Interest Rates

Real Estate

The failure of Silicon Valley Bank (SVB) has put renewed pressure on commercial real estate, as fears about tighter credit conditions and a slower economy have begun impacting the already beleaguered sector.

One area clearly reflecting these concerns is the commercial mortgage-backed securities (CMBS) market, notably in the non-agency space (those not issued or guaranteed by any U.S. federal government-sponsored enterprise or agency), which currently stands at $724 billion. The CMBS market has been under a cloud since the economy was hit by COVID in 2020. Over the last three years, changing consumer and worker habits have led to a fundamental shift in how investors perceive commercial real estate, from both risk and value perspectives. This shift, in combination with higher rates from substantial tightening from the U.S. Federal Reserve, has resulted in a sharp sell-off for the non-agency CMBS market.

However, we still see some attractive opportunities in CMBS. While some subsectors like office properties face profound challenges, other areas like multifamily housing have remained more resilient. Overall, repricing across the market could provide an opportunity to add exposure. In this article, we examine the outlook for the CMBS market and discuss how investors can position for continued uncertainty amid higher rates and a potential recession.

CMBS spreads have reached interesting levels

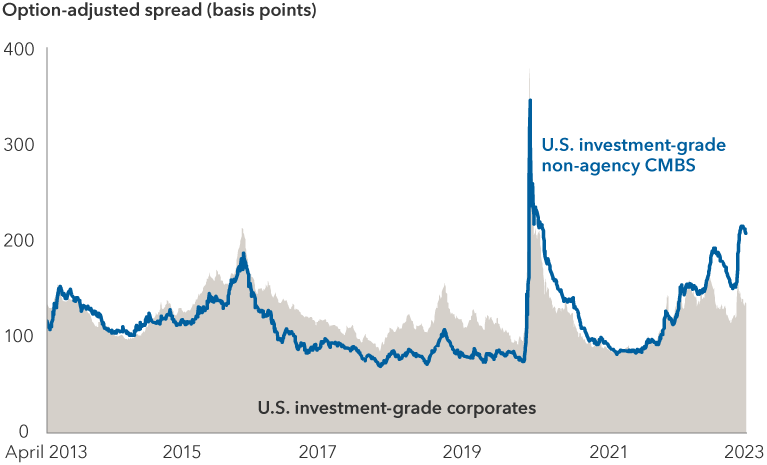

Over the past 10 years, non-agency CMBS spreads have generally been narrower than those of corporate bonds. Along with other securitized assets, CMBS assets have traditionally been a fixed income allocation for those investors seeking some yield while remaining closer to the core, compared with corporate bond markets.

However, spreads have been widening since early 2022, as concerns related to the underlying commercial real estate market have been exacerbated by Fed tightening. While we saw some recovery in early 2023 on the view that Fed action may be slowing down, the collapse of SVB quickly reversed those moves. In April, non-agency CMBS spreads were more than 70 basis points above investment-grade (BBB/Baa and above) corporates, levels not seen since 2011.

This significant repricing in CMBS assets could provide an opportunity for investors to build exposure at more attractive valuations if they see potential for markets to hold steadier in the next 12 to 18 months.

Non-agency CMBS spreads have surpassed corporate bonds

Source: Bloomberg. As of April 30, 2023. Data shown is for the Bloomberg U.S. Corporate Investment Grade Index and the Bloomberg U.S. Non-Agency CMBS Investment Grade Index.

Concerns can be largely traced back to offices

It is often the case that when one subsector is facing major headwinds, the full sector feels the impact. For commercial real estate, office properties are the main source of anxiety for investors.

The office market has been facing challenges for several years. Office tenants in sectors such as finance and law had been cutting space even before COVID amid the shift to more flexible working habits. Meanwhile, technology companies were the driver of demand for new office space. Now many are cutting their physical space in an effort to reduce costs and are even willing to spend to end their leases early.

The change in sentiment toward office space is becoming more apparent in the market. High-profile borrowers are walking away from troubled office properties at a faster rate than expected.

Fundamentals remain resilient outside of offices

While the negative outlook for office space has driven spreads in the CMBS market notably wider, it is estimated to account for less than 20% of the $5.6 trillion in outstanding commercial real estate debt. Pockets of opportunity remain for investors who can take a risk-aware, considered approach to CMBS.

In terms of fundamentals, the commercial real estate market outside of office space has remained relatively resilient. There should be room for continued growth in rents in these markets, as long as a sharp recession is avoided. For example, multifamily properties continue to enjoy strong demand, as high home prices and mortgage rates are making it necessary for many people to continue to rent. Meanwhile, robust growth in e-commerce is fueling demand for warehouses and other types of industrial real estate.

Even within office real estate, we are likely to see more bifurcation in the market over the next several years, which should paint a clearer picture for investors and uncover the buildings that can keep tenants and sustain rents.

Historical trends suggest owners of high-quality offices — who know how to attract tenants and have the money to maintain the buildings — should be able to continue to borrow. This divergence happened with malls over the past 10 years, when the valuations of most large malls were hit hard but the highest quality mall real estate investment trusts (REITs) repositioned themselves and continued to attract tenants. Over time, non-agency CMBS valuations should begin to reflect this differentiation.

Banking stress has had varied impacts

One of the biggest concerns for CMBS investors this year has been the stress in the banking system. It’s estimated that, over the past decade, smaller banks have increased their market share in commercial real estate lending to around 40%, which could leave borrowers more vulnerable to a change in bank sentiment or regulations.

Expectations have increased for banks to pull back lending in commercial real estate, particularly for office. Tightening standards by the banks could leave borrowers struggling to find options for refinancing, particularly at comparable interest rates or levels of leverage. Meanwhile, holders of loans that are near maturity will likely try to extend. These are two key risks for investors that may not have been fully priced into the market.

The degree of exposure to this risk differs depending on the property type. While office real estate is estimated to get more than 50% of its funding from banks, the percentage remains much lower for properties such as multifamily. With significant funding from governmental agencies, this backstop could provide multifamily properties with a greater level of protection from the impact of a pullback from the banks.

Uncovering opportunities in CMBS

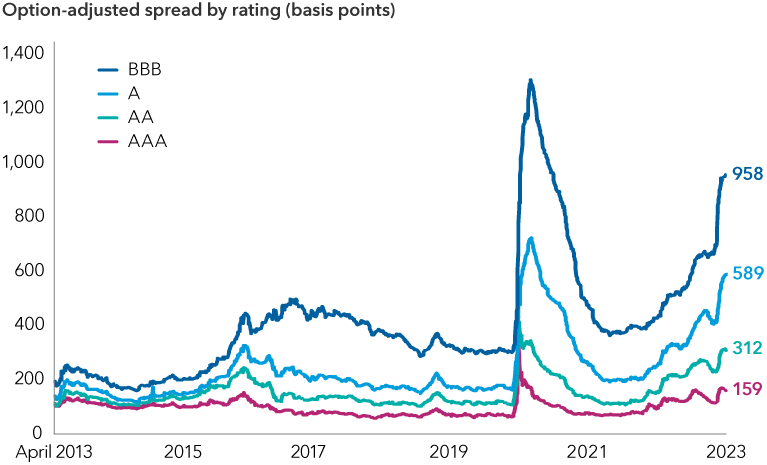

The CMBS market is currently reflecting investors’ concerns about future losses in the office subsector across the board. However, there may be numerous ways to build exposure, on the view that much repricing has already taken place.

For example, across both conduit loans (pools of commercial mortgage loans) and single-asset single-borrower (SASB) loans, lower quality assets have experienced a particularly sharp sell-off, and if volatility persists, it is likely they will continue to be under the most stress. However, higher quality assets as well as securities higher up the capital stack — where we believe the structure can provide some cushion amid future volatility — appear to offer value.

The underlying assets are also important when analyzing CMBS. Conduit loans can have meaningful exposure to office real estate of varying quality. While attractive opportunities remain, SASB loans can give an investor a clearer view of the asset’s risk profile and potentially offer a greater level of diversification in a portfolio.

The market is pricing in continued concerns for non-agency CMBS

Source: Bloomberg. As of April 30, 2023. Data shown is the option-adjusted spreads for the subindices of the Bloomberg U.S. Non-Agency CMBS Investment Grade Index.

In closing, there is no doubt commercial real estate has hit a rough patch, given rapidly tightening lending from banks, high interest and mortgage rates and a slowing economy. This has a knock-on effect on the CMBS market.

That said, considering the repricing we have already seen across the quality spectrum in CMBS, and given the sustained positive fundamentals of a large section of the commercial real estate market, we see selective opportunities in this sector. Yields and spreads appear attractive, especially relative to corporate bonds, as well as in some other areas of the securitized market.

The Bloomberg U.S. Corporate Investment Grade Index represents the universe of investment grade, publicly issued U.S. corporate and specified foreign debentures and secured notes that meet the specified maturity, liquidity, and quality requirements. This index is unmanaged, and its results include reinvested distributions but do not reflect the effect of sales charges, commissions, account fees, expenses or U.S. federal income taxes.

The Bloomberg U.S. Non-Agency CMBS Investment Grade Index represents a subset of the Bloomberg U.S. Aggregate Index that includes eligible non-agency conduit and fusion commercial mortgage-backed securities deals, with a minimum current deal size of $300mn and a rating of BBB/Baa or above. This index is unmanaged, and its results include reinvested distributions but do not reflect the effect of sales charges, commissions, account fees, expenses or U.S. federal income taxes.

Option-adjusted spread measures the difference in yield between a bond with an embedded option and the yield on U.S. Treasuries.

Investments in mortgage-related securities and other asset-backed securities involve additional risks such as prepayment risk and interest rate risks. They are also subject to the risk that underlying borrowers will be unable to meet their obligations and the value of property that secures the mortgage may decline in value and be insufficient, upon foreclosure, to repay the associated loans. Investments in asset-backed securities are subject to similar risks.

Xavier Goss

Xavier Goss

Hannah Greene

Hannah Greene