Over the next decade or so, one of the largest ever U.S. intergenerational wealth transfers will take place. But if client advisors don’t connect to that next generation, many heirs may take that wealth to other professionals. As advisors prepare their clients in this process, they should also engage with the heirs. That’s one way to preserve relationships key to their business.

Significant wealth is going to be changing hands. Heirs could potentially change advisors along the way, too.

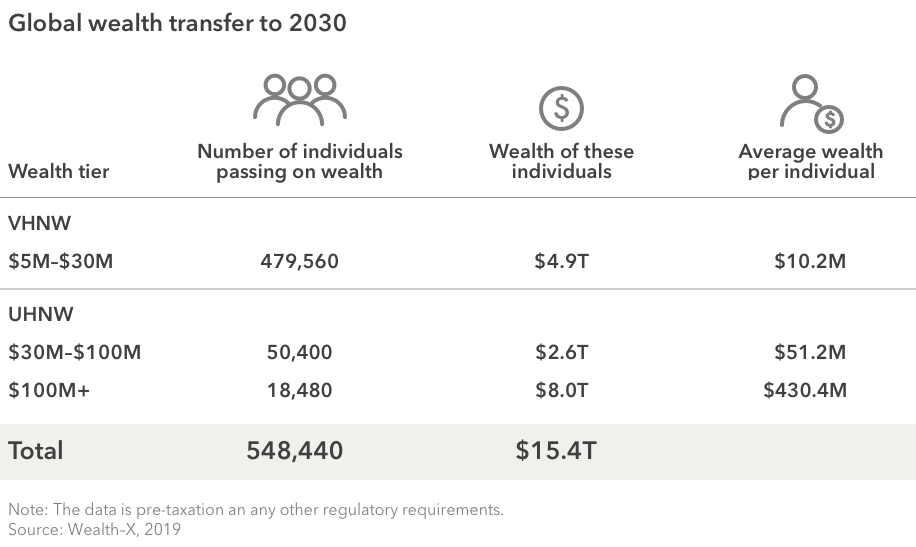

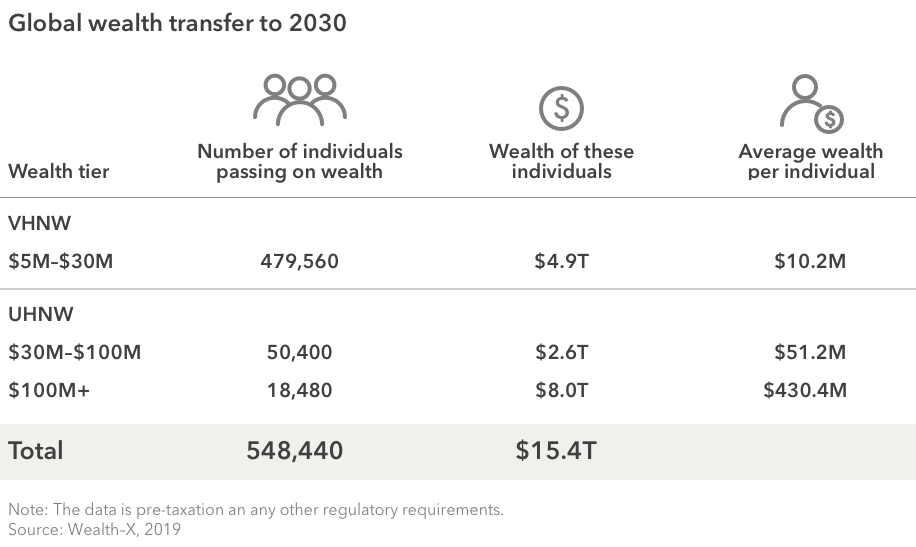

Wealth transfer is going to touch every advisor and a sizable segment of their clients in one way or another in the years to come. Considering all U.S. individuals with a net worth of $5 million or more, Wealth-X expects nearly $9 trillion of wealth to be transferred by 2030.1 To put this into perspective, this sum is more than 10 times the market capitalization of Amazon, one of the world’s most valuable companies.

Between now and 2030, some 366,000 wealthy Americans will transfer some ─ if not all ─ of their wealth.1 Most heirs are likely to be spouses and their children, but other beneficiaries will be grandchildren, siblings and other relatives, as well as nonfamily individuals, foundations and philanthropic legacies.

What this means for RIAs:

According to a Deloitte study, wealth transfers from one generation to the next have resulted in as many as 90% of heirs changing advisors.2 Money moves because heirs do not know or have any rapport with their parents’ advisor and, therefore, often choose alternative advisors they know and trust. With all the money that is expected to change hands, it’s imperative that advisors take steps to strengthen relationships across generations.

Those passing on wealth show differences by wealth tier

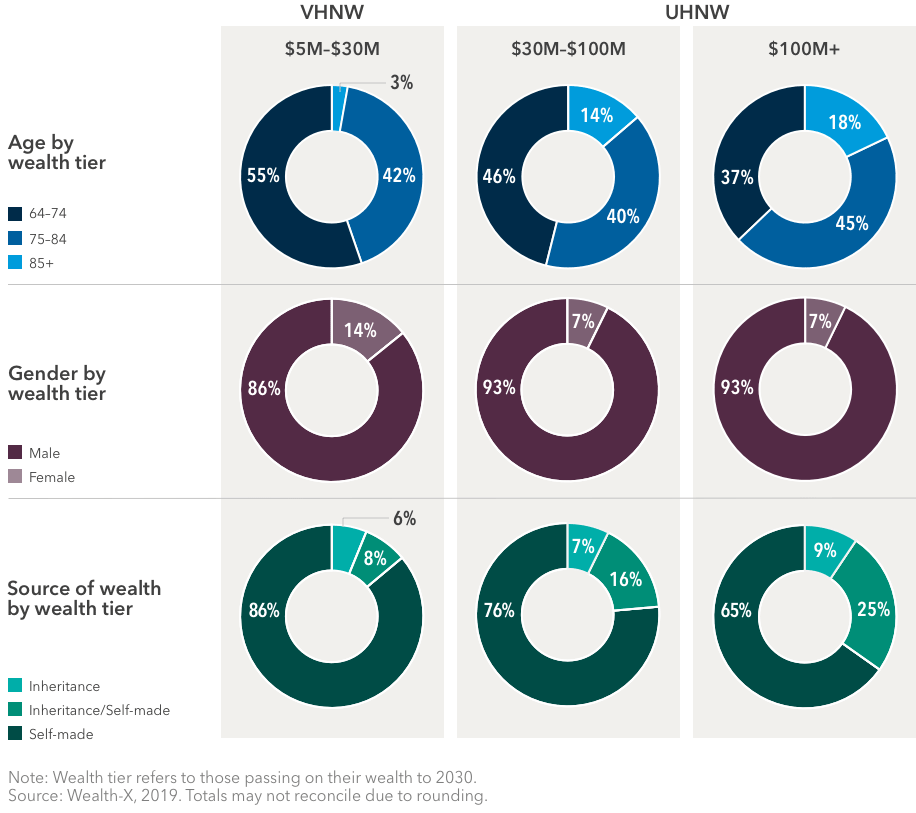

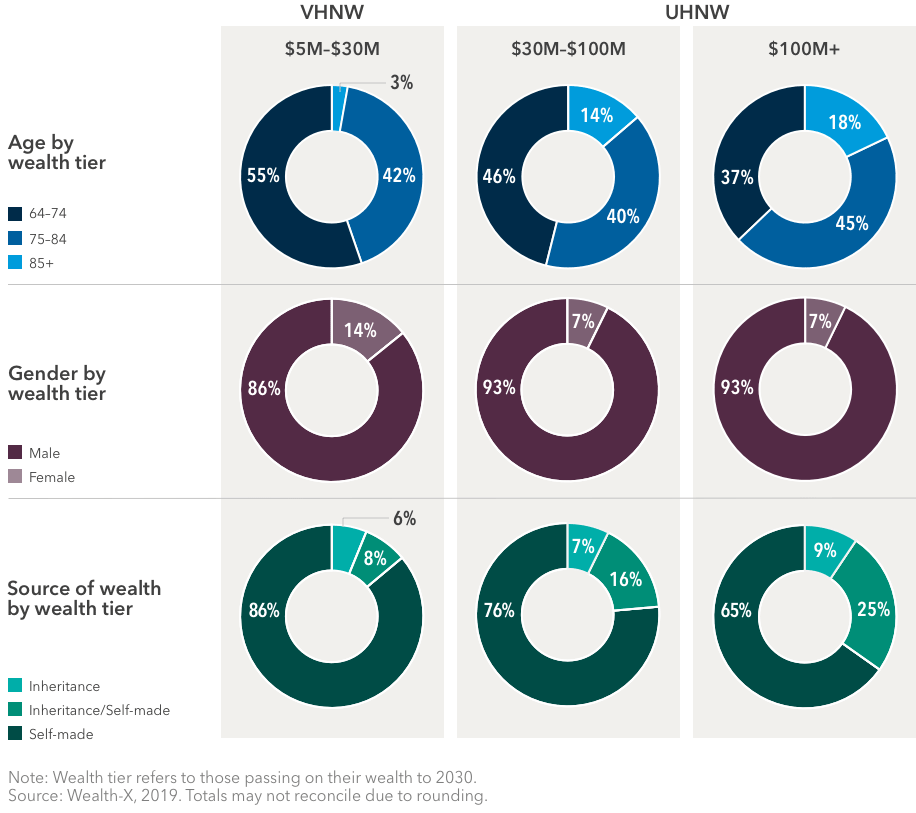

There are differences among those who will be passing on their wealth. Among very high net worth (VHNW) individuals (those with between $5 million to $30 million), most of those who will be passing on wealth over the next decade or so are currently between 65- and 74-years-old. Representation of this age group declines as the wealth threshold increases ─ a reflection of the higher average age of the wealthiest individuals.

Meanwhile, the proportion of men to women is even higher than the gender divide among the wealthy population as a whole. In reality, however, many women are expected to be closely involved in their husband’s or partner’s wealth transfer plans.

In terms of the source of wealth of those passing on such wealth, VHNW individuals are highly represented among those who have made their fortunes themselves. In contrast, while a majority of ultra high net worth (UHNW) individuals (those with a net worth of $30 million or more) are also self-made, inheritance plays a greater role in their population.

What this means for RIAs:

Advisors will need to tailor the conversations they have with their clients according to their respective characteristics. For instance, whether an individual has created or inherited the bulk of their own wealth will often have a considerable influence on their outlook and priorities for the next generation.

Small changes can make a big difference

In order to build a successful long-term practice, advisors should make sure their strategies around helping clients with transferring wealth take into account who is getting the money. By adopting some small habits now, advisors could benefit for years to come:

- Take some time to review your strategy. Ensure that in interactions with clients, discussions on wealth transfer are built into the customer journey map.

- Start talking about wealth transfer early. Starting the conversation early in the client relationship will make a substantial difference in protecting revenue and value. One way to begin the discussion and build trust is through education and training that includes different members of a client’s family.

- Be honest and transparent throughout the process. Building and implementing a successful wealth transfer plan can force clients to tackle difficult issues and make tough decisions. Honesty and transparency will not only build trust but will also make plans more successful and future-proof.

- Look to understand, connect to and engage with the next generation. This cohort is mostly from generation X but also includes millennials, and both are different from the generation that is passing on the wealth.3 Advisors should seek to understand the values of these individuals and how best to engage with them ─ as well as how to develop new products, services and skills to serve them ─ or risk losing out on this valuable next set of customers.

Wealth transfer poses both opportunity and risk to advisors’ businesses in the long term. Clients are not just those with their names on client forms, but also their families and trusted associates. By taking steps to prepare and engage with this wider group of individuals, advisors’ businesses, in turn, will benefit.

1 The Wealth-X Family Wealth Transfer Model sizes the number of wealthy individuals that will be passing on wealth and the amount of this wealth in the period to 2030 by wealth tier. The model uses a three-step process. First, the model uses Wealth-X’s Wealth and Investable Assets Model to size the general wealthy population by country and to estimate the total wealth held by individuals in each wealth tier. Second, Wealth-X uses the Wealth-X Database to incorporate age distribution by wealth. Third, Wealth-X uses secondary sources to integrate life-expectancy distribution of wealthy individuals by country. Wealth-X uses life-expectancy data from 46 countries globally to estimate (with a 99% confidence level) the proportion of the population within each age bracket that will experience mortality in the next decade or so. Additionally, to gain further insight on the individuals who will be passing on this wealth, Wealth-X also uses the Wealth-X Database, an extensive collection of curated research and intelligence on HNW and UHNW individuals.

2 Deloitte, “10 Disruptive Trends in Wealth Management,” 2016.

3 Van Wyk, Mike. “High net worth millennials: Savvy with high expectations,” 2018, and “High net worth Gen Xers: ‘Do-it-yourself’ generation,” 2018.

Wealth-X is a global leader in wealth information and insight, and partners with prestige brands across the financial services, luxury, not-for-profit and higher-education industries to fuel strategic decision-making in sales, marketing and compliance. Wealth-X has developed an extensive collection of records on wealthy individuals and produces high quality data analysis to help its clients uncover, understand, and engage their target audience, as well as mitigate risk. Founded in 2010, with offices across North America, Europe and Asia, Wealth-X provides unique data, analysis, and insight to a growing roster of over 500 clients.