also like investments that offer low correlation to other parts of the portfolio. I try to have five or six major themes in the portfolio that have some diversification. It is becoming more difficult as markets have become more correlated and much more sensitive to central bank policy, but it is still the way I manage my portfolios. As central banks begin to adjust policies to a more neutral setting, bond markets should become less correlated.

Andrew Cormack

Andrew Cormack