The COVID-19 pandemic affects everyone, yet the wealthy are impacted in unique ways due to their professional responsibilities and the makeup of their asset holdings. Many are anxious not only for their health and families but also for their businesses and financial future. What can you do to help your clients and strengthen your relationship for the long term?

The COVID-19 pandemic affects everyone, yet the wealthy are impacted in unique ways due to their professional responsibilities and the makeup of their asset holdings. Many are anxious not only for their health and families but also for their businesses and financial future. What can you do to help your clients and strengthen your relationship for the long term?

Unique business challenges

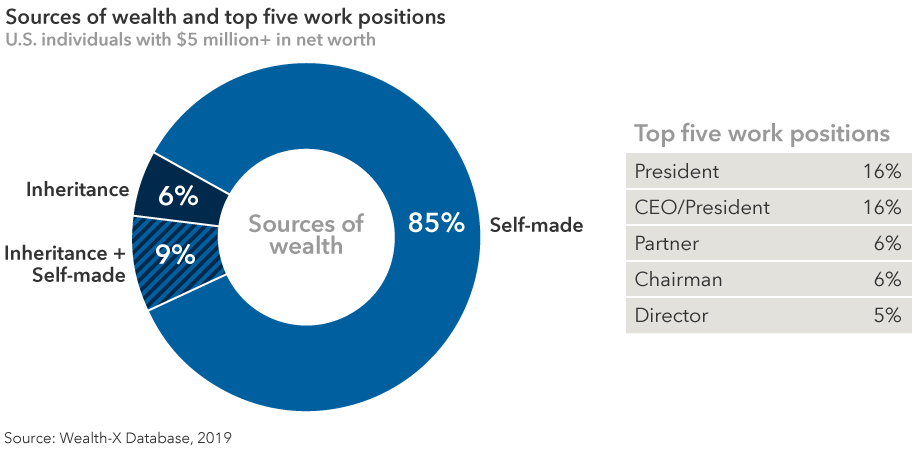

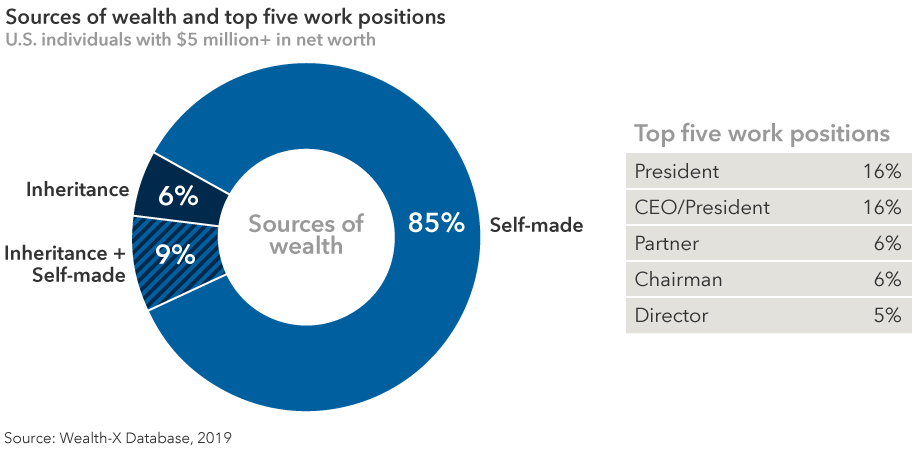

In contrast to the majority of the U.S. population that are employees — many of whom will be worrying about job security or have already suffered job losses — most wealthy individuals either run or own a business. So they also have business-related concerns, like choosing the right time to open up again and ensuring the well-being of staff.

The fallout from the pandemic has hit a wide range of economic sectors. In spite of huge government stimulus and aid packages, businesses owned by HNW individuals are just as likely to be struggling. Businesses in hard-hit sectors such as travel and tourism could be grappling with solvency, liquidity or operational challenges. Of course, those with businesses in sectors such as technology and health care are likely seeing higher demand in this time of social distancing.

What this means for RIAs:

Now more than ever, there is an opportunity to engage with clients on a personal basis. Ask your clients how they are coping with reopening their business in a different environment and how they plan to run the business differently than before. Don’t lead with a discussion about financial products unless a relevant moment reveals itself. Building a closer personal relationship can often strengthen the professional relationship in the long term.

Anxiety around their financial future

The most impactful pandemic-related disruption that the majority of the U.S. population will experience is a reduction of income. Their concerns are likely to be focused on how to cover their mortgage, loans and living expenses, as well as the state of their retirement accounts.1

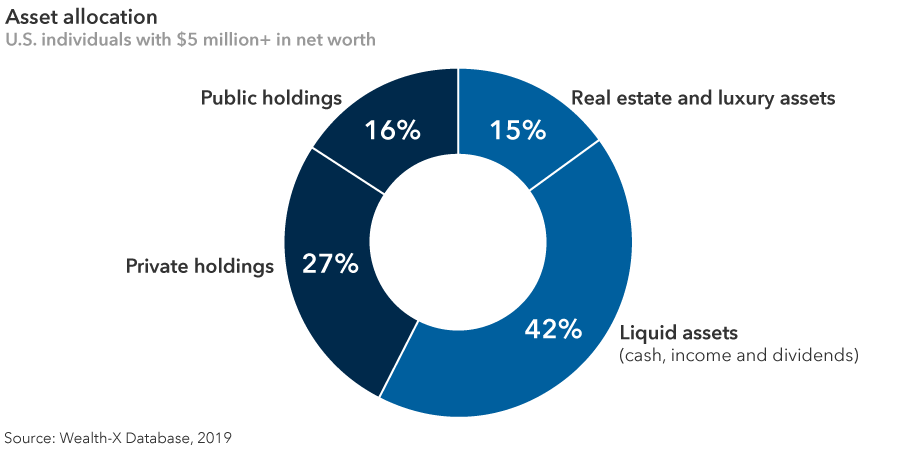

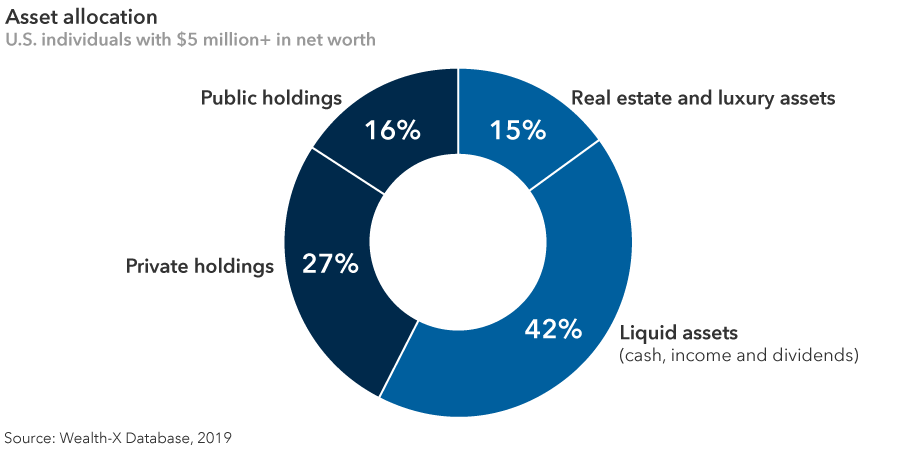

In contrast, the wealthy tend to have much of their wealth tied up in business or private equity ventures (private holdings) and in market-listed equity shares (public holdings). This means that they are less exposed to short-term income losses, but more exposed to other risks like the performance of the stock market and the profitability of their business.

With more volatility in the stock market and many businesses struggling due to COVID-related shutdowns, many wealthy individuals could see the overall value of their wealth fall, some quite substantially. (Of course, some may be invested in funds that have weathered the crisis well and, therefore, may not be as impacted.)

Individuals still in the early stages of their wealth creation are particularly affected. Their wealth is often tied up in a single business and one or two real estate properties. So falling asset prices and a stagnant housing market could constrain their liquidity.

What this means for RIAs:

Be proactive in your engagement. As they see volatility and potentially some dramatic falls in the value of their wealth portfolios, some of your clients may be questioning their choice of financial advisor at this time. Get in touch with your clients to discuss their overall financial goals. Review their diversification strategy and determine if any changes should be made. This will help demonstrate your value by being there for them both professionally and personally.

Clients may want to sell holdings to avoid further damage to their financial assets, but encourage them to focus on their long-term goals and strategies. Markets can and should recover, as they have in previous crises.

1 This reflects the general population’s net worth composition, which is made up mostly by their primary residence and vehicle. Source: Federal Reserve Bulletin, September 2017.

Wealth-X is a global leader in wealth information and insight, and partners with prestige brands across the financial services, luxury, not-for-profit and higher-education industries to fuel strategic decision-making in sales, marketing and compliance. Wealth-X has developed an extensive collection of records on wealthy individuals and produces high quality data analysis to help its clients uncover, understand, and engage their target audience, as well as mitigate risk. Founded in 2010, with offices across North America, Europe and Asia, Wealth-X provides unique data, analysis, and insight to a growing roster of over 500 clients.