Chart in Focus

Fed

The U.S. Federal Reserve kept its benchmark interest rate unchanged this week as it takes stock of how its prior rate hikes are impacting the real economy. This ends a streak of 10 consecutive rate increases, but central bank officials were quick to point out that the tightening cycle is not necessarily over.

The Fed’s new summary of economic projections (commonly referred to as the dot plot) indicates there could be two more hikes before the central bank is done. The latest report shows a majority of Fed officials expect the federal funds rate to peak between 5.5% and 5.75%. This is a notable change from the March dot plot, in which a majority of Fed governors predicted the federal funds rate would top out at 5% to 5.25% (where it sits today).

“As you can see from the [dot plot], the committee is completely unified in the need to get inflation down to 2% and will do whatever it takes to get it down to 2% over time. That is our plan,” Fed Chair Jerome Powell said, striking a hawkish tone.

“Allowing inflation to get entrenched in the U.S. economy is the thing that we cannot allow to happen for the benefit of today's workers and families and businesses, but also for the future.”

Headline inflation fell to 4% in May, down from its June 2022 peak of 9.1%, but the latest core reading (stripping out volatile items like food and energy) remains at 5.3%. That is still high relative to the Fed's 2.0% target, but it is moving in the right direction.

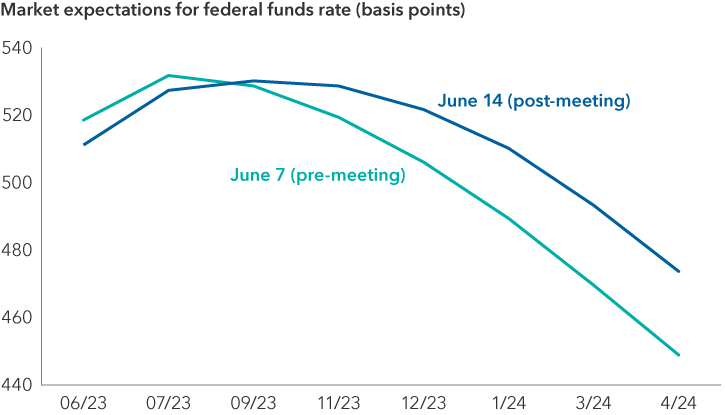

However, if inflation does not come down more quickly and the labor market stays resilient, the Fed may not be able to stay on pause for long — and Powell pushed back against the notion that rates might come down later this year.

“It will be appropriate to cut rates at such time as inflation is coming down really significantly. And we're talking about a couple years out,” Powell added. “I think as anyone can see, not a single person on the committee wrote down a rate cut this year, nor do I think it is at all likely to be appropriate.”

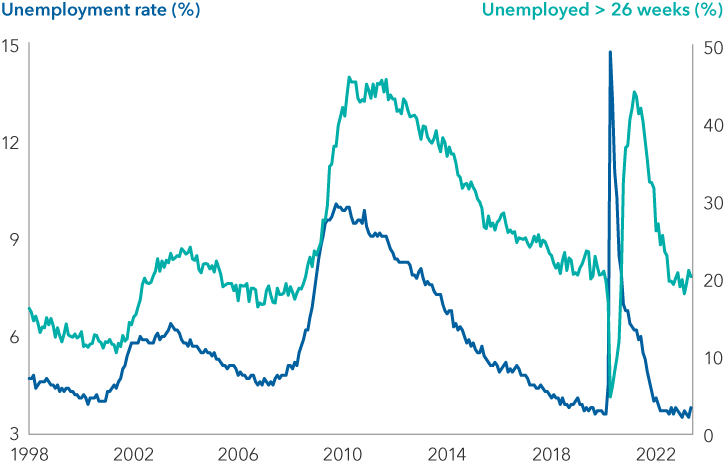

U.S. labor market remains persistently strong

Source: Capital Group. Bureau of Labor Statistics. Data as of May 31, 2023.

The U.S. labor market — likely the key to reducing inflation — remains extremely tight. The unemployment rate recently dropped to a level not seen in more than 50 years (3.4%). While it has ticked up slightly (alongside claims for unemployment insurance), job openings suggest demand for labor remains strong.

Consumer spending represents around 70% of the U.S. economy, so labor market developments — particularly regarding wages — are important to the outlook. I believe it will take more effort from the Fed for labor markets to meaningfully loosen. As such, I think the risk is the Fed does not ease policy at the speed markets are pricing in.

Markets reconsider timing of rate cuts

Source: Capital Group. Data as of June 14, 2023.

Although some of the recent banking sector problems have been unique to the institutions involved, our banking analysts are seeing tighter lending standards implemented across the sector. Overall, however, the Chicago Fed’s National Financial Conditions Index does not show that conditions are excessively tight, suggesting the potential need for more restrictive monetary policy. If that occurs, we should see further weakening in economic activity. We have already seen it in housing, and it is currently occurring within the goods sector. Eventually it will reach the service sector — the largest part of the economy.

The recent rally in equities, powered by excitement over AI, has lifted the S&P 500 to a price-to-earnings multiple of over 20x. With the fed funds rate above 5%, 10-year Treasury yields near 3.8%, and the potential for profits to contract if the economy weakens, there still seems to be downside risk to equities.

In fixed income, the extremely inverted yield curve is compelling. In our bond portfolios, many managers continue to favor a yield curve steepener (a position designed to profit as the Treasury yield curve moves from being inverted to a more normal shape). As a counterbalance to this more defensive position, some managers have selectively invested in the spread sectors, especially in securitized markets, including agency mortgage-backed securities and asset-backed securities.

Yield curve measures the difference between the yields of bonds of different maturities. A yield curve is said to be inverted when shorter term bonds provide higher yields than longer term bonds.

Yield curve steepening occurs with long-term rates rising more than short-term rates, or short-term rates falling more than long-term rates.

S&P 500 Index is a market-capitalization-weighted index based on the results of 500 widely held common stocks.

Darrell Spence

Darrell Spence